Trading Update

Welcome to our first newsletter for 2024!

The RBA’s decision on Tuesday to leave rates on hold was widely expected after the December quarter inflation print came in at lower than expected at 4.1%.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

Residential property prices continue to remain resilient with Core Logic’s national Home Value Index indicating a 0.4% increase in values for January with Brisbane, Adelaide and Perth values increasing by 1% or more.

We do expect residential prices to stabilise during the course of 2024 supported by the likelihood of interest rate reductions later this year and also the ongoing reality of a structural under supply in housing across the country predominantly due to elevated migration levels.

The gross rental yield on residential property also remains stable at 3.73% nationally, supported by a 0.8% increase in rental values in January which was up from a 0.6% increase in December. The current yield is in line with the average over the last 10 years at 3.78%.

Consumer confidence remains low, however with cost of living pressures slowly starting to ease and rate reductions on the horizon we do expect this will improve during the course of 2024.

Whilst the commentary contained in the RBA statement indicated it was open to further rate raises should future data releases not be in line with their forecasts we believe inflation will continue to fall over the coming the months.

This should open the door for the RBA to cut rates later this year with most economists expecting two rate reductions of 0.25% each which would bring the cash rate back down to 3.85% by year end.

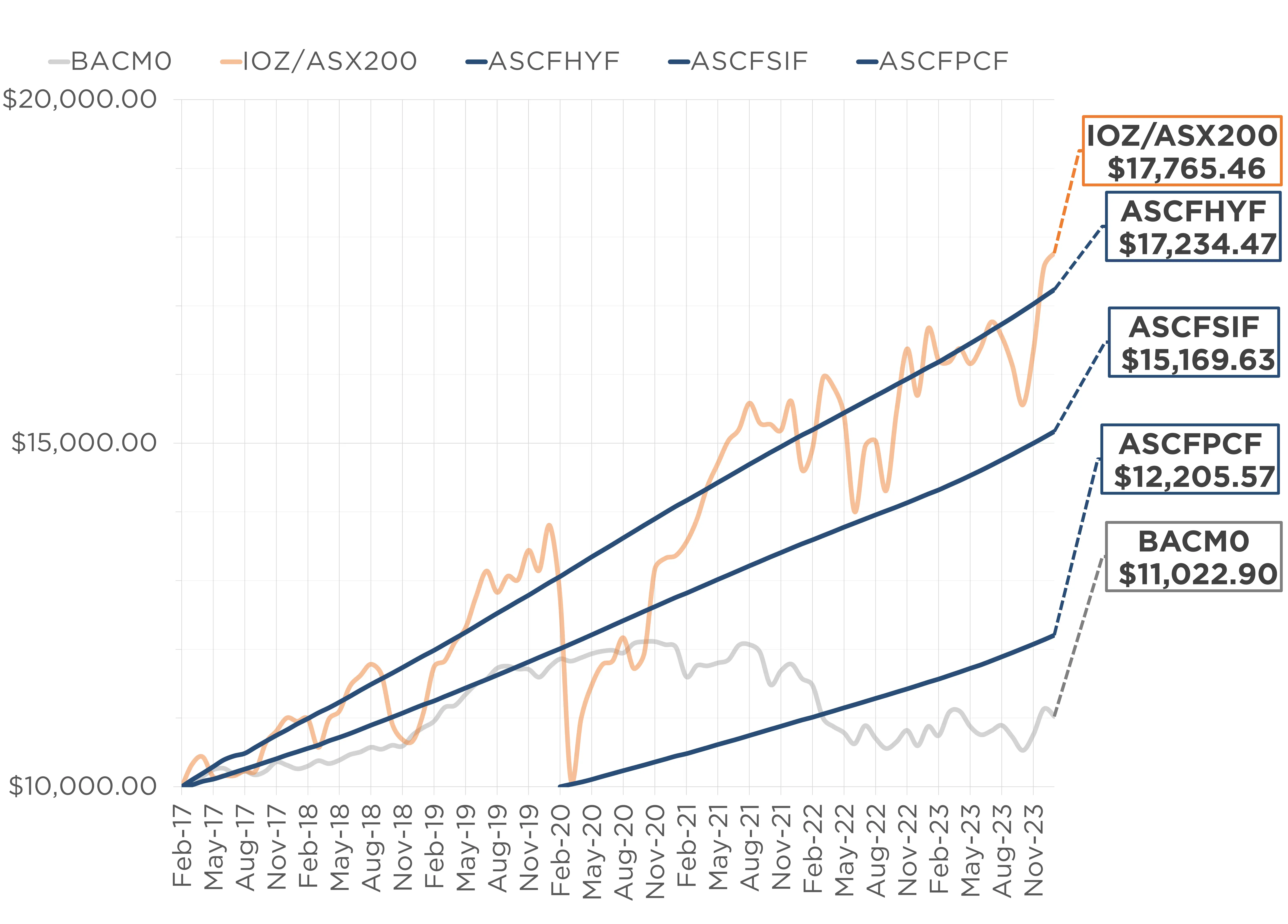

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Managed Funds Under Management

as at 31st of January 2024

| January 2024 | |

|---|---|

| ASCF High Yield Fund | $137,303,003.97 |

| ASCF Select Income Fund | $45,408,687.73 |

| ASCF Premium Capital Fund | $23,083,853.82 |

| Combined Funds under Management | $205,795,545.52 |

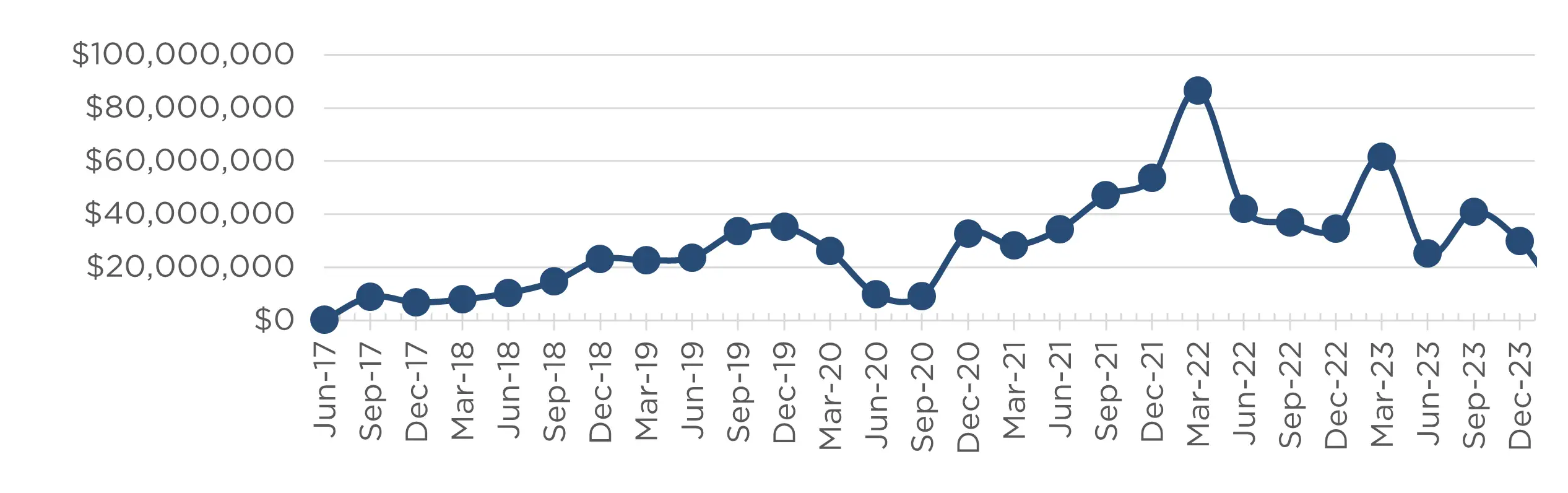

In January, loan originations and inquiry levels remained solid, with $7,997,814.00 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of January.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of January 2024

