Trading Update

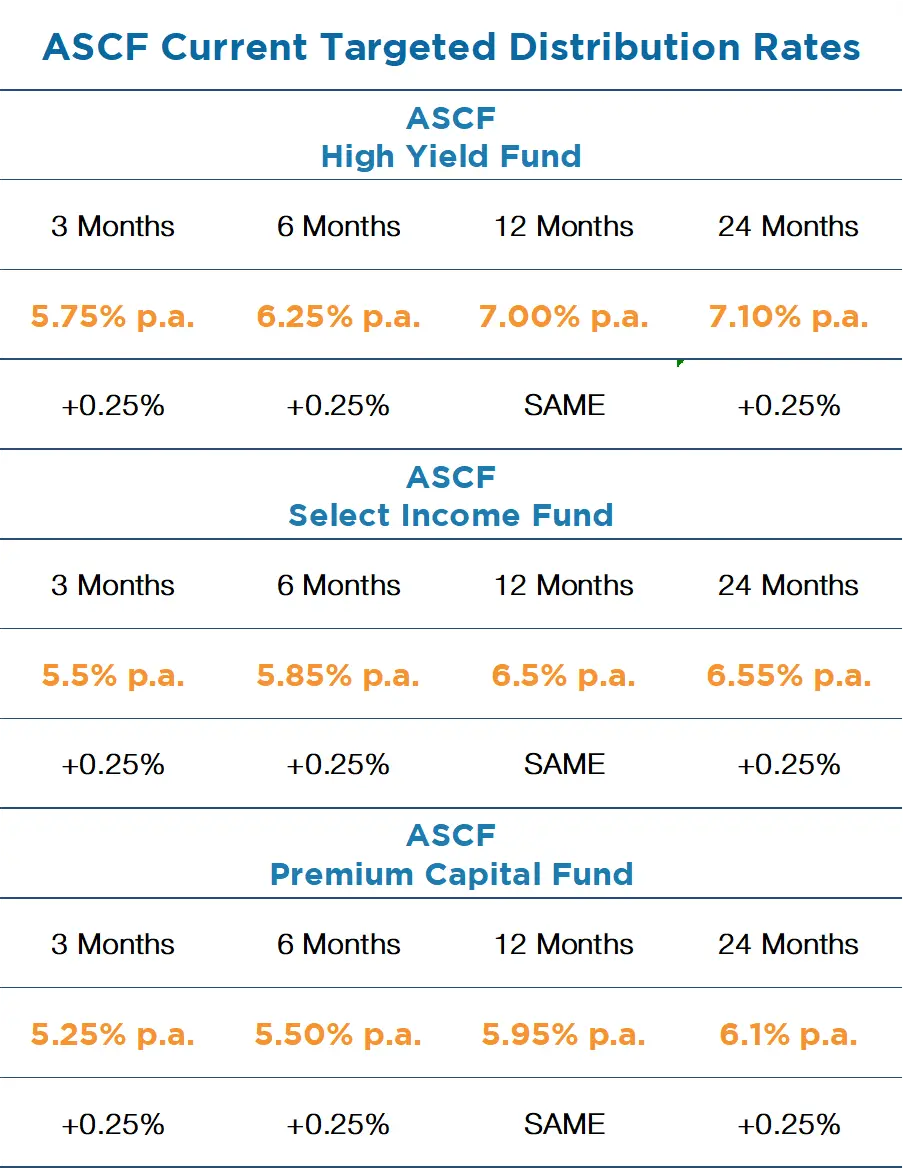

ASCF is pleased to advise that we have once again this month increased our investment rates. The increase applies to all 3, 6 and 24 month investments in each of our retail funds and is effective from today.

Our new investment distribution rates are as follows:

The new rates will apply to all new and additional investments with existing investors receiving the benefit of the new rates on the rollover of their accounts on the scheduled maturity date of their investment. We have also reduced the minimum investment required to invest in any of our retail funds to $5,000.

