Managed Funds Trading Update

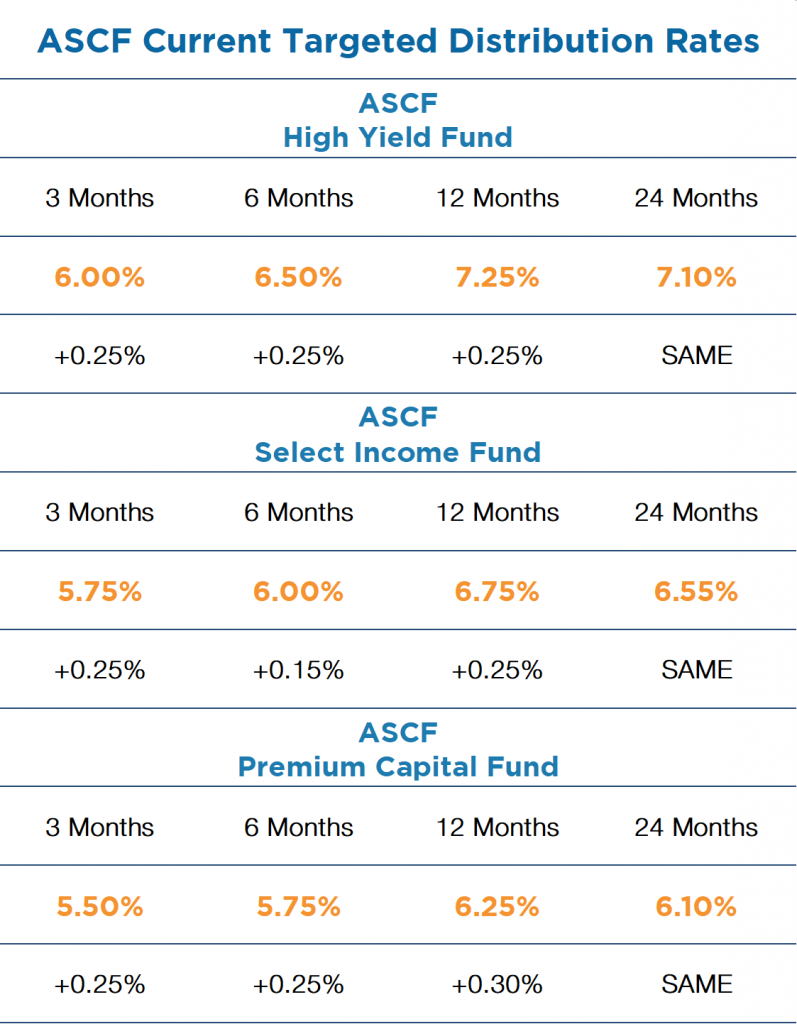

We are pleased to advise that we are seeing a continued increase in loan origination inquiries, enabling us to increase our managed fund investment rates for our 3, 6, and 12 month term accounts effective immediately.

