Trading Update

Australian Secure Capital Fund is pleased to provide this monthly update to our investors.

ASCF’s primary focus is and always will be capital preservation first and foremost. Since inception in 2016, we have been careful managers of all our investor’s funds, with no investor ever incurring a loss on any investment in any of our funds, a record we are very proud of.

Whilst our targeted distribution rates are reviewed monthly, at this stage we are not seeing an increase in lending rates across the competitive landscape in which we operate however we do believe this will come over the next several months.

At the point, we do see an increase in lending rates we will certainly look to increase investor rates on the basis we are able to operate within a margin of safety in terms of the spread to ensure that our investors are well cushioned as interest rates return to more normalised settings from historical lows.

Our loan originations across our origination channels remain strong however we have recently adopted a more conservative stance with respect to our loan terms and LVRs until such time as we have clearer visibility of the impacts on the economy and more particularly property prices during the current monetary policy tightening being undertaken by the Reserve Bank.

Being a short term lender with an average loan term of 6 – 9 months has always been a competitive advantage for ASCF particularly when property prices adjust. This is because almost 60% of our funds are in loans with a loan term of 6 months or less and over 98% in loans with a term of 12 months or less. If property prices do adjust from historical highs the security position across our loan book also adjusts to factor in the change as existing loans are repaid and new loans are originated at current valuations.

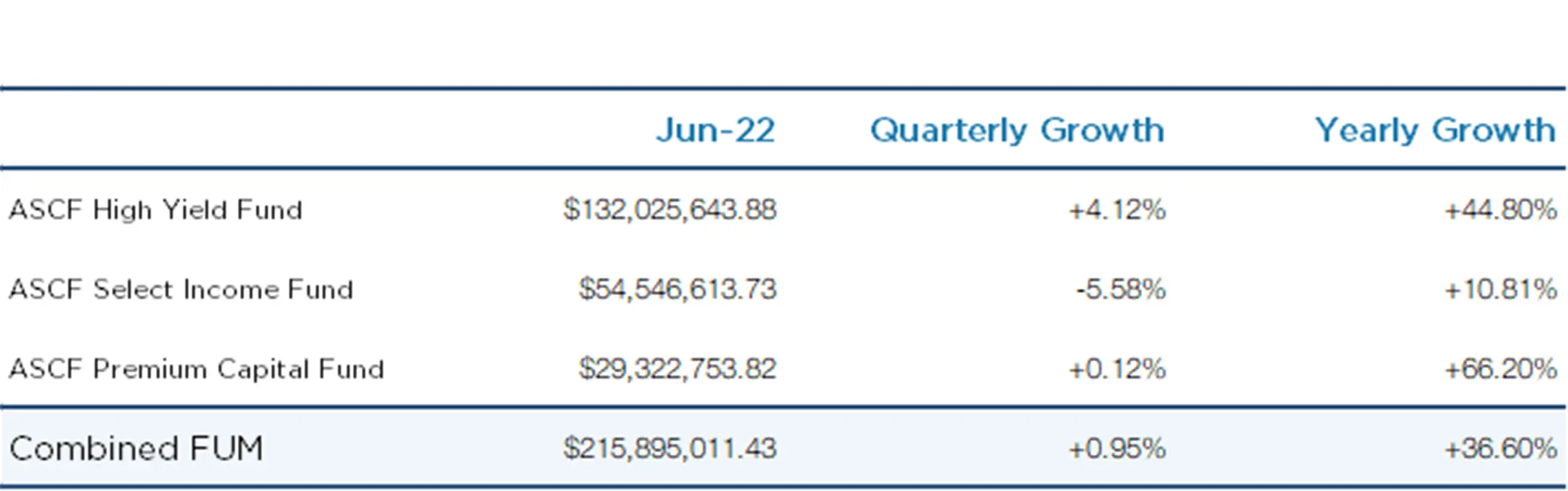

Funds Under Management

as at 30th of June 2022

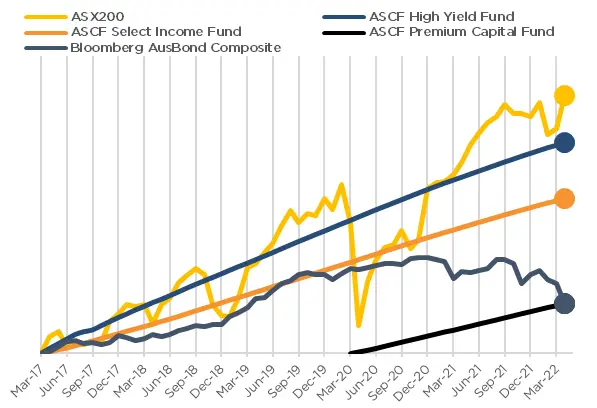

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of June.

