Trading Update

This Saturday’s Federal election result is unlikely to have much of an impact on the RBA’s decision to lower interest rates when it meets on the 19th May.

With todays March quarter inflation data release coming in at 2.4% well within the RBA’s desired target band we are likely to see a 0.25% drop in the official rate to 3.85%. The RBA’s preferred measure of trimmed mean inflation also dropped from 3.3% to 2.9%.

Neither of the major parties have committed to inflationary policies by way of an increase in Government spending and on balance the LNP’s policies are likely to push inflation down further with their reduction in the government fuel excise levy.

On housing both major parties are committed to assisting first home buyers which should see an increase in activity in that sector of the market and provide considerable support for entry level residential housing.

Whilst neither party’s policies will solve the housing supply issue in the short term, the LNP’s infrastructure assistance policy would assist local councils and may expedite delivery of additional product over the medium term.

On balance we believe residential property prices will remain buoyant throughout the remainder of the year with the RBA likely to drop the official rate to around 3.35% by year end.

Whilst the introduction of US tariffs may bring additional volatility to equity markets as it plays out we believe Australia remains well insulated with the expected slowing of the Chinese economy likely to have a nominal impact on the Australian economy with little or no impact on our housing market.

If you are seeking a capital stable investment our High Yield Fund continues to offer a competitive 7.75% per annum targeted distribution rate for a 12-month fixed-term investment, with monthly interest payments to investors.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

Managed Funds Under Management

as at 31st of March 2025

| March 2025 | |

|---|---|

| ASCF High Yield Fund | $162,994,097.22 |

| ASCF Select Income Fund | $50,537,036.22 |

| ASCF Premium Capital Fund | $24,474,388.53 |

| ASCF Private fund | $38,648,518.91 |

| Combined Funds under Management | $276,654,040.88 |

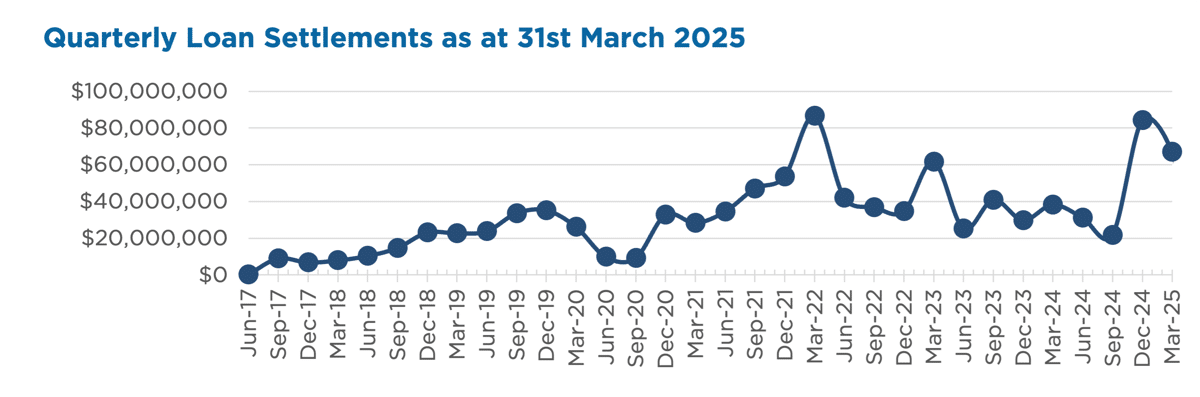

In March, loans and inquiry levels were strong, with $37,388,815.00 in new loans settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of March.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of March 2025

Current Loans by Fund Source

as at 31st of March 2025

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 75.82% | 100% | 100% |

| 2nd Mortgage Loans | 17.23% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 6.95% | 0% | 0% |

