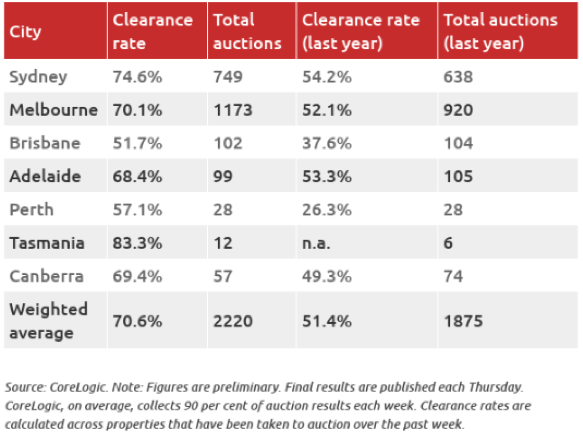

| In recent weeks the COVID-19 outbreak has continued to spread resulting in significant share market volatility along with Government imposed social distancing practices and guidelines. We are closely monitoring the situation and at this stage, we have seen no impact on our business or funds under management and the unit price across each of our funds remains stable at $1.00 per unit. We continue to operate as normal from our office in Brisbane and our employees remain unaffected by COVID-19. Should the situation change, a detailed business continuity plan is in place that will allow the continued operation of the organisation with employees working remotely. This will ensure our business operations, communications and response times with investors will remain unaffected. From a business standpoint, we continue to track any potential impact on the property market and are closely monitoring auction clearance rates across capital cities. You will note last weekend’s results as per the table below are well above this time last year. However, whilst we expect these will be affected going forward, we do expect them to recover after the virus threat has declined, supported by a record low interest rate environment and Government fiscal policy response. |

Whilst we predominantly lend for business purposes, our funds are primarily secured by a nationally diversified pool of residential property. We believe residential property values will prove more resilient than other property types as the economic impacts of the virus flow through the Australian economy.

Our Funds Under Management have continued to grow in recent weeks and currently exceed $116 Million as investors seek a more stable return on their investment and a property backed alternative to equity markets.

Our loan originations also remain strong with continued demand for our lending products. In response to the economic climate however, we have tightened our lending criteria and have allocated additional resources to monitor arrears.

We have also increased our cash position and currently hold $17.9 Million in cash, which is over 15.4% of funds under management with additional cash reserves of $6.9 Million available should additional liquidity be required by our funds.

During these times, we understand that the wellbeing of our clients and our staff and families is a priority.

A further update will be included in our monthly newsletter at the end of the month, but should you have any queries in the interim, please do not hesitate to contact us.

Thank you,

Richard Taylor

Chief Executive Officer & Director of Finance – Australian Secure Capital Fund Ltd