Lending Activity Update

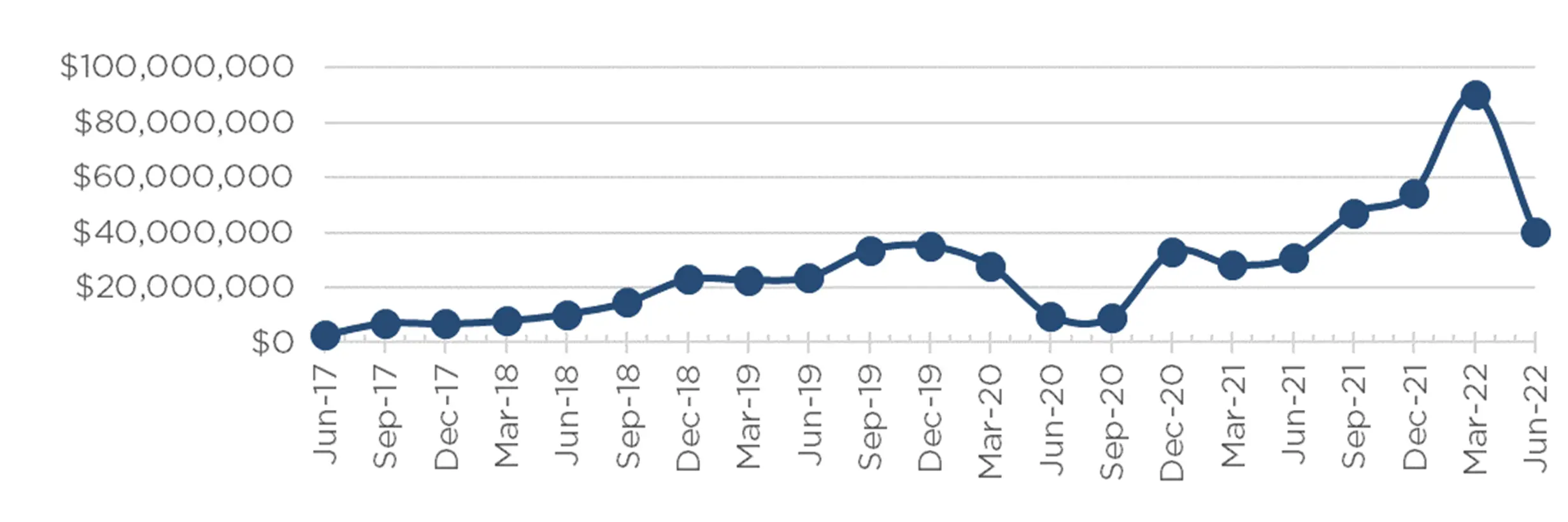

Quarterly Loan Settlements

as at 30th of June 2022

Loan originations this month were $19,713,000, with an increasing proportion being originated via our online origination portal.

