Trading Update

The ASCF team hopes you’ve had a relaxing holiday period. After moving offices to our new location, 50 Park Road, Milton, we are back in action for 2022.

We are pleased to provide this monthly update to our investors.

Loan originations this month were $5,822,750, far higher when compared to last year’s $3,085,300 in loans (+89% year on year). Most were bridging loans or funds for refinancing and working capital. The types of loans offered are likely due to the gradual recovery of economic conditions after recent COVID-19 restrictions. Many are reorganising or kickstarting their lives once more.

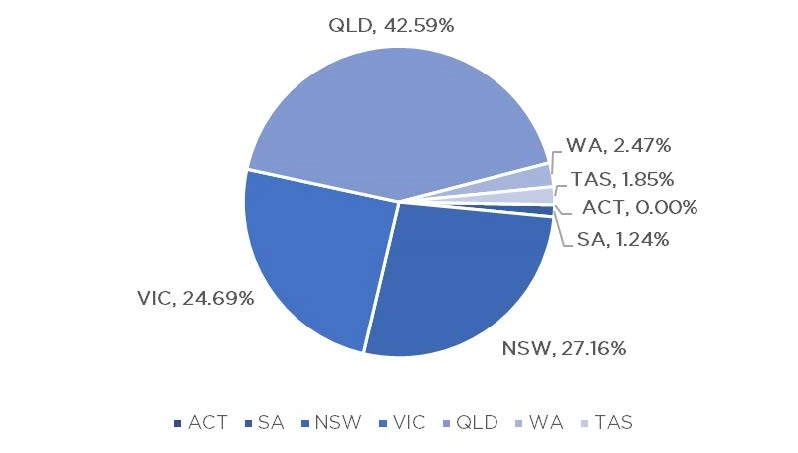

The majority of our loan inquiries have been mostly originating in Queensland followed neck and neck with New South Wales and Victoria.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months |

|---|---|---|

| 5.55% | 5.85% | 6.25% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months |

|---|---|---|

| 5.05% | 5.30% | 5.60% |

ASCF Premium Capital Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 4.50 | 4.75% | 5.00% | 5.20% |

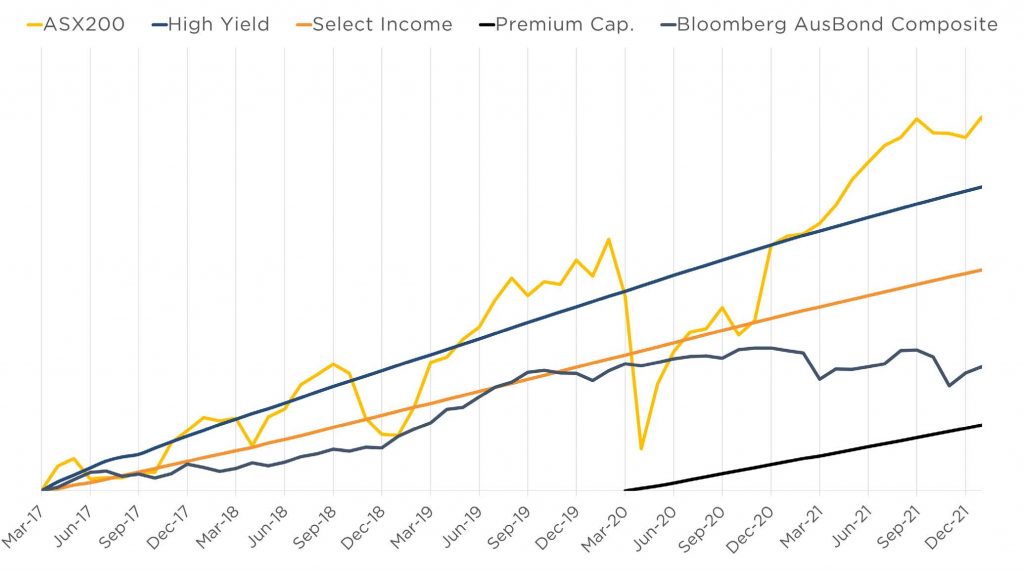

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Our pooled investments have increased to $193,163,695 as of the 31st of January and new investments across all our retail funds continue to grow..