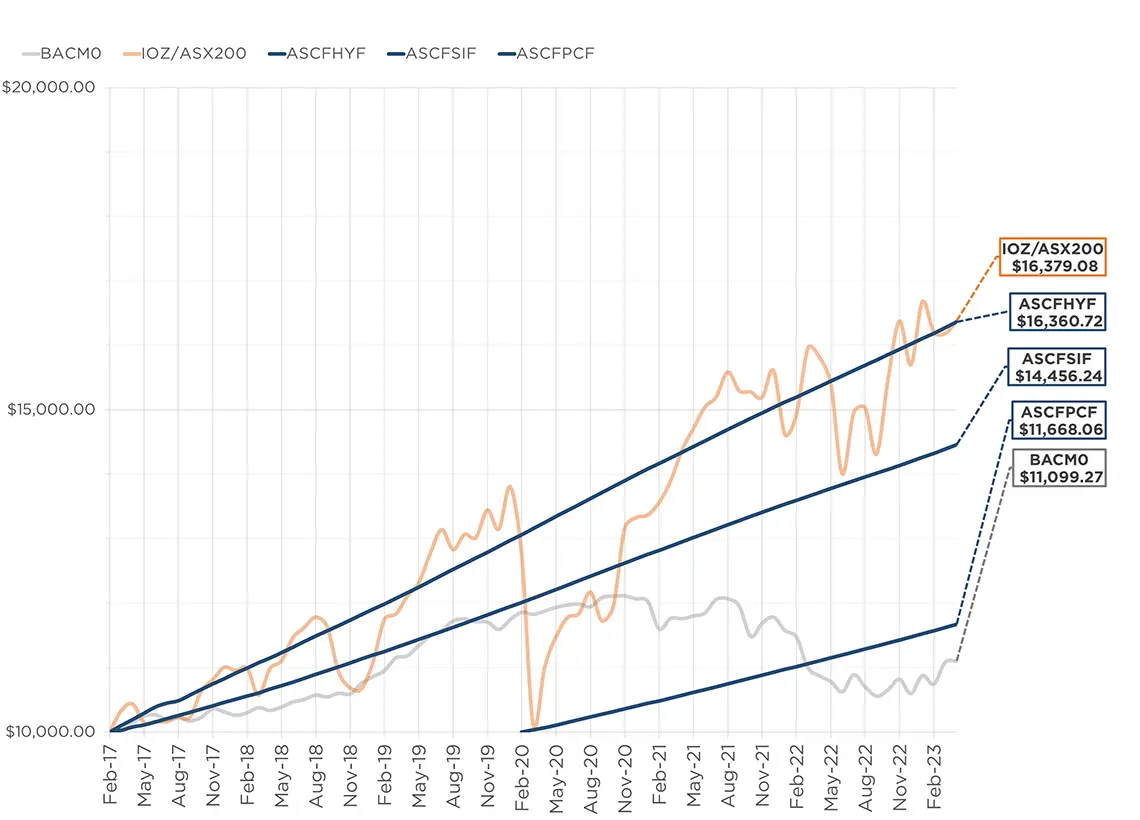

Our new investment distribution rates are as follows:

The new rates will apply to all new and additional investments with existing investors receiving the benefit of the increase on the scheduled maturity date of their existing investments.

This week’s RBA decision to increase rates by 0.25% caught many economists by surprise and left the RBA’s already tarnished reputation in tatters. Whilst we may not always agree with the Labor government’s policy decisions we commend them on their foresight in last year’s decision to review the RBA’s role in setting monetary policy and we believe many of the recommendations proposed by the review panel will result in positive outcomes through greater transparency and strengthen the RBA’s decision making processes.

Last month’s quarterly inflation data clearly indicated inflation is cooling and that we are past the peak so why the RBA would increase rates this week after having paused last month makes little sense and only confuses both business and consumers in terms of their purchasing decisions by leaving them guessing as to what the RBA’s next move is likely to be. As we have previously discussed, movements in official interest rates take time to filter through the economy and there is always a lag often up to 6 months or more before they start to take effect. If the RBA felt that there was more to be done one would think they would have raised rates last month and looked to pause this month, after all they already had access to the monthly inflation data released in February and March which showed a modest reduction so how the quarterly data would be significantly different is difficult to comprehend.

Whilst residential property markets across the country continue to stabilise with an overall national increase of 0.50% for April we do believe that price increases moving forward will be somewhat constrained more so due to the uncertainty created by the RBA’s move this week and their inability to effectively communicate their likely path forward for the remainder of the year. Despite this, we still do expect residential property to move up by 3% – 5% nationally over the next 12 months driven by a structural undersupply of housing, robust overseas migration and increased government assistance for first home buyers.

Our loan books across all our retail managed funds continue to perform strongly.

