Trading Update

We are pleased to advise that due to the ongoing strong level of loan inquiries and interest expansion on our lending products we will be increasing our investment rates across all our retail managed funds and investment terms.

The rates payable in our ASCF Private Fund remain the same and this fund is open for investment to sophisticated and wholesale investors.

Our new distribution rates are as follows:

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.75% | 7.50% | 7.20% |

| +0.10% | +0.25% | +0.25% | +0.10% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 5.85% | 6.25% | 7.00% | 6.65% |

| +0.10% | +0.25% | +0.25% | +0.10% |

ASCF Premium Capital Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 5.60% | 6.00% | 6.50% | 6.20% |

| +0.10% | +0.25% | +0.25% | +0.10% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 7.89% | 8.09% | 8.29% | 8.49% |

The new rates will apply to all new and additional investments with existing investors receiving the benefit of the increase on the scheduled maturity date of their existing investments.

Our High Yield Fund is now paying 7.5% p.a for a 12 month investment with interest paid monthly and definitely worth considering if you are seeking a low volatility inflation responsive investment.

The RBA rate rise announced this week and the commentary that followed clearly indicates that the RBA board is concerned that inflation is becoming entrenched in the economy and that it may take longer than expected to get the inflation rate back within its desired 2% – 3% range.

The higher than anticipated April inflation numbers released last week predicated the move which was subsequently reinforced by the Fair Work Commission’s 5.75% wage increase for 2.4 million people on awards.

There is no doubt that the economy is slowing with yesterday’s GDP numbers showing the economy expanded by a weaker than expected 0.2% in the March quarter, well below the December quarter of 0.5% and also below economists expectations of 0.3%.

However with further wage increase’s expected to flow through to the economy during the course of the year consumers will have more to spend putting further pressure on inflation.

As a consequence expectations are that there could still be another one or two rate rises on the cards, but with the cash rate having increased from 0.1% in April last year to 4.1% we believe we are nearing the end of the interest rate tightening cycle with much of the heavy lifting having already been done.

Whilst any subsequent moves are likely to be data dependent we believe much of the uncertainty regarding rates is starting to subside with some level of rate cuts expected late this year or early next year.

Interestingly residential property prices rose nationally in May driven by the surge in overseas migration and weakening supply. With limited new stock coming to the market and rental yields continuing to increase we expect to see continued stability in residential housing prices.

Our loan book across all our retail managed funds continue to perform strongly.

In order to assist potential investors better understand what ASCF does and how it does it we recently put together a short video on our retail managed funds which we thought we would share with you again in this months newsletter.