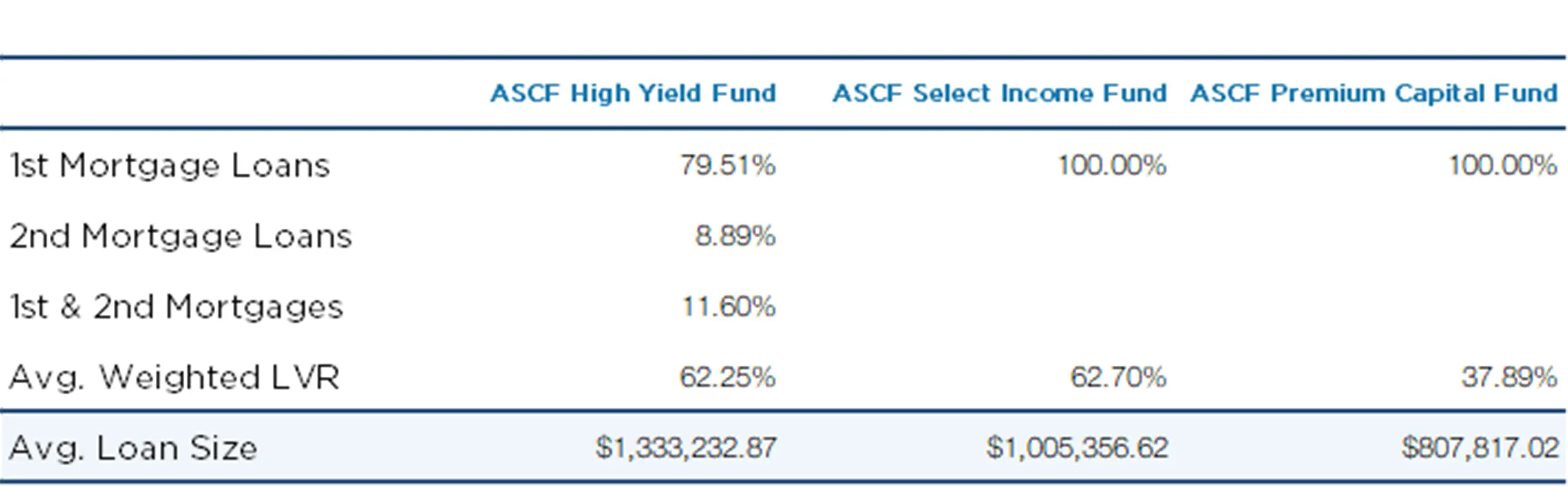

Current Loans by Fund Source

as at 30th of June 2022

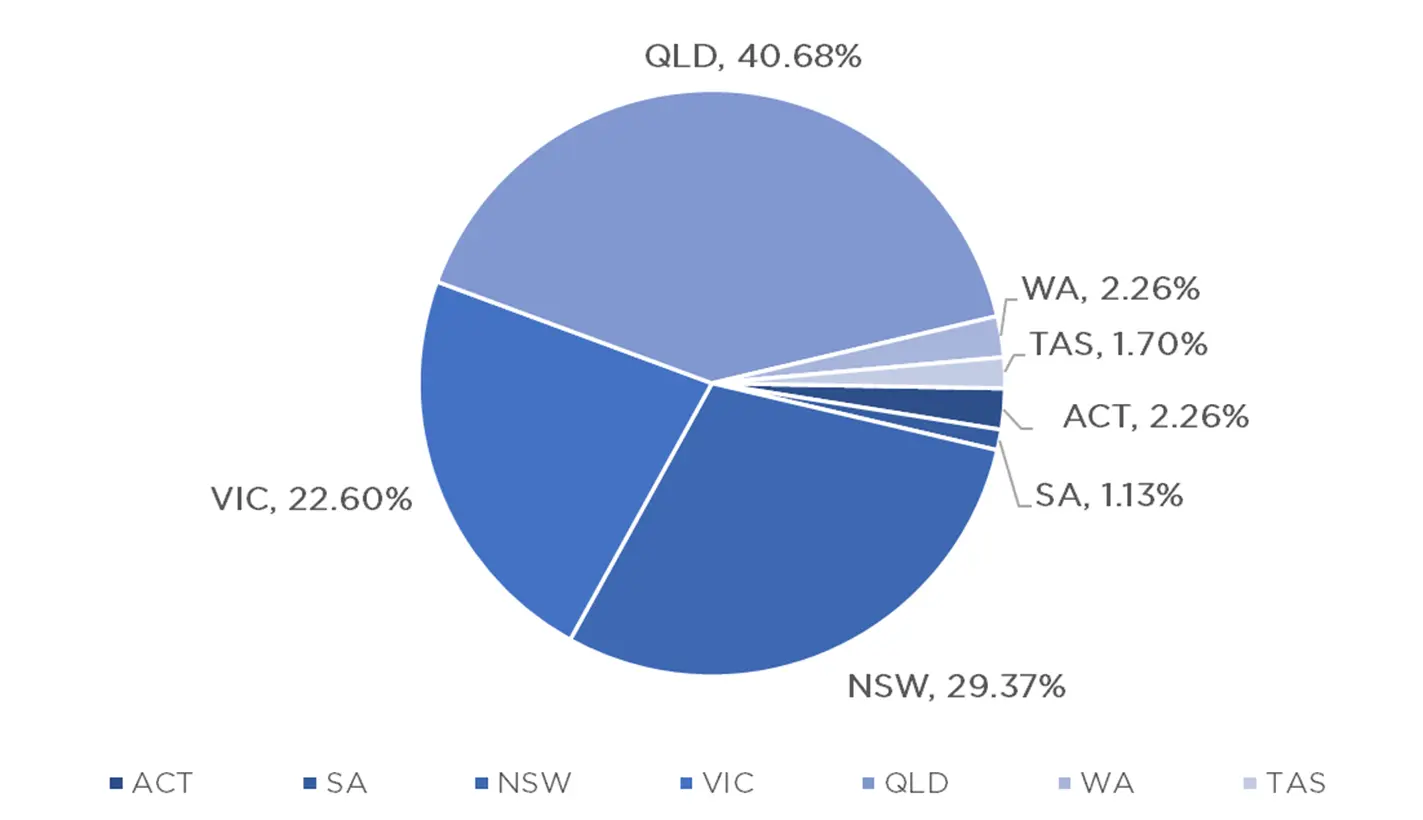

Current Loans Geography

as at 30th of June 2022

Why Invest with ASCF?

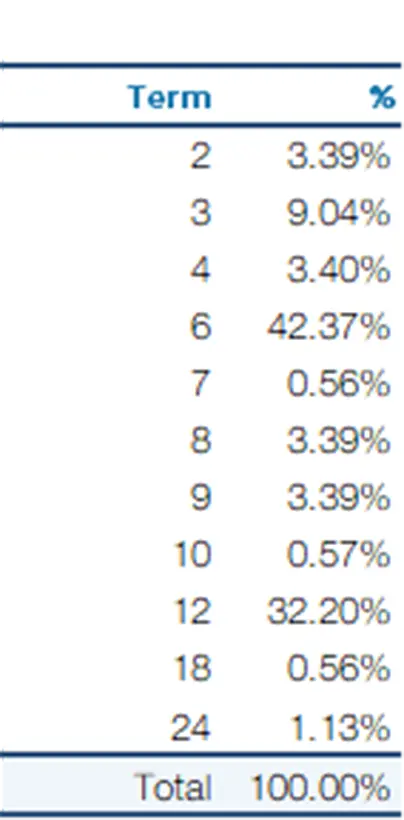

Loans by Term

ASCF offers many protections in terms of capital stability including our investor reserve account and spread protection. However, what makes ASCF mortgage funds different and thereby providing our investors additional peace of mind is that we only invest in short term loans with a maximum loan term of 24 months.

In fact the majority of our loans ie: 98% are for loan terms of 12 months or less at the time of origination and almost 60% for 6 months or less as per the table below.

Investing in short-term loans reduces the risk that the financial position of the borrower and the value of the security property will change over time as the potential impact of property market fluctuations is limited.

This strategy coupled with the fact we do not provide traditional construction loans to developers allows investors to have indirect exposure to existing real property assets in Australian property whilst limiting the risks.

Since inception ASCF has paid a total of $33.82 million in targeted monthly distribution payments to investors and my team now services close to 1,000 active accounts, a clear testament to the investment strategy adopted by our funds.

An Interesting Transaction

Problem:

ASCF was recently approached directly by a veterinarian who required cash to fund renovations on his home whilst his property was prepared for sale. He had recently retired and was living in regional New South Wales. After living and working regionally all his life, he felt a change was needed and planned to move closer to a regional city. By selling his current home, he would have the money to purchase a new home, but his current property was in dire need of renovations to maximise its value.

Solution:

ASCF obtained a valuation and took a 1st mortgage over his property, providing the borrower with a loan of $600,000 at 9.75% for six months on an LVR of 51.05% enabling him to refinance his existing mortgage and providing the funding to undertake the renovations.

The borrower plans to use the proceeds from the sale of his freshly renovated property to pay back the debt.

What ASCF Does Differently:

Many borrowers wish to make the most of their assets and maximise their returns. ASCF’s solutions-focused lending approach is just another way we help borrowers achieve their goals.

.

