Trading Update

This month, the ASCF staff supported food insecurity non-proft Dig In. ASCF has always believed in the power of volunteerism. As a platinum partner for Dig In, we made good on our values serving over 100 of Brisbane’s homeless warm meals and blankets.

Australian Secure Capital Fund is pleased to provide this monthly update to our investors.

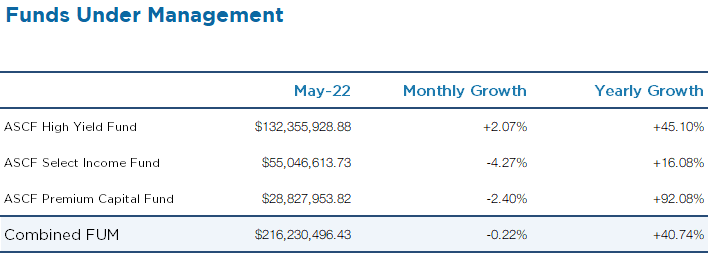

Managed Funds Under Management

as at 31st of May 2022

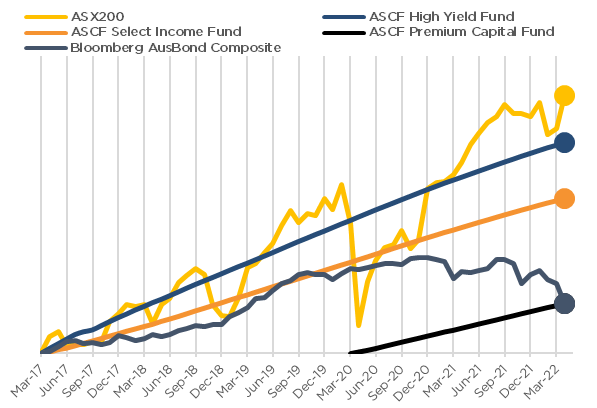

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

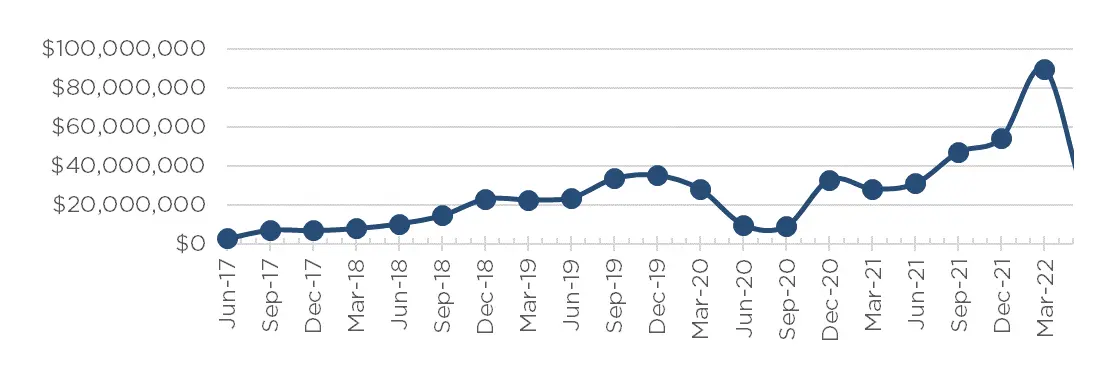

Loan originations this month were $13,603,402.30, with an increasing proportion being originated via our online origination portal.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of May.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of May 2022