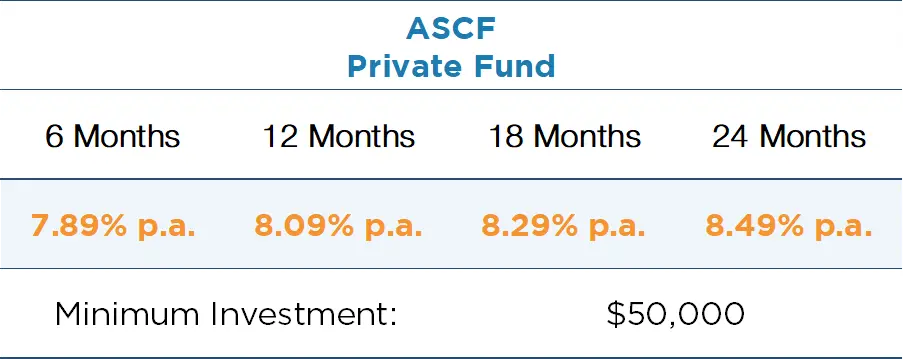

ASCF Private Fund is also now open and accepting new investments. This fund is open for investment to sophisticated and wholesale investors and has a slightly different investment mandate when compared to our retail funds. The rates payable by our ASCF Private Fund are as follows:

If you are interested in investing in our ASCF Private Fund please contact one of our investment team on 1300 269 419 or visit our website here. We will be happy to discuss the investment mandate for this fund and determine if you qualify.

With the RBA now on hold and their next rate move likely to be down, now is a great time to invest in one of our term investments knowing that the rate will be fixed for the duration of the investment term regardless of whether rates start to fall later this year.

Last weeks monthly CPI indicator showed annual inflation has slowed to 6.8% in February down from 7.4% with inflation down for two consecutive months after peaking in December last year. Whilst the labour market is still tight at 3.5% unemployment, and retail sales buoyant having increased 0.2% in February, after 10 consecutive rate rises the RBA has finally adopted a wait and see approach to allow the full impact of the prior rate rises to filter through the economy.

Whilst the future direction of interest rates will be data dependent, markets are betting the RBA has now done enough and bond markets are now pricing in a 25 basis point cut in official rates by December.

The pause in rates will certainly bring some confidence back to housing markets and as we predicted in last months newsletter we believe the residential property market bottomed in February and will now stabilise.

Interestingly residential property prices nationally did increase slightly during March by 0.6% and with supply limited, rental yields tightening further and net overseas migration at record highs we still anticipate a 3% – 5% increase in residential property prices nationally over the next 12 months.

With credit now certainly more expensive to access and most banks tightening their lending criteria we have seen a significantly increased level of deal flow across our broker networks since the start of the year enabling us to set a new record of close to $50m in new loan originations across our retail funds in March.

Our loan books across all our retail funds continue to perform strongly.

Half-Yearly Financials Now Online

Our half-yearly audited financial statements for each of our retail funds for the period ending 31 December 2022 are now available for viewing on our website or by clicking here.

Should you have any questions, do not hesitate to contact our Investor Relations

team on 1300 269 419.