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of January.

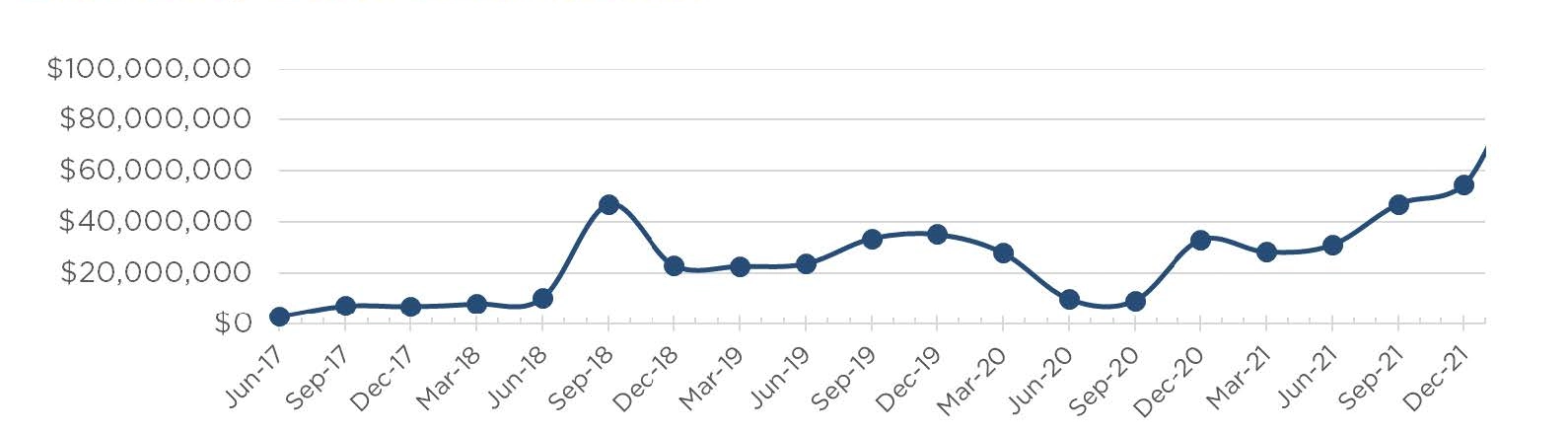

Lending Activity Update

Quarterly Loan Settlements

as at 30th of January 2022

Current Loans by Fund Source

as at 30th of January 2022

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 76.25% | 100% | 100% |

| 2nd Mortgage Loans | 11.98% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 11.77% | 0% | 0% |

| Avg. Weighted LVR | 66.58% | 66.41% | 37.70% |

| Avg. Loan Size | $1,025,954.28 | $967,901.00 | $863,809.72 |

Current Loans Geography

as at 30th of January 2022

Why Invest with ASCF?

ASCF employs prudent risk mitigating strategies to service our customers’ needs and help keep investors funds safe.

One of these strategies is the Investor Reserve Account, and it is in place for all of the ASCF Funds.

So what is it, and how does it work?

ASCF contributes funds to an Investor Reserve Account out of management income received each month. This account is for the investor’s benefit and is separate from the Funds’ assets. The amount is at the discretion of ASCF with the balance normally around 1% of FUM.

Should any impairment or capital loss be incurred in any of the three ASCF Funds, the directors can at their discretion, use this account to make good the loss.

While this strategy is in place, since inception there has never been the need to tap into the account.

An Interesting Transaction

Problem:

At the end of last year, we were contacted directly by a client concerned about losing her deposit on a house she wished to purchase in Devonport, Tasmania.

