Trading Update

Australian Secure Capital Fund is pleased to provide this monthly update to our investors. Our pooled retail investments have increased from $204,949,605.92 in February to $211,943,994.43 as of the 31st of March (+3.41%) and new investments across all our retail funds are continuing to grow.

Our half-yearly audited financial statements for the year ending 31 December 2021 are now available for ASCF Premium Capital Fund, ASCF Select Income Fund and ASCF High Yield Fund. You can review the interim financials by clicking here. Should you have any questions, do not hesitate to contact our Investor Relations team on 1300 269 419.

Managed Funds Under Management

| As as 30th of March 2022 | ASCF Premium Capital Fund | ASCF Select Income Fund | ASCF High Yield Fund |

|---|---|---|---|

| Average Weighted Loan to Valuation Ratio (LVR) | 39.88% | 64.83% | 65.67% |

| Average Loan Size | $959,630.01 | $1,054,800.76 | $1,290,378.37 |

| Percentage of 1st Mortgage Loans on a Weighted Basis | 100% | 100% | 75.75% |

| Percentage of 2nd Mortgage Loans on a Weighted Basis | 9.75% | ||

| Percentage of 1st & 2nd Mortgage Loans on a Weighted Basis | 14.49% | ||

| Total Funds Under Management (Retail) | $29,286,475.82 | $57,768,903.73 | $126,798,614.88 |