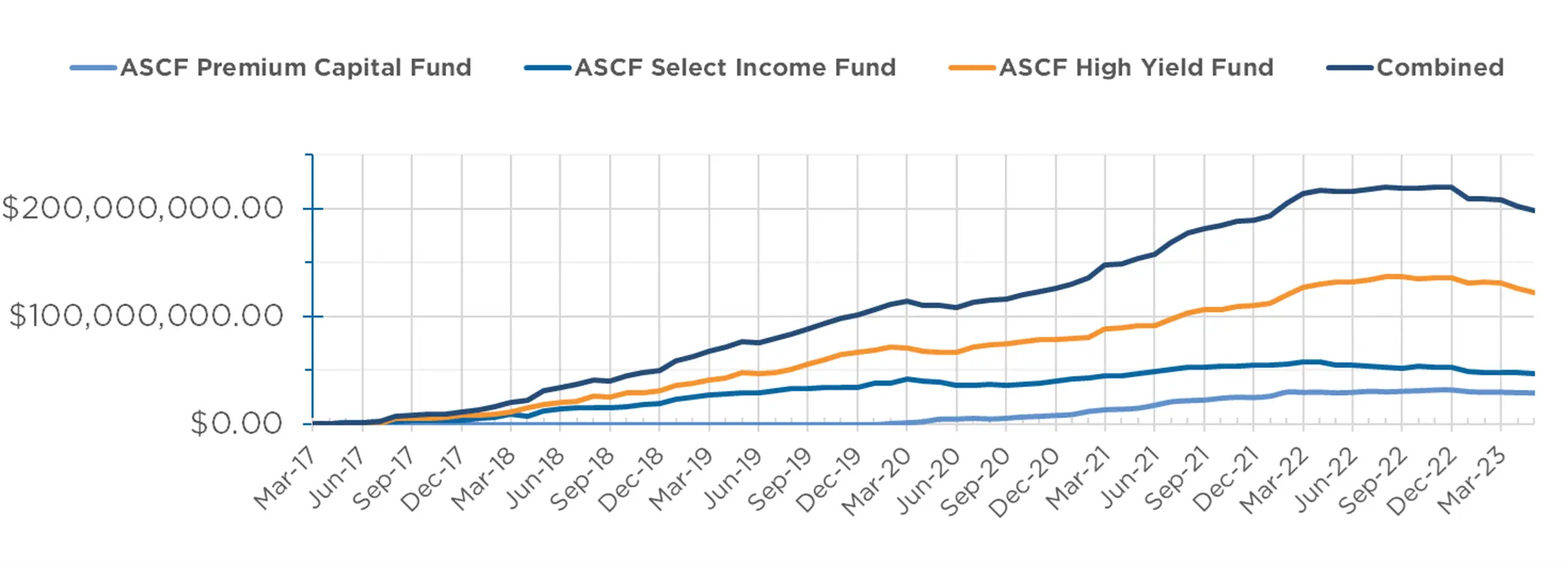

Monthly Managed Funds Under Management

Managed Funds Under Management

as at 31st of May 2023

| May 2023 | |

|---|---|

| ASCF High Yield Fund | $122,131,530.56 |

| ASCF Select Income Fund | $47,066,118.73 |

| ASCF Premium Capital Fund | $23,783,353.82 |

| Combined Funds under Management | $197,981,003.11 |

