Trading Update

The release of the GDP data by the Australian Bureau of Statistics last week which came in at 0.2% for the 3 months to December clearly shows that the impact of the rate rises we saw last year are starting to bite. Annual growth has now slowed to 1.5% from 2.1% in the prior quarter and is the lowest since 2000 if you exclude the pandemic data sets.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

Monthly inflation data for January came in at 3.4% and based on the weak economic growth number will continue to trend lower. Property prices have mostly stabilised in Melbourne but continue to rise across the other capital cities.

The rental crisis also appears to be getting worse with rents continuing to climb across the country by 0.9% in February and by 8.5% over the last 12 months. So where does that leave our economy? Well with anaemic economic growth and inflation likely to hit the RBA’s target later this year interest rates will come down, with economists divided between one rate cut and as many as three so the cash rate is likely to be somewhere around 3.85% by year end.

The housing crisis is unlikely to see any relief until governments at all levels realise the issue is really one of supply. The policies governments at all levels have implemented historically through stamp duty relief and first home owners grants whilst important do nothing to increase supply levels to make housing more affordable on a sustained basis. Governments need to start removing the red tape on housing approvals, release more land for housing either through new large scale releases or zoning changes as well as incentivise employers in the construction industry to employ more skilled labour.

It is only when they realise that the issue rests on the supply side and take action to increase supply that they can truly start to tackle the housing affordability crisis. This really requires collaboration between governments at all levels nationally and even if they started to work on this immediately it would take at least a couple of years for the benefits of these policies to flow through and make an impact. As a consequence, residential property prices are likely to remain well supported and depending on how much the Federal government tinkers with migration levels between now and year end we expect further price increases are likely as rate cuts start to flow through.

Half-Yearly Financials Now Online

Our half-yearly audited financial statements for each of our retail funds for the period ending 31 December 2023 are now available for viewing on our website or by clicking here. Should you have any questions, do not hesitate to contact our Investor Relations

team on 1300 269 419.

New Staff Appointment

We are pleased to advise that we have recently appointed Mr John Reghenzani as our new Head of Compliance. Mr. Reghenzani has over 25 years experience across the Australian financial services industry spanning roles in private legal practice, as a Senior lawyer at the Australian Securities and Investments Commission and working in-house as a compliance manager and advisor to ASIC regulated managed investment, asset management and retail and wholesale banking businesses.

Mr Reghenzani has a Bachelor of Economics and Bachelor of Laws from Monash University and a Master of Laws from the University of Queensland.

Mr Reghenzani reports to and works with the ASCF Compliance Committee and ASCF Credit Committees in order to support compliance with ASCF’s Australian Financial Services and Australian Credit licenses and associated regulatory requirements.