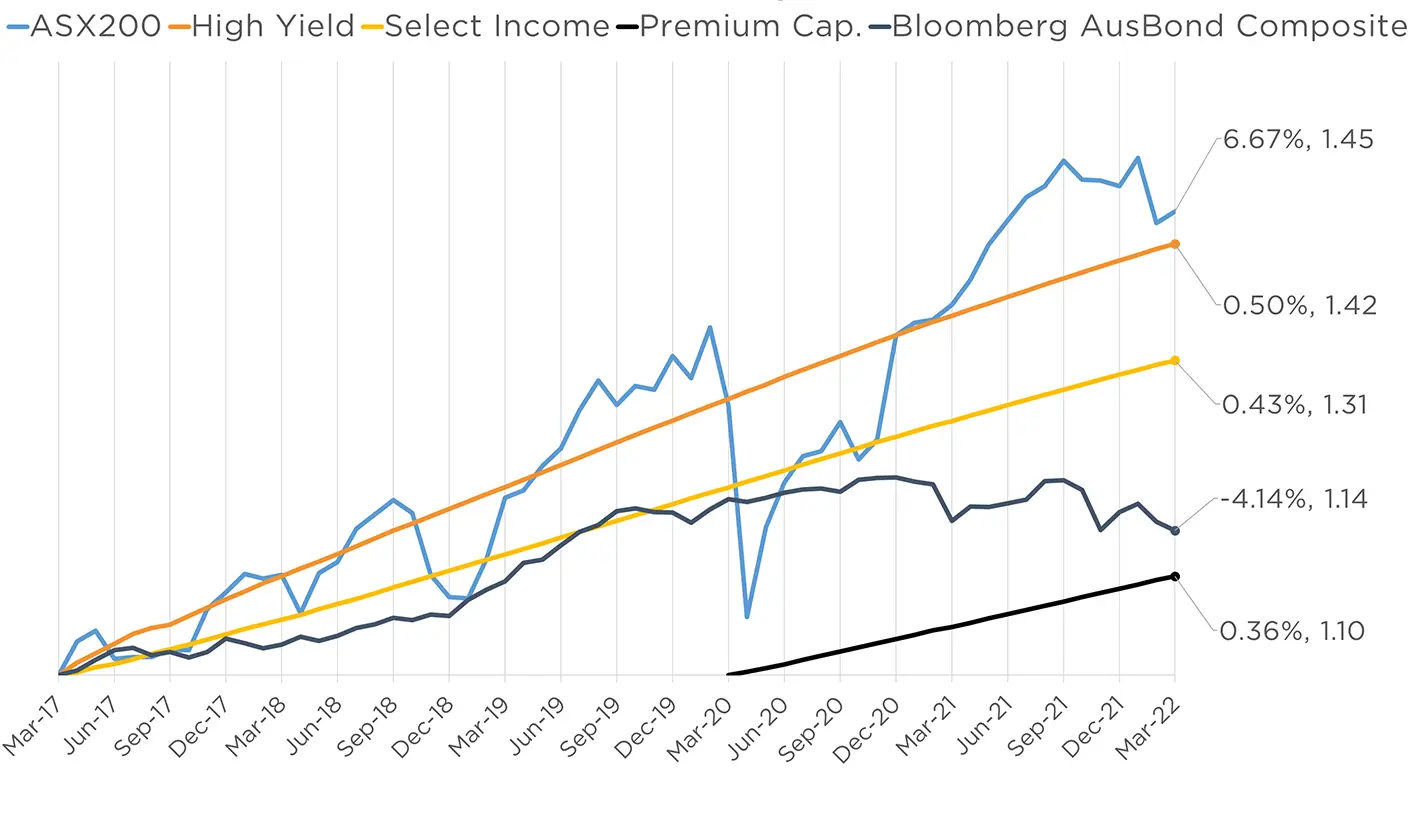

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

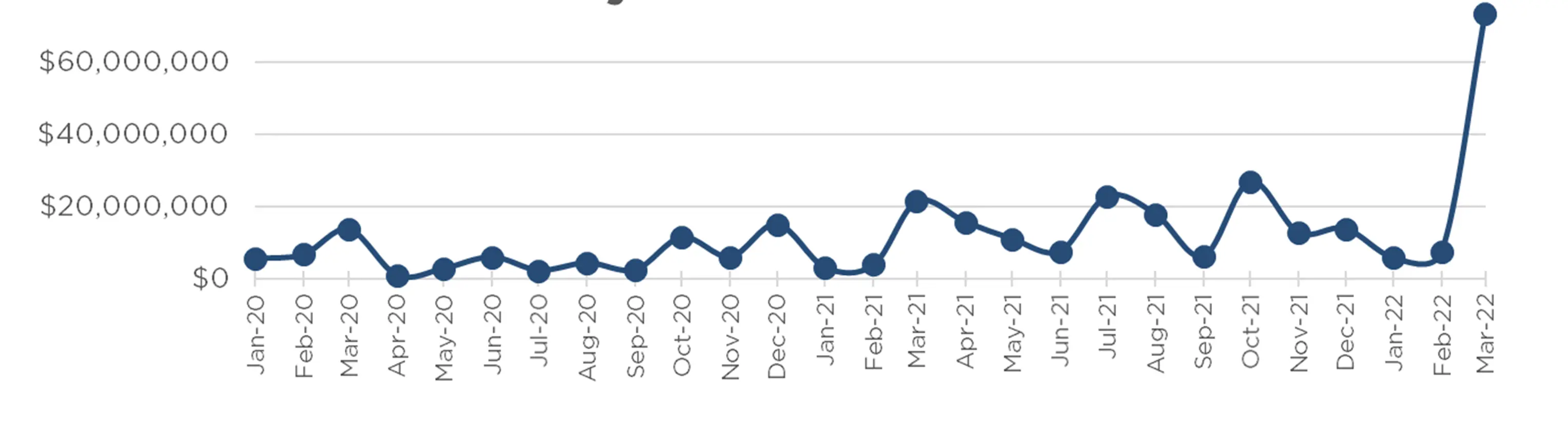

Loan originations this quarter were $86,513,720, exceeding expectations when compared to the previous year’s performance at $28,311,300 (+205.58%). We continue to see elevated demand in loan originations.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of March.

