Trading Update

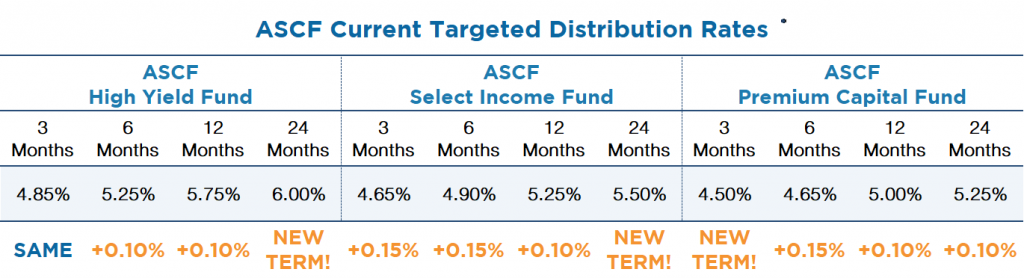

We are pleased to advise that effective 1st September 2022 our investment rates across all our retail funds have increased.

We have also introduced 24 month investment terms in our Select Income and High Yield Funds and a new 3 month investment option in our Premium Capital Fund.

The new investment rates are as follows:

The rates payable across our funds now vary from 4.5% p.a for a 3 month investment in our Premium Capital Fund to 6% p.a for a 24 month investment in our High Yield Fund.

If you are looking at making an investment or increasing a current investment please call our investment team on 1300 269 419 who will be more than happy to discuss your investment options with you and guide you through the process.

The new rates will apply to all current investments from the maturity date and all new investments from the date of investment.