Current Loans by Fund Source

as at 31st of January 2024

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 81.08% | 100% | 100% |

| 2nd Mortgage Loans | 12.63% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 6.29% | 0% | 0% |

| Avg. Weighted LVR | 54.06% | 54.16% | 46.05% |

| Avg. Loan Size | $1,368,807.43 | $1,142,474.06 | $737,589.29 |

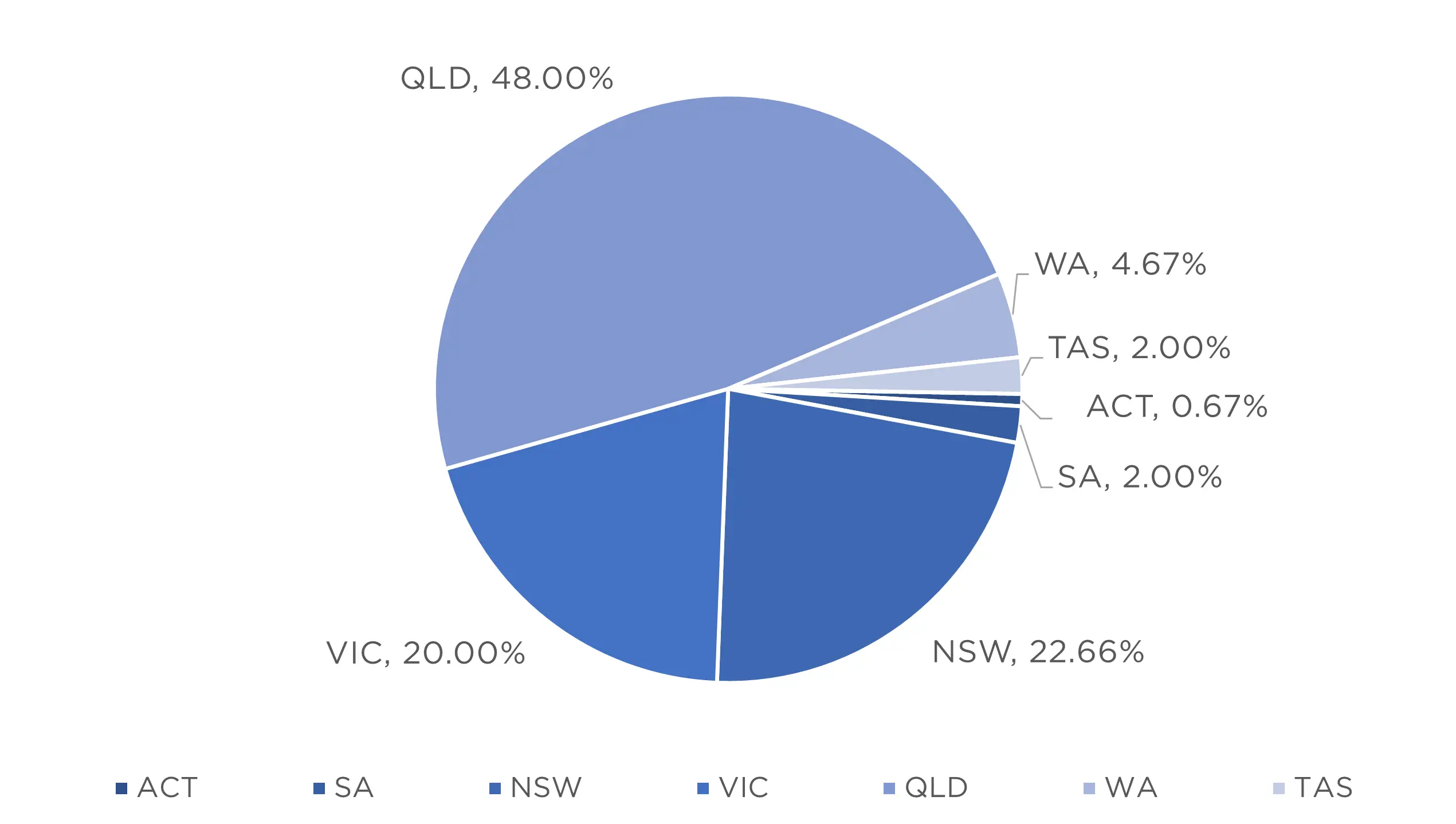

Current Loans Geography

as at 31st of January 2024

Why Invest with ASCF?