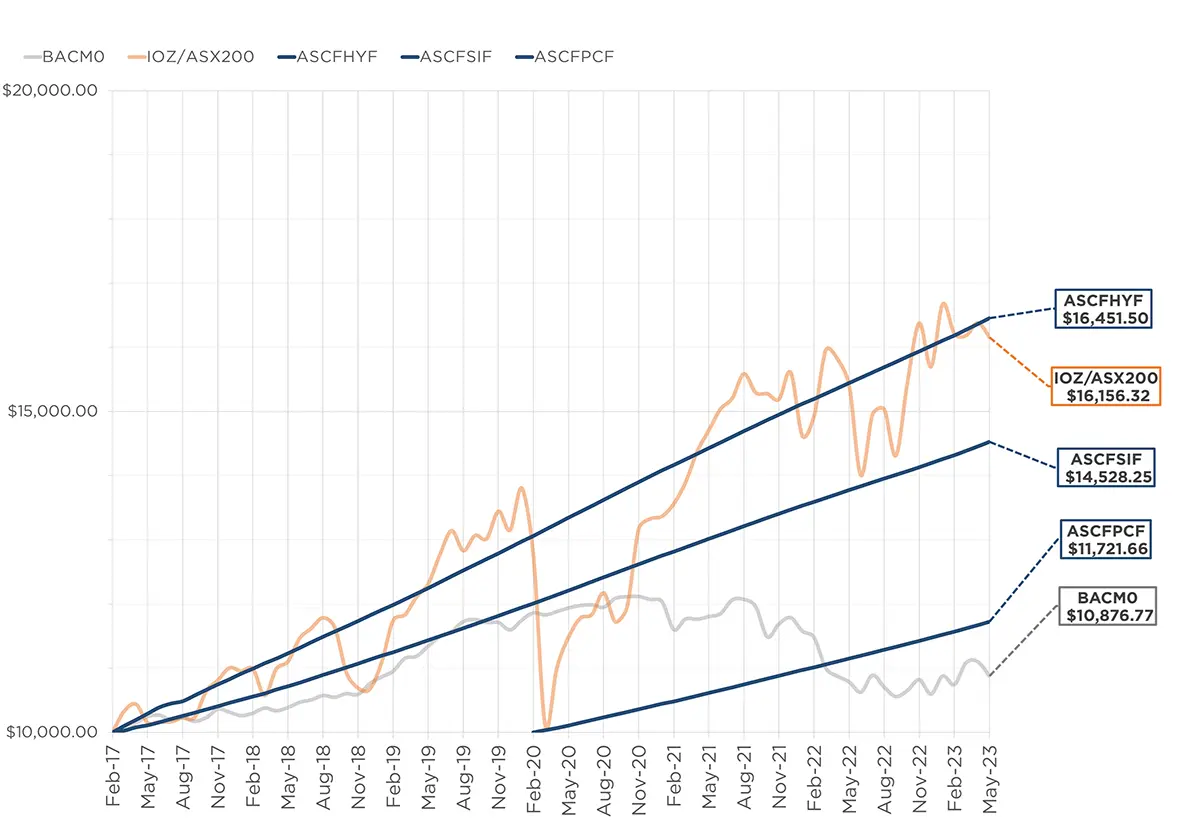

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

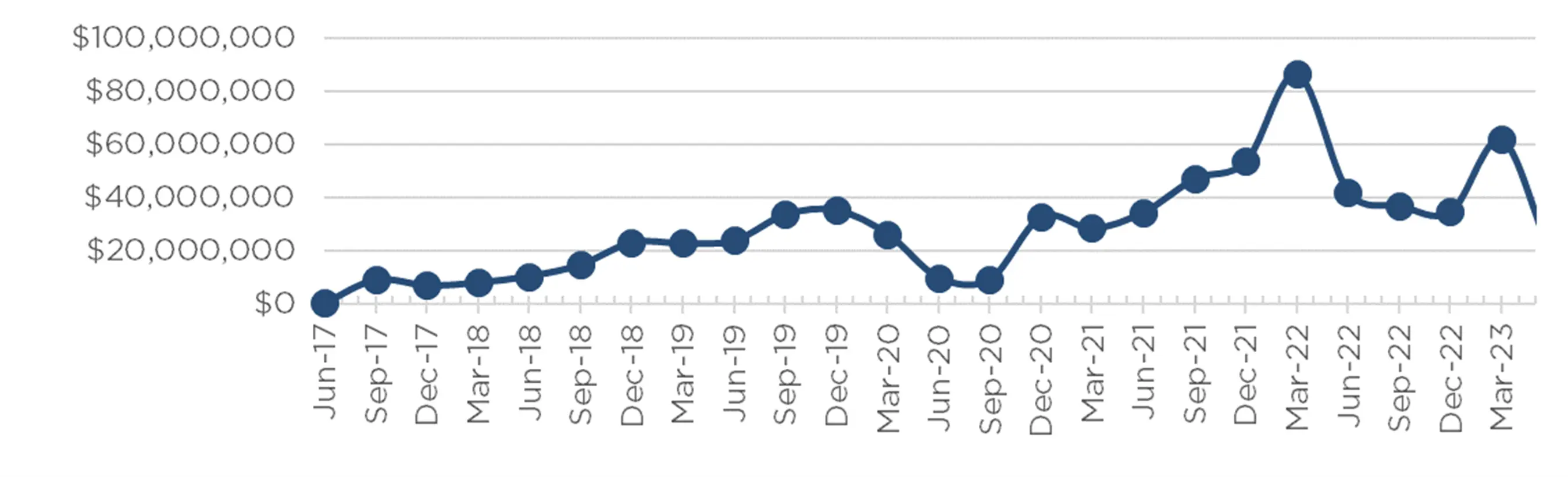

In May, loan originations and inquiry levels remained solid, with $9,492,007.75 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of May.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of May 2023