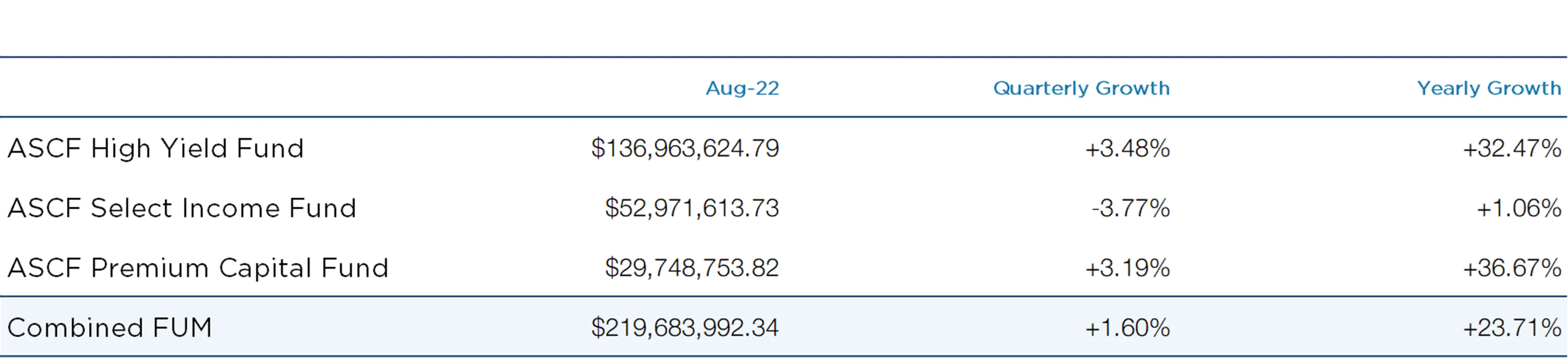

Funds Under Management

as at 30th of August 2022

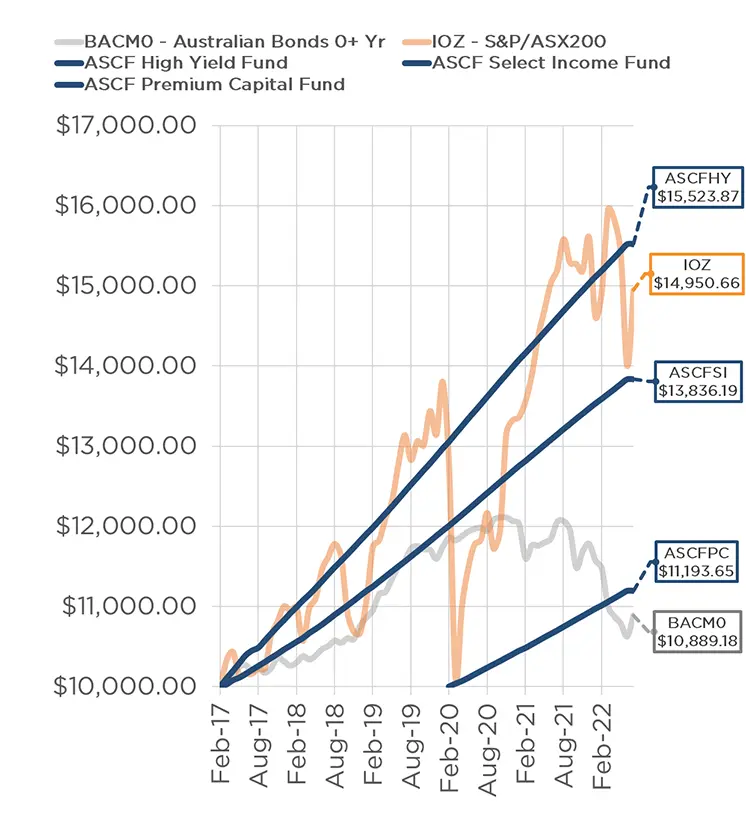

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Loan originations and inquiry levels in August remained strong with over $10m in new loan originations settled.

We are starting to see the impact of higher funding costs reflected in lending rates across second-tier lenders with their rates increasing. As a consequence, our lending products have become more competitive which has resulted in a significant spike in our inquiry levels and we are currently originating more loans than we can fund. The loan to valuation ratios across all our funds remain low and arrears across all funds are tracking well within historical levels. We expect our full-year audited financials across all funds for 2022 to be available for review on our website by 30th September 2022.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of August.