Private credit is now flourishing in most overseas markets and the uptake of Australian investors into an asset class that can move with interest rates, beat the inflationary pressures on their cash and assist with rising cost of living by generating consistent returns is now becoming more prevalent.

But what makes ASCF different from other mortgage funds?

- We don’t fund risky construction loans. ASCF does not provide construction loans to property developers, that is we only lend on the as is value of the asset at the time of the loan.

- Over 95% of our loan book across all our funds is in residential loans, we rarely lend on commercial properties.

- We are a short term lender, with an average weighted loan term of around 9 months. This makes our funds very liquid and as the property market moves our loan book resets based on the movements in the market.

- Our targeted distribution rates are set for the duration of your investment, so if you invest with us now your rate will not fluctuate during the course of your investment term should the RBA reduce rates during your term.

- Capital preservation. Since inception we have funded close to $1B in loans across all ASCF funds and no investor has ever suffered any loss, and all interest distributions and investor redemptions have been paid on time and in full.

Whilst past performance is not indicative of future performance, we believe our record speaks for itself so if you are looking for an inflation response investment with capital stability we believe an investment in our ASCF High Yield Fund which is currently paying 7.75% p.a for a 12 month investment term is definitely worth considering.

An Interesting Transaction

Problem:

A repeat ASCF borrower was completing renovations to an investment property and required a further $200,000 to complete the renovations before placing it on the market for immediate sale. Their current lender refused to increase their 1st mortgage due to the short term nature of the loan. ASCF obtained a valuation report which provided an ‘as is’ valuation of the property.

Solution:

Based on the valuation figure, ASCF was able to lend sufficient funds for the borrowers to pay out their first mortgage, and complete their renovations. ASCF provided a gross loan amount of $500,000, including capitalised interest, at an LVR of 52.63% and an annual rate of 13.80%.

Our loan provides a six-month term which allows sufficient time for the renovations to be completed and the property to be marketed and sold.

What ASCF Does Differently:

ASCF is a specialist in providing short term loans to borrowers so they can meet their objectives when traditional lenders refuse to assist borrowers in meeting their short term goals.

Market Update

The first RBA meeting of the year has taken place, with the cash rate remaining on hold at 4.35%. Recent inflation data has given economists confidence that we have reached the end of the rate hike cycle.

