Trading Update

The Reserve Bank of Australia (RBA) will convene next week to determine whether interest rates should be cut further following on from February’s cut.

Most economists do not expect a further rate reduction of 0.25% until the May meeting however the lacklustre employment data which showed employment fell by 53,000 in February indicates a further rate cut could be possible.

Whilst the overall employment rate held steady at 4.1% mainly due to a fall in the participation rate, it will be the ABS February monthly CPI indicator due tomorrow which will likely determine if the April board meeting results in a further rate cut.

If the monthly inflation data comes in softer than expected, and signals that the March quarter CPI, due at the end of April, is likely to be below the RBA’s forecasts, the meeting may well become a live one, with a rate cut definitely a possibility.

With the US stance on further trade tariffs creating uncertainty for policy makers as to whether they may stimulate inflation, we believe their economic impact on Australia is likely to be limited and on balance the uncertainty should add to the case for a further rate reduction next week.

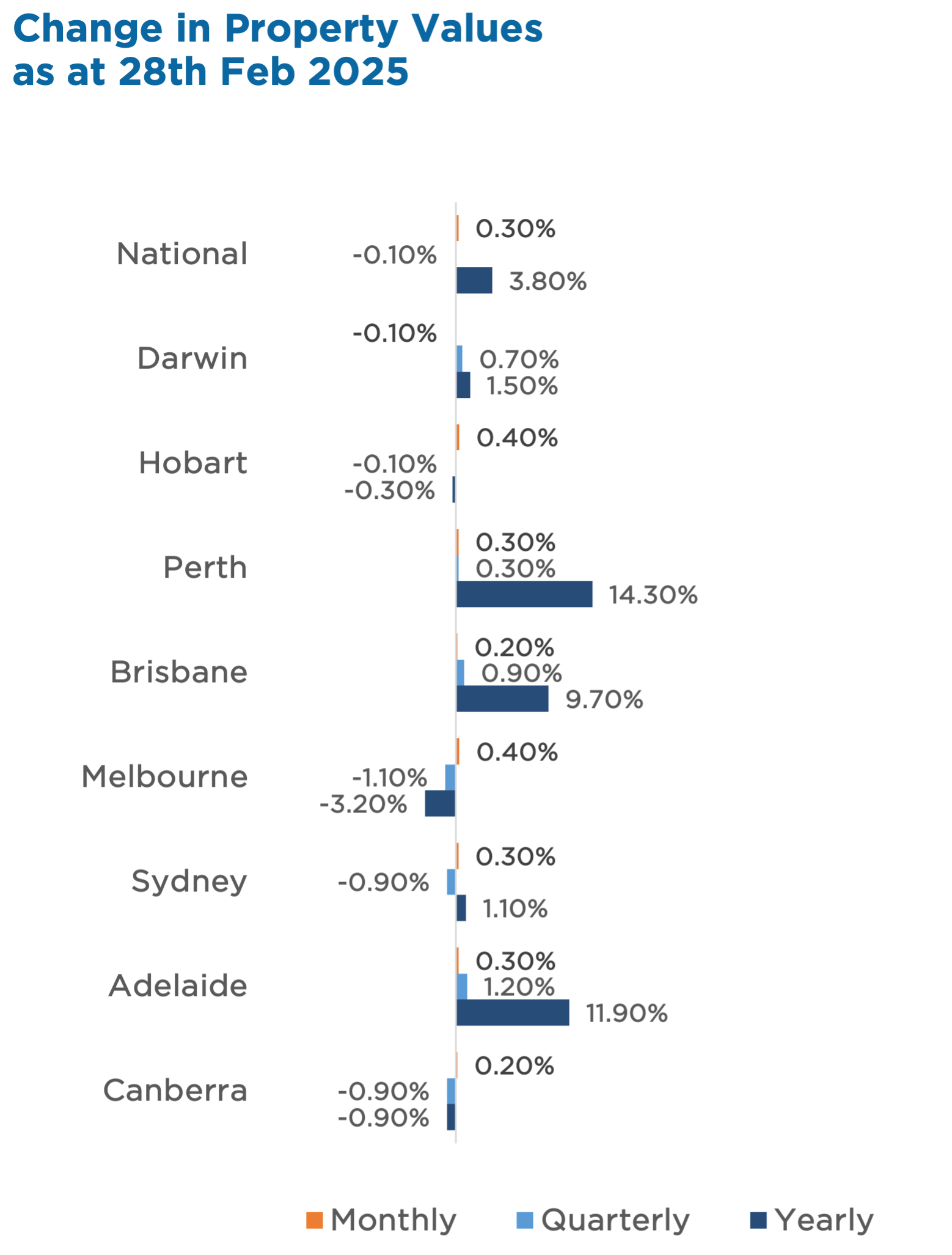

Residential property prices stabilised in February, with CoreLogic reporting a 0.3% national increase. Lower borrowing costs and improved sentiment are supporting renewed buyer confidence and we expect this to be the theme of 2025 as the RBA cuts rates further.

ASCF is currently offering some of the most competitive returns in the market for pooled mortgage funds.

If you are considering an investment our High Yield Fund is currently paying a targeted distribution rate of 7.75% per annum with interest paid monthly on a 12-month fixed-term investment, meaning your targeted rate of return will not change during the investment term.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

