Trading Update

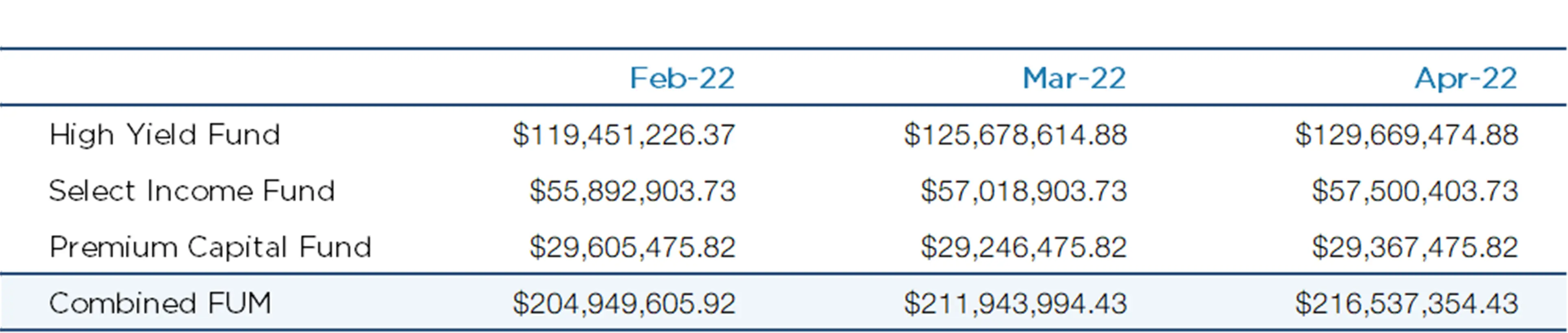

Australian Secure Capital Fund is pleased to provide this monthly update to our investors. Our pooled managed investments have increased from $211,943,994.43 in March to $216,537,354.43 as of the 29th of April (+2.17%) and new investments across all our managed funds are continuing to grow.