Lending Activity Update

Quarterly Loan Settlements

as at 30th of March 2022

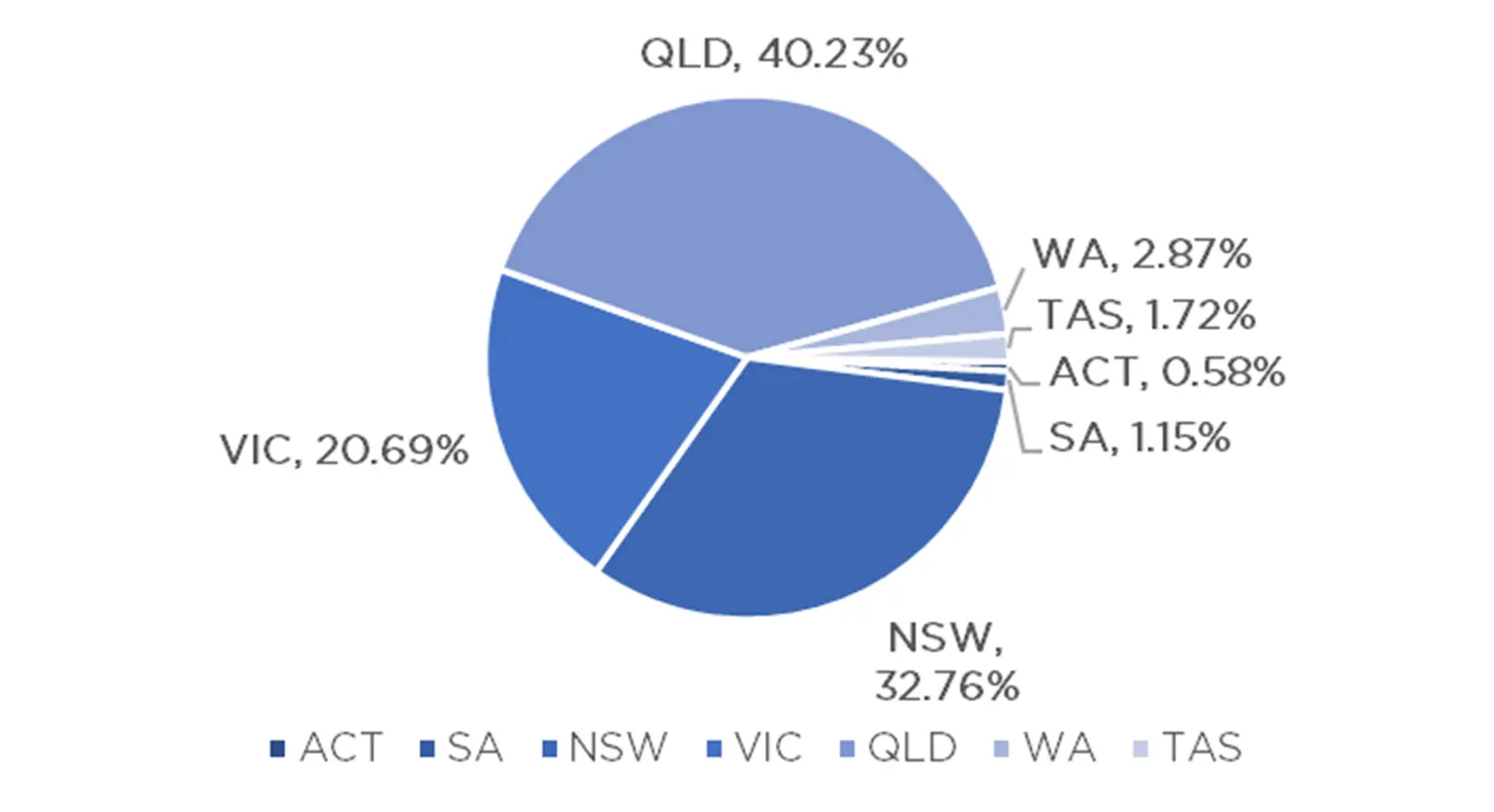

Current Loans Geography

as at 30th of March 2022

Why Invest with ASCF?

ASCF operates three pooled mortgage funds with monthly distributions for investors secured by mortgage investments over Australian property.

Our business serves a niche area in the market for borrowers. We provide a short-term solution for borrowers where, if approved, funds can be provided in as little as 72 hours subject to the loan meeting our lending criteria and valuation policy.

The higher rate the borrower pays for our service is a short-term rate for a specific purpose and intended to be treated as such. When assessing a loan, we examine a range of factors, including the property location and quality of the asset, the purpose of the funds and the loan to value ratio.

The most important criteria however is the borrower’s exit strategy. We require evidence of how the borrower intends to exit the loan at the expiration of the term which could include the sale of the security property or refinance.

A key question in our assessment is always whether the borrower will be better off after they leave us as a result of having taken out the loan.

An Interesting Transaction

Problem:

A broker approached ASCF on behalf of their client, who required funds that would allow him to fulfil his dream of living in a tropical paradise on his own houseboat.

Unfortunately, he did not hold the funds to purchase the boat. However, the borrower owned a home in Port Macquarie, New South Wales, which he intended to sell once he had embarked on his new life.

Solution:

After ASCF reviewed an independent evaluation, we were able to approve a sale funding loan of $139,000 at 7.95% pa for a 3-month term, with an LVR of 26.99%. This provided him with sufficient funds to purchase his new home on the high seas.