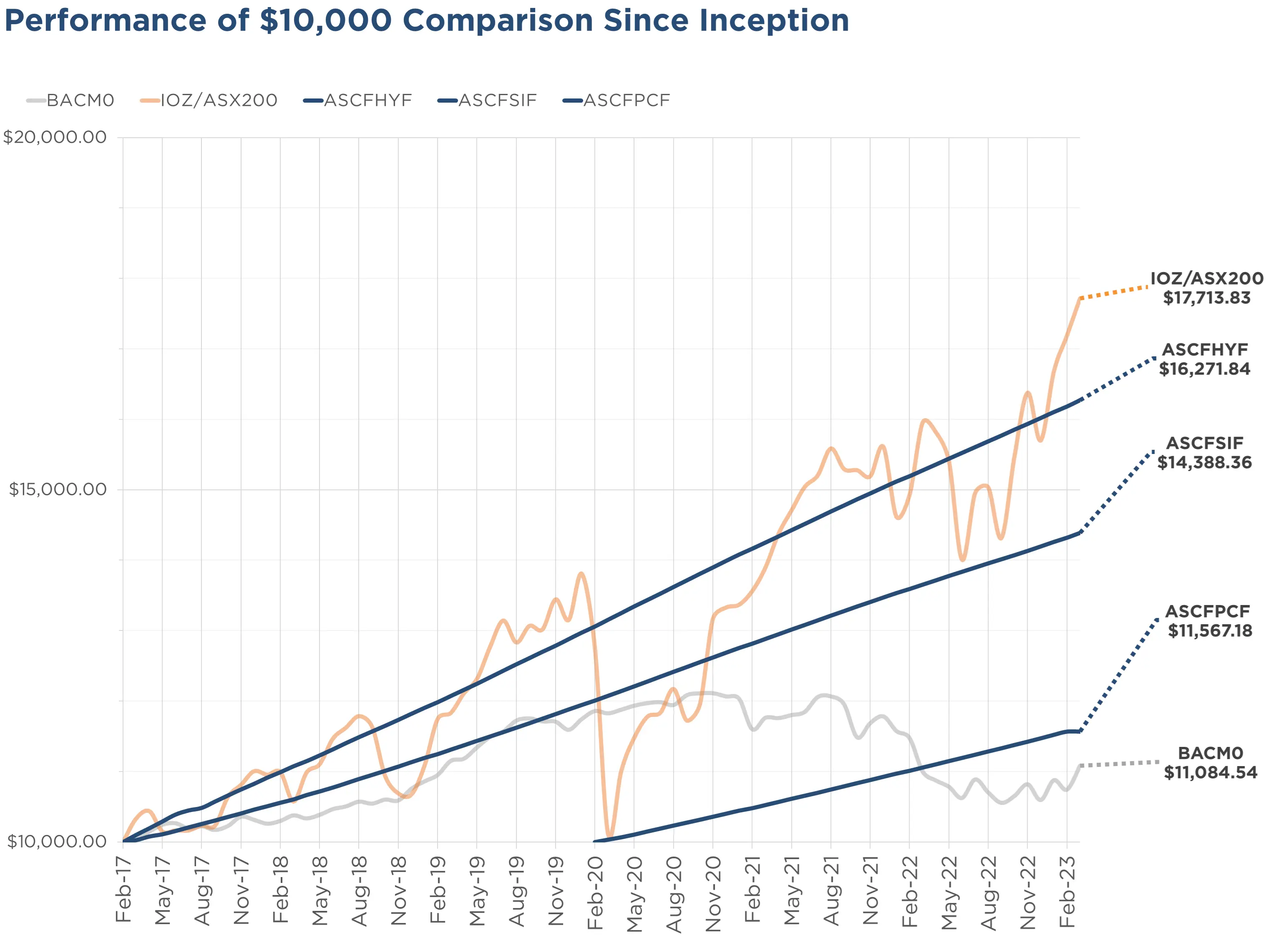

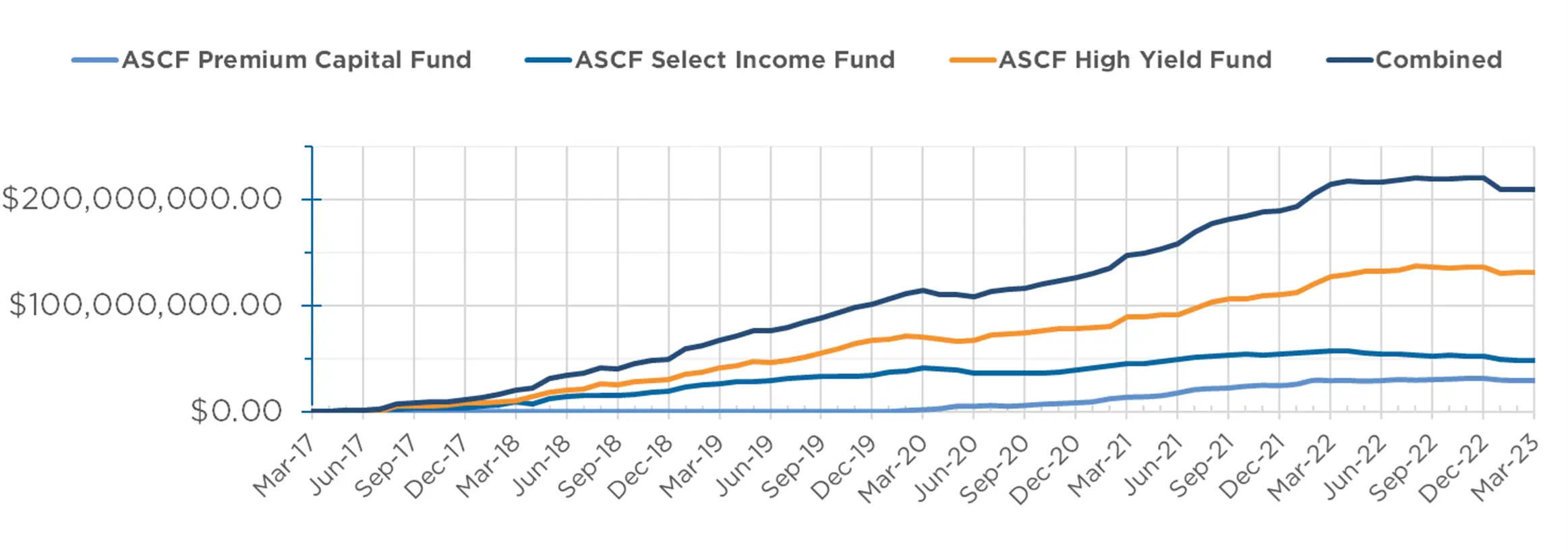

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

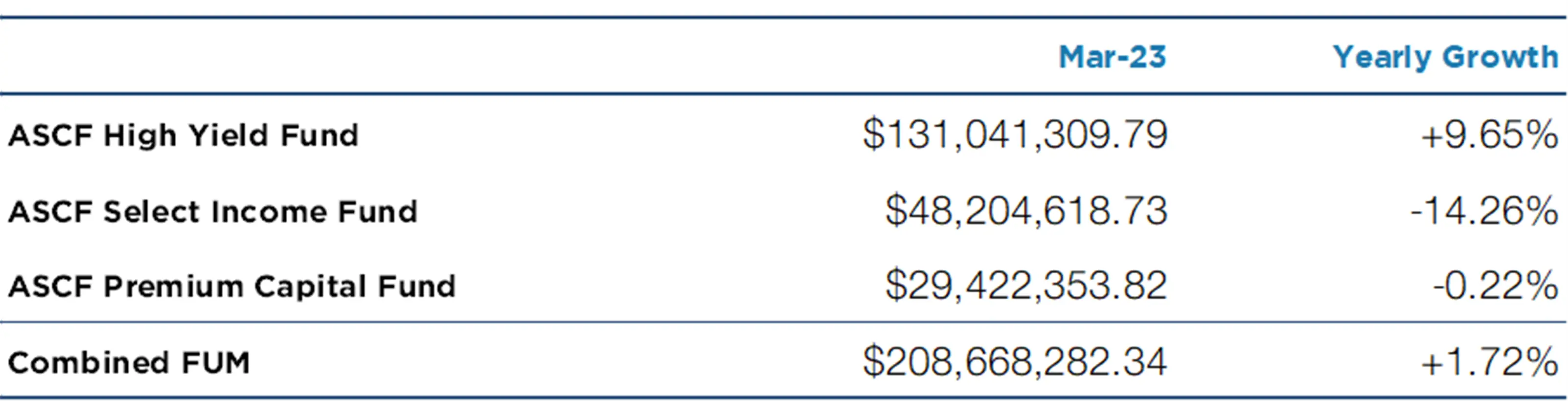

Monthly Funds Under Management

Funds Under Management as at 31st of March 2023

In March, loan originations and inquiry levels remained solid, with over $49,000,000 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of March.