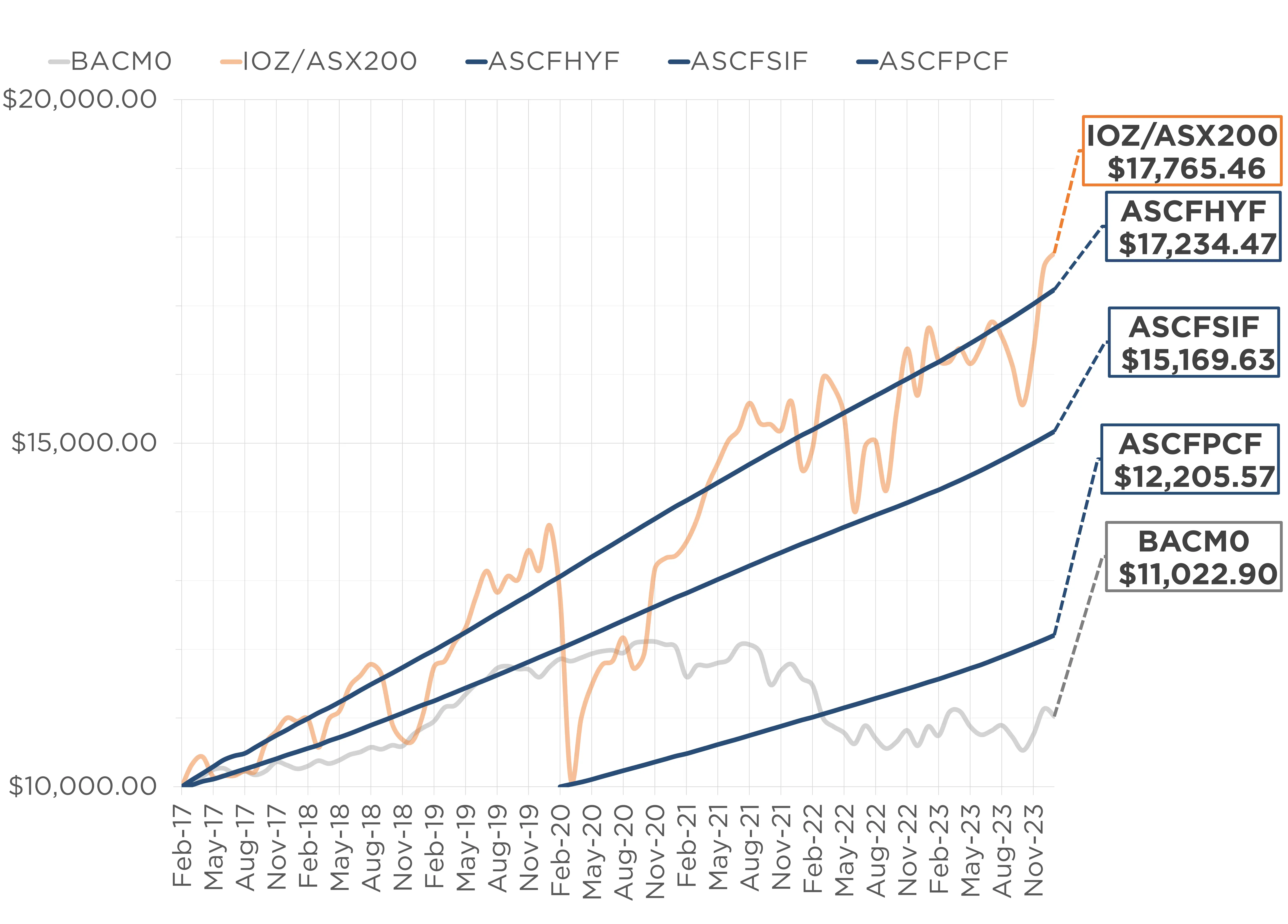

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Managed Funds Under Management

as at 29th of February 2024

| February 2024 | |

|---|---|

| ASCF High Yield Fund | $135,559,793.97 |

| ASCF Select Income Fund | $44,831,687.73 |

| ASCF Premium Capital Fund | $23,334,851.53 |

| Combined Funds under Management | $203,726,333.23 |

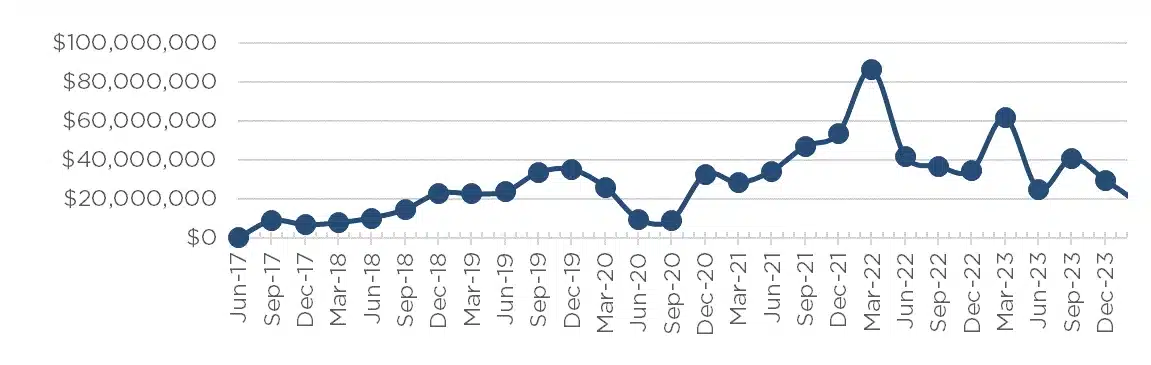

In February, loan originations and inquiry levels remained solid, with $9,384,275 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of February.

