Trading Update

Australian Secure Capital Fund is pleased to provide this monthly update to our investors.

An analysis by Australian Fund Monitors on our ASCF High Yield Fund:

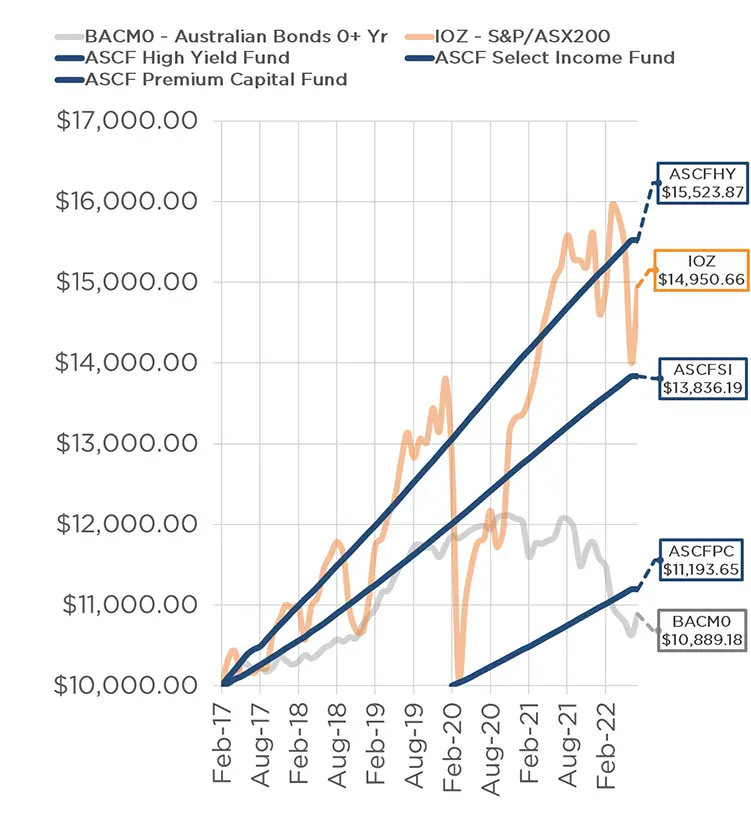

The ASCF High Yield Fund rose by +0.53% in June, an outperformance of +2.01% compared with the Bloomberg AusBond Composite 0+ Yr Index which fell by -1.48%. The ASCF High Yield Fund has a track record of 5 years and 4 months and has outperformed the Bloomberg AusBond Composite 0+ Yr Index since inception in March 2017, providing investors with an annualised return of +8.60% compared with the index’s return of +1.09% over the same period.

On a calendar year basis, the fund hasn’t experienced any negative annual returns in the 5 years and 4 months since its inception. Over the past 12 months, the fund hasn’t had any negative monthly returns and therefore hasn’t experienced a drawdown. Over the same period, the index’s largest drawdown was -12.13%.

The Manager has delivered these returns with 3.77% less volatility than the index, contributing to a Sharpe ratio that has consistently remained above 1 over the past five years and which currently sits at 23.03 since inception. The fund has provided positive monthly returns 100% of the time in rising markets and 100% of the time during periods of market decline, contributing to an up-capture ratio since inception of 87.00% and a down-capture ratio of -78.00%.