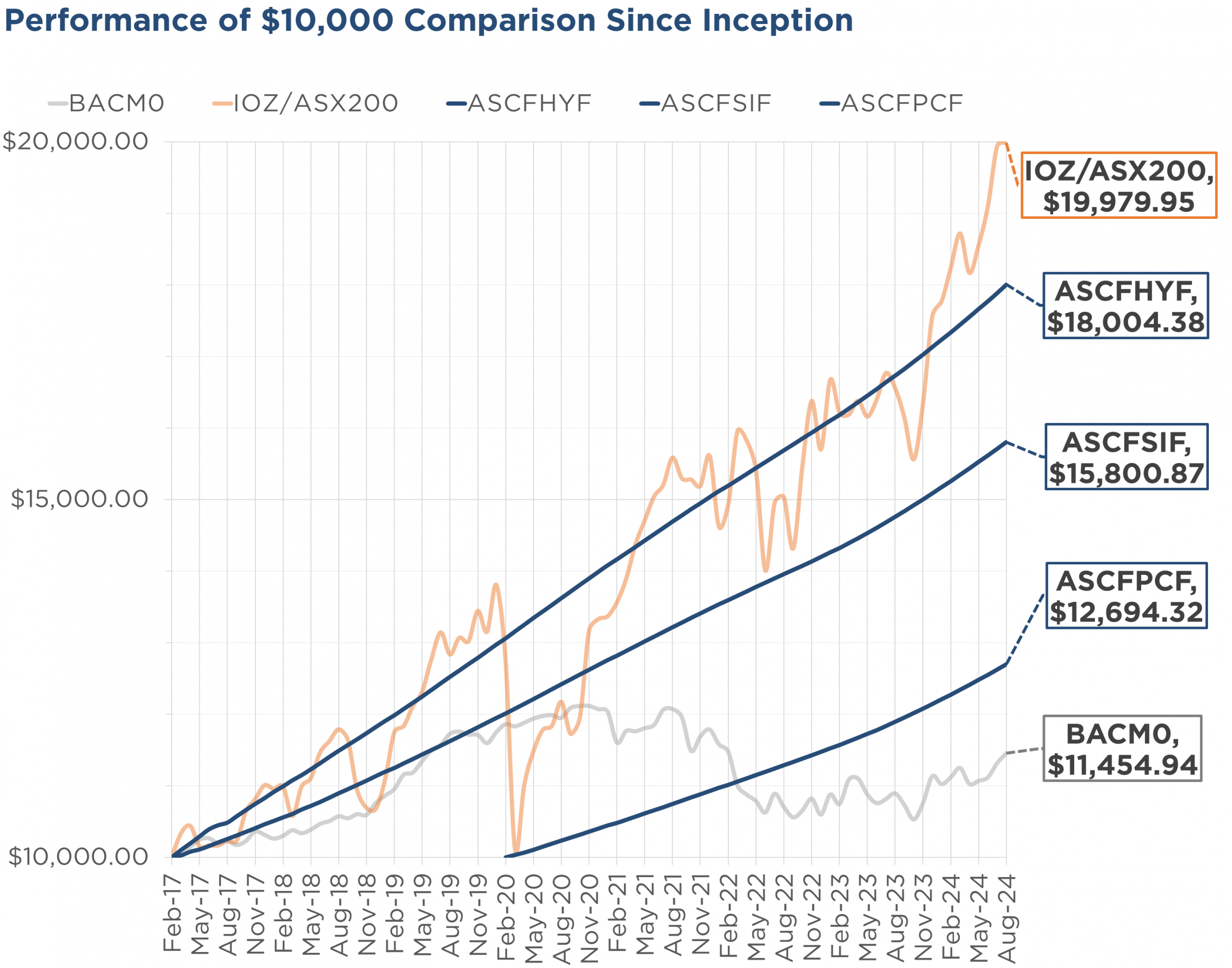

Monthly Managed Fund Cumulative Growth & Performance

Managed Funds Under Management

as at 28th of February 2025

| February 2025 | |

|---|---|

| ASCF High Yield Fund | $160,974,127.22 |

| ASCF Select Income Fund | $51,509,036.22 |

| ASCF Premium Capital Fund | $24,129,388.53 |

| ASCF Private fund | $38,590,820.87 |

| Combined Funds under Management | $275,203,372.84 |

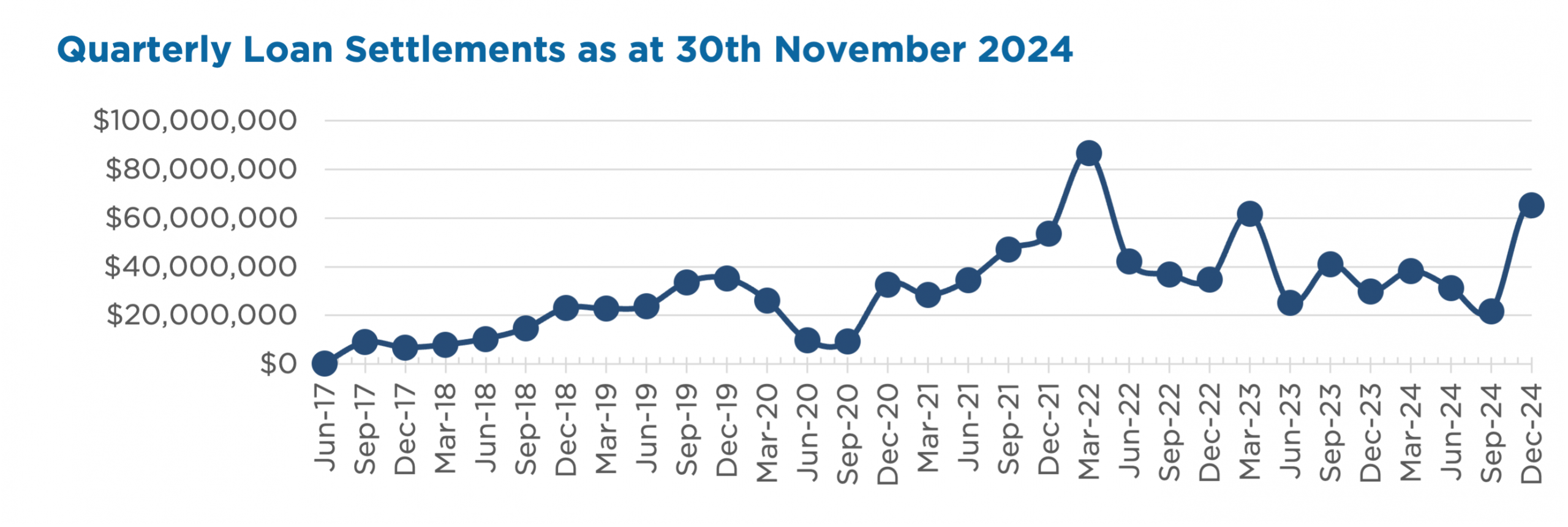

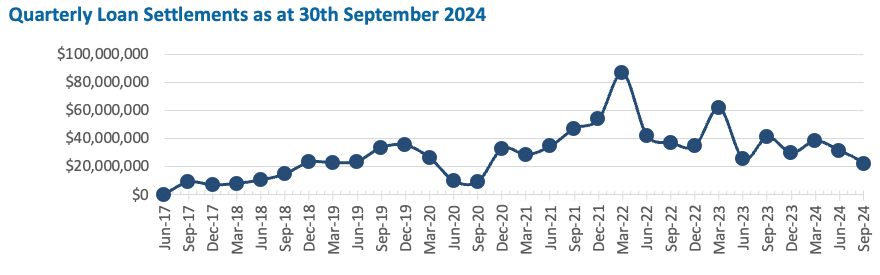

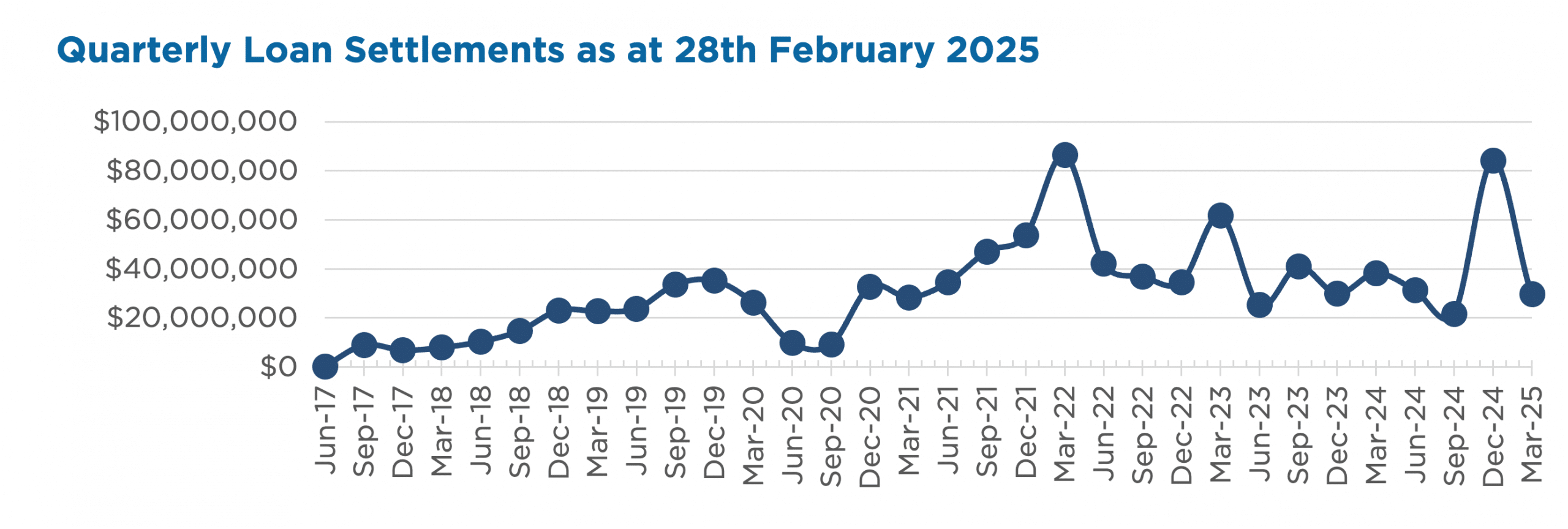

In February, loans and inquiry levels were strong, with $19,017,322.000 in new loans settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of February.

