Trading Update

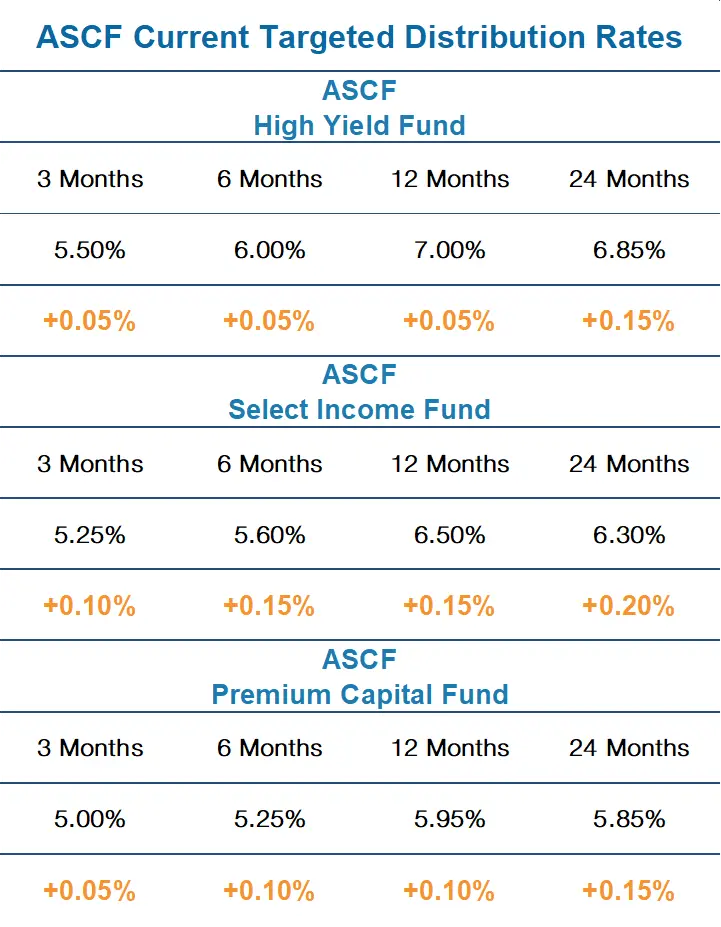

ASCF is pleased to advise that we have increased our investment targeted distribution rates again this month across all our

retail Funds effective the 1st March 2023.

Our new investment distribution rates are as follows:

The new rates will apply to all new and additional investments with existing investors receiving the benefit of the new rates on the rollover of their accounts on the scheduled maturity date of their investment.

Our High Yield Fund is now paying 7% p.a for a 12 month investment with interest paid monthly and definitely worth considering if you are seeking a low volatility inflation responsive investment.

Yesterdays release of Australia’s Q4 National Accounts showed economic growth increased by 0.5% in the December quarter well below economic forecasts of 0.8% growth for the quarter.

It seems the RBA rate increases are finally starting to bite and at this stage we would not be surprised to see GDP growth slow further in subsequent quarters.

On a positive note, the release of The Australian Bureau of Statistics (ABS) monthly inflation gauge also showed a drop to 7.4% year on year in January, down from 8.4% in December.

Whilst this is still the second highest monthly inflation reading on record it was well below analyst expectations of 8.1% growth and confirms the opinion we expressed last month that inflation peaked in the December quarter.

Whilst the weaker than expected GDP and inflation numbers caused interbank futures to scale back expectations of upcoming RBA rate increases marginally, we believe the release of the data will give the RBA some encouragement that inflation is now heading in the right direction but will also create some uncertainty as to how much further they need to raise rates.

As we indicated last month, the risk of further rate raises from this point really could start to hurt the economy and whilst we thought last months increase would be the last, the minutes of the RBA meeting and the statement released after the meeting indicated otherwise.

In other reports released yesterday, the household savings ratio hit a five year low of 4.5% from 7.1% in the September quarter meaning the savings buffer consumers had built up during Covid is almost gone. Based on all this data one would think that the RBA could actually pause next week and avoid putting more pressure on mortgage holders but as they have once again set market expectations via their commentary it would appear they are likely to increase rates by a further 0.25% which in our opinion is unnecessary.