Solution:

We offered her a bridging loan that allowed her to buy the property in Tasmania worth $520,000 while waiting to sell her unencumbered property in Elwood, Victoria, valued at $2,200,000.

After reviewing the scenario, we provided a loan facility of $575,000 at 7.45% per annum for a 3-month term at an LVR of 21.14%.

Our client was able to complete their purchase on the property in Tasmania and has subsequently discharged her loan via the sale of her property in Victoria.

Market Update

The number of auctions across Australia’s eight capitals increased from 882 to 1,159 (+31.22%) this week compared to last year with Melbourne performing 393 auctions, Sydney 326, Brisbane 152, and the remainder of the country 289 auctions.

Brisbane and Adelaide in particular presented the market with 102 (+204%), and 109 (+128%) more auctions respectively.

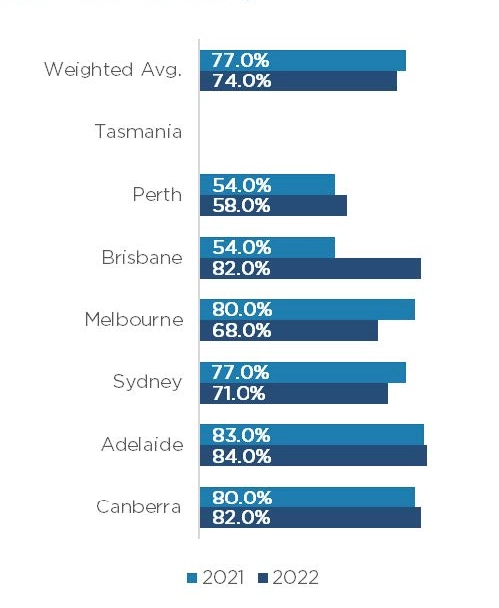

The weighted average clearance rate across the country is tracking on par to last year at 74% in comparison to 2021’s 77% clearance rate (-3%).

Other cities achieved rates fairly similar to last year, with the exception of Brisbane and Melbourne. Compared to previous years, Brisbane performed exceedingly well (+32%), with Melbourne performing lower (-12%).

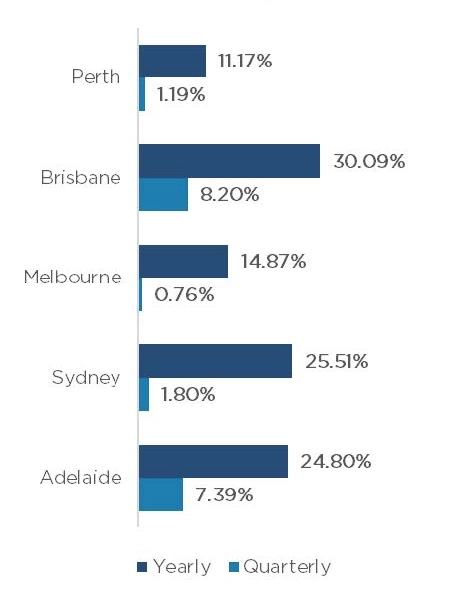

Aggregated property values across the country on a year on year basis have grown strongly (+21%), with the highest performer being Brisbane (+30%) followed closely by Adelaide (+25%).

However, we are starting to see some price moderation in Sydney and Melbourne which is likely to extinguish the Australian Prudential Regulation Authority’s planned increase in financial regulation for home buyers.

Clearance Rates

as at 24th – 30th of January 2022

Property Values

as at 30th of January 2022

Median Dwelling Values

as at 30th of January 2022

Quick Insights

According to global real estate firm Cushman & Wakefield, city commercial space is unlikely to grow significantly in value until 2023.

Source: Australian Financial Review

Stay-at-home working arrangements could begin to cause damage to the growth of regional housing values around Australia. As some areas become as expensive as capital cities, there may be less incentive to buy.

Source: Australian Financial Review

Inner-city Melbourne rents have jumped by 10% as residential property values and the economic damages of COVID-19 begin to subside.

Source: Australian Financial Review