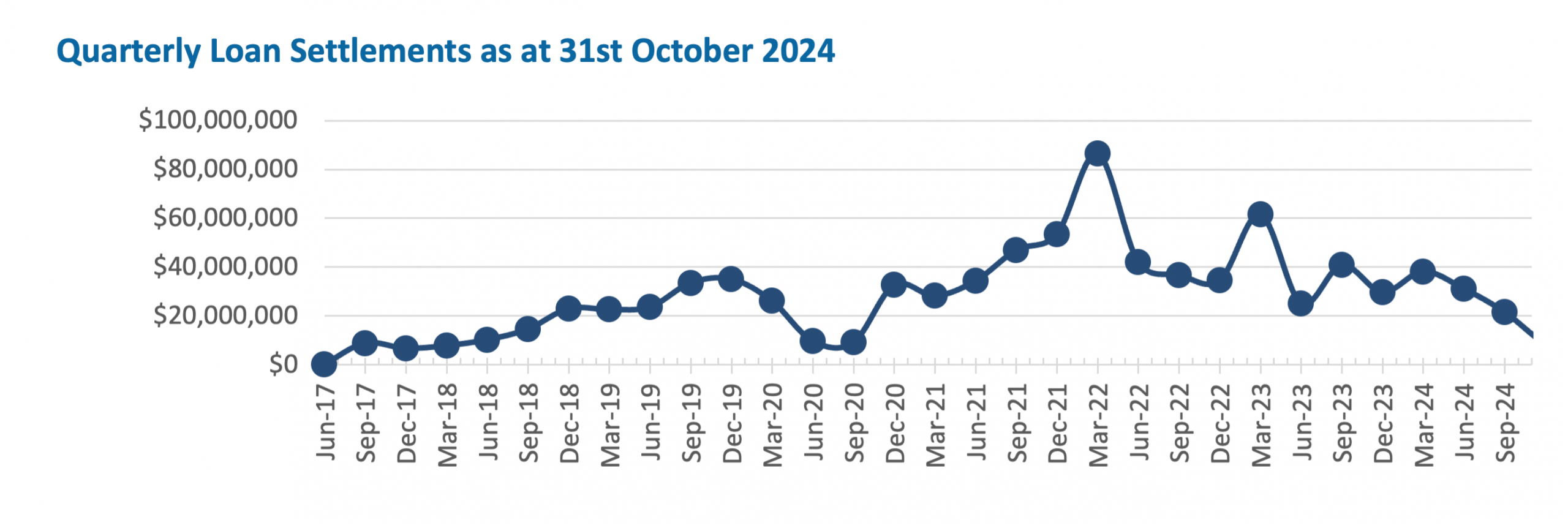

Lending Activity Update

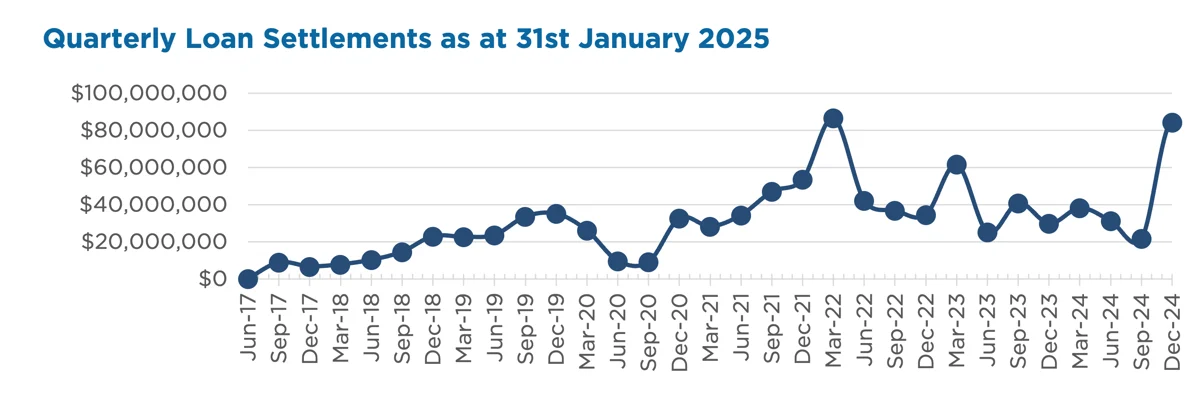

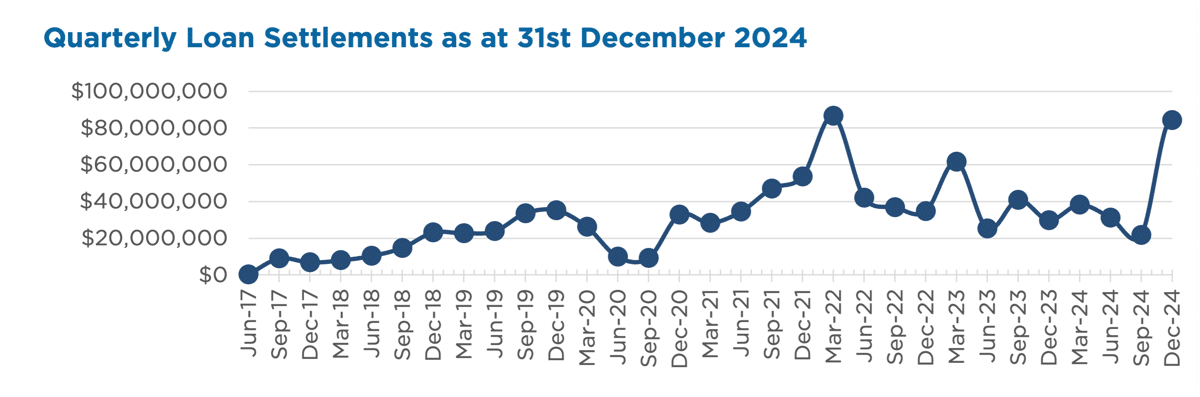

Quarterly Loan Settlements

as at 28th of February 2025

Current Loans by Fund Source

as at 28th of February 2025

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 76.54% | 100% | 100% |

| 2nd Mortgage Loans | 18.36% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 5.11% | 0% | 0% |