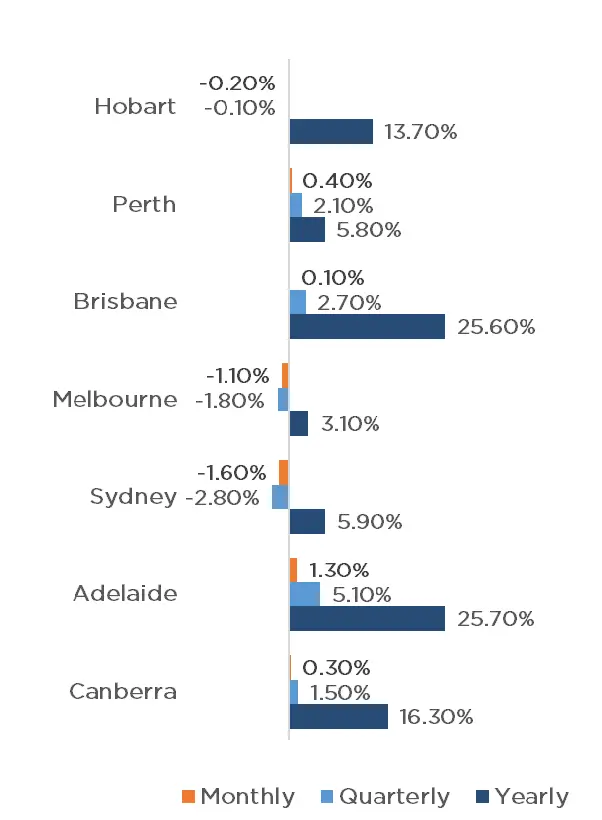

Market Update

Aggregated property values across the country on a monthly basis have slowed marginally, (-0.80%). The highest performer this month was Adelaide (+1.30%), followed closely by Perth (+0.40%).

Australia’s property price increases experienced over the last 18 months are now well and truly past their peak rate of growth.

Interestingly however unit prices are holding their value better than houses across capital cities with regional property still remaining in positive growth.

The market is quickly becoming a buyers market with aggregate home sales nationally through the June quarter now 15.9% lower than a year ago.

However, with housing conditions cooling, the flow of new listings to the market is slowing which along with a strong labour market should help support prices.

Rental markets around the country also remain extremely tight with rents and residential property yields now rising at a faster rate than housing values also providing a buffer for property investors. Ultimately however it will be interest rates which will have the largest impact on the path of housing markets.

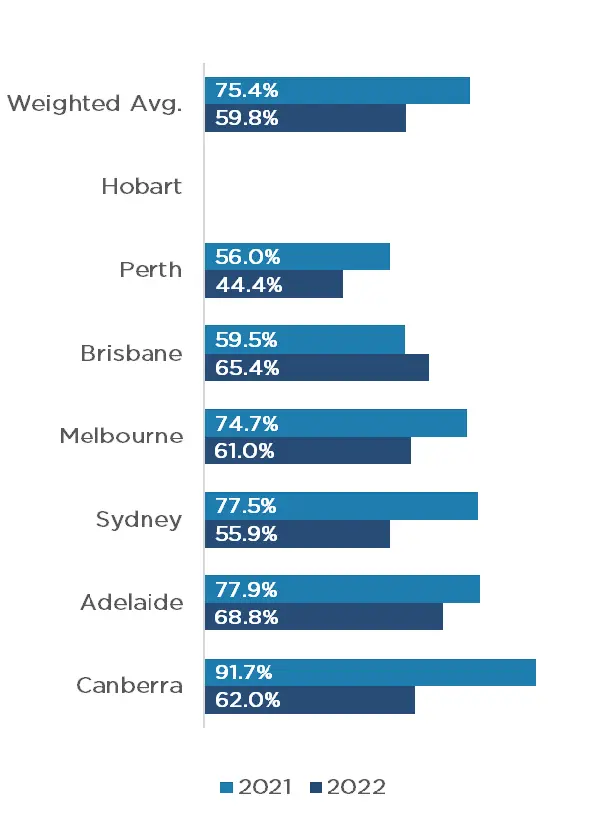

The weighted average clearance rate across the country is lower than last year at 59.8% compared to 2021’s 75.4% clearance rate (-15.60%).

Other cities across the board also achieved rates marginally lower than last year, with the exception of Brisbane.

Brisbane increased by +5.90% compared to the previous year, with Canberra being dropping in comparison (-29.70%).