| Avg. Weighted LVR | 58.11% | 50.24% | 43.71% |

| Avg. Loan Size | $1,318,902.77 | $1,036,301.06 | $803,115.11 |

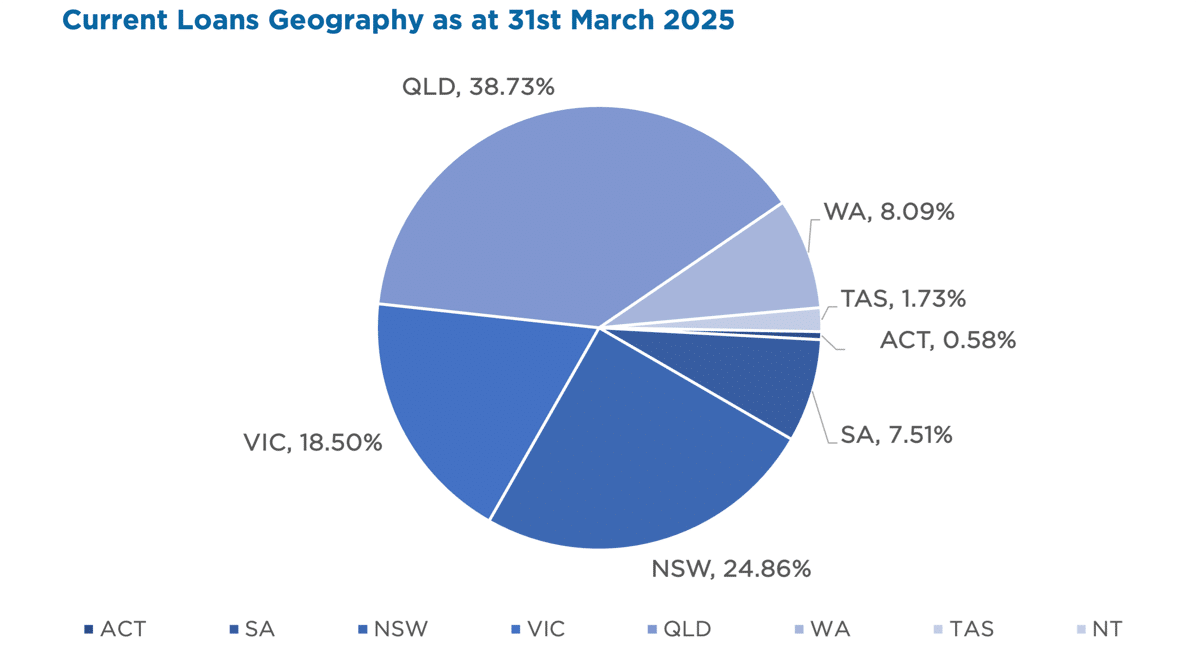

Current Loans Geography

as at 31st of March 2025

Why Invest with ASCF?

Looking for an alternative to market volatility?

With ongoing headlines around inflation, tariffs, and global uncertainty, traditional markets have become increasingly unpredictable. It’s no surprise many investors are asking: Is there a more consistent option?

One such option is a Pooled Mortgage Fund.

Unlike shares, pooled mortgage funds are not subject to daily market fluctuations. These funds invest in loans secured by Australian real property and aim to deliver more stable income through regular interest distributions.

Why some investors consider mortgage funds:

- Lower Correlation to Equity Markets – Less exposure to market volatility.

- Regular Monthly Distributions – From interest collected on loans.

- Asset-Backed – Loans are secured by Australian property.

- Experienced Management – Lending professionals assess and monitor every loan.

While all investments carry risk — including the risk of capital loss and variability in income — pooled mortgage funds may suit investors seeking more consistency than equities currently offer.

Want to learn more? Contact us to explore your investment options.

Important information: At ASCF, we’re here to help you invest on your terms. Since inception, all investors have received their targeted distribution rate monthly and all redemption requests have been paid on time and in full, however past performance is not indicative of future performance. Distributions are not guaranteed nor a forecast. Lower than expected returns may be achieved. Investment in the Funds is not a bank deposit and investors risk losing some or all of their capital. Withdrawal rights are subject to liquidity and may be delayed or suspended. Read the PDS and TMD, available from our website.

An Interesting Transaction

Problem:

A borrower came to ASCF seeking urgent funding to assist with payment of legal fees and purchase a motor vehicle following finalisation of his divorce proceedings which included the sale of joint property owned with his wife.

Solution:

ASCF provided a $50,000 loan using the equity in another property owned solely by the borrower at Biggera Waters at 10.95% per annum for a 6 month term at an LVR of 13.89% with interest capitalised for the full 6 month term. The joint property subsequently settled the following month and the ASCF loan was repaid within 4 weeks with the excess interest for the remainder of the loan term refunded to the borrower.