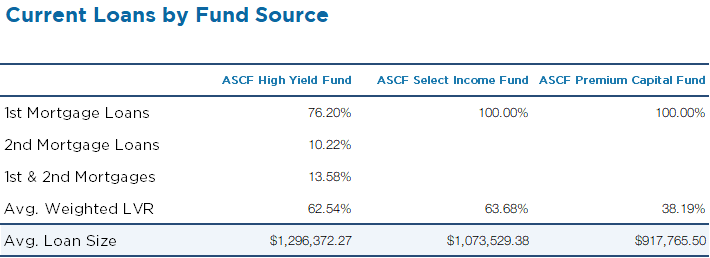

Current Loans by Fund Source

as at 31st of May 2022

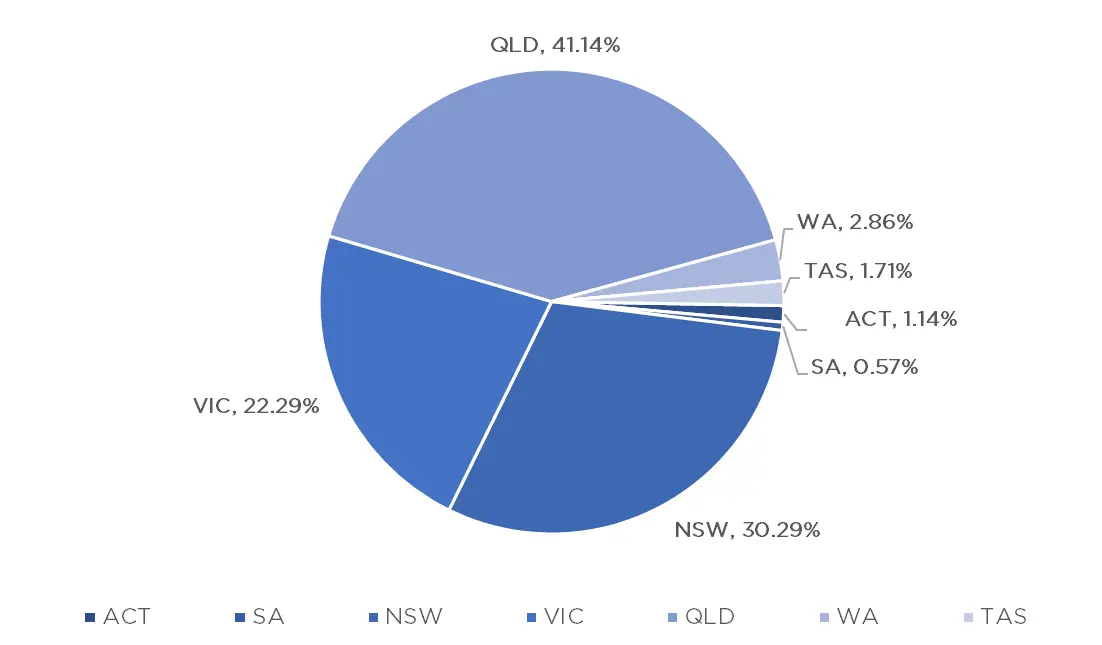

Current Loans Geography

as at 31st of May 2022

Why Invest with ASCF?

One of the benefits of investing in ASCF pooled mortgage funds is that it grants investors access to the property sector without owning, operating, or directly financing properties.

Our managed pooled mortgage funds pay monthly targeted distribution rates of 4.5% to 5.5% per annum, depending on your choice of fund and investment term, allowing for income without the hassle and time cost of tenants.

Direct property investment takes time, as such, investing with ASCF relative to direct property investment may provide further liquidity advantages, with terms as short as three months.

Further, with lower capital investment requirements, you can access our range of pooled mortgage funds starting from $10,000, denoting that it is unnecessary to make large deposits to be invested in the property market.

An Interesting Transaction

Problem:

ASCF was approached directly by a charity foundation that builds accessible educational programs for disadvantaged children of Australia. The charity had been growing recently thanks to donor interest in their work and they planned to expand their operations. Unfortunately, the charity lacked the required funds to pay the stamp duty on their new regional office location, and traditional lenders were taking far too long.

Solution:

ASCF reviewed in independent valuation on a 1st mortgage property they owned and approved a 6-month loan of $160,000 at 8.28% pa with an LVR of 17.78%. The borrower paid the duty owing and plans to repay the debt with their newly acquired donor funding.

Repayment will come from cashflow.