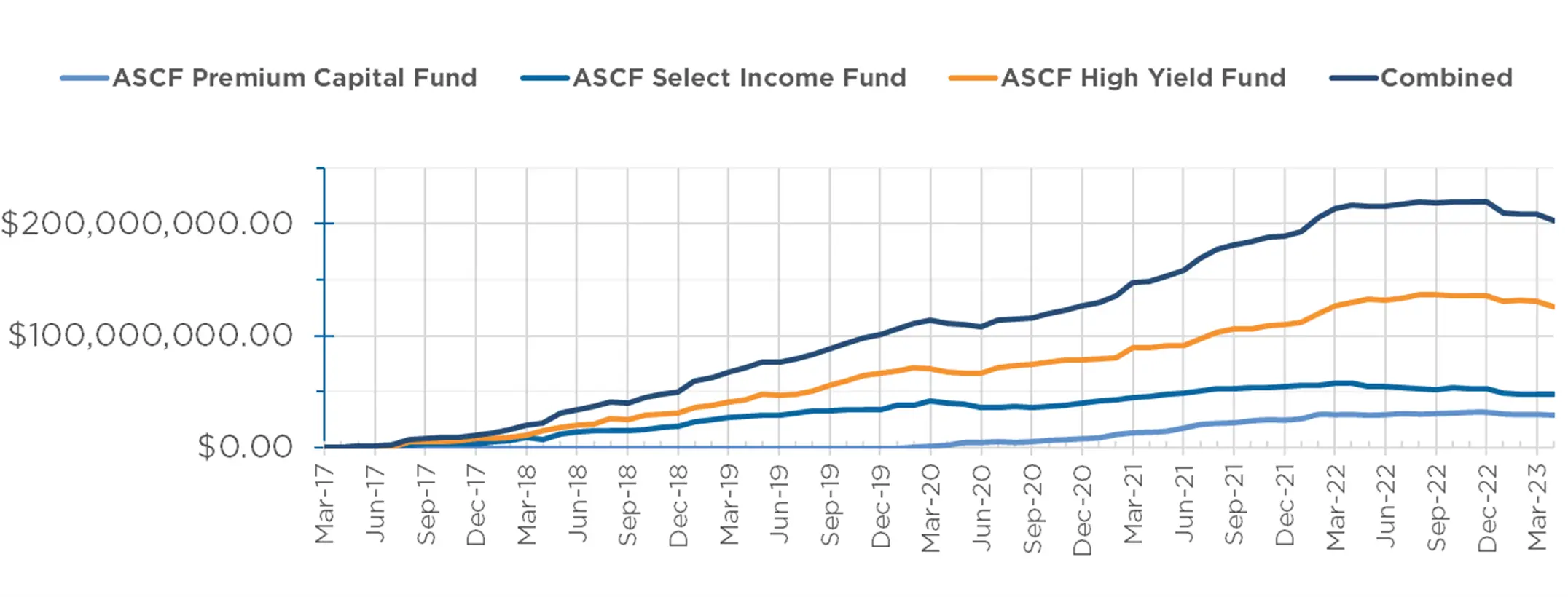

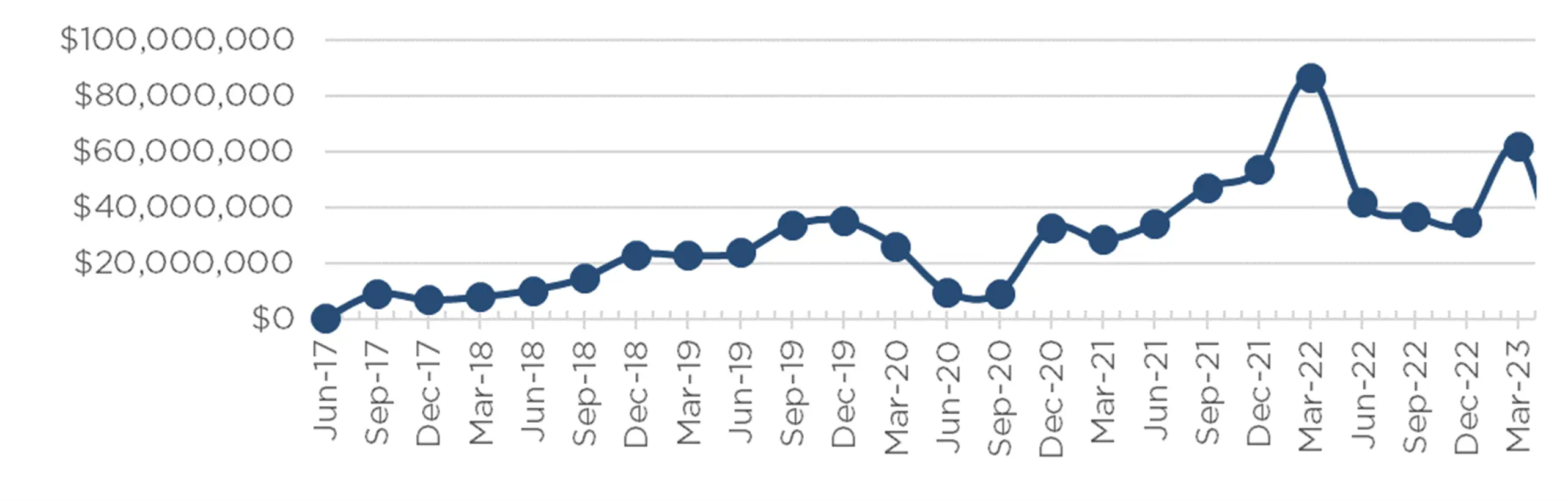

Monthly Managed Funds Under Management

Managed Funds Under Management

as at 30th of April 2023

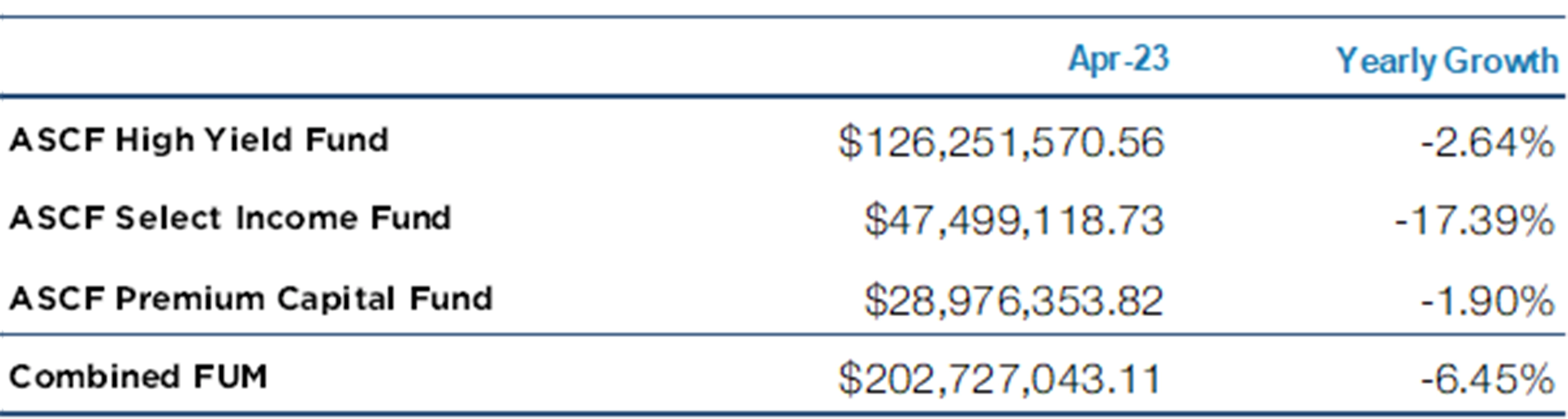

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

In April, loan originations and inquiry levels remained solid, with $8,799,745 in new loan originations settled.

The unit price across all three of our retail mortgage funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of April.