Lending Activity Update

Quarterly Loan Settlements as at 31st of March 2023

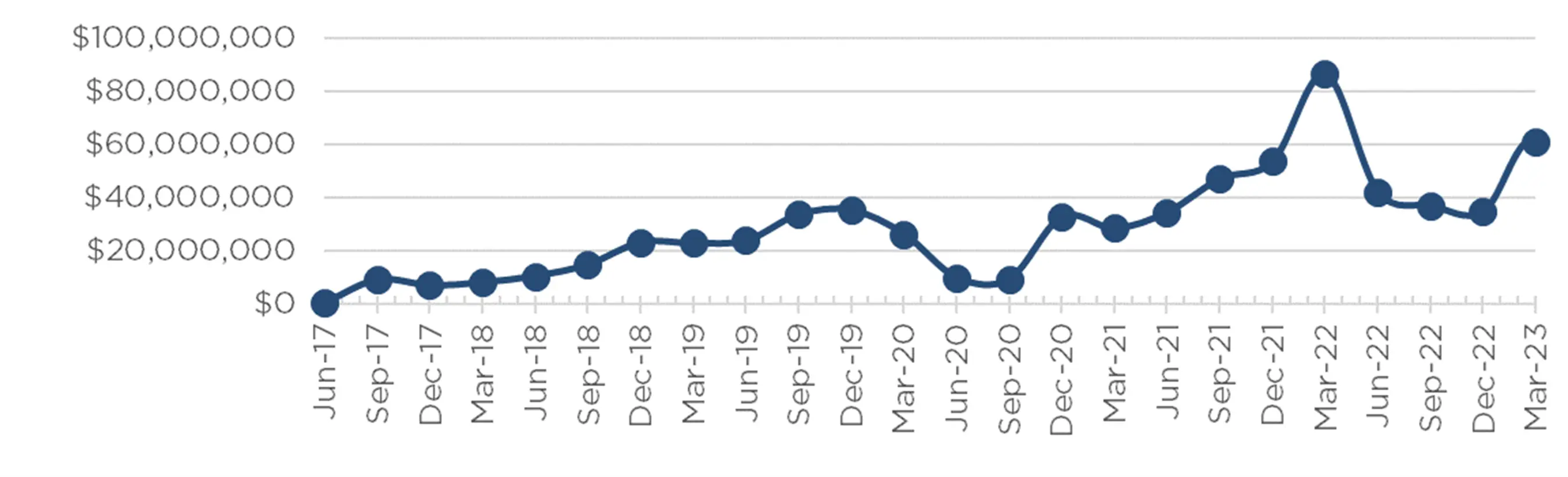

Current Loans by Fund Source as at 31st of March 2023

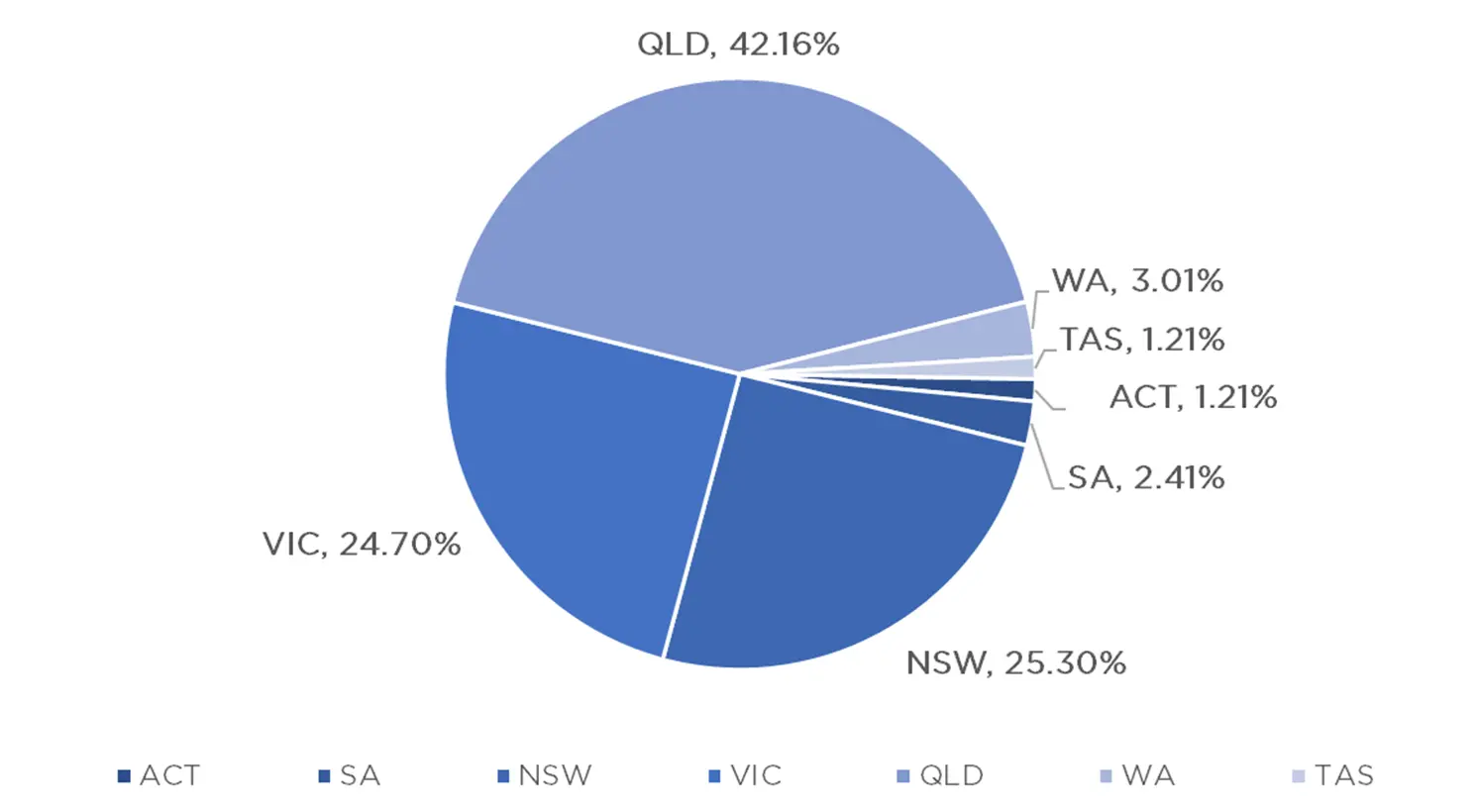

Current Loans Geography as at 31st of March 2023

Why Invest with ASCF?

Mortgage funds are considered to be one of the safest investments in terms of underlying security due to several factors.

First, mortgage funds invest in pools of mortgages that are secured by real estate. This means that the mortgages are backed by the properties’ value, which serves as collateral for the loans. If a borrower defaults on their mortgage, the lender can foreclose on the property and sell it to recover their investment. This provides a high degree of protection for mortgage investors, as the value of the underlying real estate provides a significant level of security.

Second, mortgage funds typically invest in a diversified portfolio of mortgages. This helps to spread the risk across a broad range of properties and borrowers, reducing the impact of any single default on the fund’s overall performance.

Third, mortgage funds such as ASCF are managed by experienced professionals who have expertise in underwriting, risk management, and asset management. They carefully evaluate the creditworthiness of borrowers and properties before making investments, which helps to minimise the risk of default.

Finally, mortgage funds typically generate a steady stream of income through the payment of interest and principal on the underlying mortgages. This can provide a stable source of cash flow for investors, even during periods of market volatility.

Overall, the combination of strong underlying collateral, diversification, professional management, and steady income make mortgage funds one of the safest investments in terms of the underlying security. However, as with all investments, there are still risks involved, and investors should carefully evaluate their investment objectives and risk tolerance before investing.

An Interesting Transaction

Problem:

An AFG broker approached us with a transaction where one of the parties to a jointly owned large parcel of land in the fast-growing Lockyer Valley, Qld wanted to sell their interest in the land but the other party wished to retain their share as there was significant interest from developers. The client wanted to purchase the outgoing parties’ interest, but could not raise funding through traditional sources due to a servicing shortfall.

Solution:

The client committed to selling the land within 12 months, so we provided a 12-month sale funding loan of $858,000 with an 11.95% interest rate to assist at an LVR of 37.30%. Being a coded loan, interest and monthly fees for the term was retained in our solicitor’s trust account negating the need for servicing. Should the client sell before the end of the term, any unused interest and monthly service fees will be rebated.

Exit:

The customer’s proposed exit is via the sale of the land.

What ASCF Does Differently:

Another example of how ASCF can help where others cannot.