Lending Activity Update

Quarterly Loan Settlements

as at 29th of February 2024

Current Loans by Fund Source

as at 29th of February 2024

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 81.65% | 100% | 100% |

| 2nd Mortgage Loans | 11.75% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 6.60% | 0% | 0% |

| Avg. Weighted LVR | 53.74% | 54.29% | 46.48% |

| Avg. Loan Size | $1,393,290.66 | $1,029,808.36 | $756,388.89 |

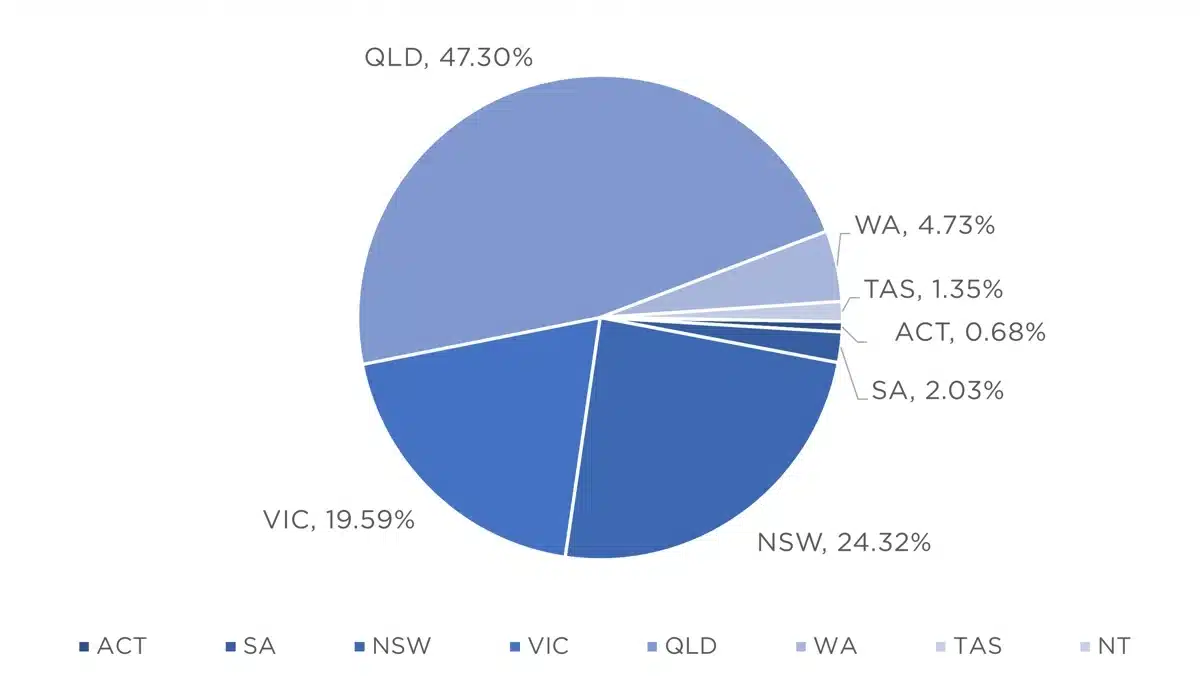

Current Loans Geography

as at 29th of February 2024

Why Invest with ASCF?

We are often asked how funds invested in ASCF are secured.

The short answer is that all funds are invested in loans over Australian property secured by a registered mortgage in favour of ASCF. Over 98% of our loans are in residential backed property with a limited number of loans over commercial property.

If you look at the average weighted loan to valuation ratio on these loans across all our retail funds they are currently at sub 60% which leaves quite a buffer. We have all heard of the term “safe as houses” well one could argue that in terms of our track record the saying applies and we don’t say that lightly.

Since inception in 2016 ASCF has funded close to $1 billion dollars in loans across the group, and no investor has ever suffered a loss, nor has our unit price declined at any point. All investor redemptions have been in full and on time and all investor interest payments have been met.

As we enter our eighth year in operation, we have paid out over $56,500,000 to investors in interest payments and whilst we are very much a boutique mortgage fund we believe that our business model has stood the test of time in ensuring our investor’s funds are well managed with capital preservation remaining our highest priority across all our portfolios, and our track record clearly evidences that.

An Interesting Transaction

Problem:

A customer was introduced to us by a valued broker seeking funding to pay out their outstanding ATO tax debt. The customer was in the process of listing their property for sale, and using the proceeds to clear the tax debt, however the ATO was putting pressure on the customer to pay immediately.