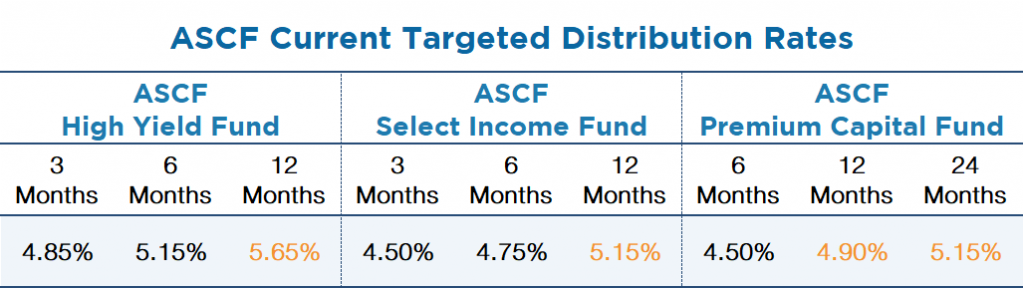

NEW RATE INCREASE EFFECTIVE TODAY AUGUST 1st

We are pleased to advise that our investment rates across each of our funds for 12 and 24-month term investments will be increasing effective today by 0.15%.

Whilst we are yet to see any decisive moves across the competitive landscape in which we operate with respect to lending rates on loan originations we are seeing some second-tier lenders start to move their rates higher making ASCF a more competitive alternative for borrowers.

Our investment rates continue to be reviewed monthly and we anticipate we will be in a position to increase our rates further as we start to see the impact of higher funding costs flow through to lending products across our market enabling us to increase our investment rates.

2021 – 2022 TAX CERTIFICATES ARE NOW AVAILABLE

Tax Certificates for Financial Year 2021-2022 are now ready for download via our online portal. If you are not registered for the portal, please contact us on 07 3506 3690 or via email at [email protected] and our team will assist you through the registration process.

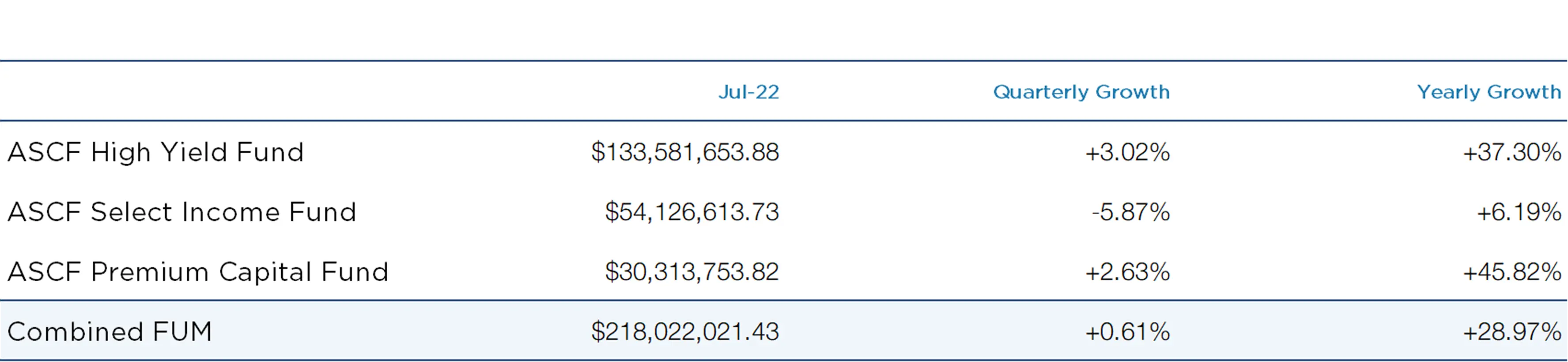

Funds Under Management

as at 30th of July 2022

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of July.