Current Loans by Fund Source

as at 31st of May 2023

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 79.24% | 100% | 100% |

| 2nd Mortgage Loans | 14.85% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 5.91% | 0% | 0% |

| Avg. Weighted LVR | 58.96% | 61.00% | 48.46% |

| Avg. Loan Size | $1,306,457.02 | $1,177,439.05 | $747,420.03 |

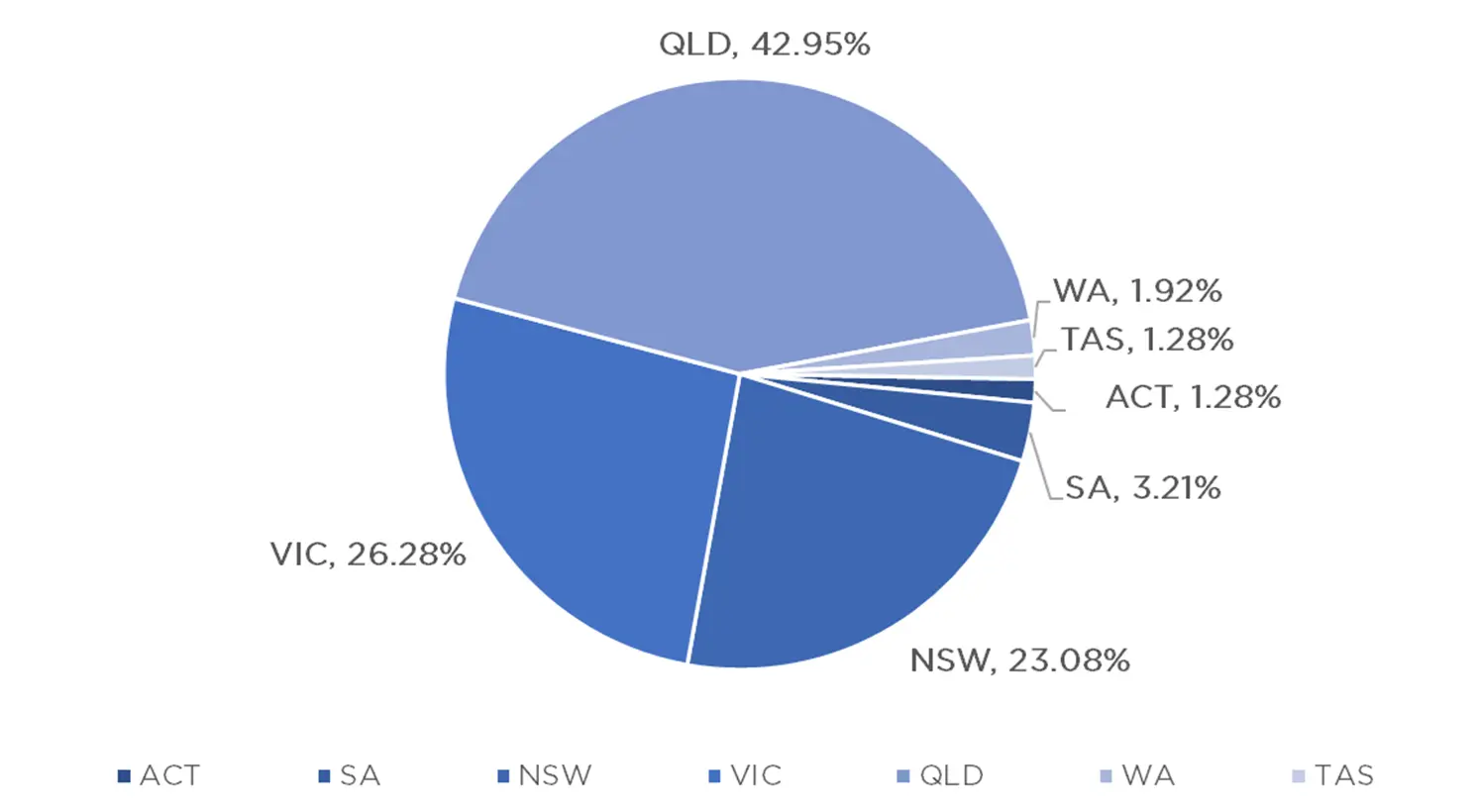

Current Loans Geography

as at 31st of May 2023

Why Invest with ASCF?