Market Update

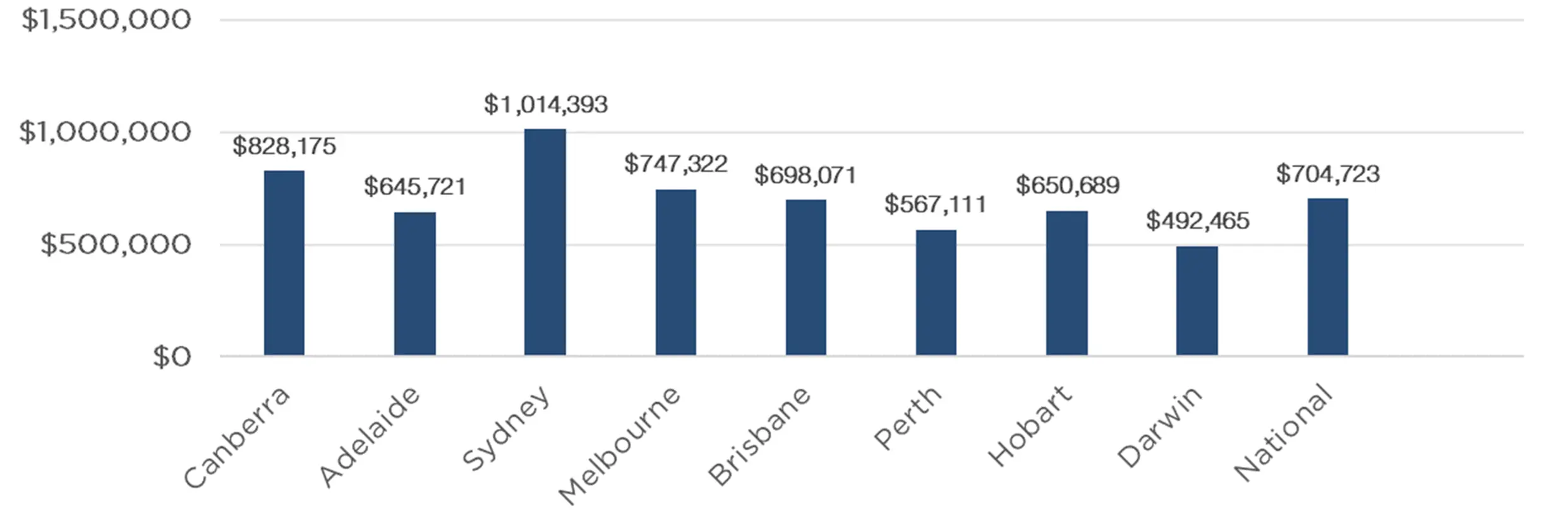

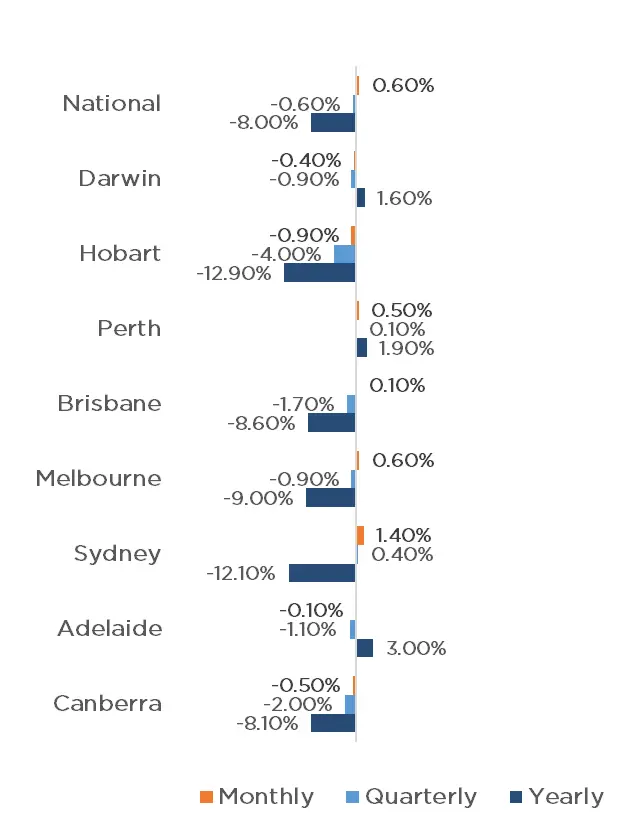

Property Values as at 31st of March 2023

The property market continues to show signs of recovery, with CoreLogic’s National Home Value Index posting the first month-on-month increase since April 2022, with values up 0.60% for the month of March.

This monthly growth was driven by strong results in Sydney, with values increasing 1.40% for the month. This figure has been impacted heavily by housing values in the most expensive quarter of Sydney’s market up 2.00% and unit values also up 1.40%. Results across Melbourne, Perth and Brisbane were also positive, with the capital cities recording growth of 0.60%, 0.50% and 0.10% respectively. Adelaide (-0.10%), Darwin (-0.40%), Canberra (-0.50%) and Tasmania (-0.90%) however all recorded reductions in value.