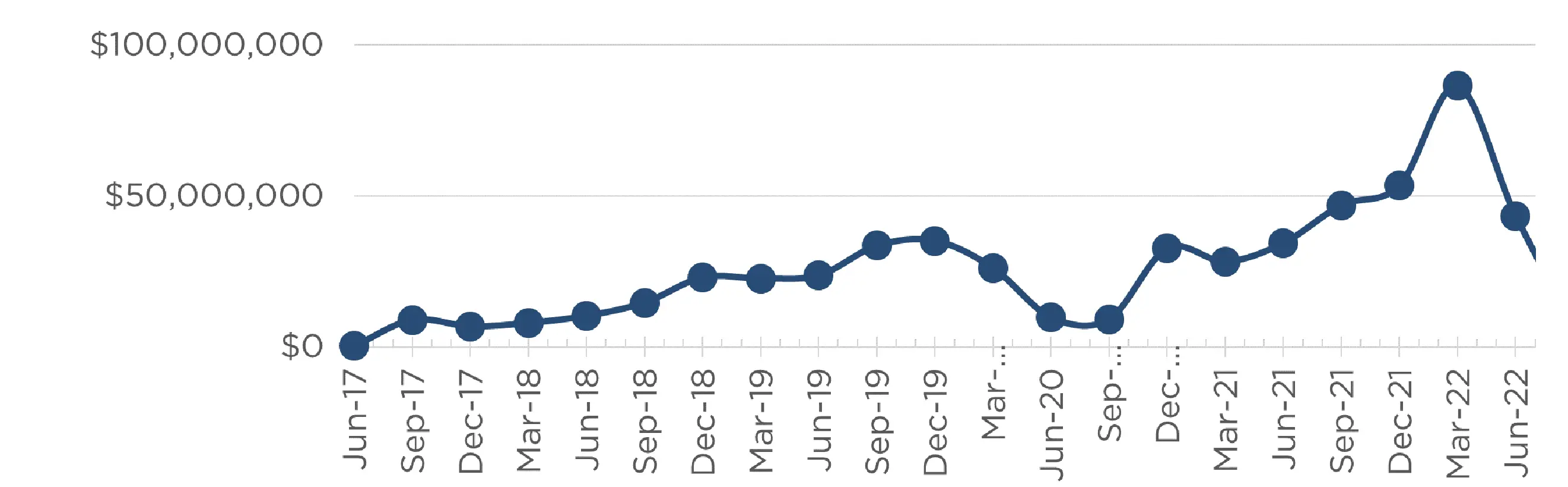

Lending Activity Update

Quarterly Loan Settlements

as at 30th of July 2022

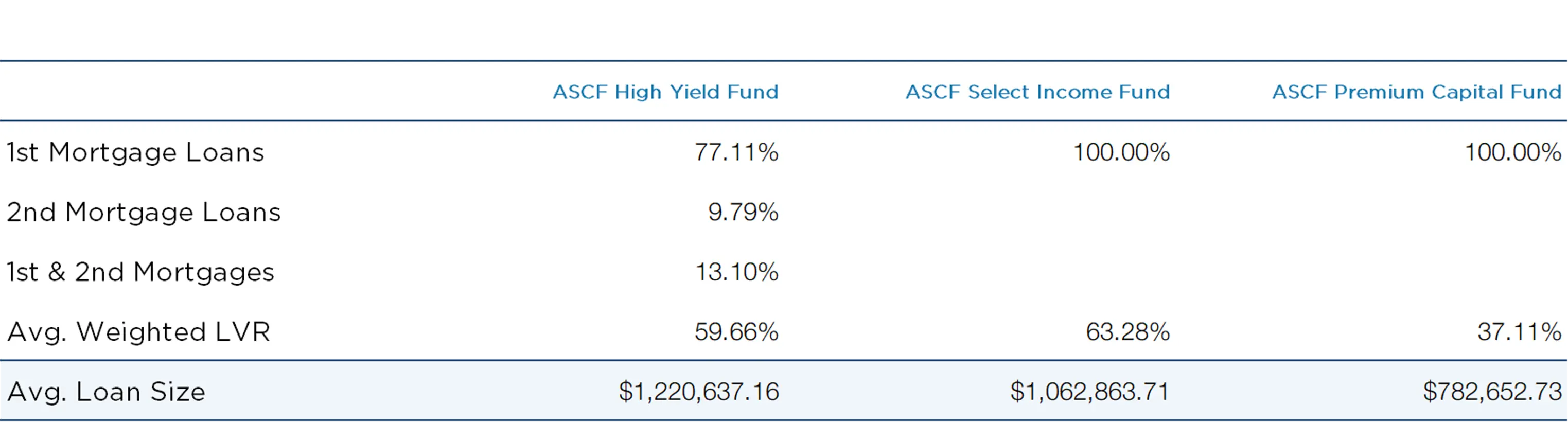