Investing in mortgage income funds can provide benefits during a high inflation cycle compared to other investment types. Here are a few reasons why this might be the case:

- Income Generation

Mortgage income funds typically invest in real estate loans which are mortgage-backed. These investments generate income through interest payments from borrowers. During periods of high inflation, lending rates tend to rise. As a result, the income generated by these investments generally also increase, providing investors with a higher yield. - Inflation Hedge

Real estate investments, including mortgage-backed loans, are often considered an inflation hedge. As inflation rises, the value of real assets such as properties tends to increase. Mortgage income funds, which invest in real estate loans, can benefit from this appreciation in property values. Additionally, the income generated from mortgage payments is usually also adjusted for inflation, providing investors with a potential hedge against rising prices. - Fixed Income Stability

Even during a high inflation cycle, mortgage funds typically adjust the interest rate payable by borrowers as rates rise. This fixed income component can provide stability and certainty to investors. - Diversification

Investing in mortgage income funds can provide diversification benefits to a portfolio. These funds typically invest in a range of mortgage-backed securities or real estate loans with varying maturities, credit ratings, and geographic locations. Diversification helps spread the risk across different investments, reducing the impact of inflation on the overall portfolio.

An Interesting Transaction

Problem:

A broker approached ASCF seeking a bridging loan for a client who had contracted to purchase a residential block of land at Burrum Heads in QLD. The customer already had a mortgage on their principal place of residence at Highland Park, also in QLD but required the funds from that sale to complete the land purchase as they could not demonstrate servicing on the proposed peak debt.

Solution:

Given that there was no forecast end debt once the customer sold their existing residence, we were able to provide a loan of $467,000 at 15% against a 1st mortgage over the land and a 2nd mortgage over their PPR at an LVR of 63.75% for a 4 month term.

Once the customer sells their current home, they will repay the 1st mortgagee and ASCF in full. If they manage to sell prior to the end of the term, we will rebate the unused interest.

What ASCF Does Differently:

Another example of how ASCF helps customers meet their financial objectives in time sensitive circumstances.

Market Update

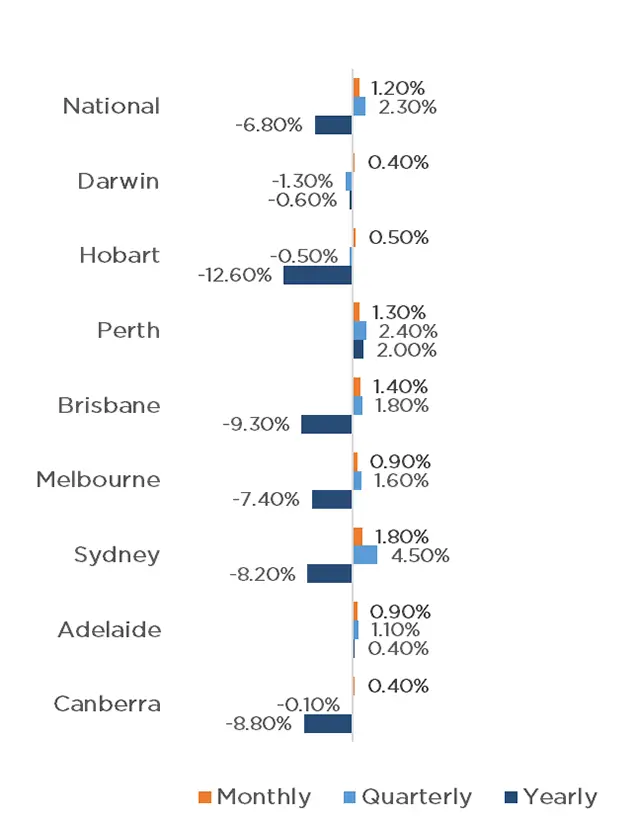

The Australian housing market continues to bounce back despite further interest rate rises, with CoreLogic’s national Home Value Index rising by 1.2% in May.