What ASCF Does Differently:

ASCF is no stranger to charities; we are a platinum partner of the national food insecurity non-profit Dig In: and are quick to provide for foundations in need of funding.

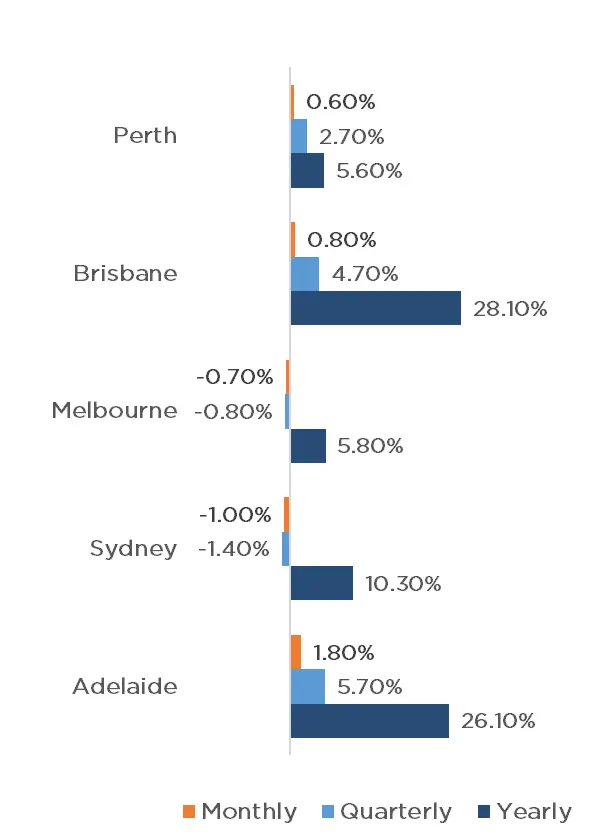

Market Update

Aggregated property values across the five major capitals on a monthly basis dropped by -0.4%, with the highest performers being Brisbane showing +0.80%, and Adelaide at +1.80% both continuing to show growth. Sydney and Melbourne dropped by -1.00% and -0.70%, respectively.

Regional Australia has been shielded from the slight slowdown in housing values across the capitals.

Specifically, in Sydney and Melbourne, stock levels have been rising by +1.5% and +8.1% above average levels in the past five years. In Adelaide and Brisbane, stock levels are below average at -39.5% and -38.2%. These conditions weaken values in the former and significantly boost values in the latter.

With interest rates expected to normalise over the next 12 months, we anticipate continued softness in the Sydney and Melbourne property markets; however, we expect the impact to be limited due to a structural undersupply of housing across the country and unprecedented levels of international migration and investment.

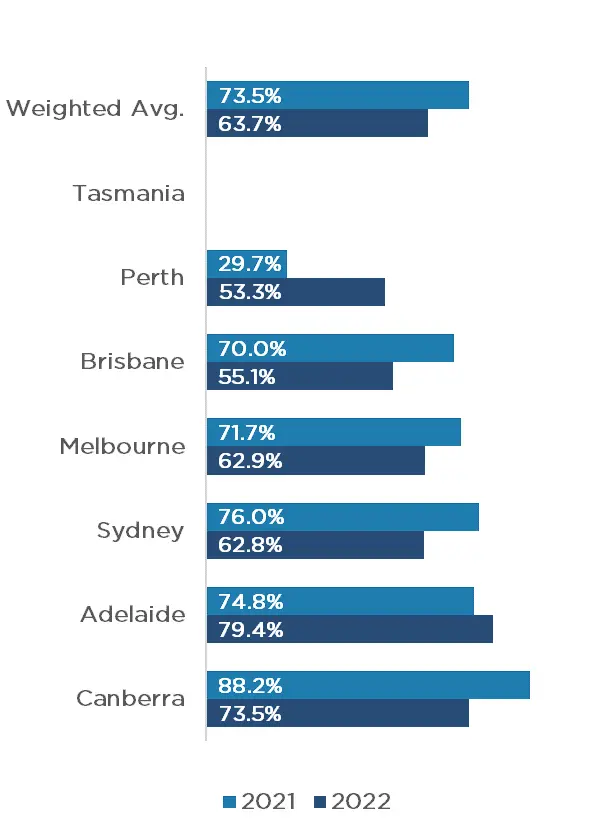

The weighted average clearance rate across the country is lower than last year at 63.7% compared to 2021’s 73.5% clearance rate (-9.80%).