Current Loans by Fund Source

as at 30th of July 2022

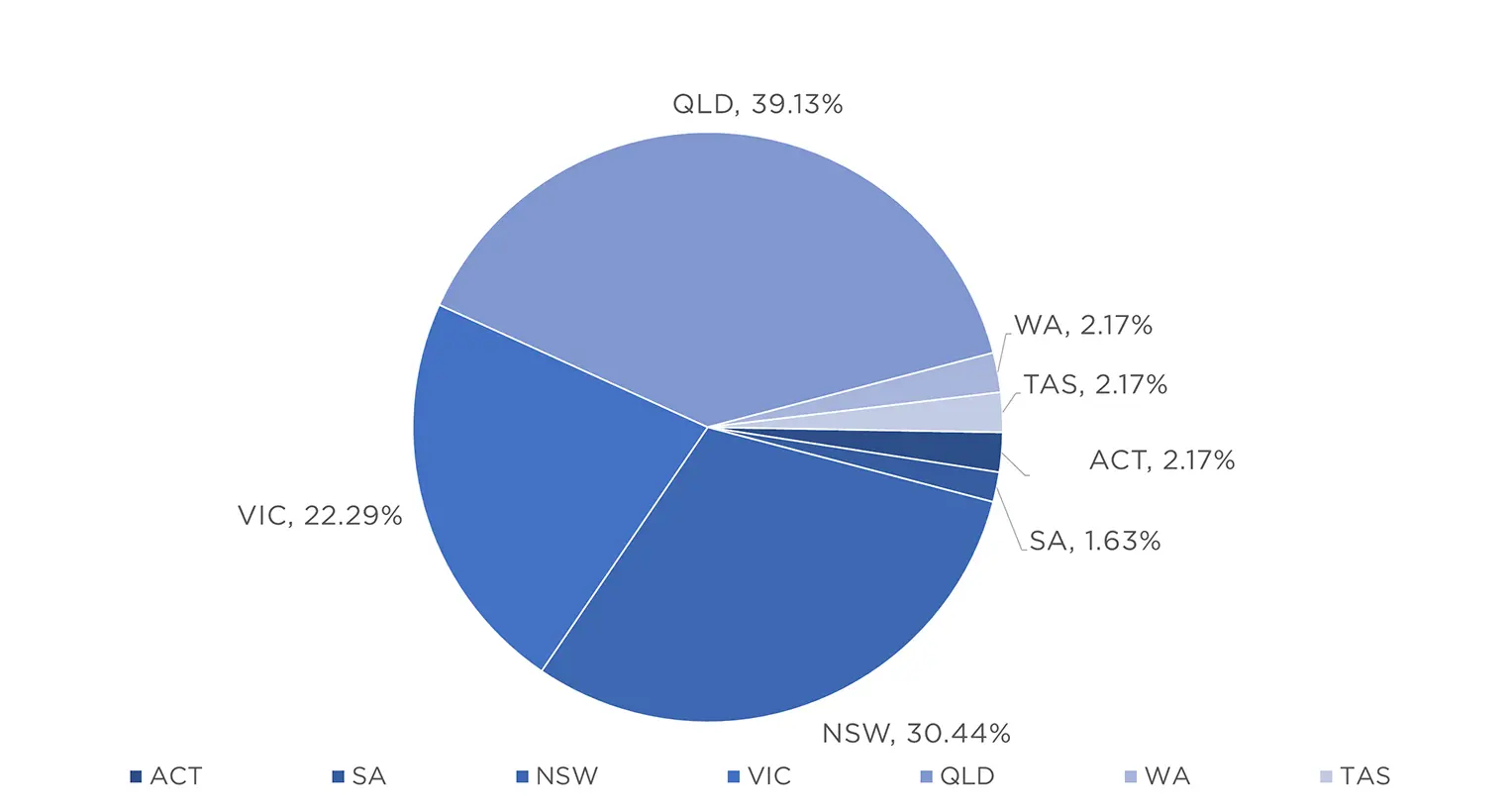

Current Loans Geography

as at 30th of July 2022

Why Invest with ASCF?