Lending Activity Update

Quarterly Loan Settlements

as at 30th of April 2023

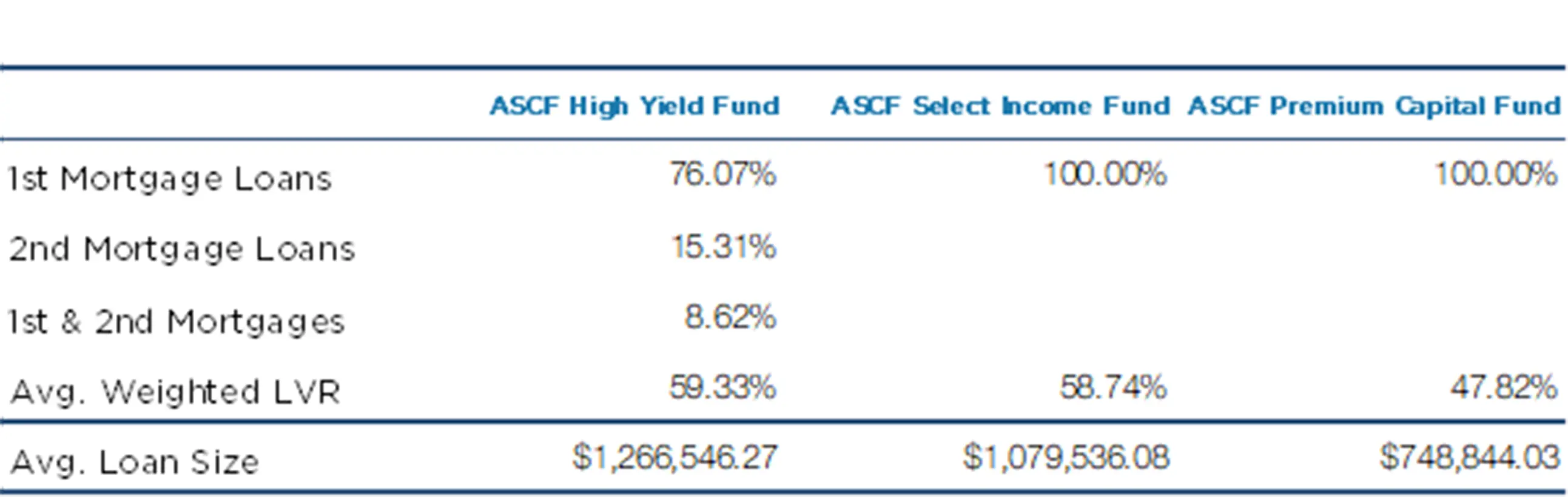

Current Loans by Fund Source

as at 30th of April 2023

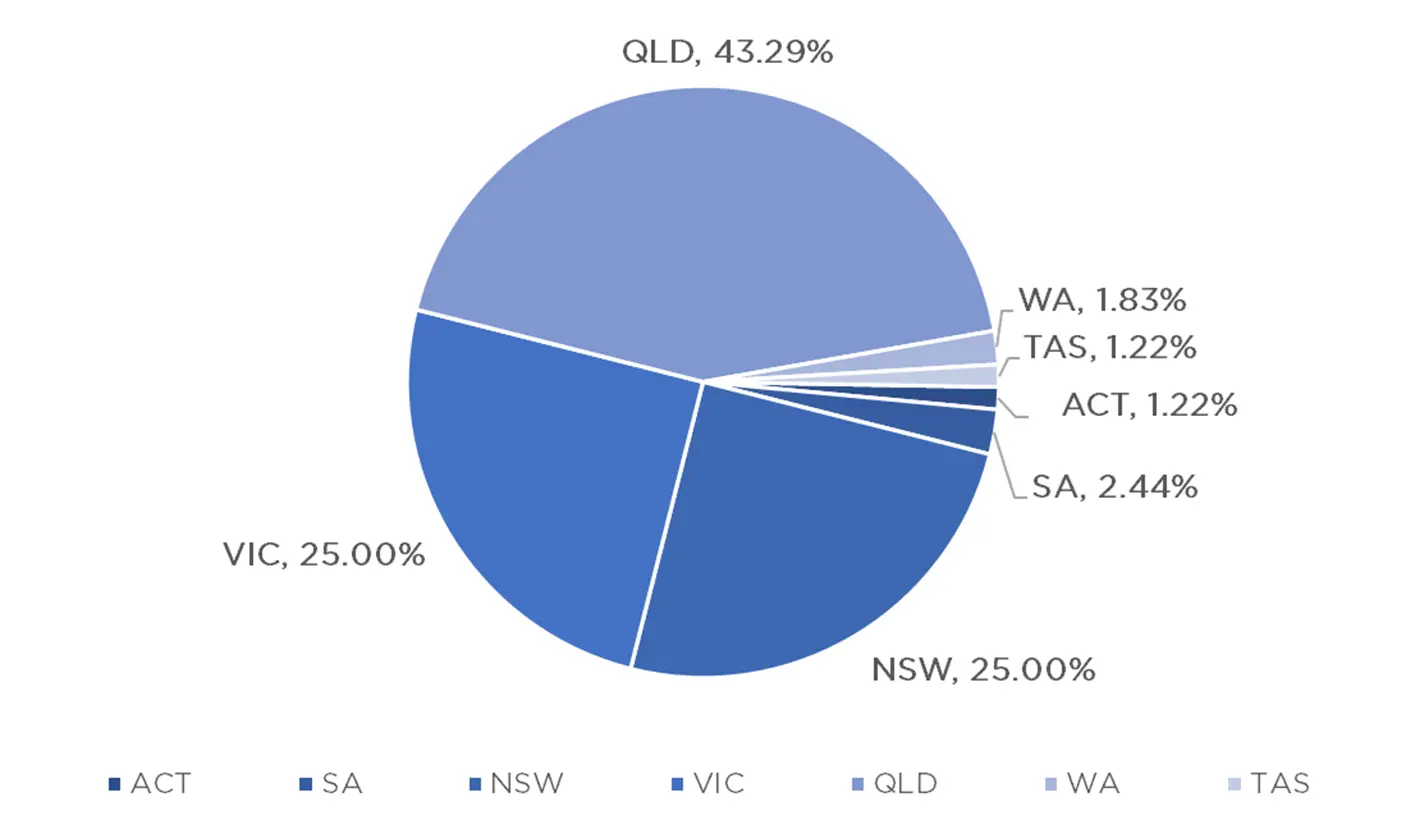

Current Loans Geography

as at 30th of April 2023

Why Invest with ASCF?

We have often discussed the many reasons to invest with ASCF but at the end of the day the primary reason investors do invest is that they trust us to look after their hard earned money.

This is a responsibility we have never taken lightly and during the last 7 years we are proud of our record of having paid out over $45m to investors in interest earned on their investments with all investor redemption requests having been paid in full and on time when needed.

Our loan book today remains as solid as ever even in an increasing interest rate environment, and our model of originating solid loans with over 85% secured by residential Australian property, one of the safest and most stable asset classes in the world, provides our investors with the confidence they need when seeking an inflation responsive capital stable investment that provides solid returns.

Whilst approximately 15% of our book is invested in mortgages over commercial property this has predominantly been industrial land with or without improvements which more recently is a market that has defied the recent residential downturn in Australia and has in fact outperformed residential housing.

In order to assist potential investors better understand what ASCF does and how it does it we recently put together a short video which we thought we would share with you in this months newsletter.

An Interesting Transaction

Problem:

A client recently approached us directly via their accountant, requiring urgent funding to settle on the purchase of a large industrial warehouse in Hemmant, QLD. Due to a change in the tenancy arrangement, the previous bank approval fell through and required re-assessment, with only 5 days remaining before the settlement was due.

Solution:

The client was able to provide us with the new leasing agreement, which showed a rental increase over the previous agreement, resulting in an uplift in the property value. We were able to provide a 4-month facility of $3,075,000 at 12% pa with an LVR of just 51.25% and were able to settle the transaction for the client on the due date.

The borrower expects his bank to approve a refinance of the loan later this month.

What ASCF Does Differently:

ASCF is able to quickly assess changing situations borrowers may experience when seeking property finance.

Market Update

Australian housing values appear to have stabilised, with a second consecutive monthly increase as CoreLogic’s national Home Value Index rose by half a per cent.