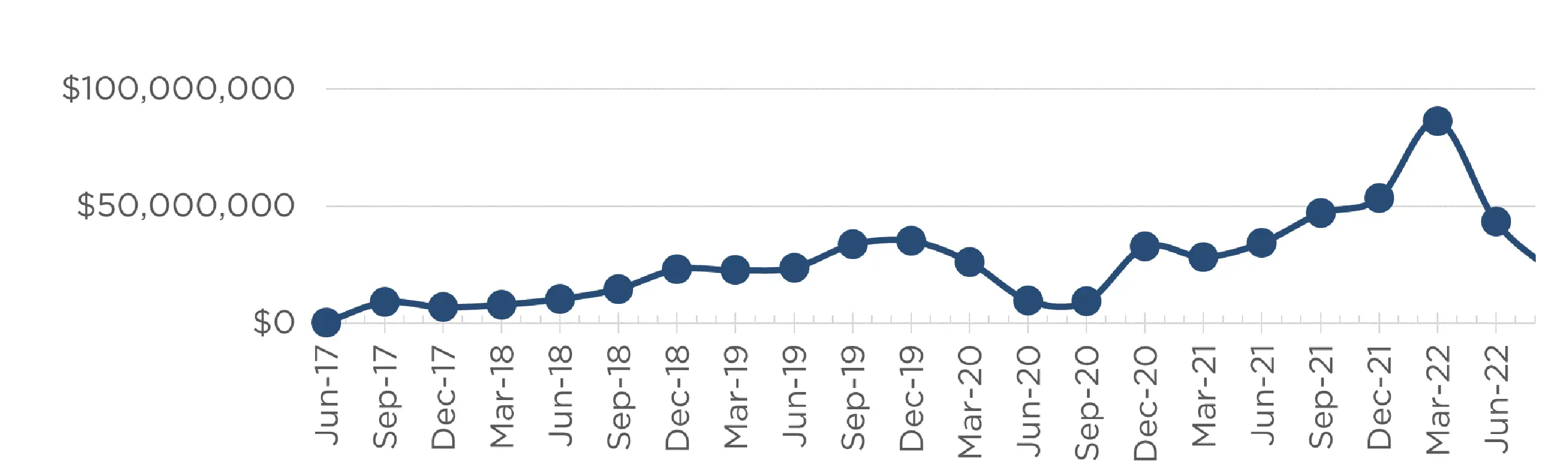

Lending Activity Update

Quarterly Loan Settlements

as at 30th of August 2022

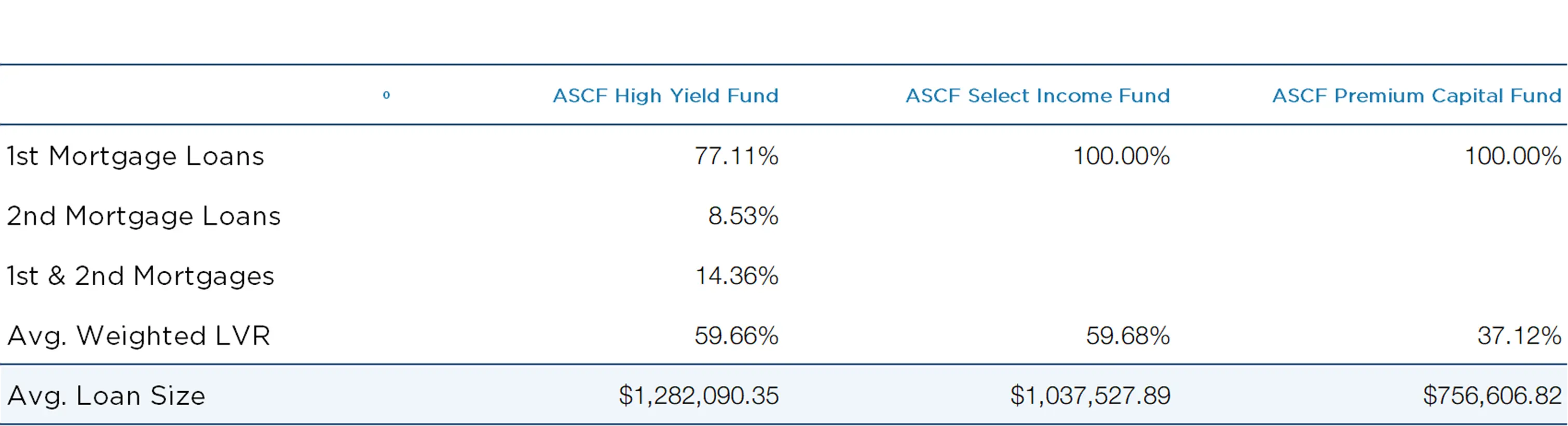

Current Loans by Fund Source

as at 30th of August 2022

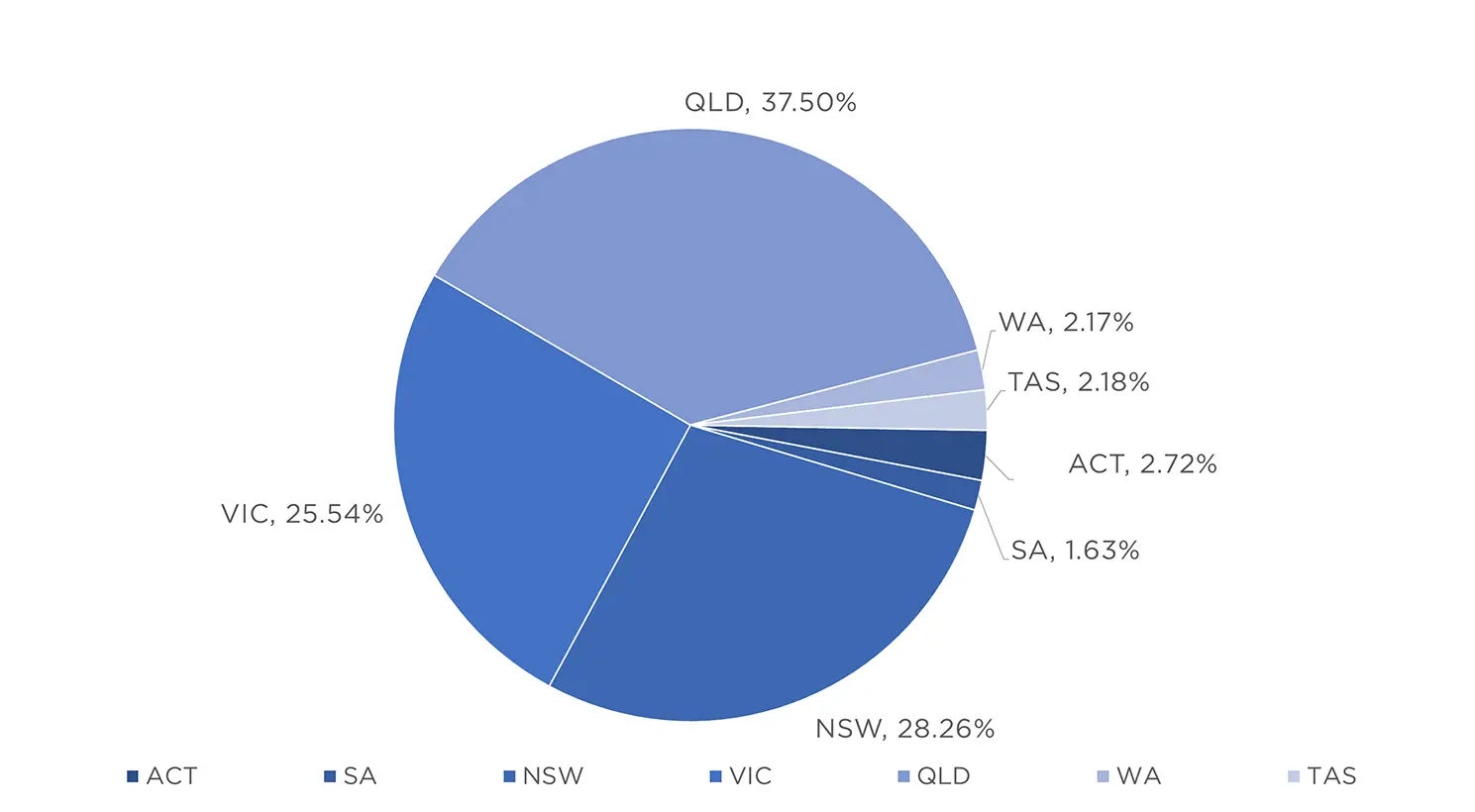

Current Loans Geography

as at 30th of August 2022

Why Invest with ASCF?

With recent increases in mortgage interest rates, the share market proving volatile, uncertainty over rental returns and returns from dividends diminishing; savings and fixed term deposits have left many investors, particularly self-funded retirees in self-managed superannuation funds (SMSFs), fearing an income crisis.

This has resulted in savvy investors seeking alternative investment options with attractive rates of return that provide regular income, diversify their portfolio and protect their capital at the same time.

Our Funds are unit trusts that earn a return for their investors by using the invested funds to provide borrowers with short-term loans. Each fund has slightly different lending policies, but all loans are secured by registered mortgages over the borrowers’ property.

ASCF then pays investors a monthly return (currently ranging from 4.50% to 6% per annum depending on the term of the investment and choice of fund) from the interest earned on these loans.