| Avg. Weighted LVR | 55.23% | 46.06% | 47.97% |

| Avg. Loan Size | $1,318,902.77 | $984,295.50 | $877,489.13 |

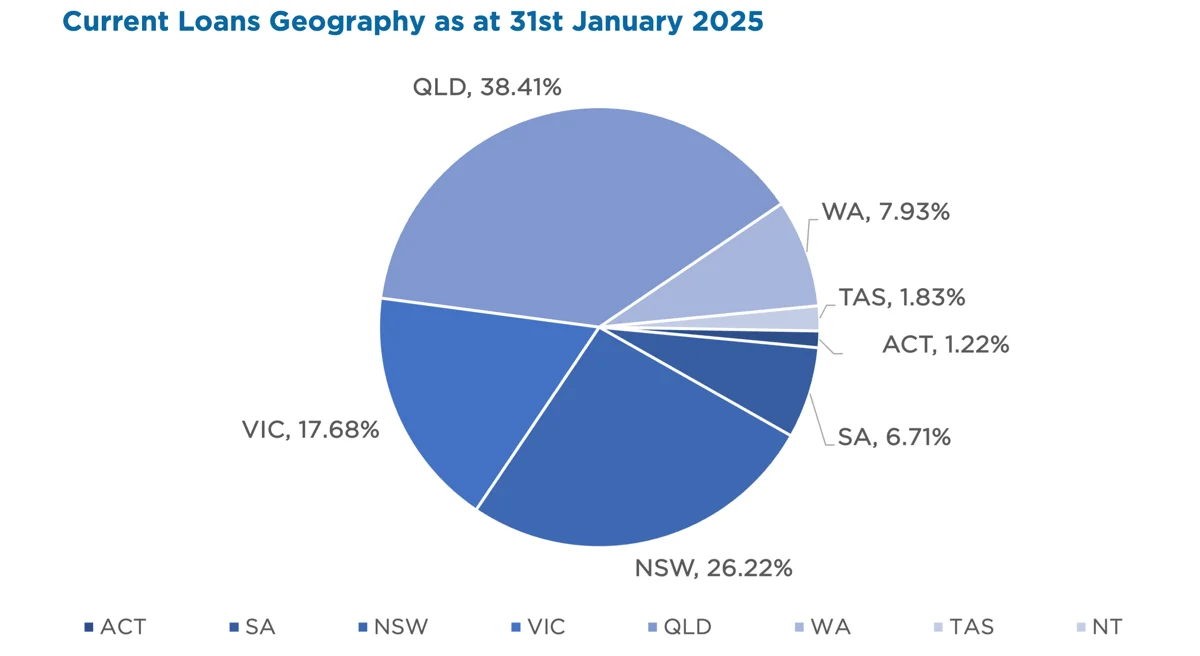

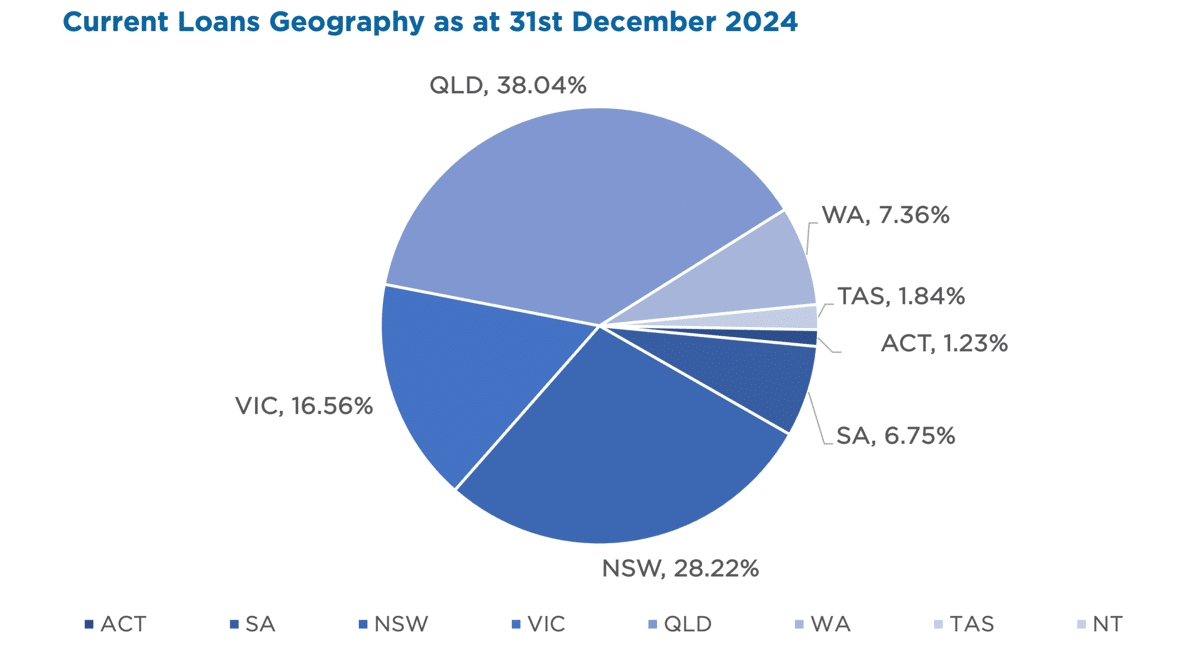

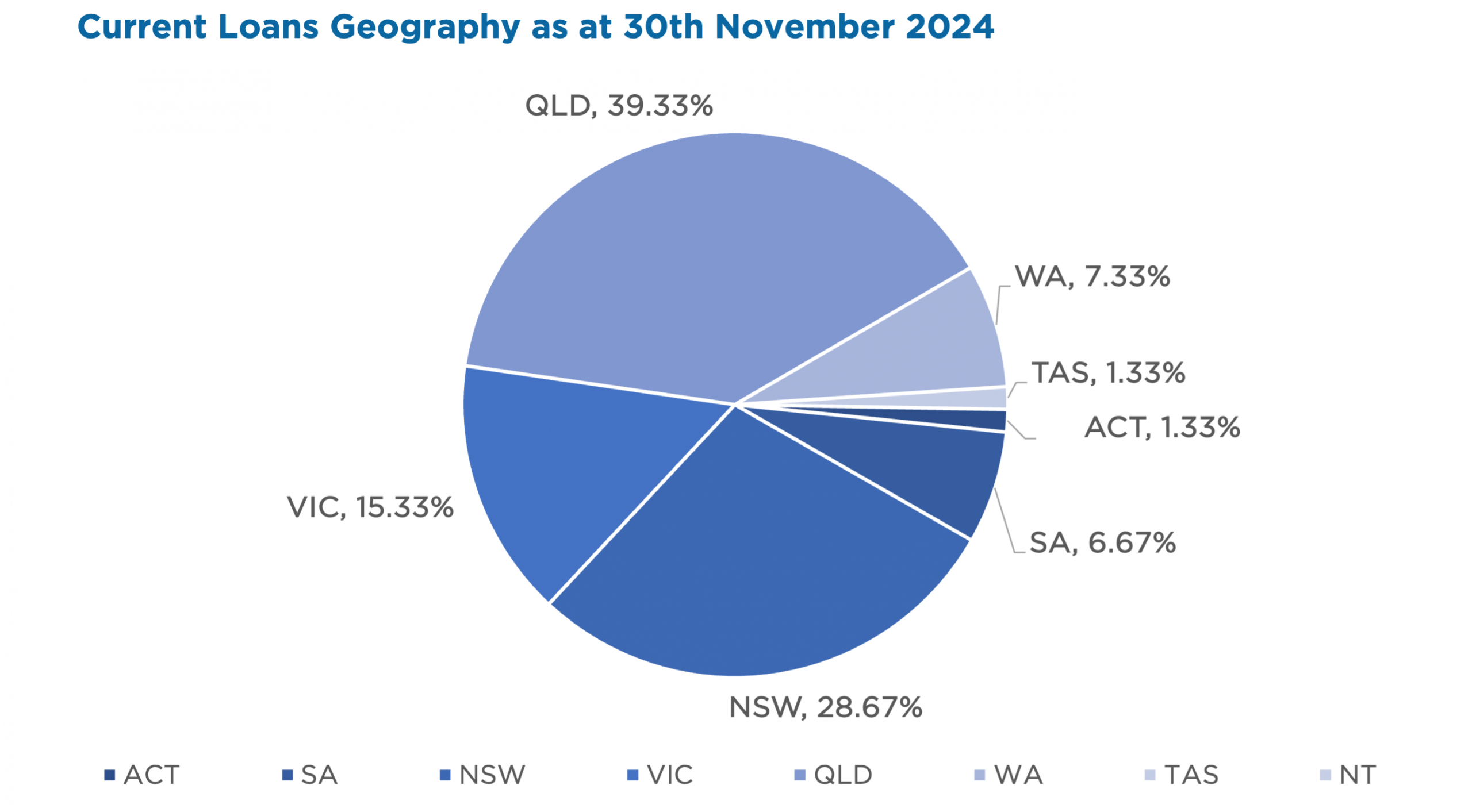

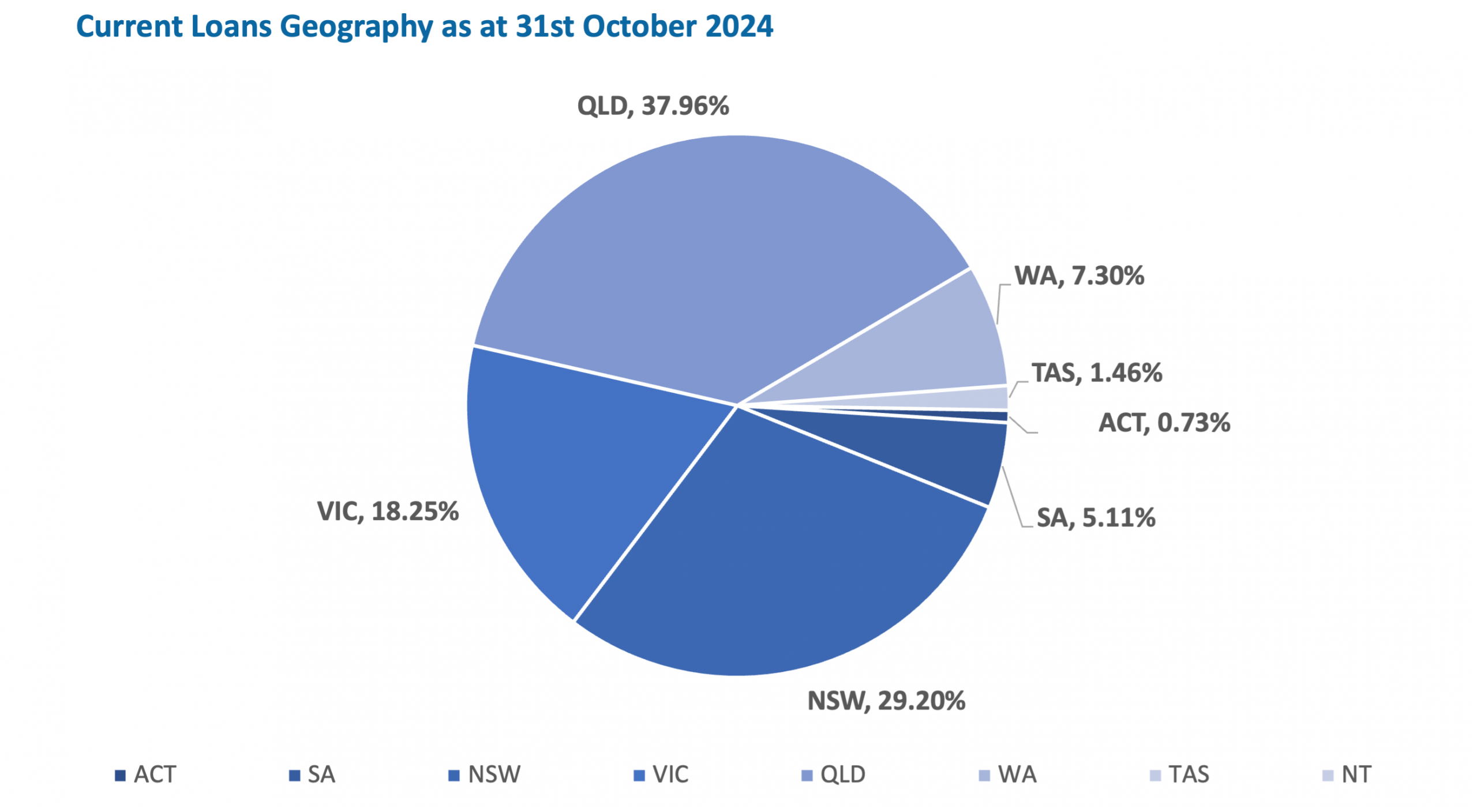

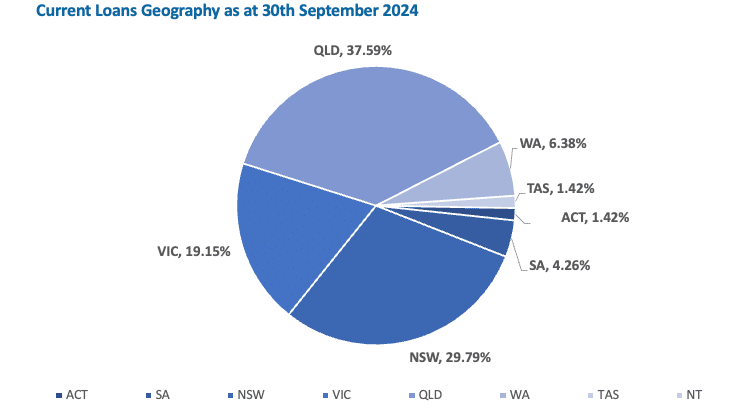

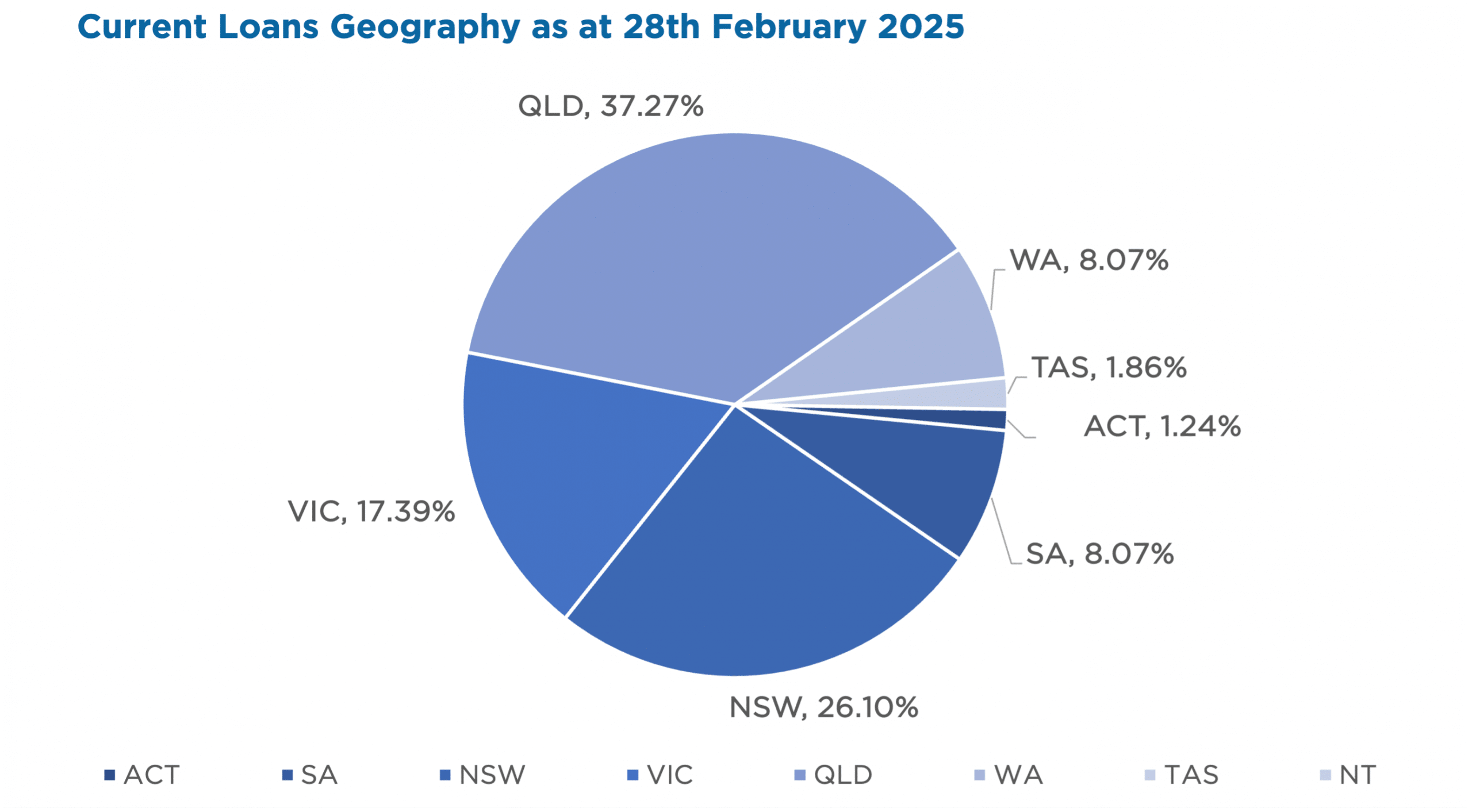

Current Loans Geography

as at 28th of February 2025

Why Invest with ASCF?

What are the benefits of using a Custodian for an investor

When it comes to managing investor funds, ASCF takes investor security seriously and uses Certane CT Pty Ltd as the custodian of all investor assets. A custodian is a financial institution that safeguards investor funds, providing peace of mind by ensuring funds are managed securely and in compliance with regulations.

Here’s why using a custodian is a smart move:

- Stronger Security – Custodians keep funds separate from investment managers, reducing the risk of fraud or mismanagement. This extra layer of protection ensures your investments remain safe.

- Regulatory Compliance – Financial regulations are complex, but custodians help ensure investments meet legal standards, reducing the risk of penalties or compliance issues.

- Lower Risk – Custodians help prevent unauthorised transactions and errors, creating a secure environment for your investments.

- Faster Transactions – They streamline asset transfers and settlements, reducing delays and errors.

The bottom line

Using a custodian isn’t just about compliance—it’s about security, efficiency, and peace of mind.