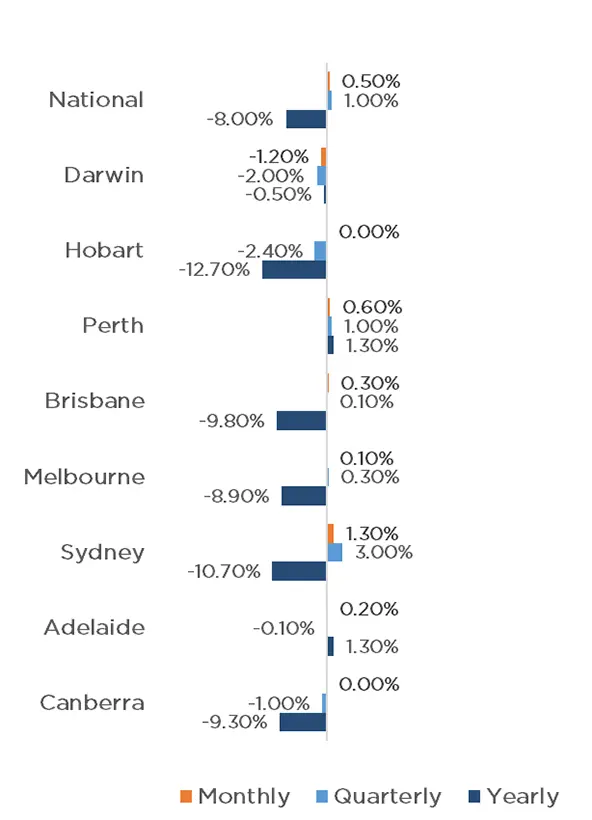

The capital cities performed strongly, with Sydney leading the way with a 1.30% increase for the month, followed by Perth (0.60%), Brisbane (0.30%), Adelaide (0.20%) and Melbourne (0.10%). Canberra and Tasmania remained stable, whilst only Darwin recorded a decrease in values, with a 1.20% reduction.

Similarly, the regions have also performed quite well, with South Australia seeing a 0.90% increase, followed by Queensland (0.80%) and Western Australia and Tasmania, both increasing by 0.10%. Only regional Victoria and New South Wales experienced a reduction in values, of 0.40% and 0.30%, respectively.

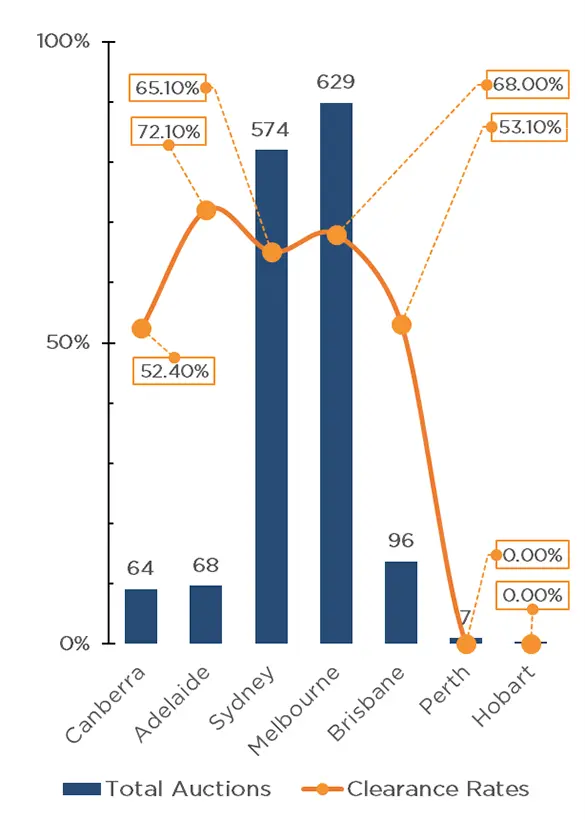

Auction activity remained low in April, with volumes down by approximately 25% when compared to last year. Persistently low levels of residential property coming to market remains a key factor in supporting housing values. The rolling four week trend during April was around 14% below the previous five year average in new listings for April. Whilst numbers were down, clearance rates remained robust.

With the decision of the RBA to once again increase the cash rate by a further 0.25% following last month’s pause, the outlook for the property market remains stable but with future growth potentially constrained. Whilst we are yet to see the full impact that the rate rise cycle has had on household cashflows, foreign buyers are returning and the labor market remains tight which should keep prices stable.