Managed Funds Under Management

as at 30th of April 2022

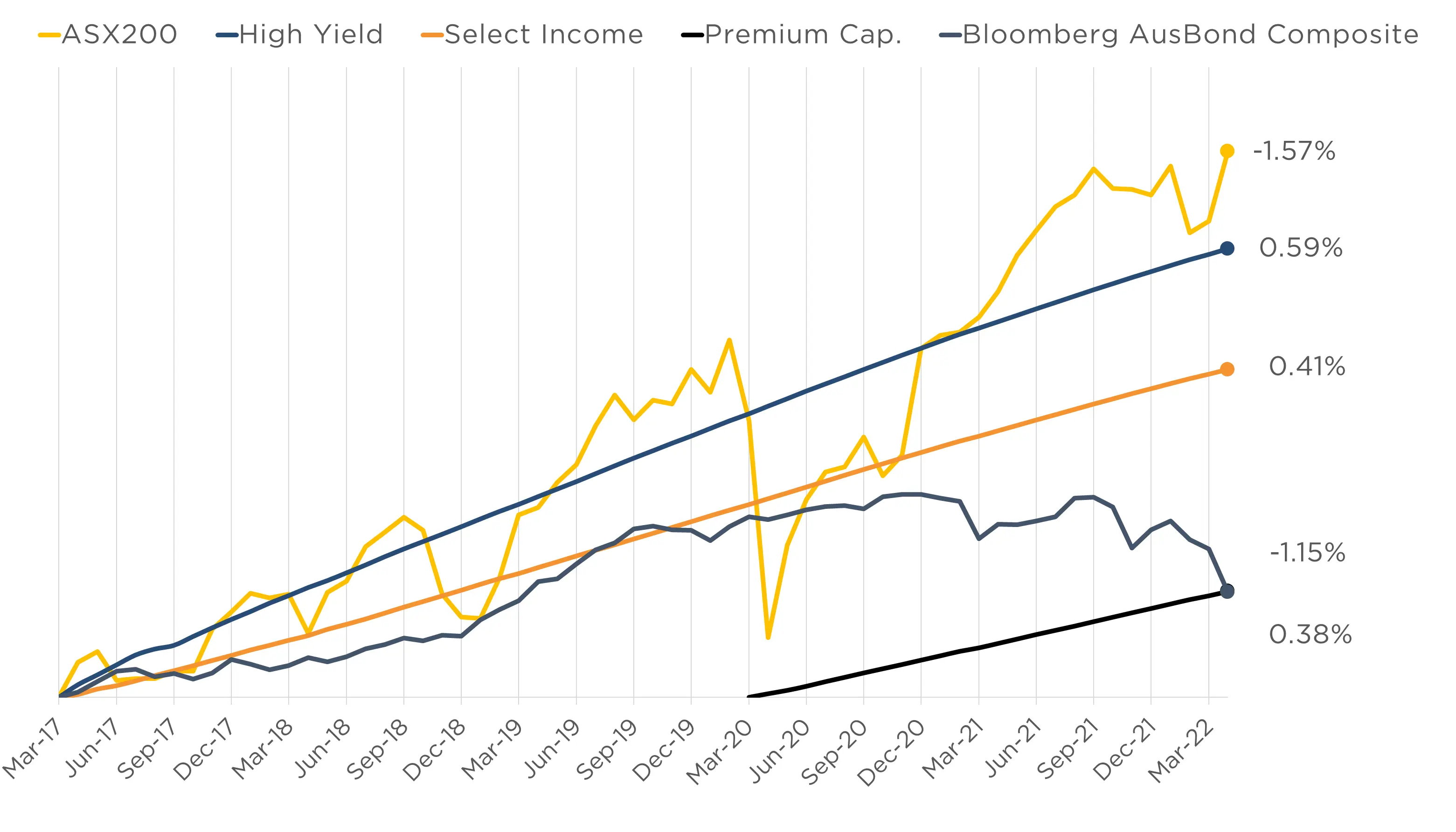

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

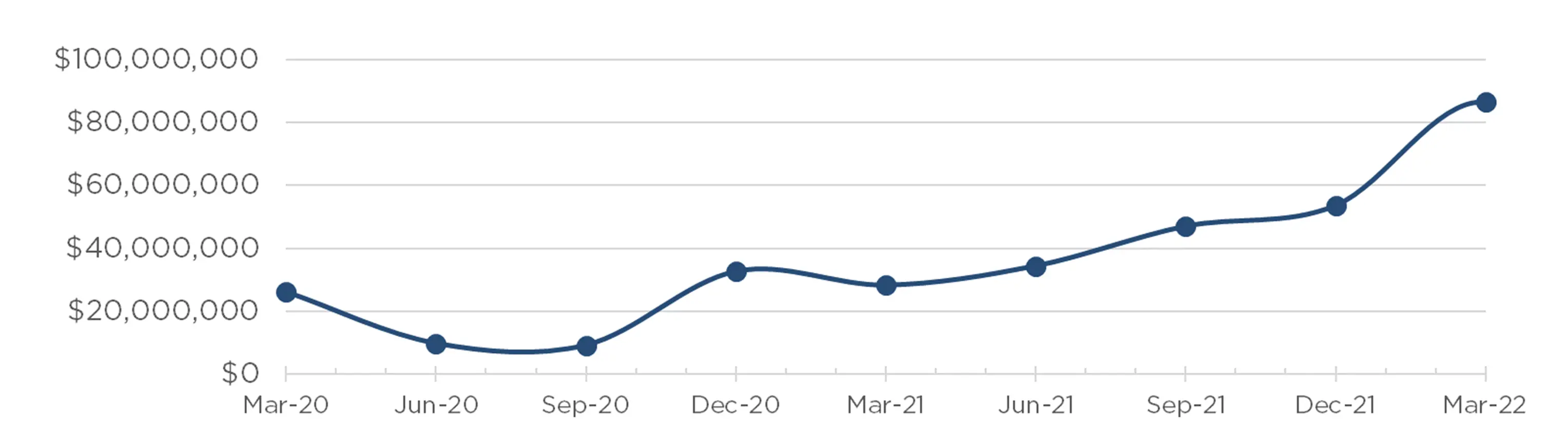

Loan originations this month were $6,977,000, with an increasing proportion being originated via our online origination portal.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of April.