Whether you’re an individual investor, company or trust, a custodian helps protect and manage your funds effectively.

Want to learn more? Contact us to explore your investment options.

Important information: At ASCF, we’re here to help you invest on your terms. Since inception, all investors have received their targeted distribution rate monthly and all redemption requests have been paid on time and in full, however past performance is not indicative of future performance. Distributions are not guaranteed nor a forecast. Lower than expected returns may be achieved. Investment in the Funds is not a bank deposit and investors risk losing some or all of their capital. Withdrawal rights are subject to liquidity and may be delayed or suspended. Read the PDS and TMD, available from our website.

An Interesting Transaction

Problem:

A transport operator was presented to us by a valued finance broker seeking funding to pay outstanding tax liabilities. The ATO is currently applying significant pressure on Australian businesses with outstanding tax liabilities and are commonly issuing winding up notices rather than offering payment plans.

Solution:

ASCF promptly ordered valuations to ensure there was sufficient equity in the customers three residential properties to allow for a 2nd mortgage to meet the outstanding tax liabilities. Upon receipt, ASCF offered the customer a 2nd mortgage loan of $560,000 for a term of 12 months at a rate of 18.96%pa. After confirming the value of the 1st mortgages with ANZ (the 1st mortgage lender), our valuations resulted in an LVR of 63.68%.

Monies were remitted directly to the tax office.