Clearance Rates & Auctions

17th – 23rd of February 2023

Property Values

as at 1st of May 2023

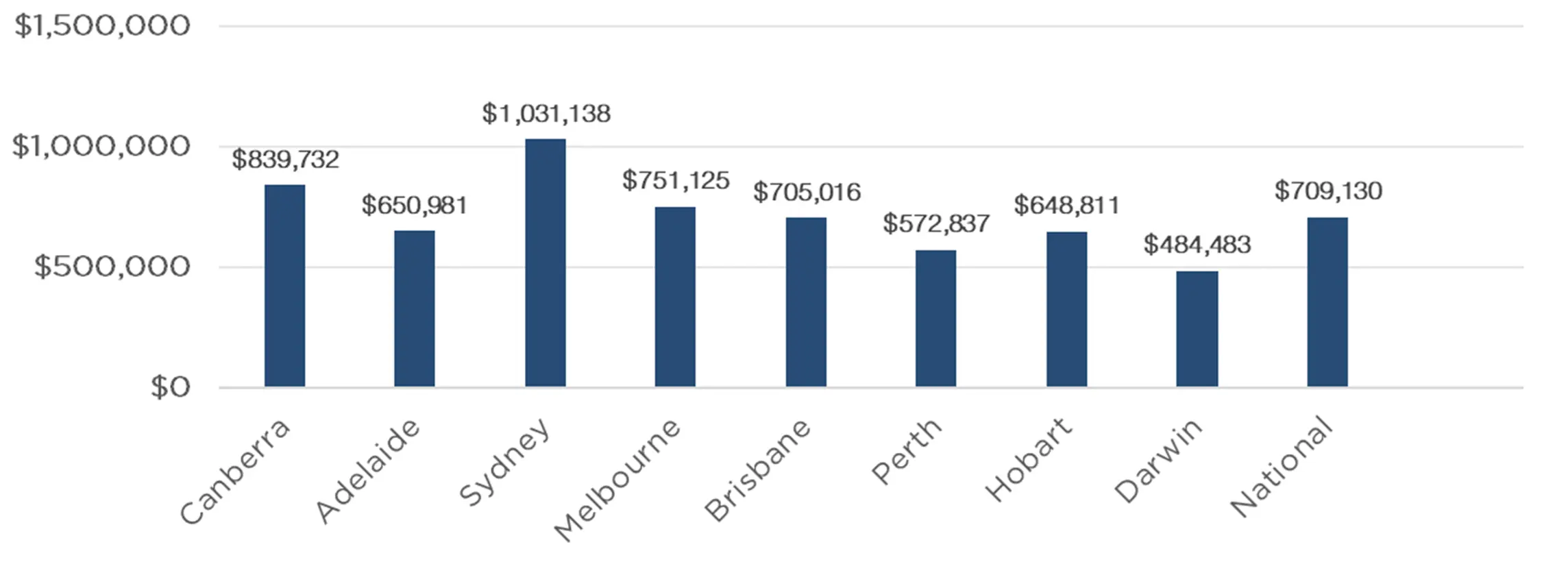

Median Dwelling Values

as at 1st of May 2023

Quick Insights

FOMO

Despite some uncertainty created by the RBA’s recent decision to increase rates, some homebuyers have not been deterred.

Dr Nicola Powell, Chief of Research and Economics from Domain, recently said, “I think the improvement in confidence that stabilised the market will be enough to sustain the market recovery. ” Sydney resident and homebuyer Scott Gardiner had this to say, “I could see that prices have started to move since January, and very soon, there will be more buyers in the market, so I decided to buy as soon as I got my mortgage pre-approval.”

Mr Gardiner just settled on a $725,000 Newcastle investment home. Sydney-based real estate agent Jack Henderson said some buyers are starting to feel some urgency as competition heats up. “After seeing 10 rate rises having less impact on house prices than people expected, people are becoming more confident.”

Source: Australian Financial Review

Housing Heroes

New research by McCrindle Research for the Finance Brokers Association of Australia has revealed that due to higher interest rates more than 60% of homeowners have cut back on leisure and social activities to manage higher repayments. Another 28% said they took on more work and 30% said they were considering it.

These homeowners are now being credited for reversing the property slide by cutting back on non-essentials instead of selling. Tim Lawless, Director from CoreLogic said that borrowers falling behind on mortgage repayments, which usually trigger distressed selling, remained low at just 0.4% of all loans.

“We haven’t seen any evidence that distressed home sales have become a feature of the housing market. A lack of sellers, let alone motivated sellers, is likely to be a key factor that has supported housing prices” Mr Lawless said.

Source: Australian Financial Review

Women & the Home Guarantee

Housing Minister Julie Collins has expanded the eligibility criteria for three home buyer schemes to include those who have not owned property in Australia in the past 10 years. The policy has been aimed at older women who may have lost their home in a divorce or separation.

“We know divorce is often a reason people lose their home, particularly women,” Grattan Institute economic policy program director Brendan Coates said. Of women who separate from their partner and lose the house, just one in three buy a home again within five years, and only 44 per cent again within 10 years. The changes hope to address this issue.

Source: Australian Financial Review