Trading Update

Inflation has fallen to an annualised rate of 2.7% based on yesterday’s release of the monthly inflation data for August.

This figure is down from 3.5% in July and is the first time that inflation is now back within the RBA’s target range of 2 to 3 per cent since October 2021 prior to the RBA commencing its tightening basis.

Whilst the RBA held firm at its meeting on Tuesday by leaving rates on hold they will now undoubtedly come under further pressure from the Federal government to lower rates prior to year end.

The fall in electricity prices by 17.9% in the 12 months to August had the largest impact however this was primarily driven by the Federal government rebates in addition to State rebates in Queensland, Western Australia and Tasmania.

The next key data to be released will be the September quarter CPI due at the end of October which still leaves room for the RBA to cut rates at either its November or December meeting.

Whilst the timing of the rate cuts or how deep the RBA will cut before adopting a neutral stance is still uncertain both consumers and businesses will be relieved by the monthly inflation print and can take comfort that rates will be coming down over the next several months.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

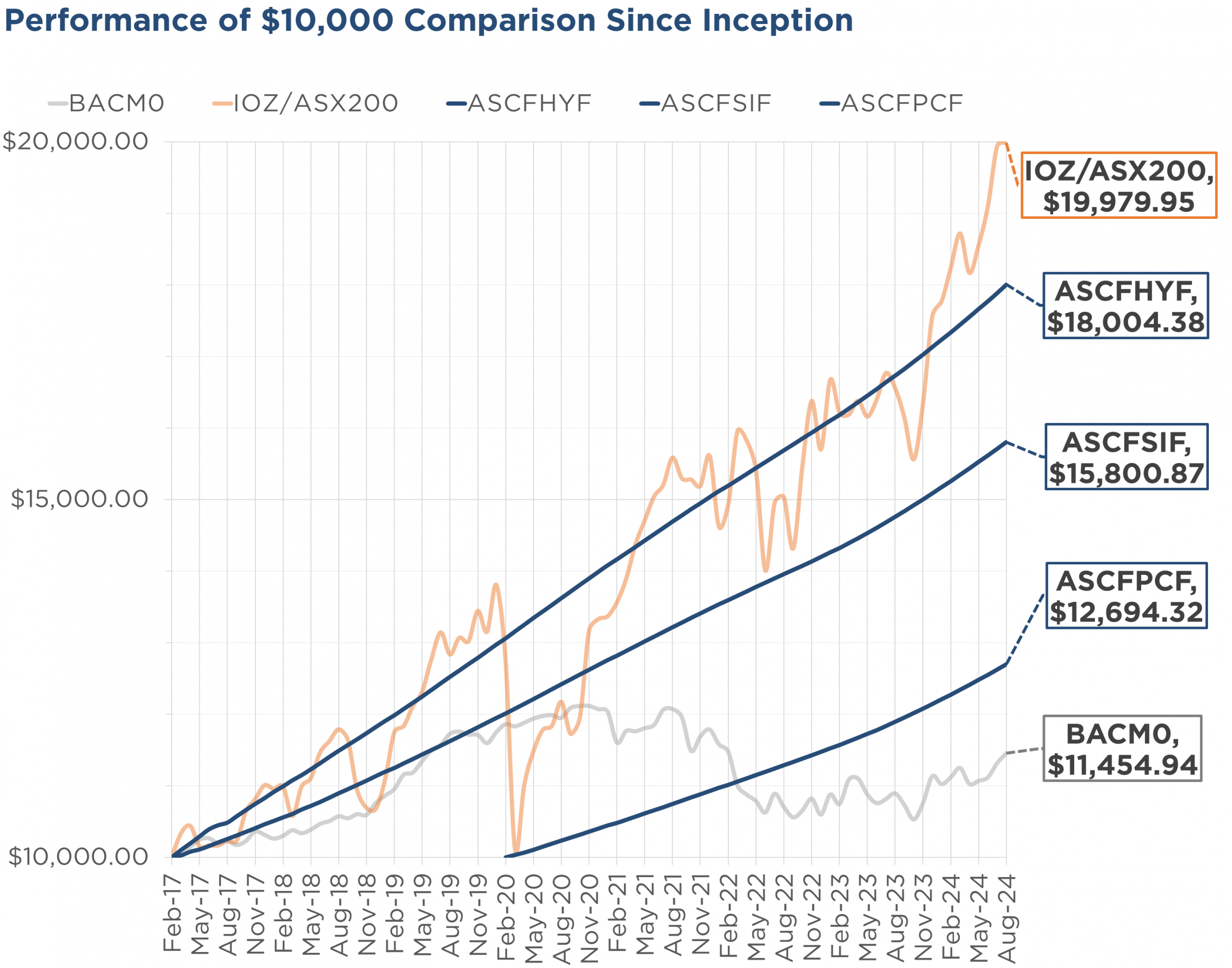

Monthly Managed Fund Cumulative Growth & Performance

Managed Funds Under Management

as at 31st of August 2024

| July 2024 | |

|---|---|

| ASCF High Yield Fund | $143,354,527.44 |

| ASCF Select Income Fund | $48,616,750.22 |

| ASCF Premium Capital Fund | $23,554,023.53 |

| Combined Funds under Management | $215,525,301.19 |

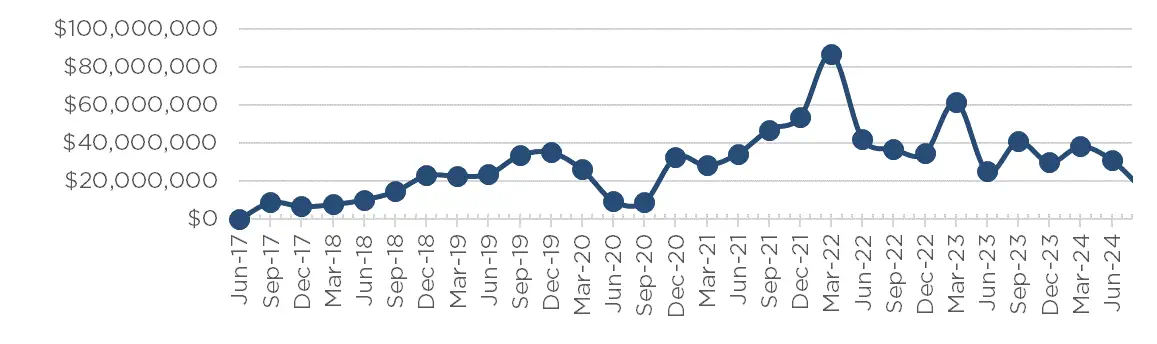

In July, loan originations and inquiry levels were strong, with $9,652,000.00 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of August.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of August 2024

Current Loans by Fund Source

as at 31st of August 2024

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 80.00% | 100% | 100% |

| 2nd Mortgage Loans | 13.07% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 6.93% | 0% | 0% |