What ASCF does differently

| ASCF assists clients in responding to ever changing market circumstances by creating products that cater to the needs of our customers. |

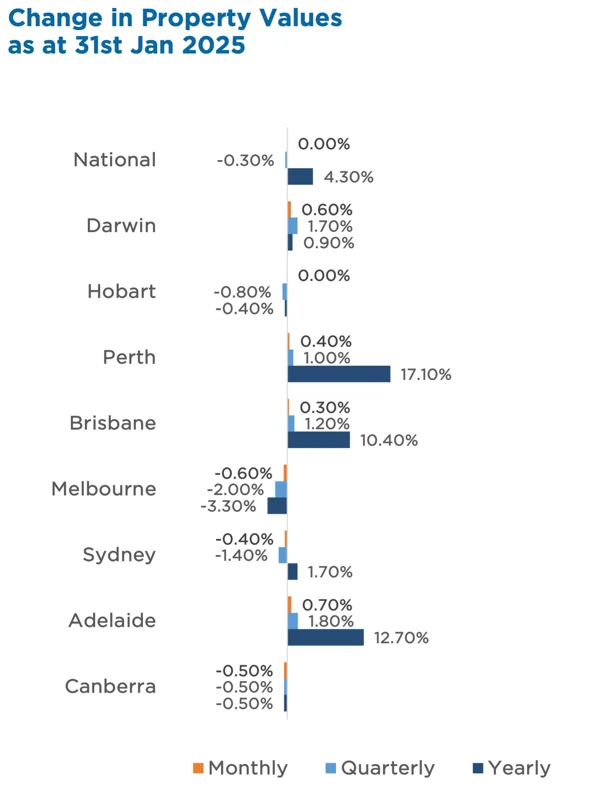

Market Update

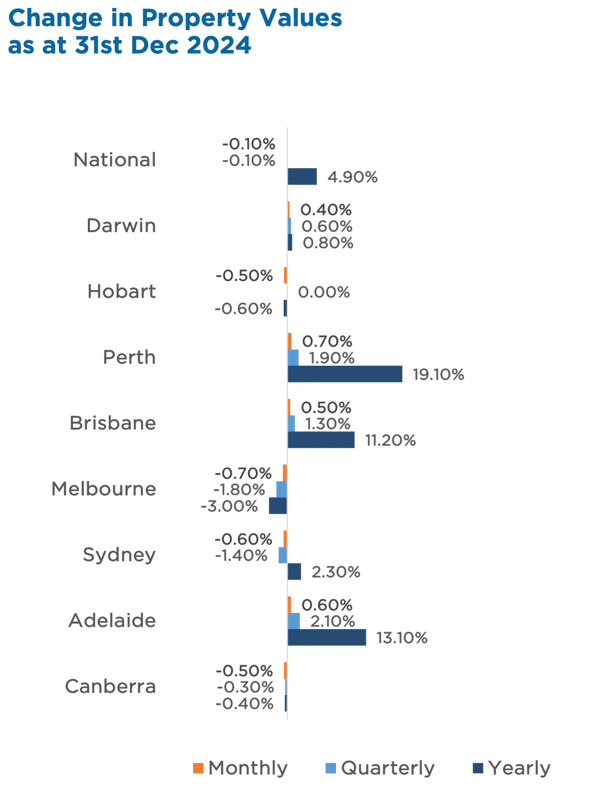

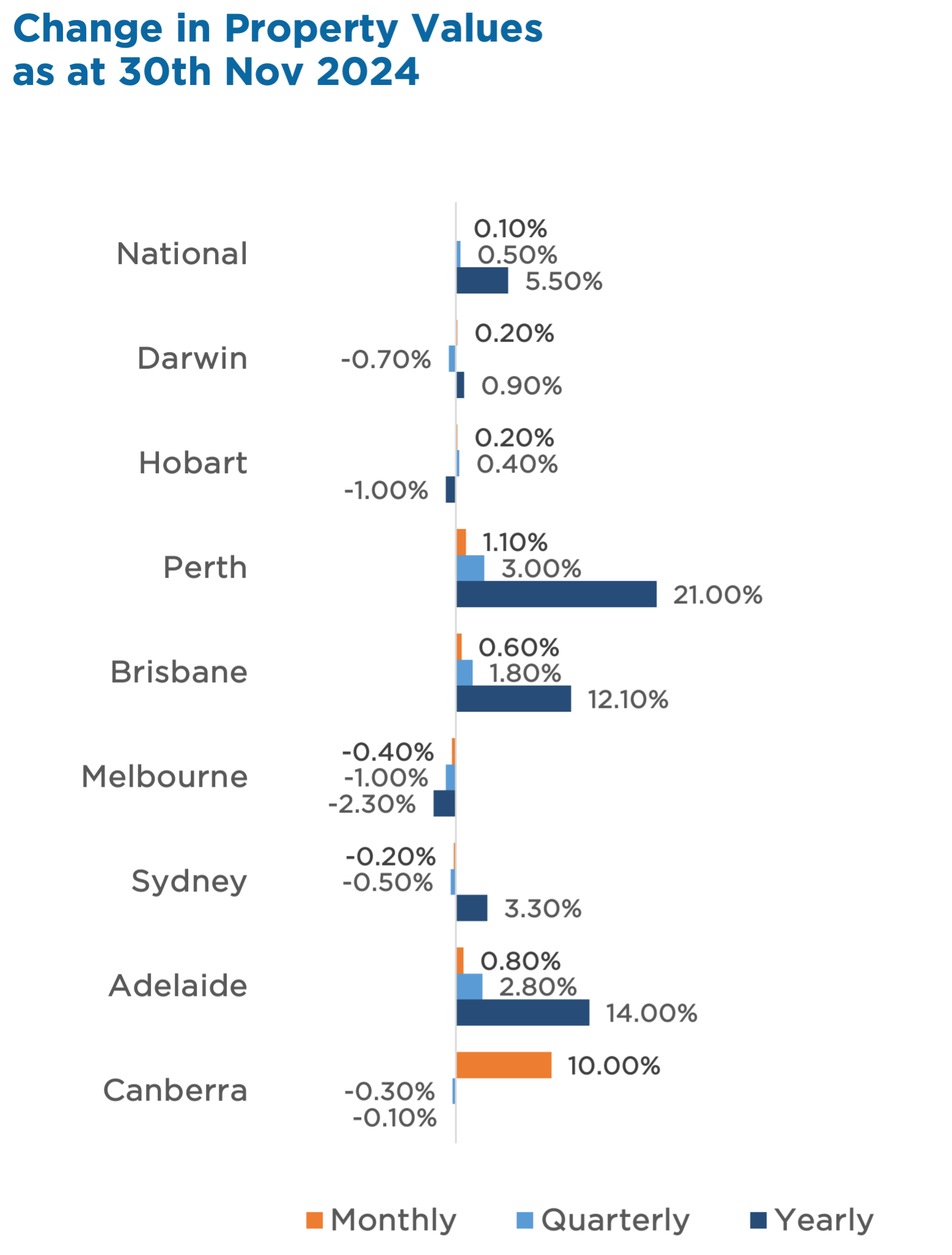

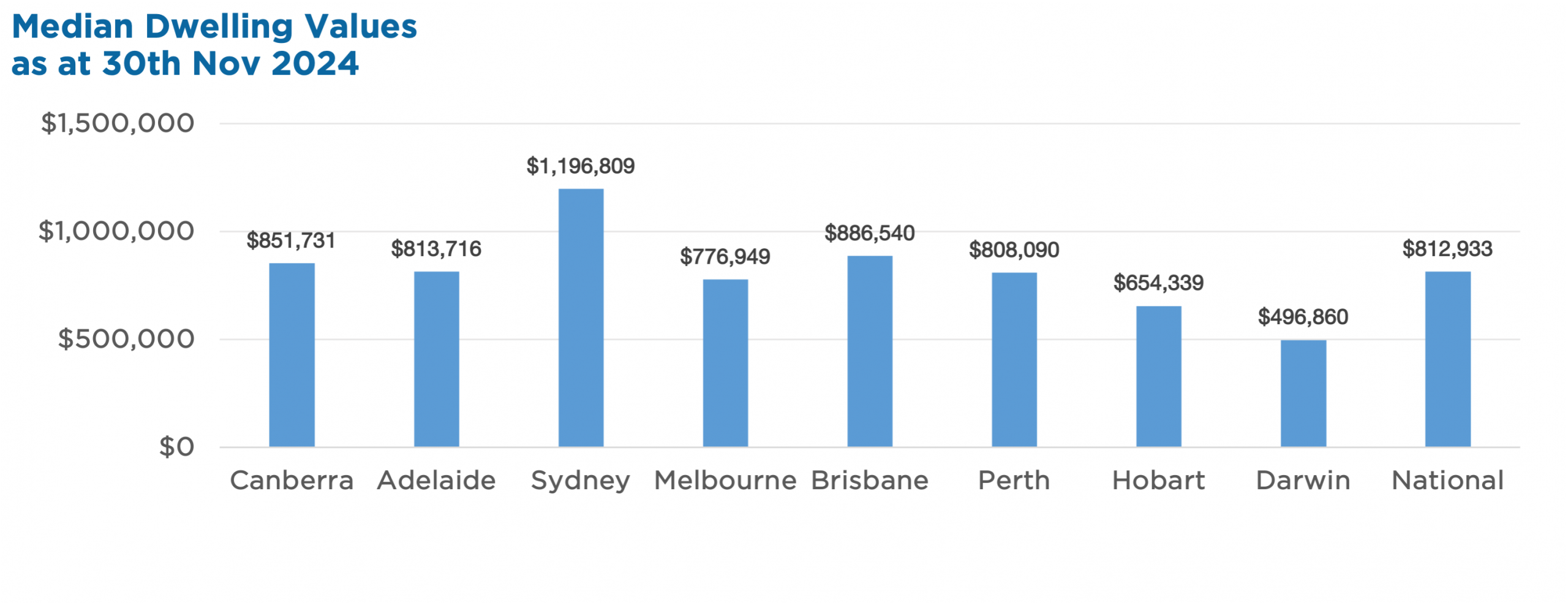

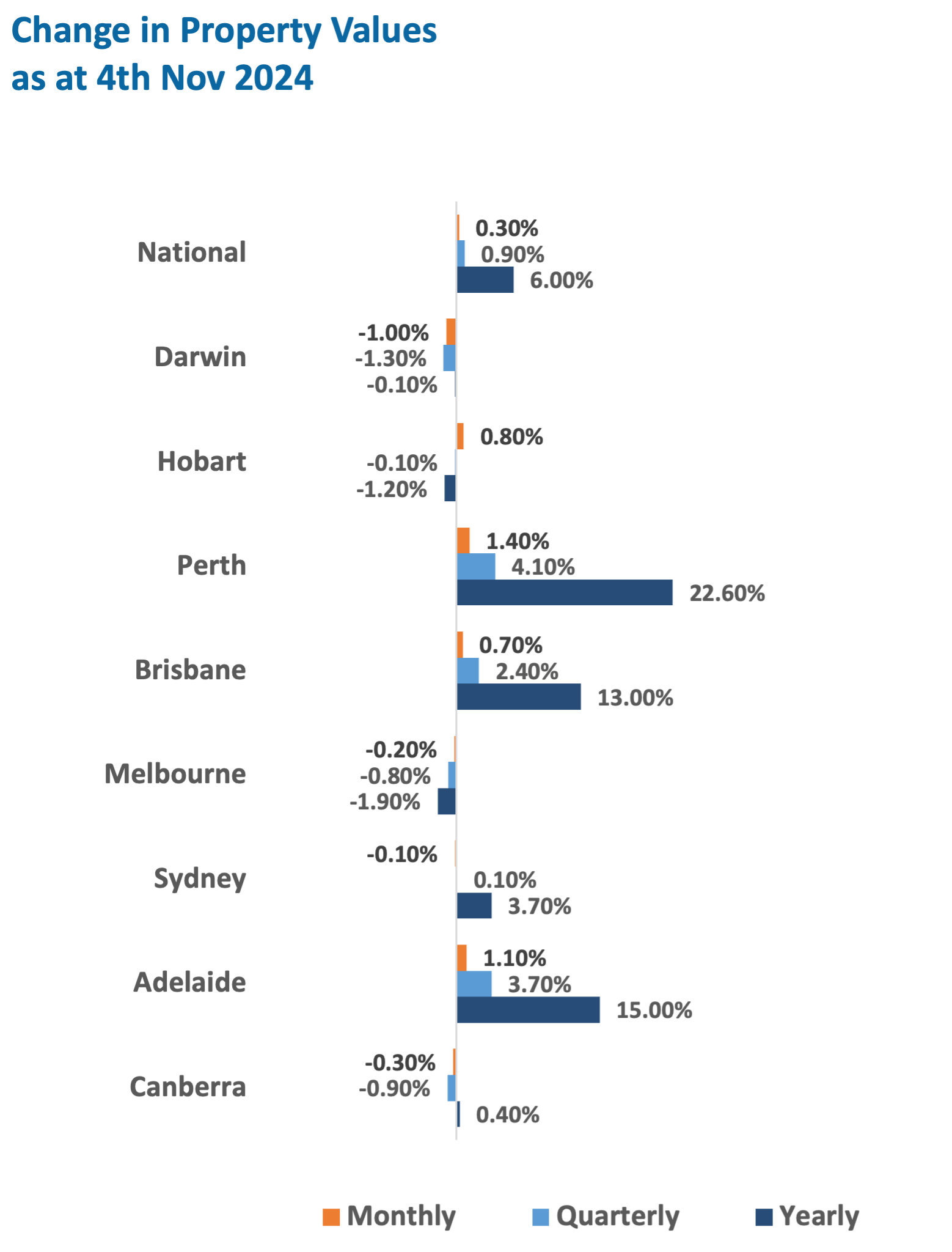

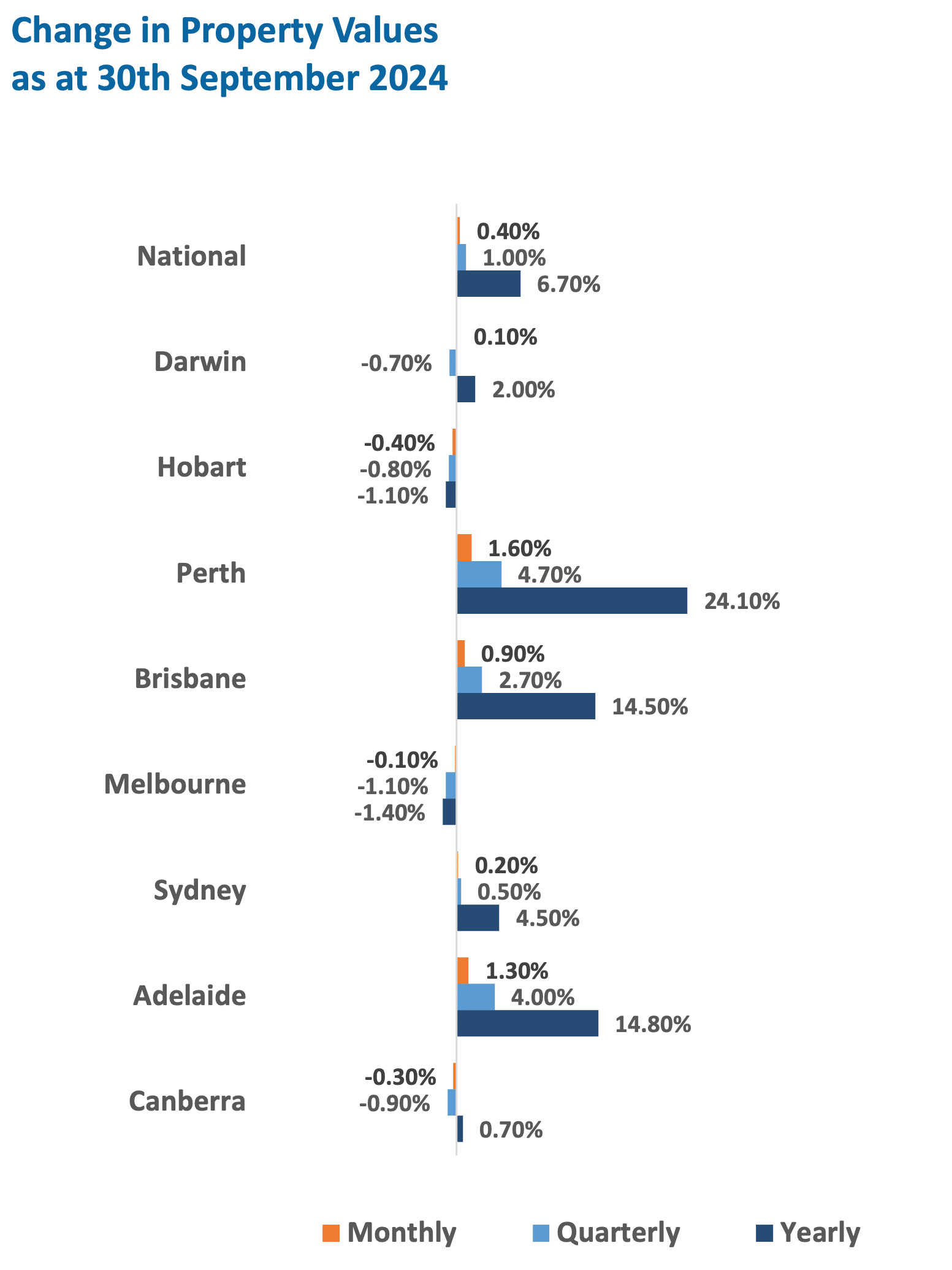

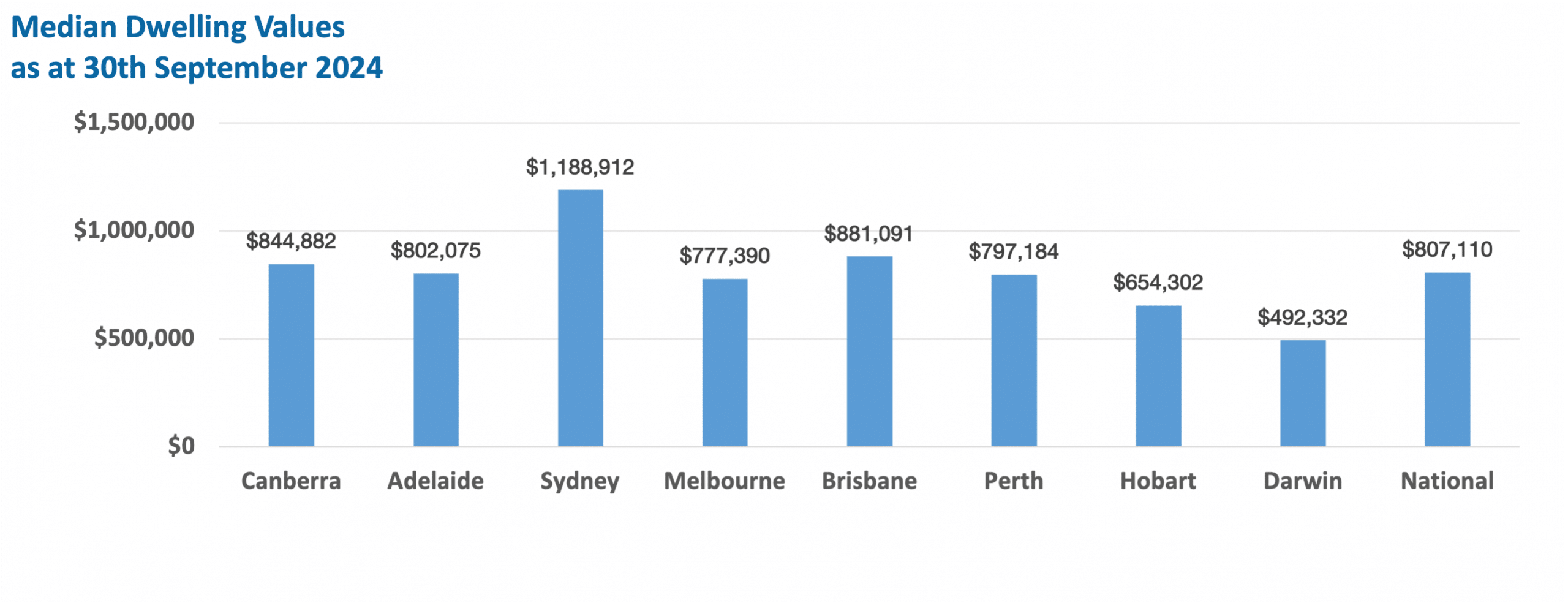

February marked a shift in Australia’s housing market, with national home values rising 0.3%, ending a three-month downturn. Gains were widespread, with Melbourne and Hobart leading at +0.4%, while regional markets continued to outperform, rising 0.4% for the month and 1.0% over the quarter.