Solution:

Given the customer was intending to sell her property, ASCF was able to provide a 2nd mortgage for $320,000 at 19.8% p.a. for a term of 9 months providing the borrower sufficient time to sell property. The LVR was confirmed by a valuation at 65.88% (including the 1st mortgage).

The customer proposes to sell their property and pay us out prior to the expiry of the loan.

What ASCF Does Differently:

With only limited options in the market available to finance ATO Tax debts, ASCF takes a pragmatic approach to providing a solution to meet our clients needs.

Market Update

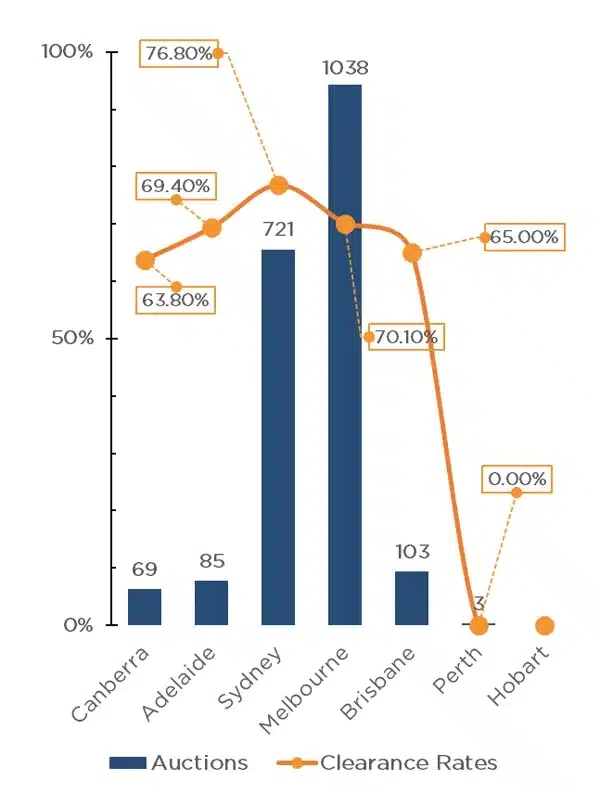

The first weekend of March saw 2,019 auctions take place across the combined capital cities, down slightly on the previous year’s 2,054, however clearance rates were up, 71.8% in comparison to 66.3% in 2023. Melbourne once again led the way, with 1,038 auctions taking place, followed by Sydney with 721, well above that of the other capitals, with Brisbane, Adelaide, Canberra and Perth recording 103, 85, 69 and 3 auctions respectively.

The preliminary clearance rate of 71.8% for the weekend indicates that buyers and sellers are on the same page for the most part, particularly in Sydney where a clearance rate of 76.8% was achieved, well above the 68.7% of the same weekend last year.

Melbourne, Adelaide, Brisbane and Canberra all managed to achieve clearance rates of above 60% for the weekend, with 70.1%, 69.4%, 65.0% and 63.8% respectively. It is interesting to note that all capital cities achieved a greater clearance rate than the same weekend in 2023, other than Adelaide, where a 72.9% clearance rate was achieved on the same weekend last year.

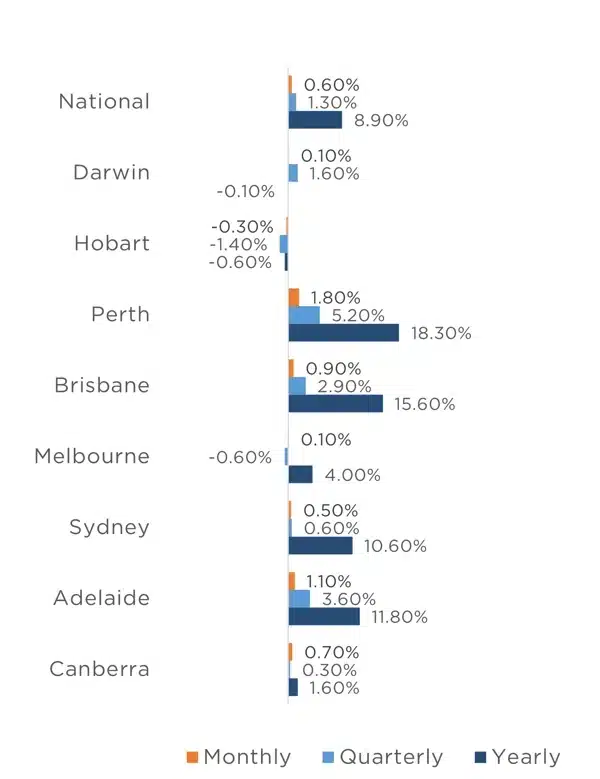

February brought yet another strong month for property prices, with CoreLogic’s Home Value Index showing a 0.6% increase across the combined capitals and combined regionals, with all capital cities experiencing growth except for Hobart, where prices fell by 0.3% for the month.