Long term inflation at elevated levels is bad for all consumers but there is absolutely nothing wrong with adopting a wait and see approach and allowing the data to filter through before making a decision. On the positive, any increases we do get from here will likely be wound back later this year or early next year once they realise they have gone too hard too fast.

As we previously indicated rate increases take time to filter through the economy with the real economic impact unlikely to be seen for several months yet. Despite this, property prices across the country appear to be levelling off with Sydney actually showing a slight increase of 0.3% in February. We believe the property market is now bottoming and will more than likely bounce off these levels over the coming months once the RBA confirms they are done.

Our expectations are that prices will actually start to increase by mid-year, with an overall increase of 3%- 5% nationally over 12 months to mid-2024 based on the limited housing supply coming to market and the return of international migration to prepandemic levels. Our loan books all continue to perform strongly across all our Funds and we are continuing to see excessive demand via our origination channels.

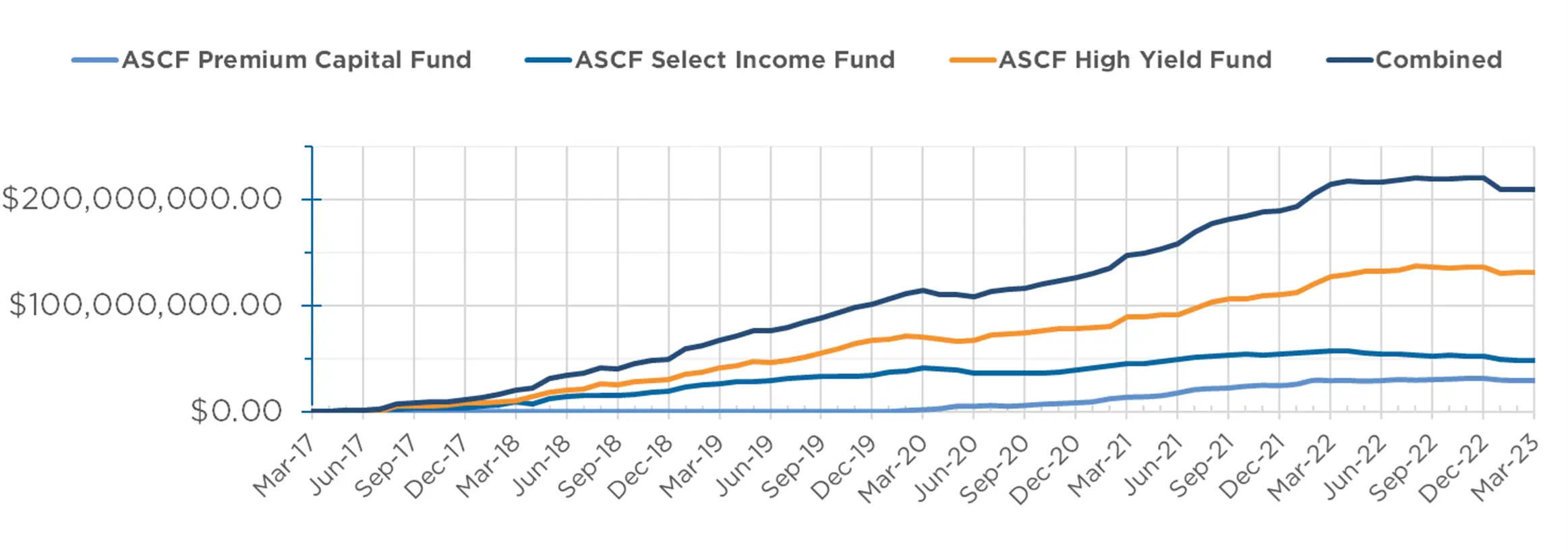

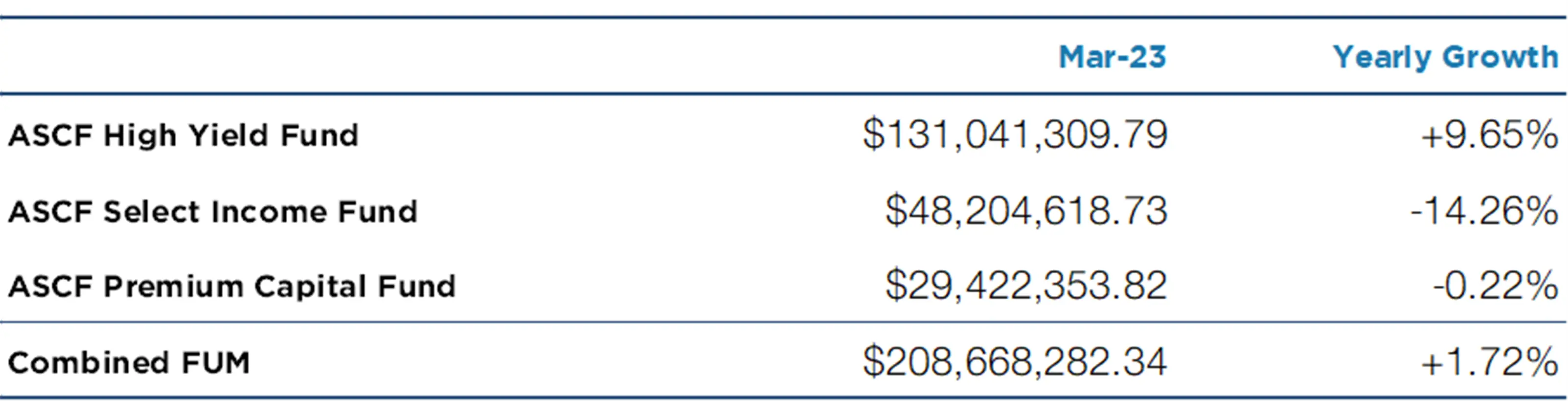

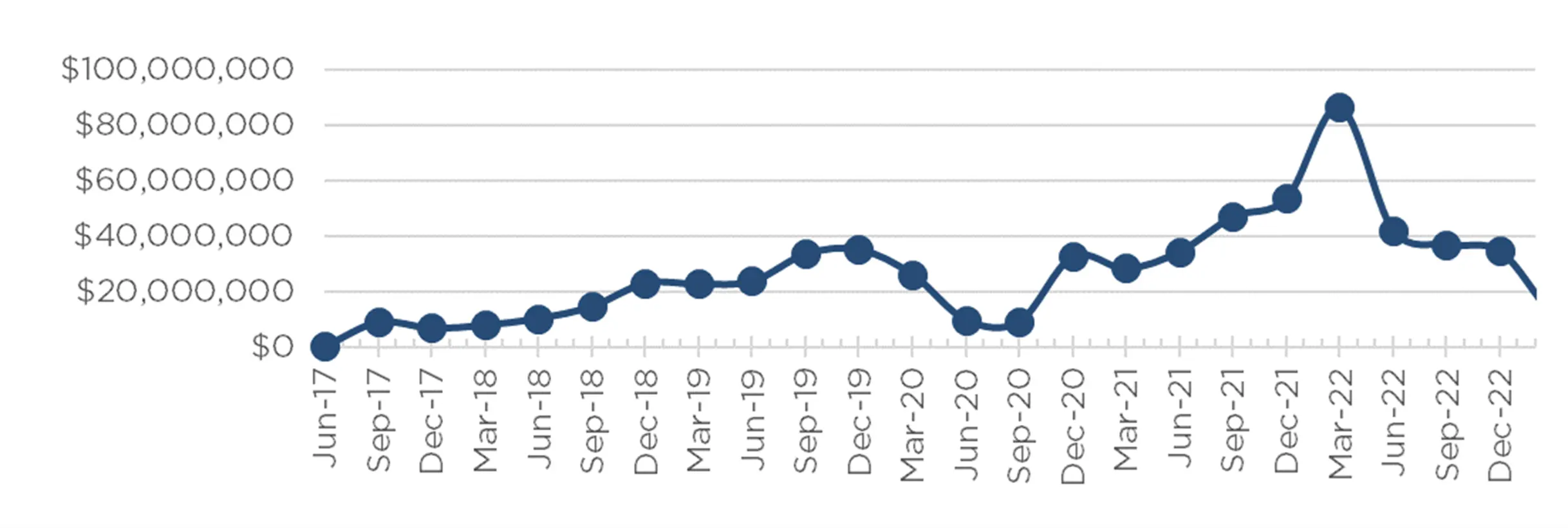

Monthly Funds Under Management

Funds Under Management

as at 28th of February 2023

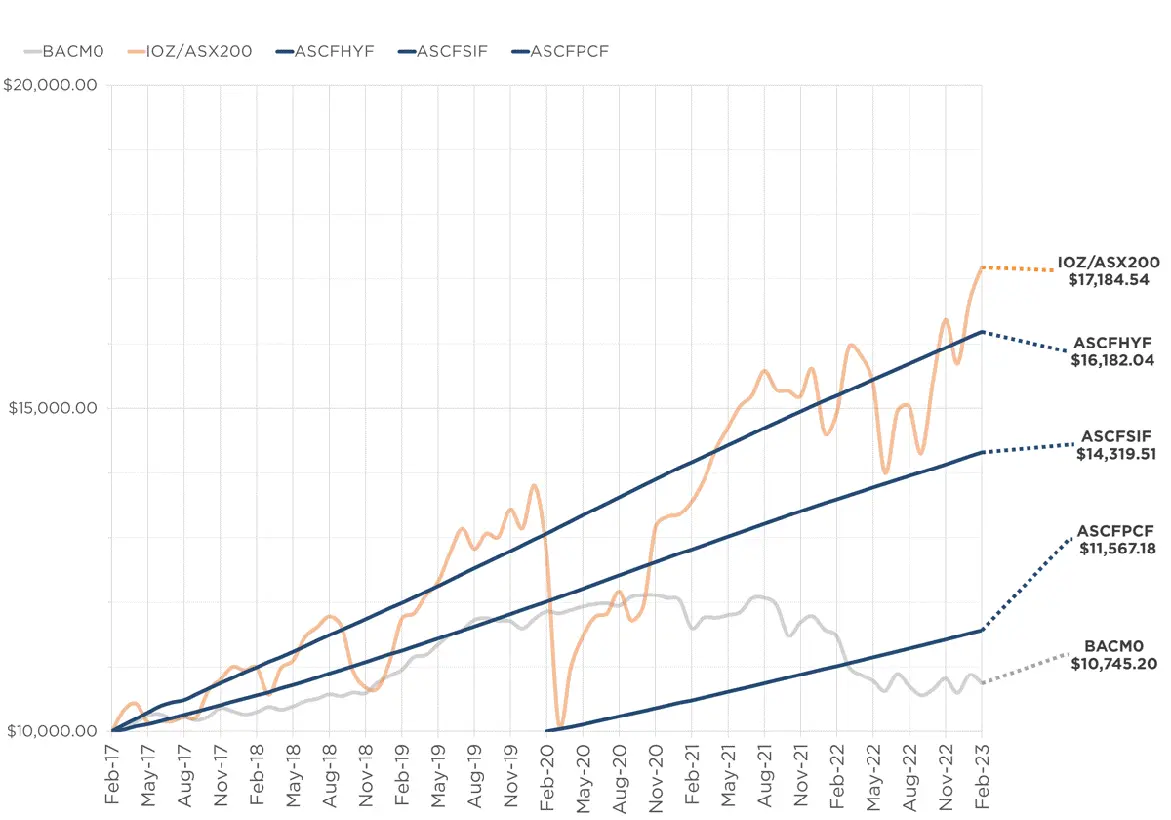

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

In February, loan originations and inquiry levels remained solid with over $7,000,000 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of February.