| Avg. Weighted LVR | 54.24% | 55.14% | 45.57% |

| Avg. Loan Size | $1,423,933.31 | $916,303.99 | $814,105.26 |

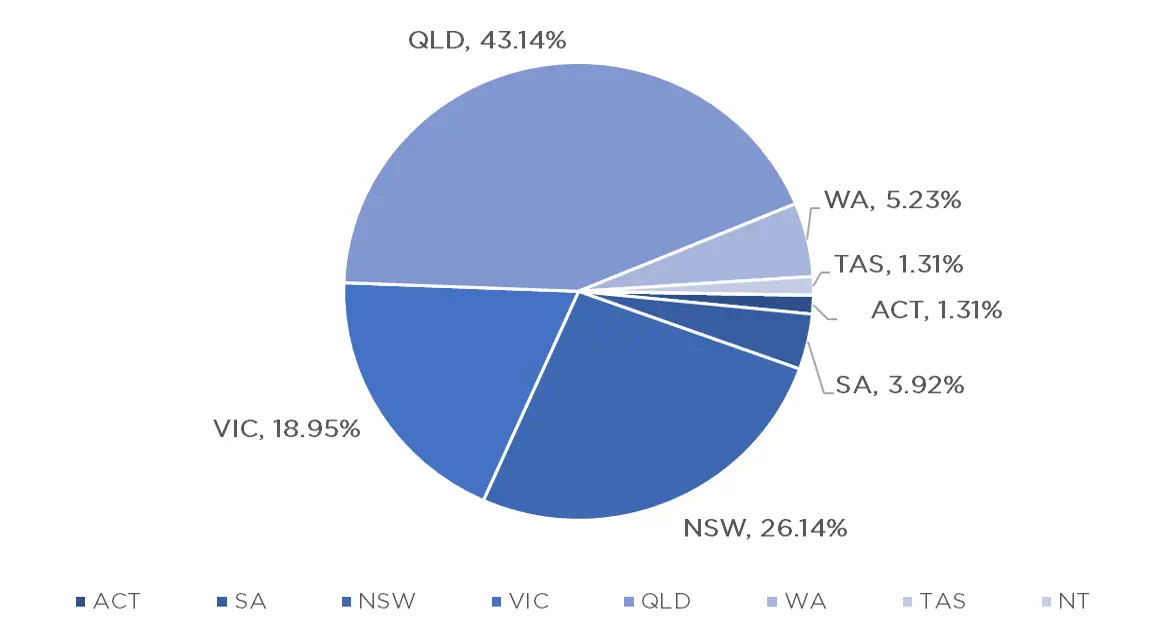

Current Loans Geography

as at 31st of August 2024

Why Invest with ASCF?

If you are looking for a regular source of income during retirement why not consider our Pooled Mortgage Funds?

Many retirees are searching for investments that can provide a more consistent return. Our Pooled mortgage funds, utilise multiple short-term loans, which offers a unique way to generate income while balancing the risk.

- How Do Pooled Mortgage Funds Work?

Investors contribute money to a collective fund that is used to finance multiple real estate loans. As borrowers make their mortgage payments, the interest earned is distributed to investors as income. - Stable Monthly Income

Our three funds distribute regular income generated from mortgage interest payments. These payments can provide consistent, monthly returns, making them a great fit for retirees who need predictable regular income. - Diversification of Risk

Rather than investing in a single loan, pooled mortgage funds spread your investment across many loans. This diversification helps reduce the risk that comes with relying on a single borrower’s ability to repay. The larger the pool, the more spread out the risk. - Higher Returns than Traditional Fixed-Income Investments

Compared to traditional savings accounts, pooled mortgage funds often provide a higher yield. By capitalising on the real estate market, you may enjoy returns that outperform other conservative income strategies. - Real Estate-Backed Security

Pooled mortgage funds are backed by real estate assets. In the event of a default, the property can be sold to recover the loan. - Passive Income with Professional Management

In the last seven years all investors have recieved their distributions monthly and all redemption requests hsave been paid on time and in full.

Interested in Learning More?

If you’d like to explore how our funds can assist your retirement income, please reach out to Nick Alcock on 0459 835 335 or email at [email protected]

.

An Interesting Transaction

Problem:

A broker came to us in August seeking short term funding for their client to refinance an existing loan facility secured by a commercial property in Adelaide that was approaching expiry. The client also wished to consolidate some small debts whilst they prepare the commercial property for sale.

Solution:

ASCF conducted full valuations on two security properties, the commercial property in Brompton SA, as well as their residential house to ensure ample security. A first mortgage was registered over the commercial asset, along with a 2nd mortgage on their house.

ASCF provided a 6-month loan facility of $785,000 at 13.80%pa, resulting in an overall LVR of 46.44% including their existing first mortgage on their residential security. This will allow ample time to sell their property and payout the loan.

What ASCF Does Differently:

ASCF is able to take a more pragmatic approach in a assessing our borrowers circumstances so that we can assist our clients with their diverse financial needs.