Other cities across the board also achieved rates marginally lower than last year, with the exception of Perth, and Adelaide.

Perth increased by +23.60% and Adelaide by a further +4.60% compared to the previous year, with Canberra being pushed down in comparison (-14.70%).

Clearance Rates & Auctions

27th – 31st of May 2022

Property Values

as at 31st of May 2022

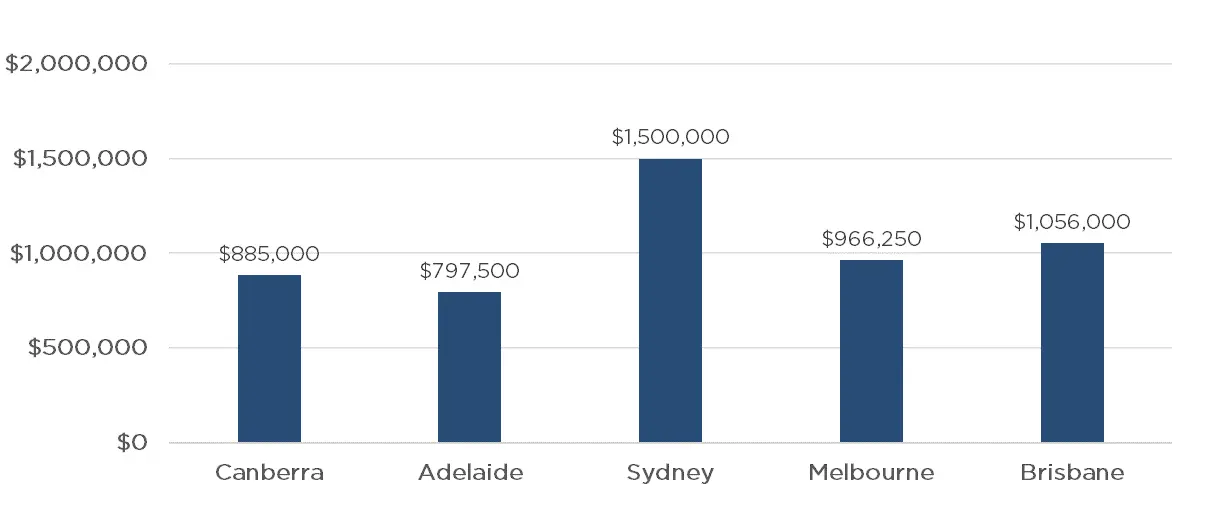

Median Dwelling Values

as at 31st of May 2022

Quick Insights

A Modest Mortgage Market

CoreLogic has released new figures suggesting mortgage repayments can be significantly cheaper than rents in over 250 suburbs. The areas affected include Adelaide and Darwin where differences can be as stark as $1000 a month. Many younger home buyers and investors are attempting to cash in as rents rise across the country.

Source: Australian Financial Review

Apartment Attraction

More and more buyers are now entering the apartment market as the difference between median unit prices and house prices grows by 41%. This trend has been buoyed by a 5.9% increase in first-home buyers in the market.

Source: Australian Financial Review

Loans under Labor

Labor’s newly proposed plan “Help to Buy” will endeavour to relieve housing affordability for homebuyers earning under $90,000 per annum. The plan will see the government take a 40% stake in purchased houses valued under $950,000. Buyers will be exempt from lender’s insurance, and they will not pay rent on the portion of their property owned by the government.

Source: Australian Financial Review