The capitals and the regions both performed strongly, with all capital cities recording a month-on-month increase, and only regional Victoria decreasing.

Once again, the capital cities performed well with Sydney leading the way with a 1.8% increase, followed by Brisbane (1.4%), Perth (1.3%), Melbourne (0.9%), Adelaide (0.9%), Tasmania (0.5%), Darwin (0.4%) and Canberra (0.4%).

Performance across regional areas was also largely positive, with only Victoria experiencing a reduction in values (-0.5%). The Northern Territory and ACT, maintained values, whilst New South Wales (0.5%), Western Australia (0.5%), Tasmania (0.7%), Queensland (0.8%) and South Australia (0.9%) all experienced growth.

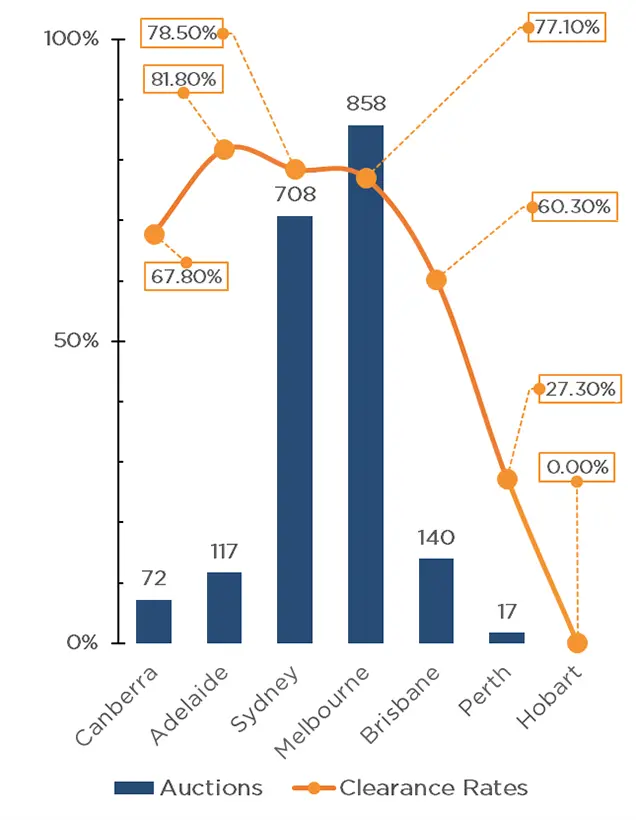

The property market continues to experience a lack of supply, with the last weekend of May holding just 1912 auctions, well below the 3226 that occurred on the same weekend in 2022. This lack of supply is likely the factor propping up property prices.

Melbourne (858) and Sydney (708) led the way with significantly more auctions taking place than the rest of the country with Brisbane (140), Adelaide (117), Canberra (72) and Perth (17) all well below previous year figures.

Whilst the total auctions were down considerably, clearance rates were exceptionally high, with a weighted average of 75.9% across the capital cities, well above the 59.3% last year. Adelaide had the highest clearance rate across the country, with 81.8% (up from 73.6% last year). Sydney and Melbourne also performed strongly with 78.5% and 77.1% respectively, well above the 56.4% and 60.4% last year. Canberra recorded 67.8% (64.4% last year) with Brisbane also outperforming last year, with 60.3% (51.2% last year). Perth was the weakest performance of the cities, with only a 27.3% clearance rate, down from 42.1% last year.