Market Update

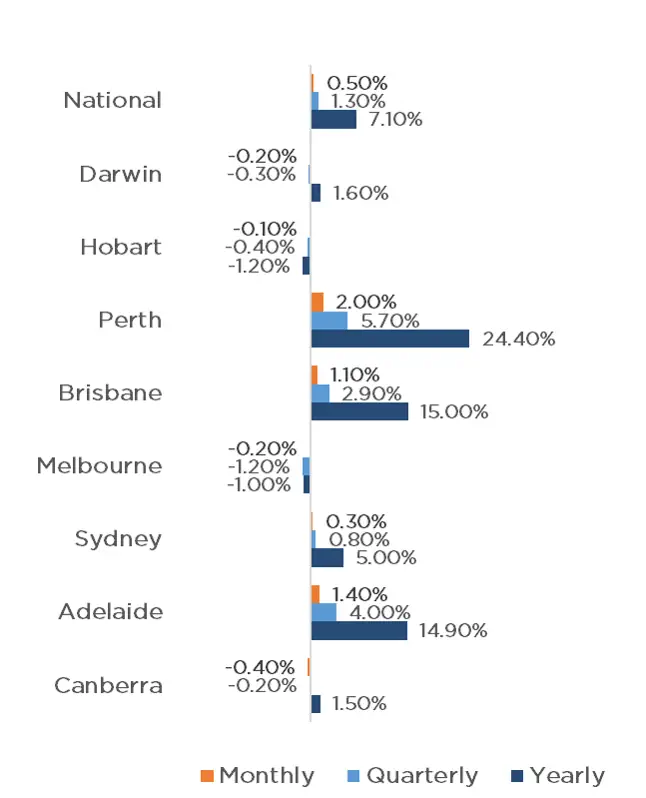

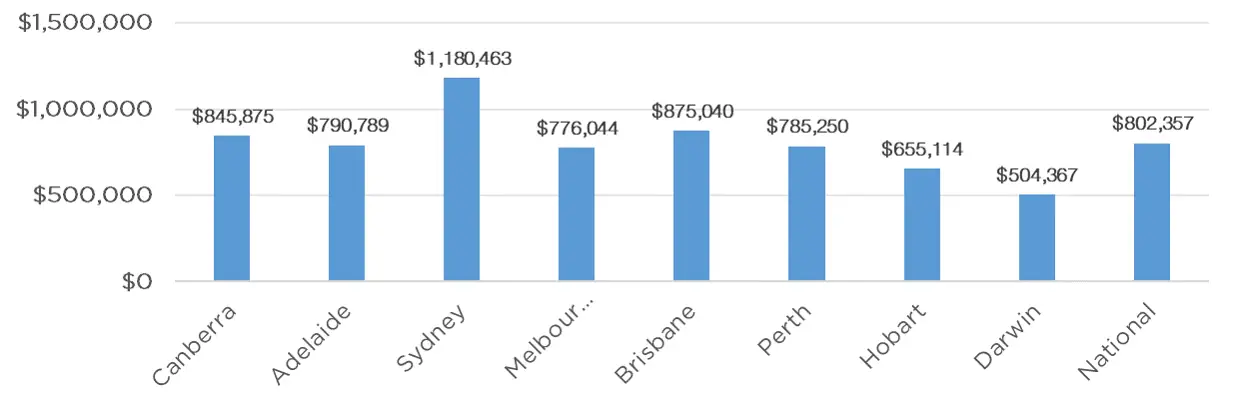

For the 19th consecutive month, headline national home values have increased by a further 0.5% for the month, however pace is easing, as quarterly growth has slowed to 1.3% compared to 2.7% for the same period in 2023. Perth continues to be the strongest performing market, with a further 2% increase, followed by Adelaide and Brisbane with 1.4% and 1.1% respectively. Sydney was the only other capital city to experience growth, with a 0.3% increase for the month, whilst Hobart, Darwin, Melbourne and Canberra all recorded a decrease, of 0.1%, 0.2%, 0.2% and 0.4% respectively.

Whilst property prices are beginning to ease, increasing talk of a potential interest rate cut in 2024, or early 2025 will likely keep prices stable. The Melbourne market, driven by changes to land tax, has recorded the weakest quarterly change, with a 1.2% decrease, resulting in the median value of Melbourne properties to now be $776,044, well below that of Sydney, Brisbane and Canberra and also below that of Adelaide and Perth, and the combined capitals.

Property Values

as at 31st of August 2024

Median Dwelling Values

as at 31st of August 2024

Quick Insights

Property Profits

Profits from home sales nationwide climbed to a record high of $285,000 on average in the June quarter.

Both units and houses have achieved their best ever profits in some time.

Sydney suburbs of Strathfield and Ryde gained the largest windfalls with every seller bagging more than $1 million gross profits.

“I still expect the share of profit-making sales will increase in the next quarter given the lift in values in the past few months…” said Eliza Owen, CoreLogic’s head of research.

Source: Australian Financial Review

Will Density Save the Housing Crisis?

The building of higher-density homes has picked up on the back of lower borrowing costs and higher rents.

Oxford Economics Australia has said that, attached homes will surge 80% from their annual rate of 60,728 in the March quarter to 109,573 by June 2029.

But that upturn is at risk from higher costs, particularly rising labour costs baked into the latest union-backed agreements between building companies and staff.

Source: Australian Financial Review