This renewed momentum aligns with improving buyer sentiment, supported by tighter housing supply and a slowdown in new listings, which remain 4.7% lower year-on-year. Auction clearance rates have also strengthened, reflecting growing confidence in the market.

While affordability remains a challenge, supply constraints and positive sentiment could support continued price growth in the coming months. Investors monitoring market trends should note the shifting dynamics, particularly in premium housing markets, which have historically been the first to respond to changing economic conditions.

Property Values

as at 28th of February 2025

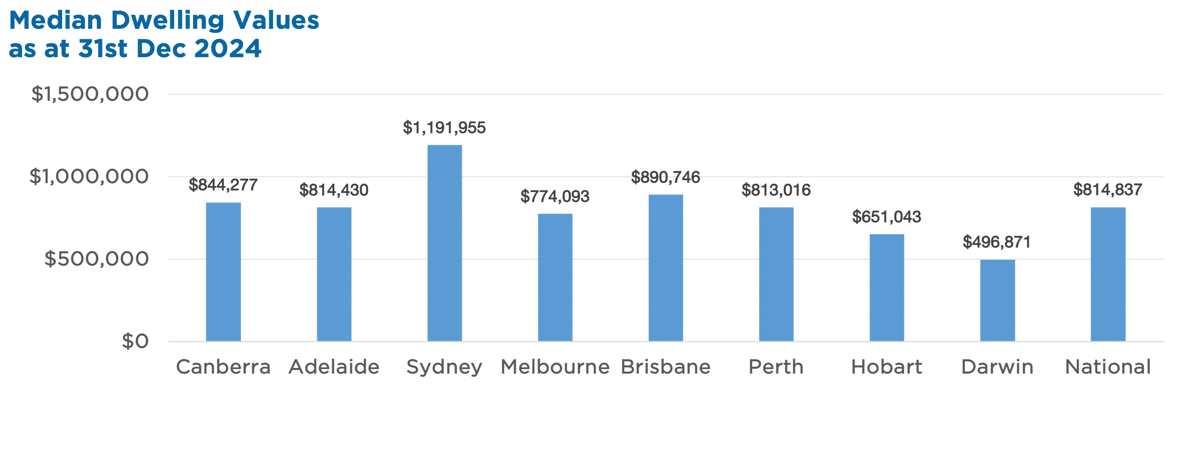