Market Update

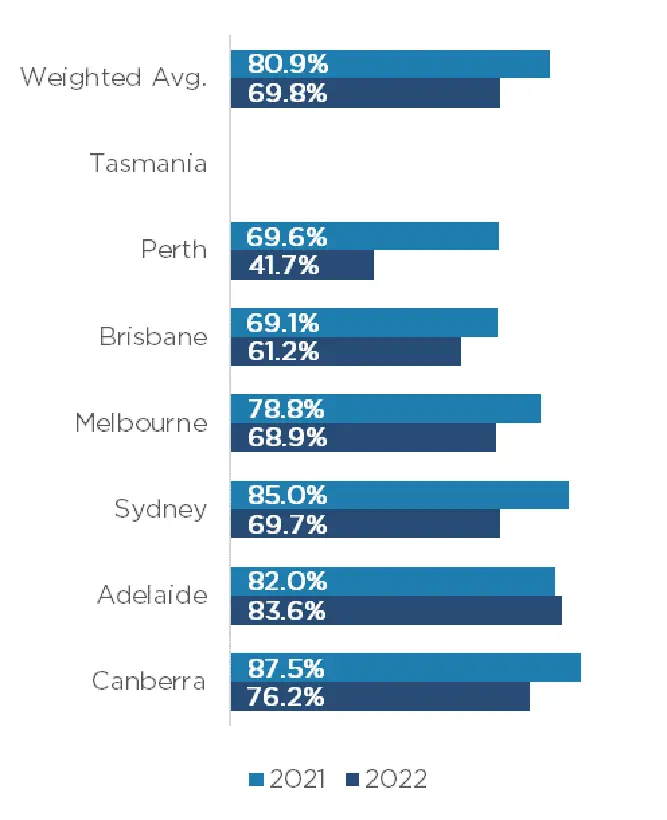

The number of auctions across Australia’s eight capitals rose from 2,710 to 3,062 (+12.99%) this week compared to last year, with Melbourne conducting 182 more auctions (+13.77%), Brisbane with 37 (+24.34%), Sydney with 20 less (-1.95%), and the remainder of the country at 155 more auctions than the same period in 2021.

The weighted average clearance rate across the country is much lower than last year at 69.8% compared to 2021’s 80.9% clearance rate (-11.10%). Other cities across the board achieved rates marginally lower to last year, with the exception of Adelaide. Adelaide increased by (+1.60%) compared to the previous year, with Perth being pushed down in comparison (-27.90%).

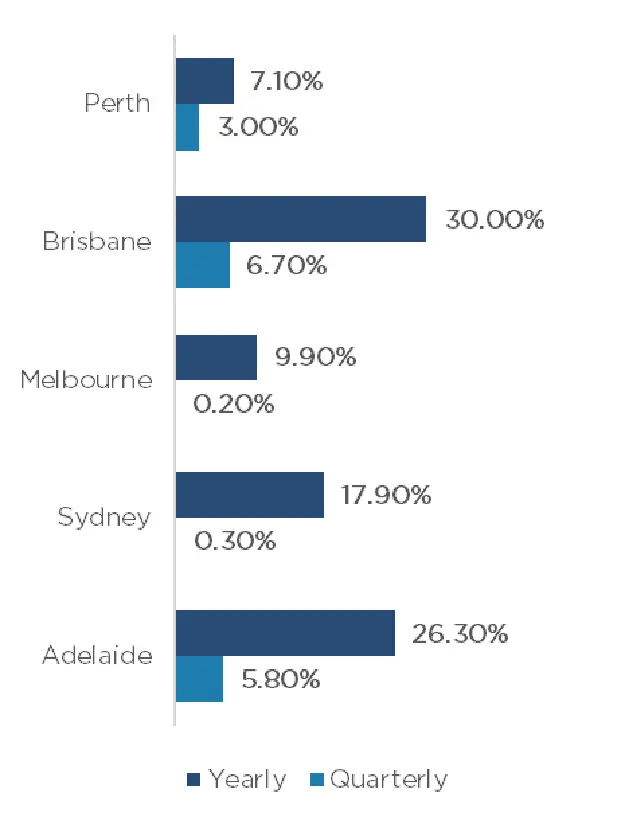

Aggregated property values across the country on a yearly basis have continued to grow (+16.20%), with the highest performer being Brisbane (+30.00%), followed by Adelaide (+26.30%) once again. Property values continue to grow throughout this year. Although clearance rates have slowed, median sale prices have climbed.