Lending Activity Update

Quarterly Loan Settlements

as at 28th of February 2023

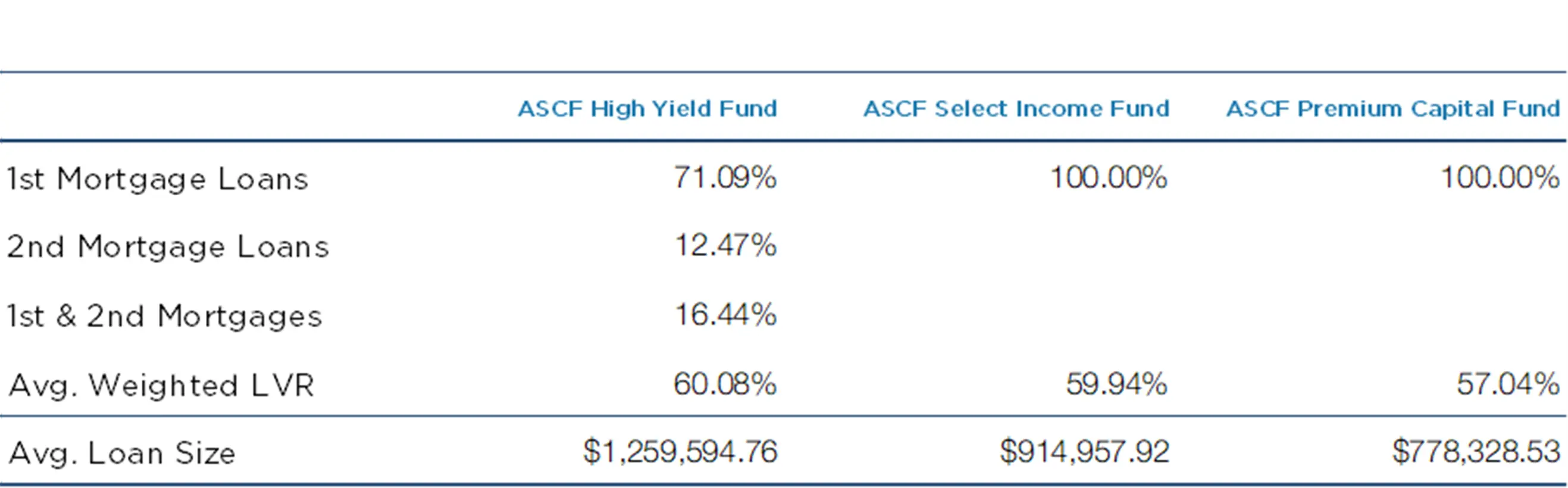

Current Loans by Fund Source

as at 28th of February 2023

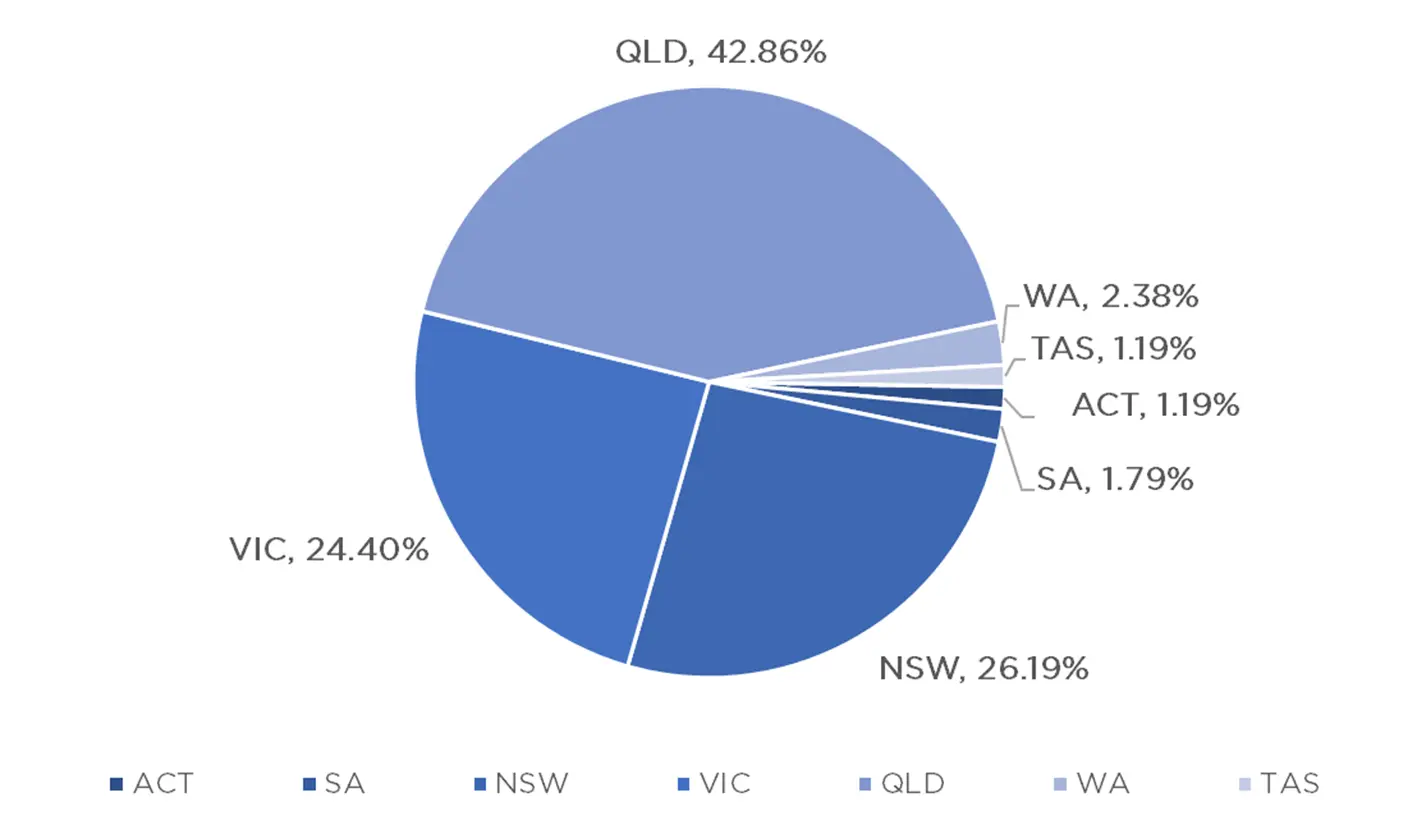

Current Loans Geography

as at 28th of February 2023

Why Invest with ASCF?

We have previously discussed the benefits of investing in ASCF pooled mortgage funds including low volatility, monthly income, diversification across mortgage assets and protection against inflation. In terms of minimising risk, a key consideration when looking at an investment in a mortgage fund should always be whether the fund undertakes construction loans to property developers.

There is a multitude of risks when investing in a fund that provides funding for construction including builder risk, construction quality risk, market movements which could negatively impact pre-sales at the time of settlement, and fluctuations in ever-increasing construction costs as we have seen over the last 18 months. Data from ASIC indicates that 1236 companies in the building industry have fallen over this year with liquidations, receiverships and administrations nearly double what they were for the same period last year.

The shortage of labour, spiraling wage costs, record rainfall and rising interest rates have all adversely impacted the sector. Mortgage funds that finance construction loans are currently experiencing the negative impact of these issues across their loan books. ASCF does not provide traditional construction funding to developers for these very reasons. Just another reason to invest with ASCF.

An Interesting Transaction

Problem:

An accountant in Melbourne, Victoria was introduced to us via our valued AFG broker network seeking funding to complete the purchase of a Commercial block of land. The contract was entered into in October 2021, and with the settlement date approaching fast, the customer needed quick funding to settle the property. Development Approval had been lodged with the council to subdivide the property, however, approval had not yet been granted.

Solution:

Our trusted panel valuer provided a valuation within 2 days and confirmed an uplift in value of $705,000 over the purchase price. Accordingly, we provided funding of $1.818 m at 60% LVR for a 6 month period at 11.95% p.a to allow the customer time for the development approval to come through and the lots to be sold.

The customer’s proposed exit is via the sale of the lots.

What ASCF Does Differently:

Another example of how ASCF can help property investors find expedient funding solutions when faced with a time sensitive deadline.