Lending Activity Update

Quarterly Loan Settlements

as at 30th of April 2022

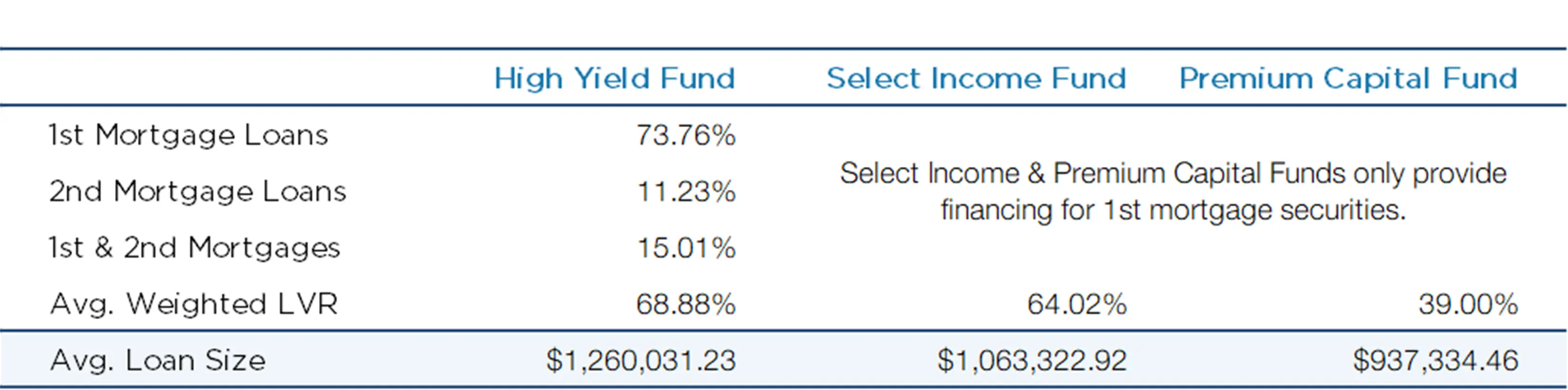

Current Loans by Fund Source

as at 30th of April 2022

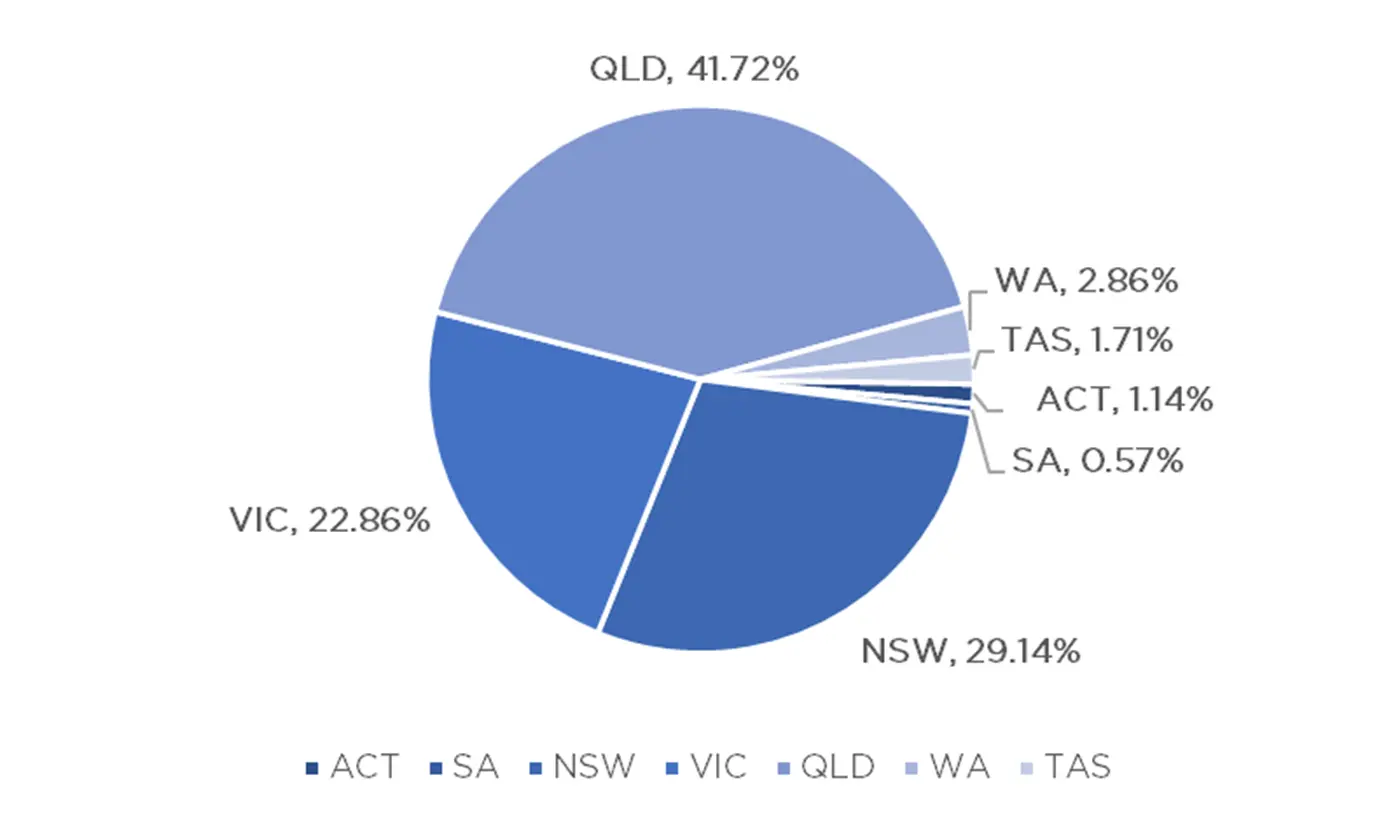

Current Loans Geography

as at 30th of April 2022

Why Invest with ASCF?

Our managed pooled mortgage funds aim to provide a predictable monthly interest distribution to investors. But how have we performed so far?

Since its inception in 2016, we have paid all investors the advertised distribution rate in full each month and no investor has ever lost any capital. We have continued to grow, even through a challenging and changing environment. Curious to see more in-depth performance statistics?

See our Performance History to view past averages of the interest paid to investors.

Investors’ capital and interest payments are not capital guaranteed and our past performance is not an indicator of future performance.

An Interesting Transaction

Problem:

A broker approached ASCF on behalf of their client in February, who required funding to facilitate the purchase of a new home close to the picturesque Blue Mountains. Unfortunately, the borrower did not have the cash on hand to realise their dream of a tranquil mountainside life. However, the borrower did own a home in the rural village of Orange, New South Wales, and wished to sell the property after moving.

Solution:

After ASCF obtained an independent valuation, we were able to approve a bridging loan of $217,000 at 8.45% pa for a 3-month term, with an LVR of 53.17%. The borrower used the funds to successfully purchase their new home and repaid their loan this month from the sale of their Orange village property.

