Trading Update

Since inception in 2016 ASCF has always strived to pay our investors the highest possible returns on funds invested and will always do so. Our performance during this time speaks for itself with no investor losses across any of our funds, all monthly distributions paid on time at the rate invested and all investor redemption requests paid in full and on time.

However in the current era of ultra low-interest rates and with the country awash with money seeking a return we are finding that the lending landscape has become increasingly more competitive, particularly over the last several months.

As a consequence, we are currently in the process of lowering our lending rates to borrowers to ensure that we do not compromise on the quality of the loans we originate and are able to adequately deploy funds as they become available in a conservative manner in accordance with our historical performance.

We had hoped that our last investor interest rate reduction would have been sufficient to get us through the current interest rate cycle, however with interest rates in Australia likely to continue to remain at these levels for some time yet and lending rates remaining extremely competitive in our sector we believe it prudent to lower our lending rates to borrowers and as a consequence our investor rates.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months |

|---|---|---|

| 4.85% | 5.15% | 5.50% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months |

|---|---|---|

| 4.50% | 4.75% | 5.00% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 24 Months |

|---|---|---|

| 4.50% | 4.75% | 5.00% |

The rate reduction will also ensure we are able to continue to maintain an adequate buffer against any future macroeconomic shocks such as we have seen over the last two years and as such we consider it to be in the best interests of all our investors.

Effective 1st April 2022 our investor interest rates on new investments across our funds are displayed to the left.

All current investments will continue to be paid at the same rates offered at the time funds were invested but will renew at the new investment rates on maturity.

We are also starting to fund longer-dated loans within the ASCF Premium Capital Fund and as such the Premium Capital Fund three-month investment term will no longer be offered.

Those investors who invested in Premium Capital with a three-month term will be contacted prior to their maturity and invited to invest in Select Income or High Yield for the same term or a longer-term within the same fund.

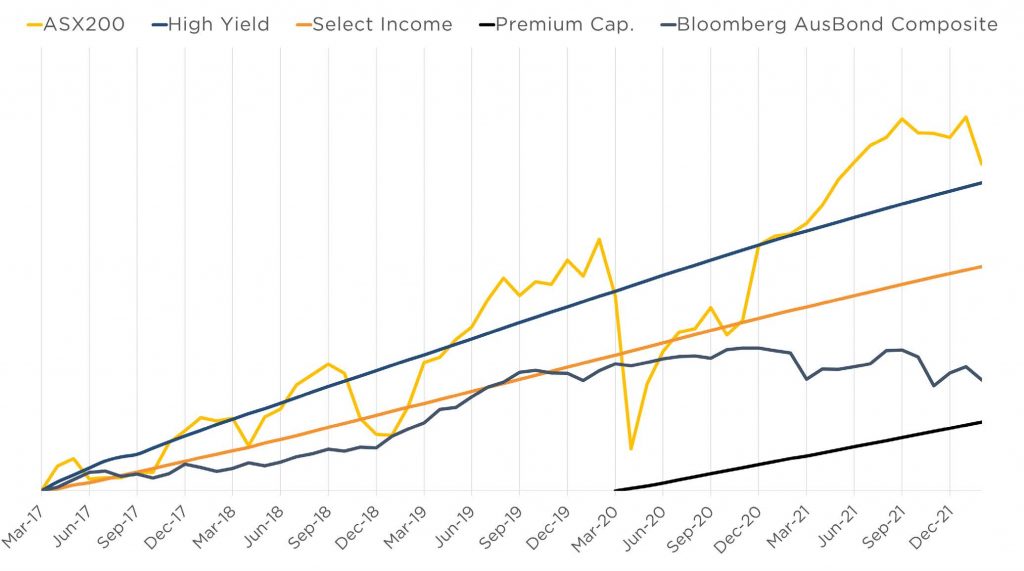

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Loan originations this month were $7,471,000, above expectations when compared to February last year $3,810,500 in loans.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of February.

Lending Activity Update

Quarterly Loan Settlements

as at 28th of February 2022

Current Loans by Fund Source

as at 28th of February 2022

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 75.32% | 100% | 100% |

| 2nd Mortgage Loans | 11.76% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 12.92% | 0% | 0% |

| Avg. Weighted LVR | 75.32% | 64.36% | 38.13% |

| Avg. Loan Size | $1,025,954.28 | $967,901.33 | $835,255.74 |

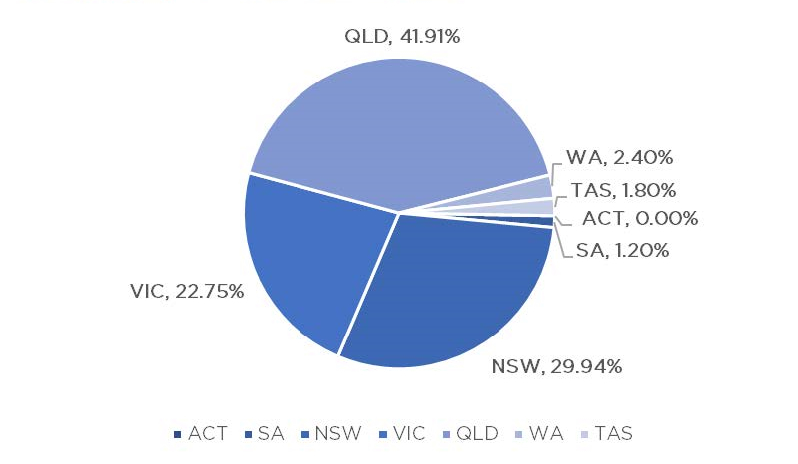

Current Loans Geography

as at 28th of February 2023

Why Invest with ASCF?