Market Update

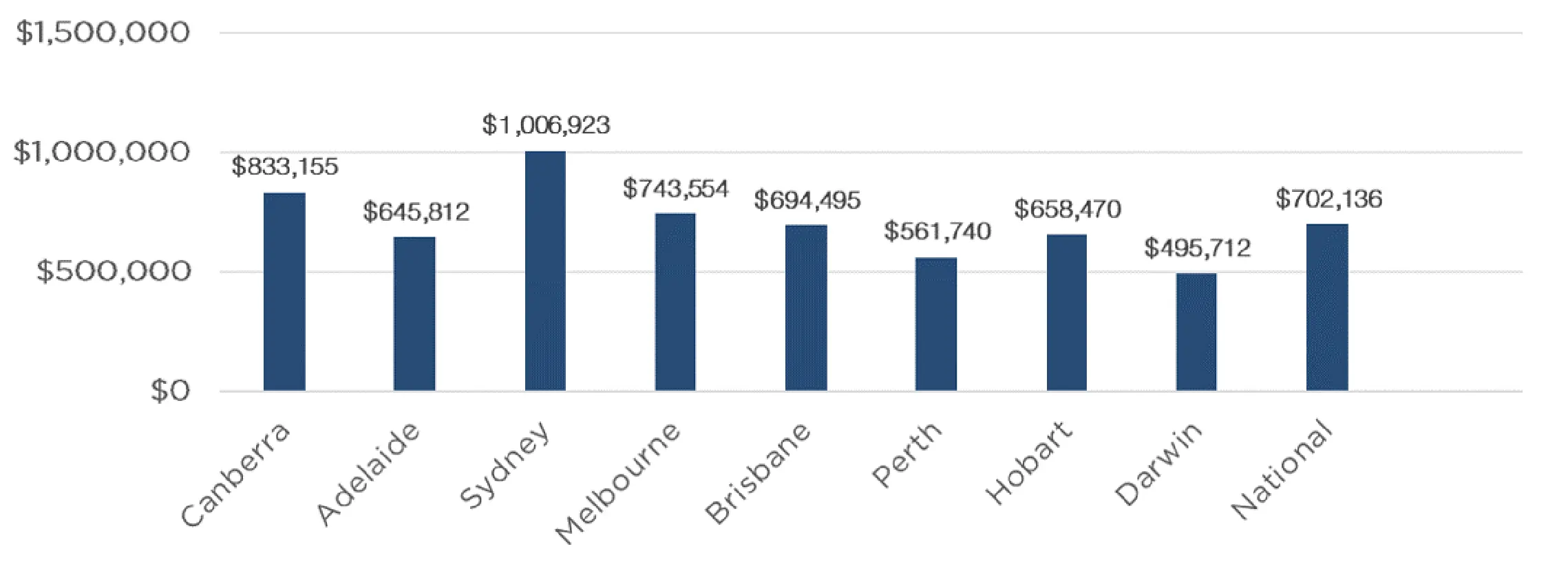

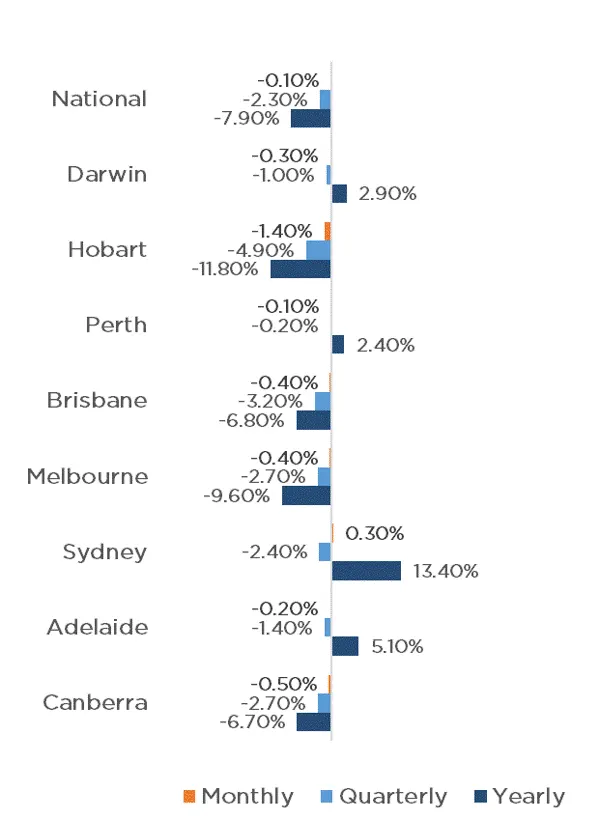

In a sign of the property market beginning to stabilise, February saw the price of dwelling values fall by just 0.1% across the nation. This is the smallest month-to-month decline since mid-2022 and the first time the monthly decline was less than 1% in almost 12 months, according to CoreLogic’s National Home Value Index.