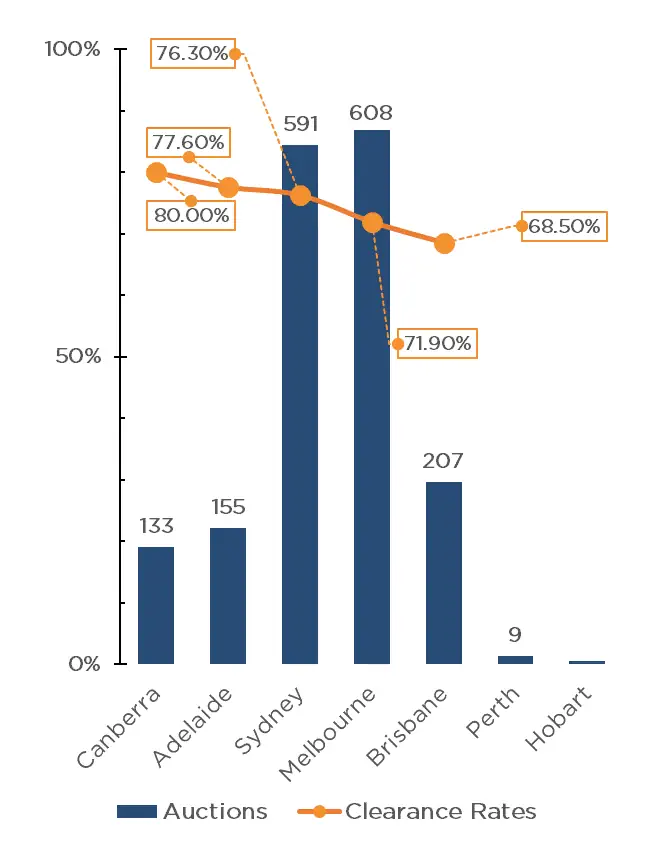

The first weekend of February brought the start of the 2024 auction season, with a mammoth 1,671 auctions being held across the combined capitals. This is the second largest opening weekend since 2008, with only the corresponding weekend in 2022 holding more auctions, with 1,779 taking place.

This result was up 26.4% on 2023 data, and was more than double than double the number of auctions held over the year so far (803). Melbourne recorded the most auctions for the weekend, with 603 taking place, followed closely by Sydney with 562. Brisbane, Adelaide and Canberra also recorded triple digit auction numbers with 203, 159 and 132 auctions taking place respectively, whilst Perth and Tasmania held just 9 and 3 auctions respectively.

Preliminary clearance rates have also begun the season strongly, with a clearance rate of 73.9% across the combined capital cities, well above the 61.9% of 2023. Canberra led the way with 80.0%, followed by Adelaide, Sydney and Melbourne with 77.6%, 76.3% and 71.9% respectively. Brisbane being the only capital below 70% with a 68.5% result.

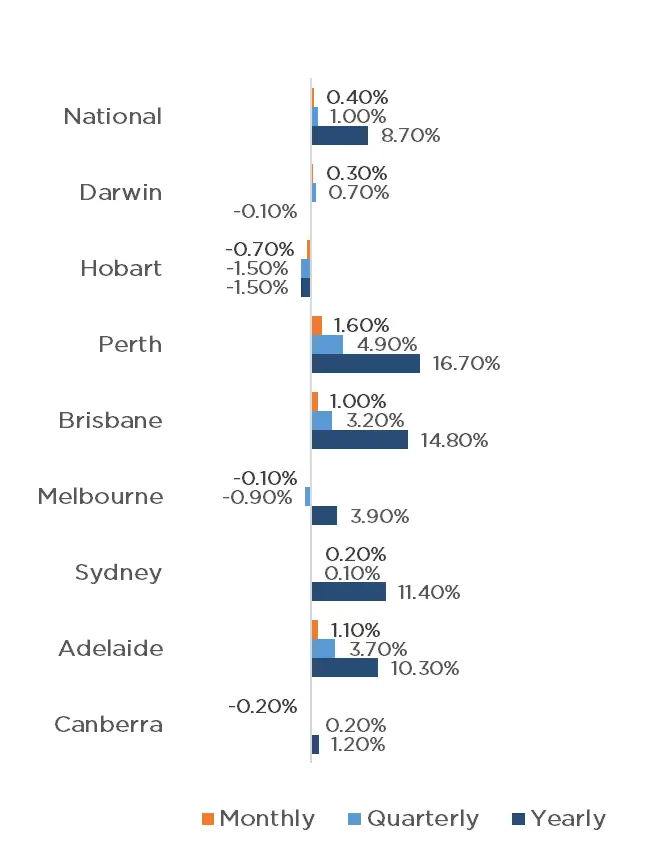

The property market continues to show growth, albeit signs of cooling do exist, with a 0.4% increase across both the combined capitals and regionals.

Perth continues to experience the highest rate of growth, increasing by 1.6% for January, followed by Adelaide and Brisbane with 1.1% and 1% respectively. Darwin and Sydney also experienced growth of 0.3% and 0.2% respectively, whilst prices in Melbourne, Canberra and Hobart have fallen by 0.1%, 0.2% and 0.7% respectively. The annual change remains significant with a 10% increase across the combined capitals, and 4.9% increase for regional centers, contributing to a national increase of 8.70%.