One word liquidity!

Liquidity is one of the most significant benefits of investing with ASCF and what distinguishes our funds from most other mortgage funds in the market.

As we discussed in last months article 98% of the loans we approve have an initial loan term of 12 months or less and almost 60% an initial loan term of 6 months or less thereby creating a better alignment of security property values with movements in the general market property market as existing loans are repaid and new loans originated at current property values.

It also means we are able to offer investors investment terms of 3,6,12 and 24 months with confidence and full knowledge that should they require to redeem their investment at maturity our loan terms are aligned with the average investment term.

Mortgage funds that provide investors with investment terms of say 12 months or less and then offer loan terms of 2 years or more are certainly at greater risk of experiencing a liquidity issue as their investment terms clearly do not match their loan terms. This would make it difficult to redeem investor funds on maturity if required.

Since inception, all ASCF investors have had their request to redeem funds paid on time and in full.

An Interesting Transaction

Problem:

ASCF was approached by a broker whose client was looking to purchase a property in the suburb of Hillcrest, Queensland. The property had been purchased off the plan and had experienced significant uplift, creating an opportunity for them to sell the property and make a profit. The investor already had two other properties in Wetherill Park, New South Wales and a second home in Hillcrest, Queensland, under mortgage, which they also planned to sell for profit.

Solution:

After obtaining a valuation, ASCF took a 2nd mortgage over their existing Wetherill Park property and a 1st mortgage over the property being purchased and provided the borrower with a loan of $ 252,500 at 9.75% for four months on an LVR of 51.56%.

The borrower plans to use the proceeds from the sale of the property to pay back their debt.

What ASCF Does Differently:

ASCF excels in providing boutique financing solutions at competitive rates. We review the borrower’s requirements and, unlike other lenders, are able to think outside the box to offer bespoke solutions that enable the borrowers to achieve their goals.

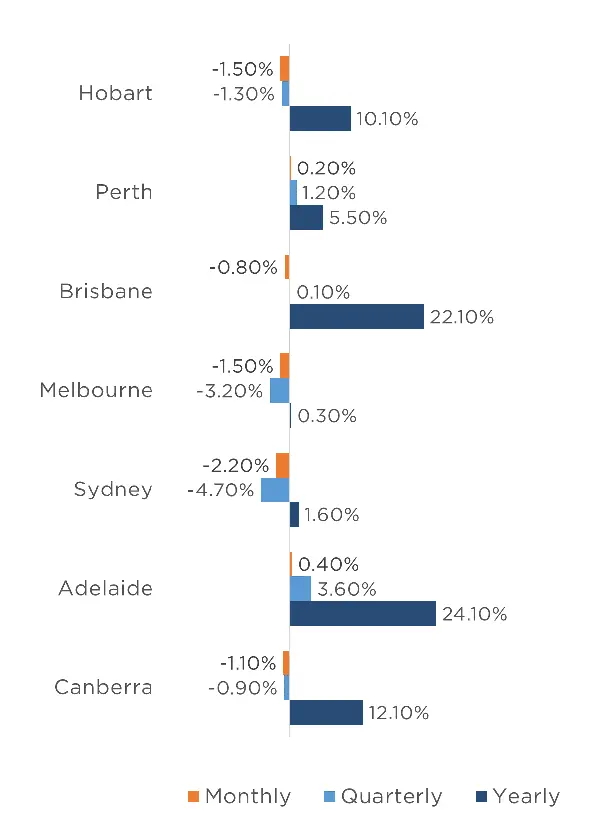

Market Update

Australian residential property values fell by 1.3% in July bringing the total quarterly decline across the country to -2%. Inventory levels have also decreased significantly and have now fallen -21.40% from the mid-March peak, helping to keep overall inventory levels low whilst on the demand side sales activity over the three months to July was -16% lower in comparison to the same period last year.