Many mortgage funds offer a fixed term but unlike the traditional term deposits, the rate of return is variable and can change significantly during the term of the investment.

Having a variable rate of return on a fixed-term investment product undermines the confidence most investors seek in achieving their targeted objectives in their investment portfolio.

At ASCF we offer a targeted investment return that remains fixed for the duration of your term providing a low volatility, stable investment option.

Since inception ASCF has paid all investors their full targeted rate of return on time and in full.*

Just another reason to invest in an ASCF fund.

*An investment in an ASCF fund is not a bank deposit and past performance may not be indicative of future performance.

An Interesting Transaction

Problem:

ASCF was approached directly by a repeat borrower and current investor to provide funding to complete a development on an investment property in Victor Harbor South Australia.

Solution:

After obtaining a valuation on an as is basis, ASCF was able to provide a 6-month facility of $292,500 at 10.25% pa secured by two properties with a total LVR of 46.80%.

The borrower will repay the loan via the sale of one of the properties upon completion.

What ASCF Does Differently:

ASCF is there for borrowers when traditional lenders aren’t. When they need funding quickly, our boutique service offerings make it happen.

Market Update

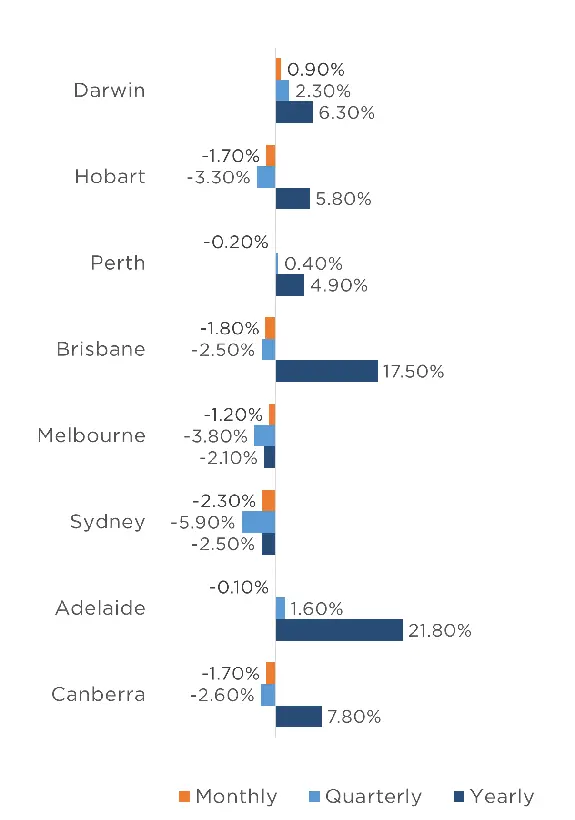

Property prices continued to decline slightly in August, with a combined average decline of 1.60% across capital cities and a decline of 1.50% across regional areas. Interestingly Sydney (-2.50%) and Melbourne (-2.10%) are the only capital cities to have recorded negative growth on an annual basis, with prices still up nationally across both capital and regional areas by 7.50%.

At this stage, we expect a further 0.75% increase in the Reserve Bank cash rate in September and October, after which we believe the Reserve Bank will pause to analyse the impact of the cash rate increases implemented over the course of the year. This should enable property prices to stabilise leading into the year-end.

As evident by the substantial increase in retail sales last month, we believe the consumer remains in a strong position, with most households having significant property equity due to the considerable rise in property prices we have witnessed across the country in the 18 months leading into this year.

Unemployment also remains historically low, supporting wage growth and providing an additional cushion against rising mortgage costs. Rental yields increased by 0.8% in August rentals alleviating some of the pressure on property investors.

As bottlenecks in the supply chain start to resolve themselves and oil prices stabilise at more reasonable levels, we do expect inflation to tame; however, despite the Reserve Bank likely to pause any further increases in November, the question will still remain going into the 2023 whether they will have done enough this year to see inflation trend back within their target zone of 2% – 3%.