Clearance Rates & Auctions

as at 27th – 30th of June 2022

Property Values

as at 30th of June 2022

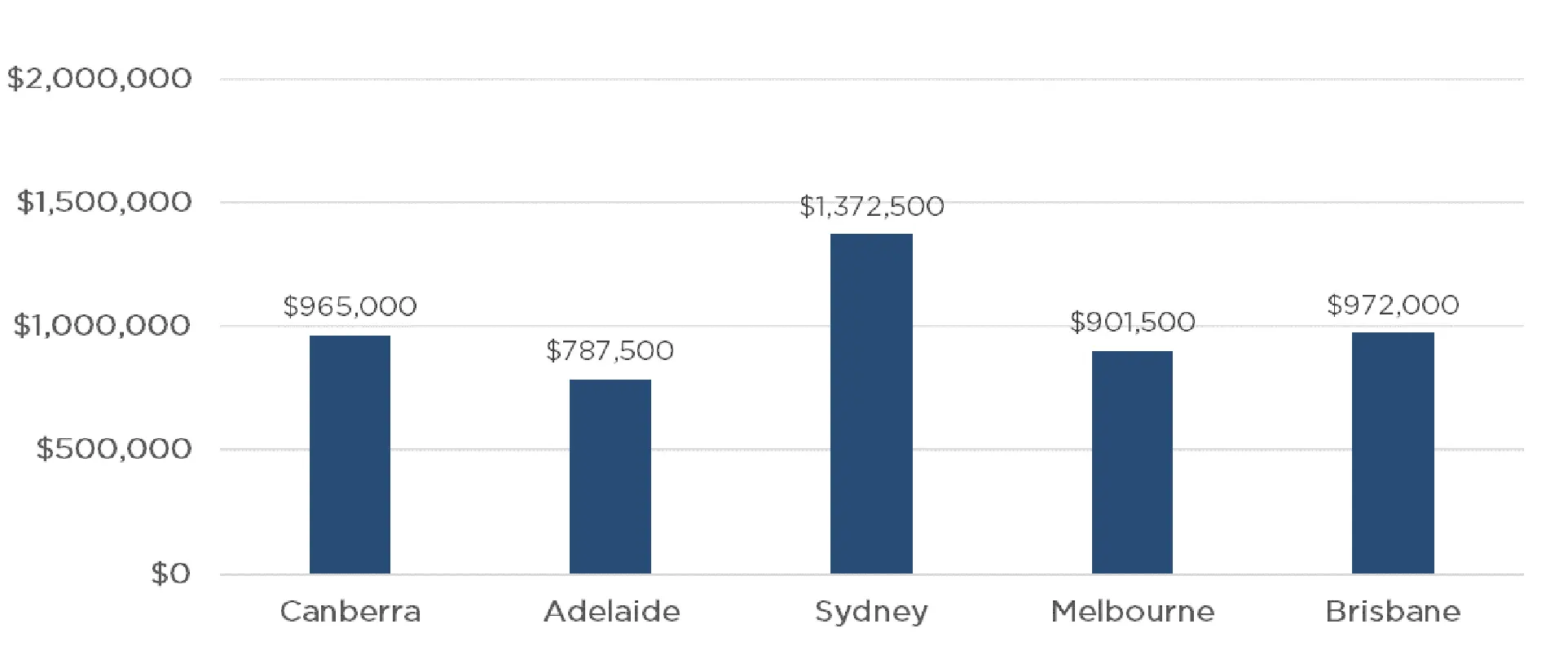

Median Dwelling Values

as at 30th of June 2022

Source: CoreLogic, Report, Article

Quick Insights

The War Room

Tony Lombardo, CEO of Lendlease; Janice Lee, PwC Australia Partner; Susan Lloyd-Hurwitz, CEO of Mirvac; and Tarun Gupta, CEO of Stockland, some of the nation’s most senior property leaders came together earlier this month to discuss the ongoing housing crisis. The conclusion drawn in the Channel Nine boardroom was that government policies stimulating demand can only do so much. Ultimately, it is the lack of investment in property infrastructure and overly tight zoning policies that continue to stoke unaffordability.

Source: Australian Financial Review

Sydney’s Stamp Duties

The NSW Coalition Government announced this month its new revisions to the stamp duty. The system would allow home buyers to opt-out of paying stamp duty in favour of a $400 and 0.3% annual land tax. Some were quick to note how this might increase housing prices as the money usually spent on stamp duty would instead go into an auction bid. However, as lenders take the cost of annual tax into their loan serviceability criteria, the impact of this legislation may become negligible.

Source: Australian Financial Review

Lowered Rates & Politicised Policy

A new study by the Melbourne Institute has revealed that government support programs contributed very little to the health of the housing market during the pandemic. Instead, it was the RBAs low cash rate that boosted the purchases. Buyers took advantage of relatively low servicing costs and interest rates. Housing programs typically assisted only the few who applied early.

Source: Australian Financial Review