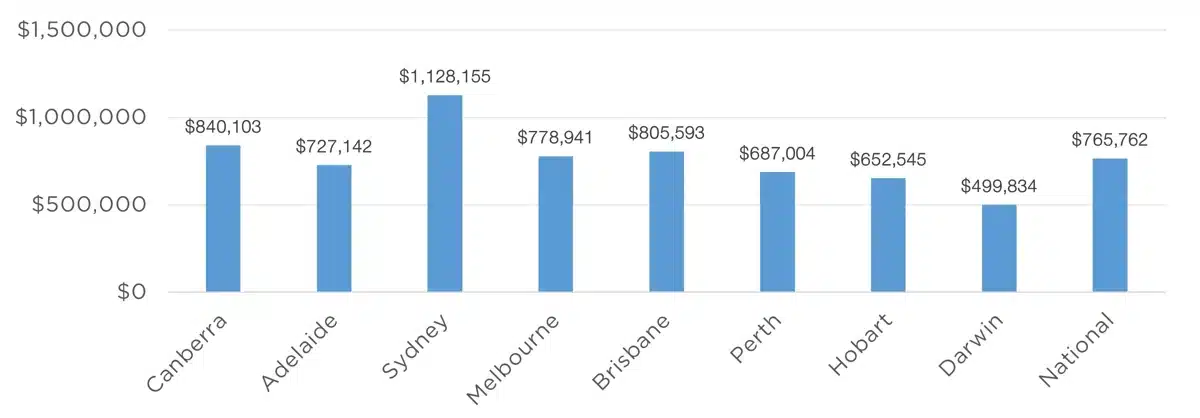

Once again, Perth experienced the greatest level of growth, increasing by a mammoth 1.8% for the month, contributing to a 5.2% quarterly growth and an increase of 18.3% annually. Adelaide also experienced strong monthly growth of 1.1%, followed by Brisbane with a further 0.9% increase, bringing the median property value of Brisbane above $800,000 for the first time, with a median value of $805,593, the second highest median value nationally, behind only Sydney with $1,128,155. Canberra, Sydney and Melbourne also experienced growth for the month of 0.7%, 0.5% and 0.1% respectively, with all cities except for Hobart (-0.6%) and Darwin (-0.1%) experiencing an annual increase.

Whilst there was no RBA meeting this month, economists continue to believe we are at the end of the rate hike cycle, with many expecting interest rate reductions before the end of 2024. Should interest rates ease, we expect that there will be a bump in property prices.

Clearance Rates & Auctions

week of 4th of March 2024

Property Values

as at 1st of March 2024

Median Dwelling Values

as at 1st of March 2024

Quick Insights

Values to Outperform

Two-fifths of valuers surveyed by CBRE have predicted house prices to outperform by up to 10% in Adelaide, Perth, and Sydney. Valuers were also relatively bullish on the apartment sector with 44 per cent predicting prices to increase over the next 12 months. The survey also highlighted a high level of demand from upgraders and downsizers, buyer segments who were less sensitive to interest rate movements.

Source: Australian Financial Review

Build-to-Rent Builds Steam

Salta Properties, is now surging into the build-to-rent sector, with ambitions to create a $3 billion platform and with its first project in inner-city Melbourne close to completion.

“We could see that we were heading into a fairly significant housing shortage in Melbourne, and more broadly across Australia,” said Sam Tarascio, manager of the firm. The first block is a 94-unit project in trendy Fitzroy North at 249 Queens Parade.

To be known as Fitzroy & Co, the building has topped out and is on track to welcome first residents from July into their one, two and three-bedroom apartments. Those tenants can expect a range of resident services, access to shared spaces and a variety of amenities.

Source: Australian Financial Review