Trading Update

Australian markets continue to be supported by the declining interest rate environment. The RBA has already reduced the cash rate twice this year, bringing it to 3.85%. Despite a slight dip in employment in May, the unemployment rate remains steady at 4.1%, indicating a resilient labour market. This stability, coupled with cooling inflation and subdued consumer spending, supports the case for further rate reductions.

Inflation has continued to fall, landing deep within the RBA’s expressed desired range at 2.1% in May fuelling the markets optimism and suggesting a significant probability of a further 25 basis point rate cut in July – a view that is supported by NAB, and Westpac, bringing forward their August prediction to July. With all four big banks predicting a cash rate as low as 3.35% by the end of 2025, the outlook is positive for the Australian property market.

Auction clearance rates continue to rebound, the combined capital’s preliminary auction clearance rate came in at 73.9% last week – the highest reading since July last year. This rate clearly displays the confidence of buyers as we continue through this phase of cash rate softening.

Australia’s property market is characterised by a cautious optimism. While challenges such as affordability and international uncertainties persist, the powerful combination of lower interest rates and increased buyer activity suggests a path toward moderate growth in the coming months.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.00% | 7.50% | 7.10% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.00% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

Managed Funds Under Management

as at 31st of May 2025

| May 2025 | |

|---|---|

| ASCF High Yield Fund | $173,840,884.93 |

| ASCF Select Income Fund | $48,726,036.22 |

| ASCF Premium Capital Fund | $27,960,390.82 |

| ASCF Private fund | $38,798,260.96 |

| Combined Funds under Management | $289,325,572.93 |

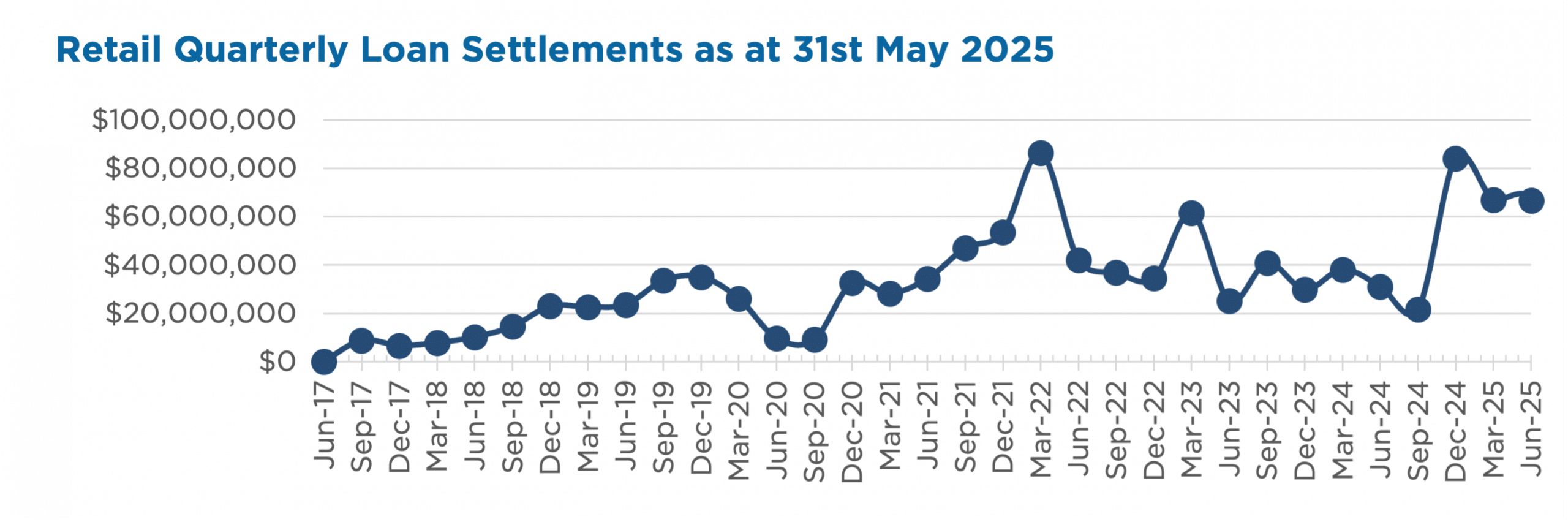

In May, loans and inquiry levels were steady, with $43,731,670.00 in loans settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of May.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of May 2025