While national home sales are also falling from record highs, they are still +9.20% above the previous five-year average for this time of year. With interest rates expected to rise further, there is a good chance that the number of transacted sales will continue to fall as confidence continues to weigh on the housing sector.

On a more positive note, however, rents across the country continued to increase through July rising +0.90% for the month to be +2.80% higher for the quarter and +9.80% higher over the past 12 months.

Rental market yields seem to be consistently improving with the most rapid recoveries in the Sydney and Melbourne unit markets. Furthermore, financial markets and some economic forecasters are now also expecting interest rate cuts through the second half of next year which means the interest rate hiking cycle may be over sooner than expected.

Whilst we, therefore, expect that property prices will retreat further we believe that the declines will be much more subdued than most economic forecasters had predicted at the start of the year particularly as interest rates stabilise over the coming months, residential property yields continue to improve and incomes continue to rise.

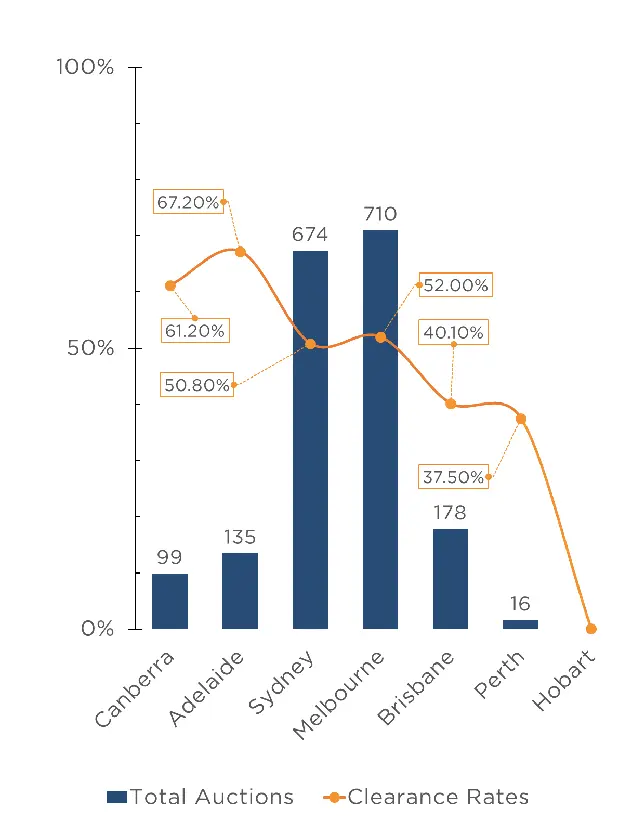

The weighted average clearance rate across the country this week was higher than last year at 51.9% (+11.80%). Other cities across the board also achieved rates higher than last year, with Sydney up by 2.70% from last year.

Buying activity has been picking up in the smaller capitals with clearance rates up by 9.20% from last year.