At ASCF, we like transparency and believe you should know what security backs up your investment.

That is why we publish our fully audited financial statements and a list of our current loan portfolio. The loan portfolio includes active loans and every loan we have ever written in the ASCF retail funds.

From this summary, investors can view how we invest the capital and what security we take. It demonstrates how we manage the funds and achieve the net monthly incomes paid to investors.

You can view the fund the loan is in, the term, the LVR, the type of mortgage security and the interest rate charged to the borrower, along with the geographical spread of the mortgages.

Mortgages over Australian property secure all the loans and you can see for yourself precisely what you are invested in.

An Interesting Transaction

Problem:

A broker approached ASCF on behalf of their client, who required funds to refinance an existing reverse mortgage and provide additional funding for the subdivision of their property in Yarramalong, NSW. The retired couple had received Development Approval to subdivide their large block and required a further $150,000 to complete the works.

Solution:

After assessment, ASCF was able to approve a loan of $475,000 at 9.85% pa for an 8-month term at an LVR of 39.58%. This provided them sufficient funds to refinance their existing loan and complete the works, and allowed them ample time for the subdivided block to be sold upon completion of the subdivision.

The couple intends to sell the subdivided block upon completion, allowing them to repay the loan.

Market Update

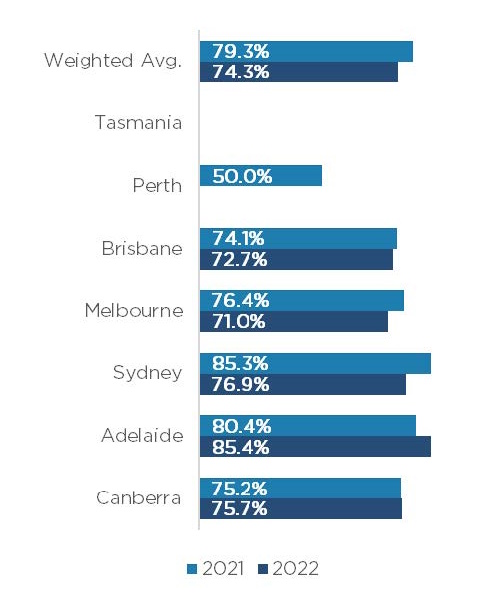

The number of auctions across Australia’s eight capitals rose from 2,473 to 3,384 (+36.84%) this week compared to last year, with Melbourne conducting 262 more auctions (+20.17%), Sydney with 365 (+43.25%), Brisbane with 107 (+92.24%), and the remainder of the country at 178 more auctions than the same period in 2021.

The weighted average clearance rate across the country is slightly lower than last year at 74.3% compared to 2021’s 79.3% clearance rate (-5%).

Other cities achieved rates reasonably similar, if marginally lower to last year, with the exception of Perth and Adelaide. Adelaide increased by (+5%) compared to previous years, with Sydney down marginally (-8.4%).

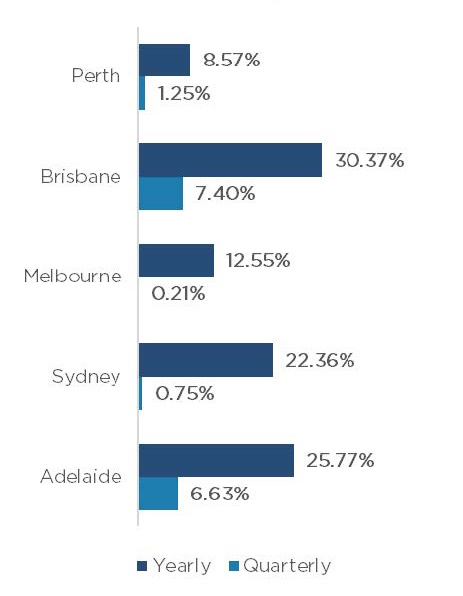

Aggregated property values across the country on a year on year basis have grown strongly (+19.03%), with the highest performer being Brisbane (+30.37%) followed by Adelaide (+25.77%).

Despite near-constant predictions that property values will fall over the next three years, property clearance rates, auction sale prices, and by extension, property values have risen considerably.

The market appears to be relatively robust in the face of such opposition by economists. However, we would expect that after a period of such growth any future growth would be considerably subdued and possibly flat.

Clearance Rates

21st February – 28th of February 2022

Property Values

as at 28th of February 2023

Median Dwelling Values

as at 28th of February 2023

Quick Insights

Rental Crisis

The national shortage of rental property continues to increase as more real estate investors remove their property from the rental market and sell to take advantage of rising prices. This will likely result in significant increases in rents as tenants compete for available properties.

Source: Australian Financial Review

Discouraging Market Movements

Despite a shortage of rental property nationally, motivated by market movement, some property owners are opting to stay put. This comes as the stamp duty rates across Australia have continued to increase over the last several years, slashing the number of properties sold each year based on historical averages.

Source: Australian Financial Review