Current Loans by Fund Source

as at 31st of May 2025

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 74.55% | 100% | 100% |

| 2nd Mortgage Loans | 16.21% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 9.24% | 0% | 0% |

| Avg. Weighted LVR | 57.16% | 49.07% | 54.91% |

| Avg. Loan Size | $1,421,003.38 | $999,624.93 | $860,765.56 |

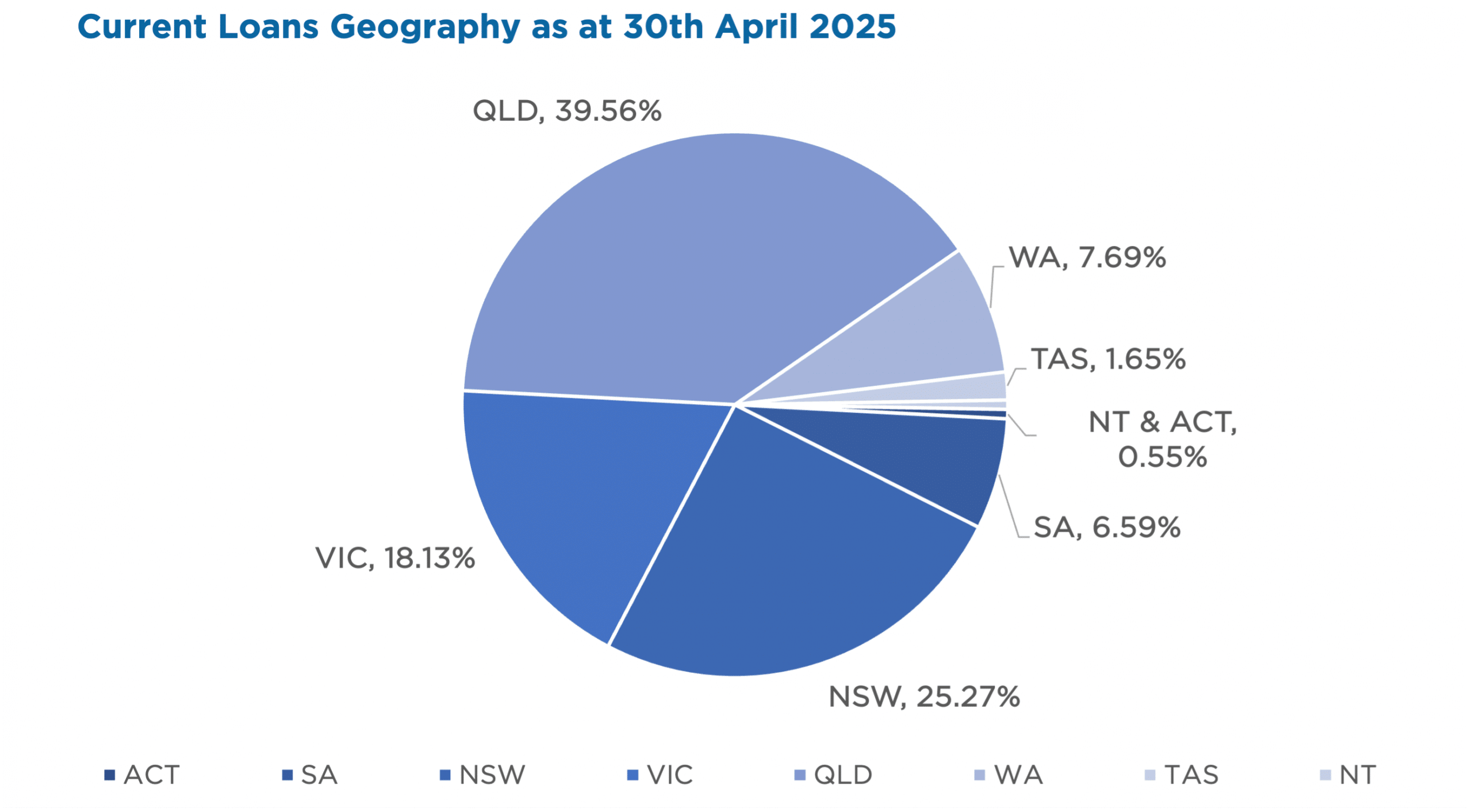

Current Loans Geography

as at 31st of May 2025

Why Invest with ASCF?

Why Some Investors Are Looking Beyond Property

Property investing has long been popular, but it’s not for everyone — especially in today’s market with higher rates, tighter lending rules, and ongoing costs like repairs, insurance, and vacancies.

For some, pooled mortgage funds are worth considering:

✅ Income from loans backed by real property — without managing tenants or maintenance

✅ Start from $5,000, no six-figure deposit required

✅ Spread your investment across multiple loans and borrowers

✅ Focused on generating monthly distributions from loan interest

✅ Access to redemption windows at the end of each term

✅ Managed by a team who assess each loan before it’s funded

You’re not investing in property directly — but in loans that use property as collateral.