Clearance Rates & Auctions

22nd – 25th of May 2023

Property Values

as at 1st of June 2023

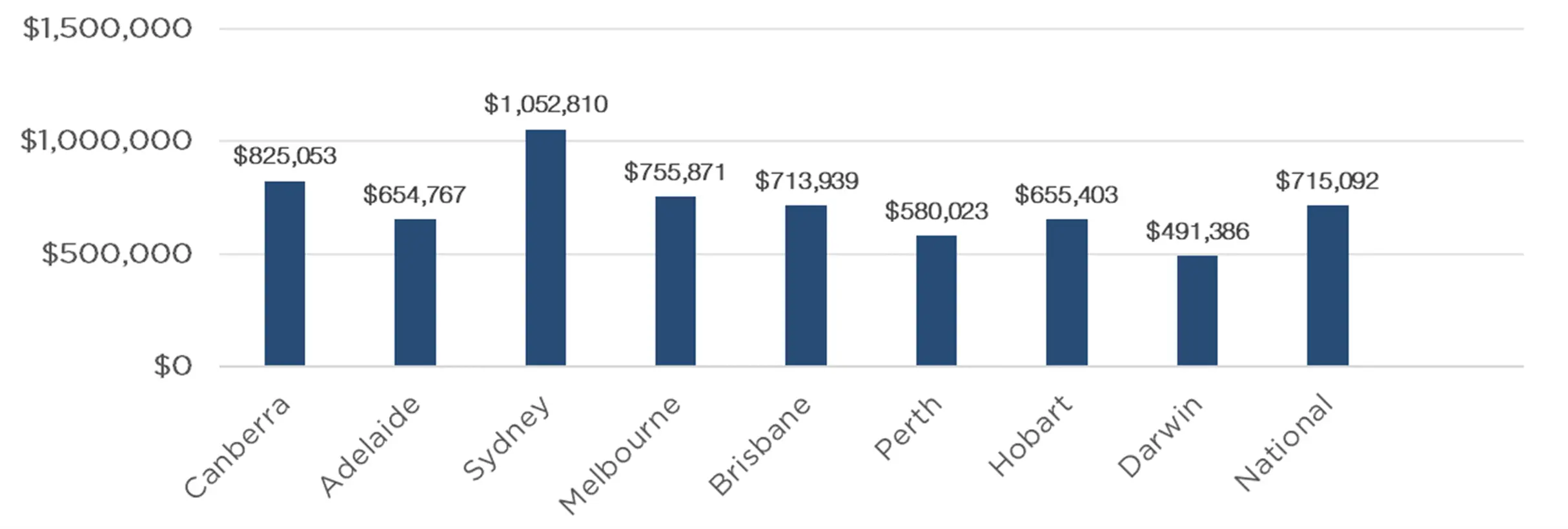

Median Dwelling Values

as at 1st of June 2023

Quick Insights

Clover Moore, Closing the Door

The National Housing Finance and Investment Corporation estimates that there is a shortfall of 400,000 houses nationwide. The Sydney basin represents nearly half of this amount, and over the next decade that shortfall will worsen by another 160,000 houses.

Rising house prices have been routinely blamed on negative gearing policies, when in reality it is the inaction and onerous requirements laid on developers in the inner cities that has exacerbated the issue.

Developers have been unable to provide supply due to the conditions city bureaucrats have placed upon them.

Source: Australian Financial Review

Paperwork & Supply

National Australia Bank boss Ross McEwan has spoken out about the housing supply saying, “Housing supply is a major issue at present and without clear moves to significantly increase supply, demand will inevitably push up prices further and faster.”

Mr McEwan was backed up by Lendlease’s Dale Connor, Mirvac’s Campbell Hanan and Charter Hall’s David Harrison – who agreed that improving planning processes was the first area to target.

Mr Harrison said that, “State governments have to take more control over the planning process to create more densification.”

“It’s got nothing to do with negative gearing or the demand side of things – it’s all about a chronic undersupply of housing stock.”

Source: Australian Financial Review

Hot Terraces

In defiance of the RBA’s then coming increase in rates, 8 out of 10 Sydney terrace homes put up for auction last weekend sold, the strongest result in 19 months.

As mentioned in our Market Update this was followed by a 77.2% clearance rate across the combined capital cities, the third consecutive week of robust increases.

Independent Sydney-based auctioneer Clarence White said, “Even one-bedders are selling quite well nowadays, such as the one I sold on the northern beaches last week, where we had five registered bidders. I wouldn’t have seen that six months ago.”

Source: Australian Financial Review