Market Update

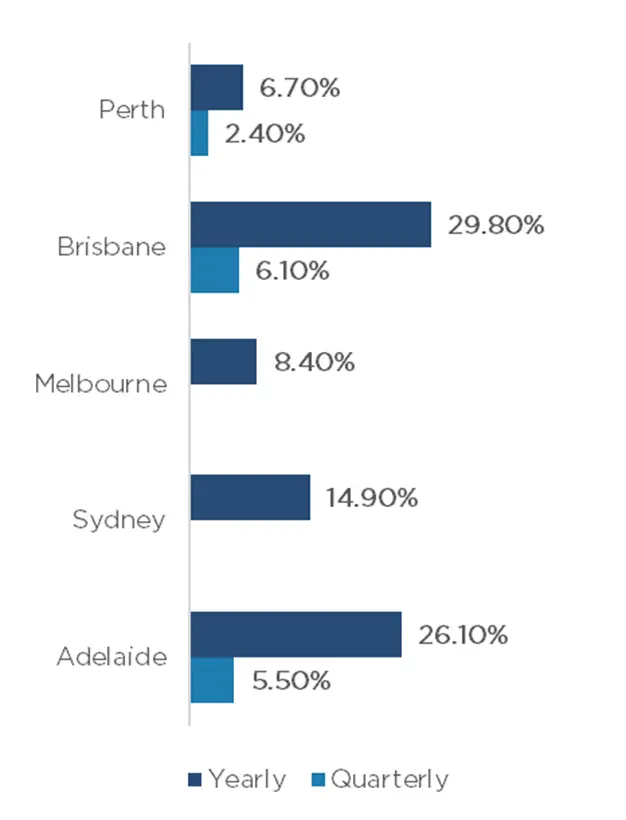

Aggregated property values across the five major capitals on a monthly basis dropped by -0.4%, with the highest performers being Brisbane showing +0.80%, and Adelaide at +1.80% both continuing to show growth. Sydney and Melbourne dropped by -1.00% and -0.70%, respectively.

Regional Australia has been shielded from the slight slowdown in housing values across the capitals.

Specifically, in Sydney and Melbourne, stock levels have been rising by +1.5% and +8.1% above average levels in the past five years. In Adelaide and Brisbane, stock levels are below average at -39.5% and -38.2%. These conditions weaken values in the former and significantly boost values in the latter.

With interest rates expected to normalise over the next 12 months, we anticipate continued softness in the Sydney and Melbourne property markets; however, we expect the impact to be limited due to a structural undersupply of housing across the country and unprecedented levels of international migration and investment.

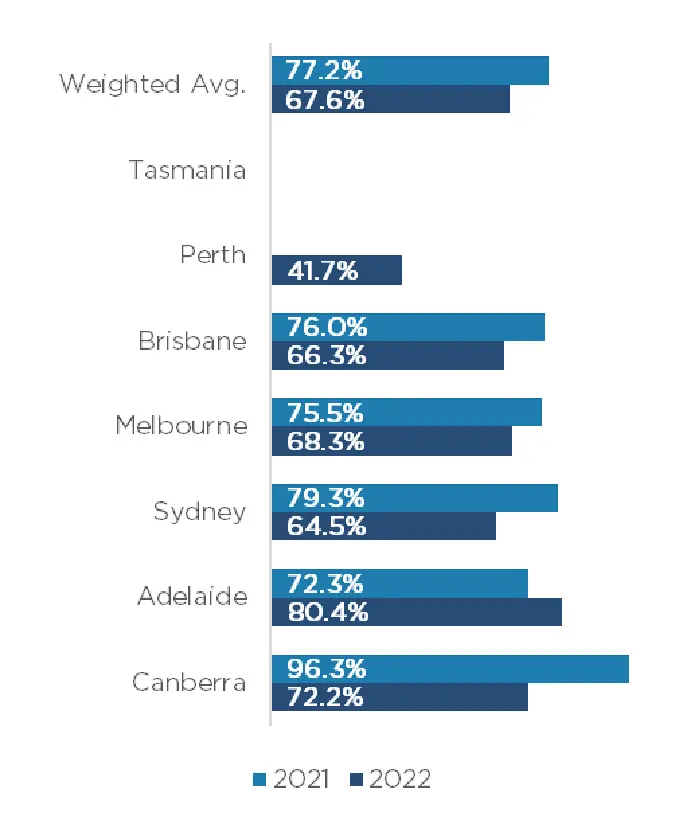

The weighted average clearance rate across the country is lower than last year at 63.7% compared to 2021’s 73.5% clearance rate (-9.80%).

Other cities across the board also achieved rates marginally lower than last year, with the exception of Perth, and Adelaide.

Perth increased by +23.60% and Adelaide by a further +4.60% compared to the previous year, with Canberra being pushed down in comparison (-14.70%).

Clearance Rates & Auctions

25th – 29th of April 2022

Property Values

as at 29th of April 2022

Median Dwelling Values

as at 29th of April 2022

Quick Insights

To Buy or Not To Buy

Interest rates have never been lower, and with the number of rental homes falling for some time, many are discovering purchasing a home to be more affordable than renting.

Source: Australian Financial Review

Beach-Day Boom

A six-bedroom, three-floor home in Noosa is set to break records in a startling show of growth in the housing market. The property was built in 1985 on land costing only $90,000 ($274,015 inflation-adjusted). However, the home is now set to sell for over $17 million!

Source: Australian Financial Review