That means no open homes or late-night plumbing calls.

Have questions? Our team is here to help.

Want to learn more? Contact us to explore your investment options.

Important information: At ASCF, we’re here to help you invest on your terms. Since inception, all investors have received their targeted distribution rate monthly and all redemption requests have been paid on time and in full, however past performance is not indicative of future performance. Distributions are not guaranteed nor a forecast. Lower than expected returns may be achieved. Investment in the Funds is not a bank deposit and investors risk losing some or all of their capital. Withdrawal rights are subject to liquidity and may be delayed or suspended. Read the PDS and TMD, available from our website.

An Interesting Transaction

Problem:

A retail and wholesale bakery operator was presented to us by a valued finance broker seeking funding to consolidate unsecured business lending. The business lending facilities were crippling the borrower’s monthly cashflow and affecting their ability to grow.

Solution:

ASCF arranged valuations on each of the security properties to confirm that there was sufficient equity to complete the debt consolidation. Upon receipt, ASCF offered the customer a 2nd mortgage loan of $540,000 for a term of 12 months (payable monthly in advance) at a rate of 16.95%pa. After confirming the value of the 1st mortgages with ING (the 1st mortgage lender), our valuations resulted in an LVR of 70.38%.

The unsecured business facilities were paid out at settlement. ASCF’s loan improved the borrower’s monthly cashflow by approximately $42,616.50.

What ASCF does differently

| ASCF’s ability to work with brokers and their clients allows for a great outcome for all. |