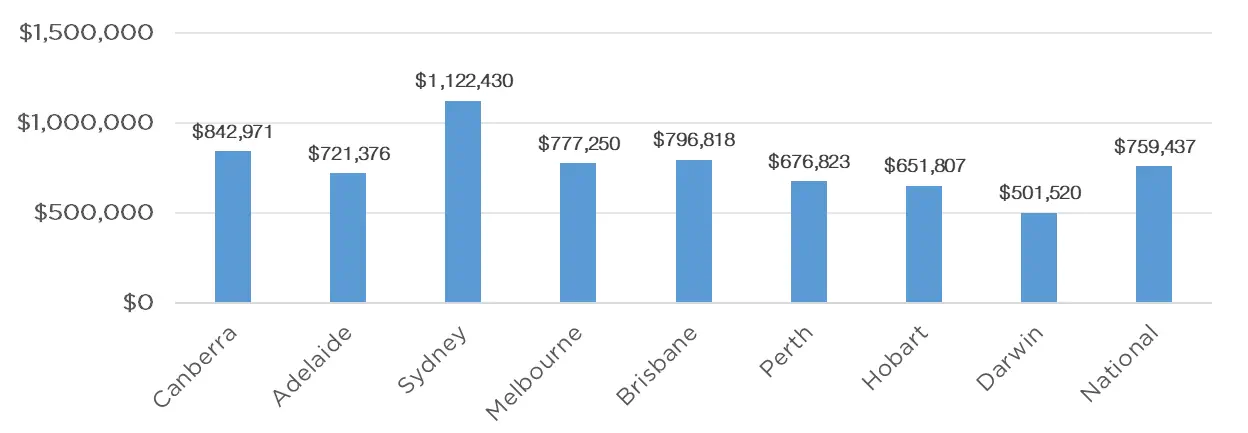

This has been driven by four of the capitals experiencing double figure growth with 16.70% for Perth, 14.80% for Brisbane, 11.40% for Sydney and 10.30% for Adelaide. Melbourne and Canberra also recorded growth for the year with 3.90% and 1.20% whilst only Darwin and Hobart saw prices fall for the year with 0.1% and 0.4% respectively. This has led to Brisbane now holding the second highest median value in the country, overtaking Melbourne with a median value of $796,818 compared to Melbourne’s $777,250.

Whilst the property market has begun to show signs of easing, given that economists predict we are at the end of the rate hike cycle, we anticipate that property prices will still experience growth throughout 2024, as interest rates begin to subside, and the lack of housing supply continues.

Clearance Rates & Auctions

week of 4th of February 2024

Property Values

as at 1st of February 2024

Median Dwelling Values

as at 1st of February 2024

Quick Insights

Will Values Fall? Unlikely.

With home values in capitals such as Sydney still 2.4% lower than their peaks, many investors such as Sydney-based investor Nicholas Marangos-Gilks are more motivated than ever to increase demand in the market. Buyers are not waiting for the rate cut to occur.

Tim Lawless, CoreLogic research director, has commented, “We are still seeing housing values below their record highs in Sydney, Melbourne, Hobart, Darwin and the ACT. In these cities we could see motivation from buyers looking to get into the market while values are still below their peaks.”

Source: Australian Financial Review

Looser Planning, not Restrictive Taxes

Eliminating negative gearing and ditching capital gains tax discounts will not solve the worsening housing affordability crisis, but boosting supply by easing planning rules will, a new report says.

Centre for Independent Studies chief economist and former Reserve Bank official Peter Tulip said restrictive planning rules have added more than 40% to house prices in Sydney and Melbourne, while property taxes boosted values by 4% at most.

“There are arguments from the tax policy perspective that negative gearing and the capital gains discount should be considered, but it’s not relevant to the question of housing affordibility,” he said.

Source: Australian Financial Review