Property in Sydney recorded growth of 0.3% for the month, whilst Perth (-0.10%), Adelaide (-0.20%) and Darwin (-0.30%) all recorded minor reductions. Brisbane (-0.40%), Melbourne (-0.40%) and Canberra (-0.50%) also recorded smaller monthly falls than in recent months, with only Hobart (-1.4%) recording a reduction of more than 1%, with all capital cities still recording values above pre-pandemic levels.

New listing volume remains low, with 24,658 listings over the 4 weeks ending February 26, 17% below that of 2022 and 11.9% below the 5-year average. The last weekend of February recorded the highest number of auctions for the year (2,393), which was up 29.6% on the previous week (1,846); however this was still 29.3% lower than the same weekend last year (3,386). This trend is likely to continue until such a time that interest rates stabilise and confidence returns.

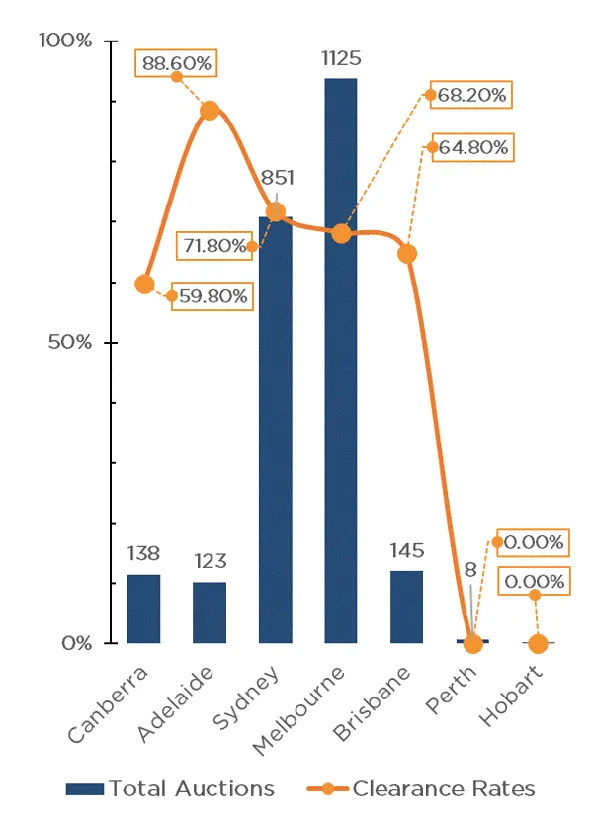

Whilst volumes are down, clearance rates are relatively strong, with Adelaide leading the way with an 88.6% clearance rate (83.8% last year), contributing to a national average of 69.7% (70.9% last year). The clearance rates for Sydney and Melbourne were also strong, recording 71.8% (72.6% last year) and 68.2% (67.6% last year), respectively. Brisbane’s clearance rate was slightly weaker at 64.8% (70.6% last year) as was Canberra with 59.8% (74.4% last year).

We believe prices should start to stabilise from here due to a fundamental under-supply of housing stock. The easing of the rate in which prices are declining is likely due to this lack of supply, and with many economists forecasting that we are nearing the end of the rate rise cycle, buyer demand is likely to increase through the second half of the year and into 2024 as confidence returns.

Clearance Rates & Auctions

20th – 26th of February 2023

Property Values

as at 28th of February 2023

Median Dwelling Values

as at 28th of February 2023

Quick Insights

Gold Coast Glamour

A stunning ten-bedroom mansion located at Tallebudgera on the Gold Coast has made history by becoming Queensland’s second most expensive home ever sold at an auction. A cash offer of $42 million was made by a buyer before the auction even began. The offer was publicly announced on the auction floor to no other bids.

Source: Australian Financial Review

Growing units and Rising Rents

A recent report by JLL has stipulated that new apartment supply will remain tight for at least another two years until financing costs stabilise. They pointed out that it would still be relatively easier for new smaller projects targeting owner-occupiers; usually downsizers, to get off the ground as opposed to large-scale projects which were unlikely to increase until 2025. It’s expected this low level of supply will continue to cause rents and unit values to rise across capital cities.

Source: Australian Financial Review