If we do see further rate rises next year, this will obviously further negatively impact property prices however we do expect most of the declines to occur this year, particularly as international migration levels start to increase next year to alleviate some of the labour shortages we are seeing across multiple industries on a national level.

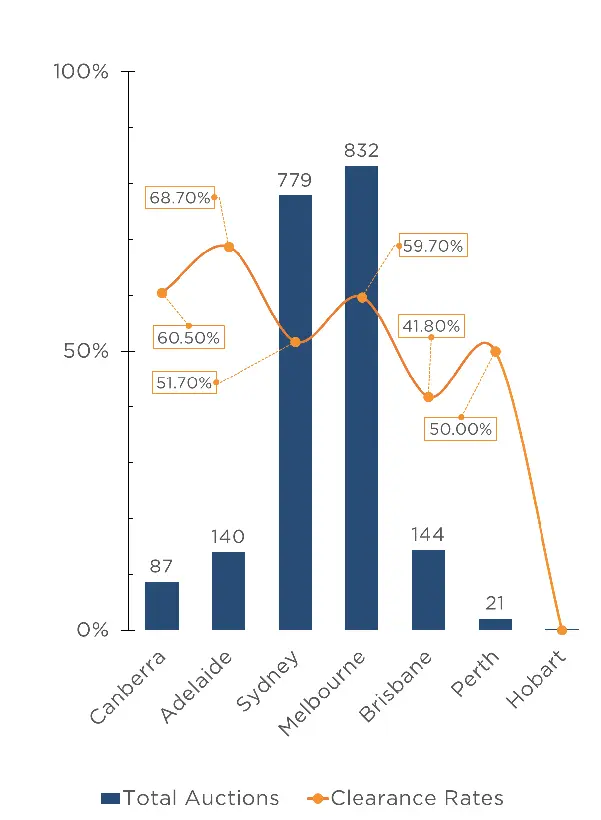

The weighted average clearance rate across the country this week was lower than last year at 55.80% (-8.5%). Other cities were also down from last year with the exception of Canberra, up by 39.70% from last year.

Auction activity has been picking up in the capitals week by week. Sydney was up by 21.90% from last week.

Clearance Rates & Auctions

as at 25th – 31st of August 2022

Property Values

as at 31st of August 2022

Median Dwelling Values

as at 31st of August 2022

Source: CoreLogic, Report, Article

Quick Insights

South Bank Skyscraper

Beulah’s $2.7 billion dollar apartment project ‘Sth Bnk’ in inner city Melbourne, has now sold $600 million dollars in units, 80% of which went to owner-occupiers. Managing director Jiaheng Chan has said that “Most of our purchasers live in Melbourne and Sydney…”, Charter Keck Cramer also noted that “[The] target market is ageing and many are seeking to (or will be forced to) downsize in the short to medium term as their living preferences change.”

Source: Australian Financial Review

Rapidly Rising Rentals

One in seven rental homes in New South Wales are achieving a positive cash flow, along with half of all rentals in Queensland, and nearly three-quarters in Western Australia. Tim Lawless, CoreLogic research director, said the brisk recovery in gross rental yields could make more properties cash flow positive in the coming months. Sydney and Melbourne unit markets posted the quickest recovery, where gross yields have increased 0.45 percentage points to 3.4 per cent and 0.4 percentage point to 3.8 per cent respectively.

Source: Australian Financial Review

Macquarie Moves

Macquarie Group’s CFO, Alex Harvey bought a doer-upper on the Kirribilli waterfront this month. The executive paid $18.7 million dollars for the three-storey federation-style home and the purchase follows Qantas’s Alan Joyce and Next Capital’s John White who also bought homes in the area at record prices. Many of these properties came onto the market thanks to local owners now downsizing to luxury units.

Source: Australian Financial Review