This state of affairs has had many economists concerned about housing affordability in recent years. But as stated in our Quick Insights section, the Government’s attempts to intervene are not assisting or balancing the situation. Instead of assisting developers and construction contractors, the government programs subsidise mortgage borrowers increasing demand beyond serviceable means.

Clearance Rates

26th – 31st of March 2022

Property Values

as at 31st of March 2022

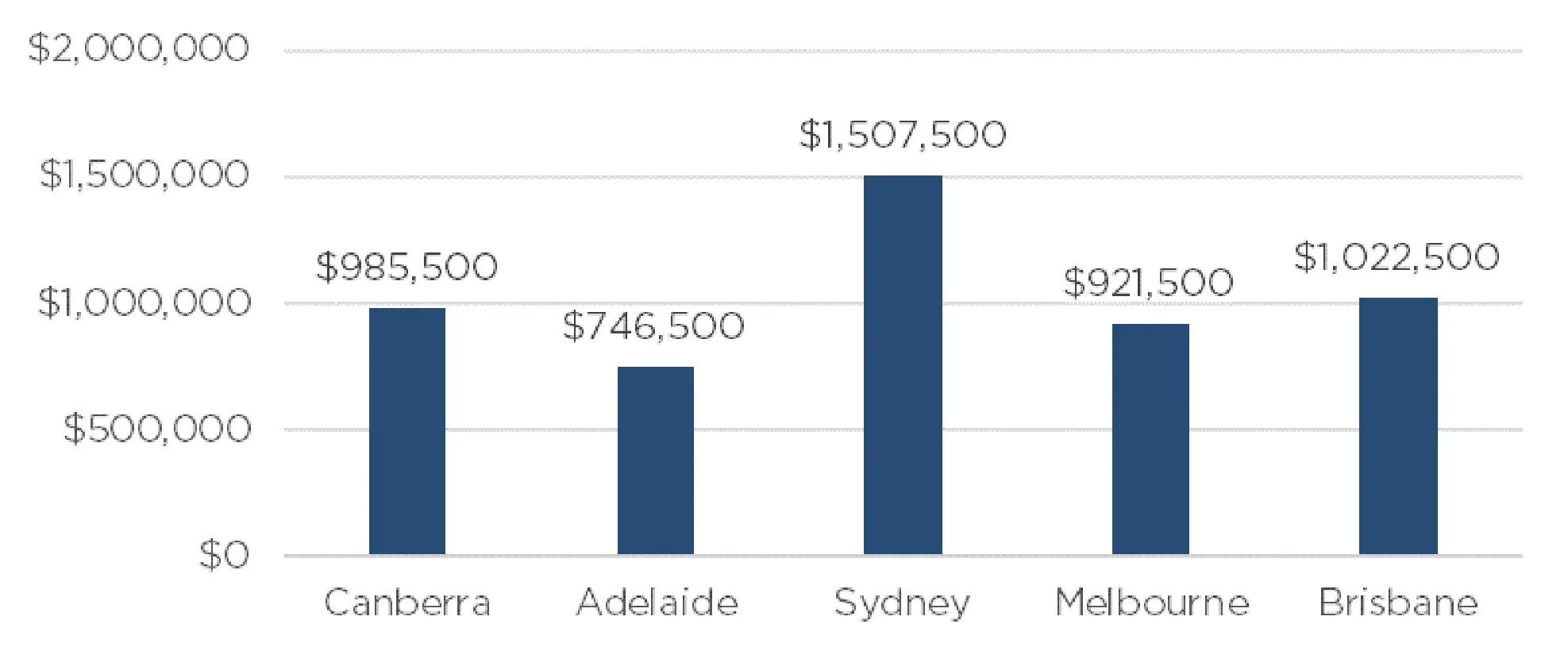

Median Dwelling Values

as at 31st of March 2022

Quick Insights

Guaranteeing Growth?

The Federal Government’s new home guarantee scheme is set to roll out into regional areas and is likely to raise property prices. The supply of housing and construction services historically responds slowly to demand; however, the scheme, which allows first-buyers to purchase with a 5% deposit, will also be open to existing homeowners.

Source: Australian Financial Review

Weekday Woes

According to recent data from Domain, the best time to auction your home are weekends. Auctions on weekends reportedly sell at prices up to 10% higher than during the working week. In Adelaide specifically, prices can increase by almost 19%.

Source: Australian Financial Review