Clearance Rates & Auctions

as at 25th – 31st of July 2022

Property Values

as at 31st of July 2022

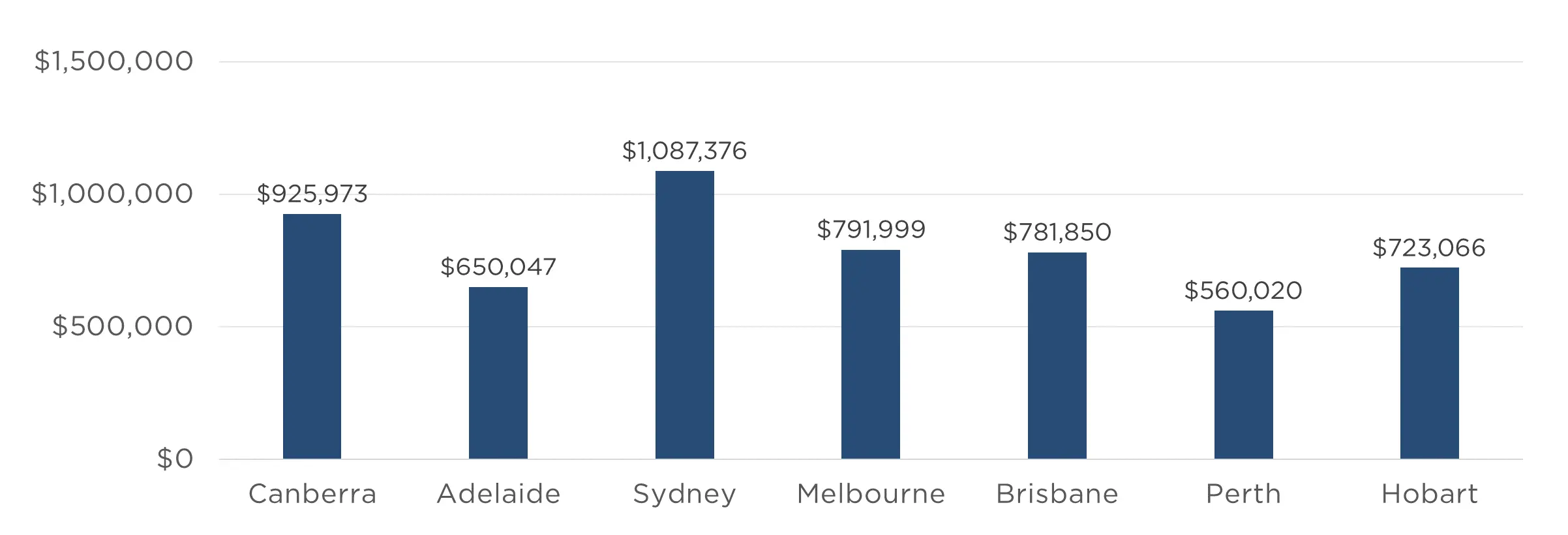

Median Dwelling Values

as at 31st of July 2022

Source: CoreLogic, Report, Article

Quick Insights

Hitting it out of the Park

Tennis Australia CFO Craig Tiley has broken a record in Melbourne’s Aspendale suburb by spending $13 million for a trophy home on the beach. The property is 2000 sqm in size and obliterated the original $8.5 million to $9 million price guide. The Jon Friedrich designed home, which includes a heated swimming pool, was also offered with a price guide of $6.4 million to $6.75 million through Kay & Burton Real Estate.

Source: Australian Financial Review

Rising Reserve Rates

Deputy Governor Michelle Bullock indicated earlier in July that the Reserve bank is likely to continue raising interest rates. She noted that the intention of the RBA is not necessarily to help or hinder the economy but instead to provide a ‘neutral’ interest rate. Most borrowers will be well-placed during this time as high debts are buoyed with equally high assets. “The accumulated stock of these savings could help to ease the transition to higher mortgage payments for many borrowers, allowing them to sustain higher levels of consumption than otherwise.”, Ms Bullock commented.

Source: Australian Financial Review

The ART of the Deal

Australian superannuation fund Australian Retirement Trust (ART) has brokered a deal with the government-owned Queensland Investment Corporation (QIC) to provide $500 million dollars in funding for the development of over 1200 affordable homes in Queensland. The move is the first time ART has pursued a social, issue-focused investment since it was founded this year by a merger between Sunsuper and QSuper.

Source: Australian Financial Review