Market Update

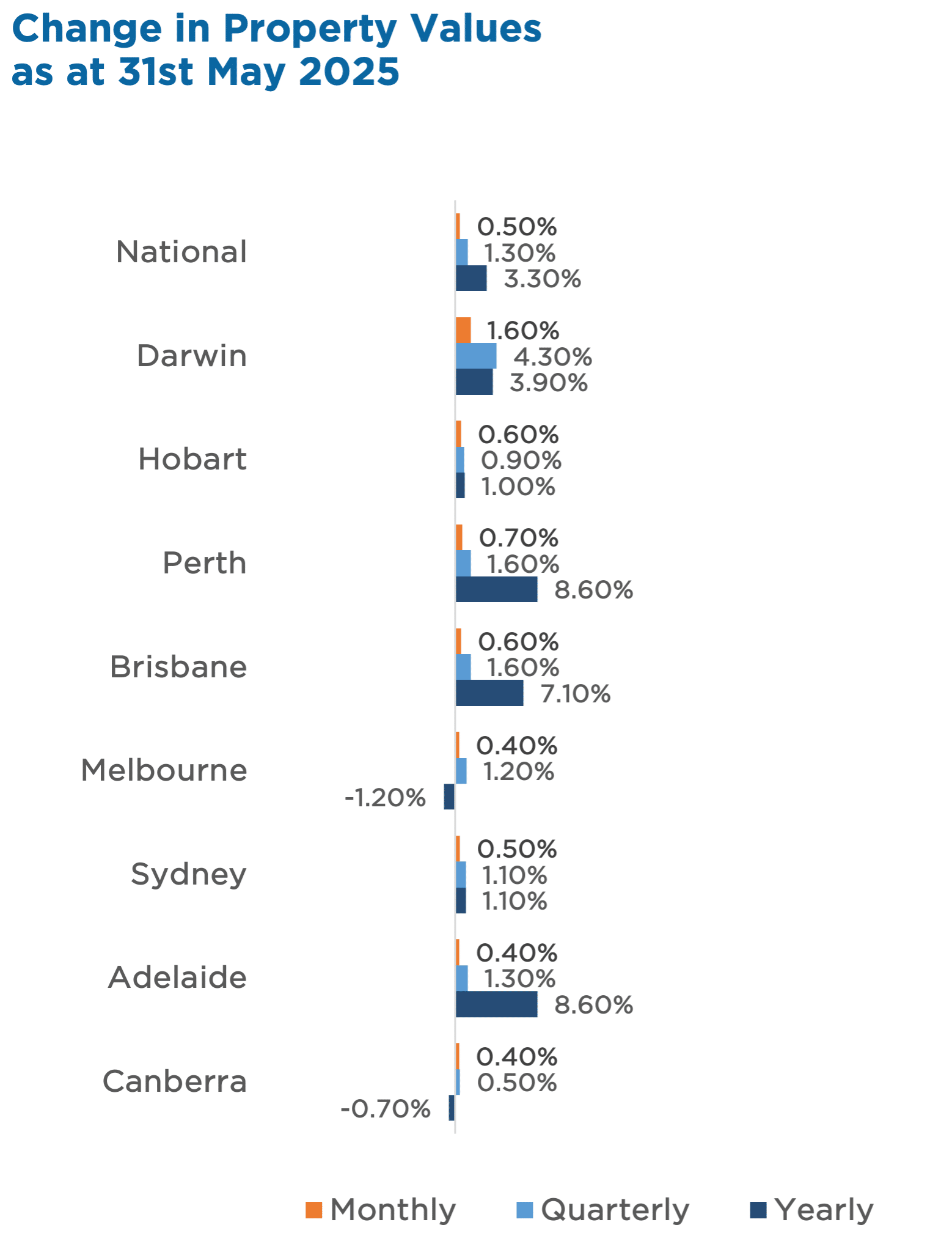

National housing values rose another 0.5% in May, bringing total growth to 1.7% so far in 2025, with every capital city in positive territory.

The market appears to be responding to recent and anticipated interest rate cuts, with auction clearance rates also picking up post-RBA’s May meeting. While annual growth has softened to 3.3%, even previously flatlining cities like Melbourne and Canberra are edging back into growth.

Regionally, SA is leading the charge, up 5.8% year-to-date, while higher-end property segments in Sydney and Canberra are now outpacing entry-level growth.

With values rising across capital cities and regions, many investors are keeping a close eye on how interest rates and housing supply may influence the months ahead.

Property Values

as at 31st of May 2025

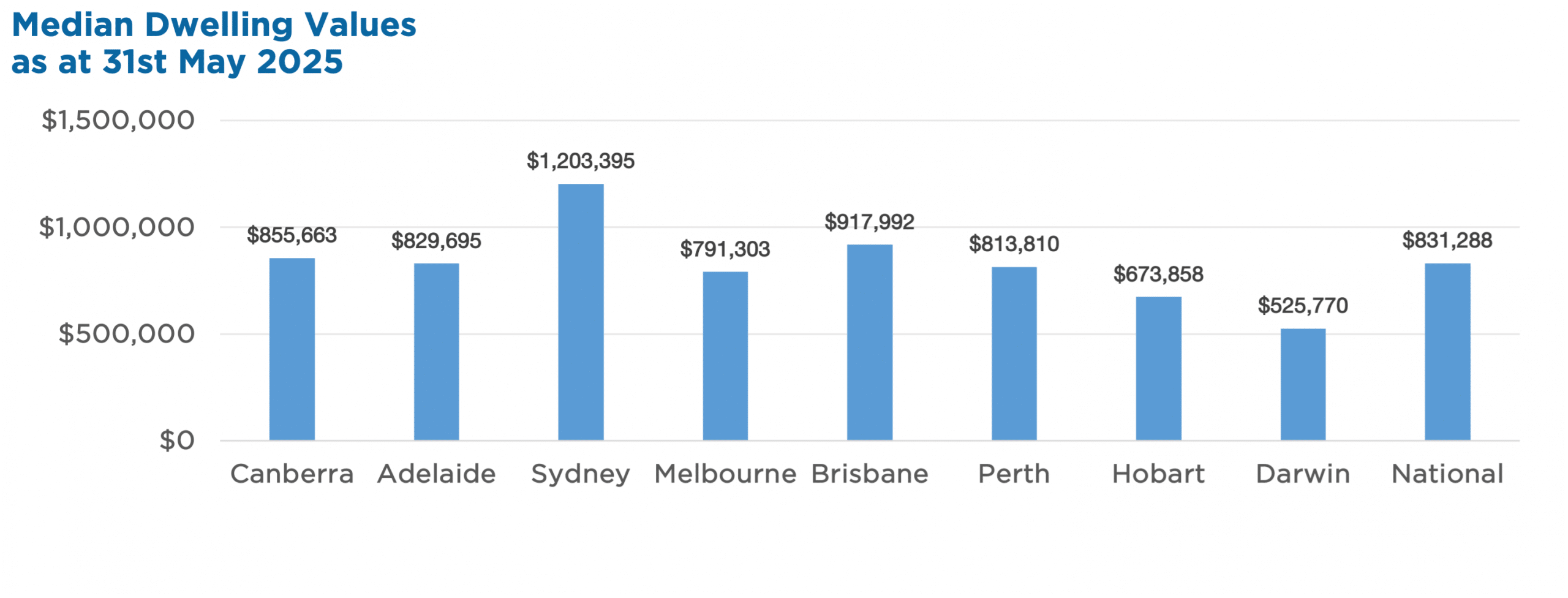

Median Dwelling Values

as at 31st of May 2025

Source: CoreLogic, Report, Article