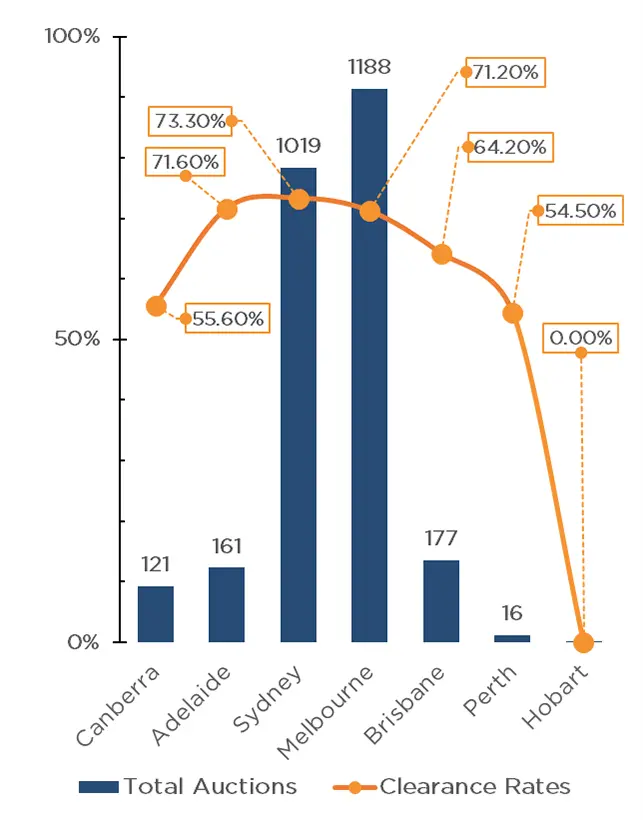

Clearance Rates & Auctions 20th – 26th of February 2023

The week before Easter brought the busiest auction week of 2023 thus far, with 2,685 properties going to auction, up 16.60% on the previous week, however still 16.30% below that of last year (3,209). Melbourne led the way with 1,188 auctions taking place, followed closely by Sydney with 1,019. Brisbane, Adelaide and Canberra which all saw significantly fewer auctions, with 177, 161 and 121 respectively.

In addition to strong auction volumes, clearance rates have continued to improve, with Sydney, Adelaide and Melbourne all receiving above 70.00% clearance rates with 73.3% (63.8% last year), 71.6% (79.1% last year) and 71.2% (67% last year) respectively, contributing to a 70.7% weighted average, up from 66.8% last year. Brisbane also recorded a clearance rate of 64.2% (65.9% last year), however results across Canberra and Perth were well down on last years values, with 55.6% (73.3% last year) and 54.5% (64.7% last year) respectively.

With the RBA opting to leave the cash rate unchanged in their April meeting after 10 consecutive increases, some relief is now given to existing mortgage holders, whilst also providing some comfort for those looking to enter the market. In line with previous forecasts, we believe buyer demand is likely to continue to increase throughout the year and into 2024.

Median Dwelling Values as at 31st of March 2023

Quick Insights

Australia faces huge housing shortfall as new home sales slump

A dramatic slump in new home sales will exacerbate the national rental and affordability crisis and put further pressure on the ability of new housing supply to meet future demand, the Urban Development Institute has warned in its latest State of the Land report. According to the benchmark report, over the 2022 calendar year, greenfield lot sales almost halved and settled apartment sales fell to their lowest level since the global financial crisis as buyer demand plummeted, all due to higher interest rates, surging construction work, and fears about builder failures.

Source: Australian Financial Review

Walk-in buyer interrupts auction, takes house sight unseen

A four-bedroom house with a pool located in Floreat, Western Australia, sold at auction for $1.7 million. There were a lot of interested parties – 10 registered bidders but only three were active bidders. Right at the tail end of bidding, as things were starting to simmer down, someone walked in and asked if they could quickly register. She’d never seen the home. She walked straight into the backyard and said “I like this house.” and within minutes she purchased the property.

Source: Australian Financial Review

Infrastructure Victoria urges Andrews to scrap stamp duty

Stamp duty should be scrapped and replaced with a broad-based land tax according to Infrastructure Victoria In a landmark report it also warned that transport and amenities are struggling to keep pace with suburban sprawl and density needs to increase in existing suburbs. The report calls for the government to fast-track planning approval for more high-quality, three or four-bedroom townhouses and better standards for family-friendly low-rise apartments, to reverse the trend of families continuing to move to bigger blocks in newly created outer suburbs.

Source: Australian Financial Review