What ASCF does differently

| ASCF understands that borrowers often only require loans for very short periods of time and whilst most lenders will not consider short dated loans, ASCF still approved and processed the loan without any penalty to the borrower for the early repayment. |

Market Update

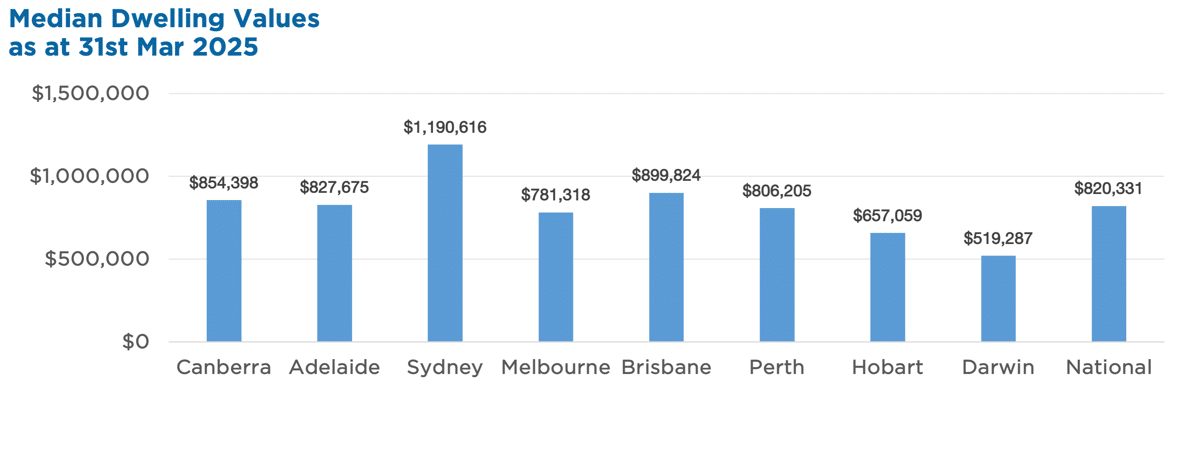

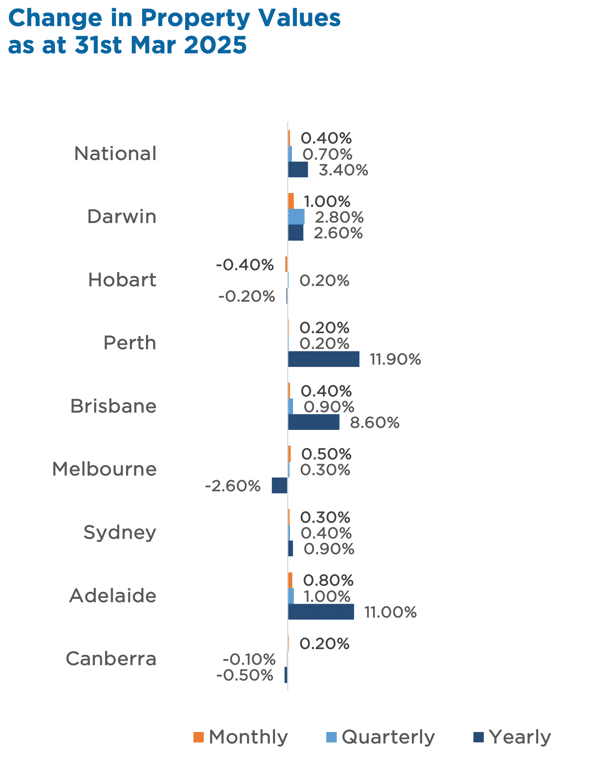

CoreLogic’s March 2025 Home Value Index signals renewed strength in the property market.

Australian home values have bounced back to record highs, rising 0.4% in March, marking the second month of growth after a brief three-month decline. The uplift was broad-based, with every capital city (except Hobart) and all regional areas posting gains. Darwin led the capitals with a 1.0% rise, while Hobart fell -0.4%.

The rebound is largely attributed to improved sentiment and borrowing conditions following the February rate cut. Sydney and Melbourne values, in particular, have turned a positive corner, though still sit slightly below previous peaks.

Property Values

as at 31st of March 2025

Median Dwelling Values

as at 31st of March 2025