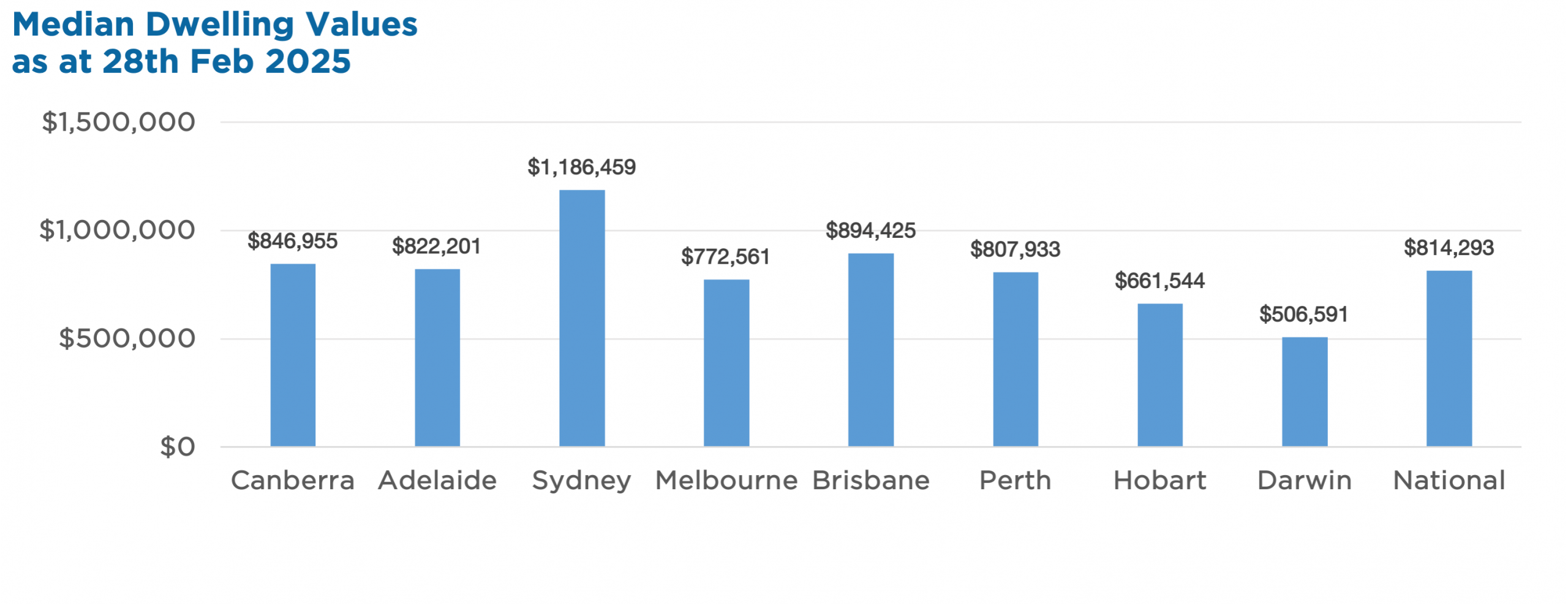

Median Dwelling Values

as at 28th of February 2025

Quick Insights

What rising property price trends are revealing

For investors, the modest drop in interest rates serves to signal market stability and clearer future direction in the near to medium term, helping to remove any destabilising fears of rapidly escalating interest rates.

Source: Australian Financial Review

Australians make a record median profit reselling their property

CoreLogic’s Head of Research Eliza Owen said: “Despite mixed market conditions, declining capital growth and lower clearance rates, Australian property continues to deliver strong profitability.”

Source: Corelogic