Trading Update

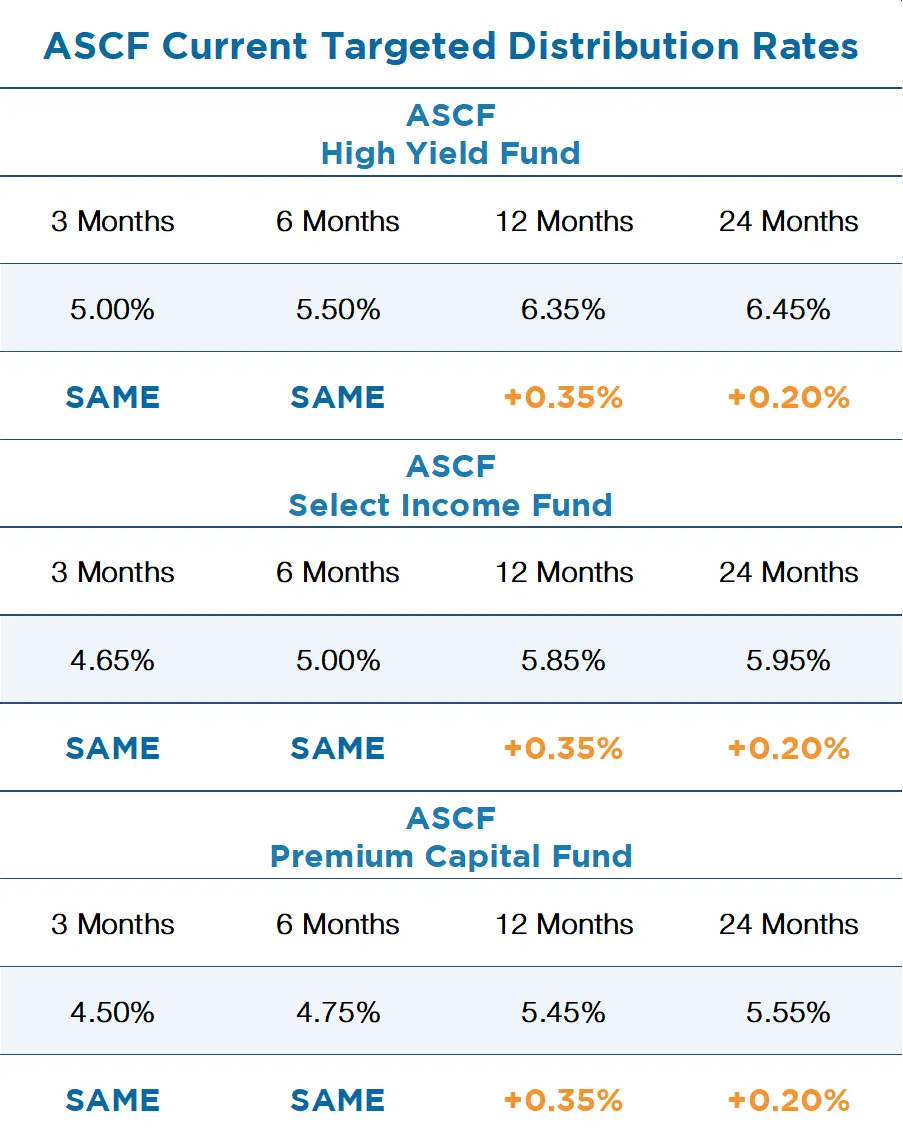

We are pleased to advise that we have increased our distribution rates across our 12 and 24 month investment terms effective the 1st December 2022.

The new investment rates are as follows:-

The new rates reflect the increases we are seeing across lending rates in our market whilst ensuring we maintain adequate interest margin protection across the loan portfolios in each of our funds to ensure investors’ funds are well cushioned against any further property market movements.

We are starting to see an increase in loan applications with our loan products becoming increasingly competitive in the market as bank and more particularly second tier lending rates increase.

Our loan book continues to perform strongly and whilst we have adopted a more conservative approach to lending as interest rates have risen our loan originations have remained solid.

We do believe that after todays interest rate rise much of the heavy lifting has now been done by the RBA in order to curb inflation and that we are close to a peak in terms of the cash rate.

Many of the bottlenecks in the supply chain have also abated over the last several months and shipping costs have come down considerably all of which is helping reduce inflation pressures.

Whilst the risk of a technical recession in the US is a possibility by mid next year, we believe the ramifications for Australia will be limited particularly based on the historically low unemployment levels and the ongoing strength in consumer balance sheets built up during Covid.

Interestingly the decline in property prices seems to have levelled off nationally in November and whilst still down slightly by the a similar amount as October in Sydney, Melbourne and Brisbane we believe the bottom to be close.

Whilst much talk has been made about the consequences of the significant number of fixed rate two and three year home loans converting to variable rates over the next 12 months we are yet to see any meaningful statistics on increasing stress levels by these borrowers and in our opinion, we are unlikely to do so.

This is predominantly predicated on the buffers imposed by APRA on banks at the time they were assessing approvals post covid for fixed rate loans and also the low levels of unemployment nationally and the wage growth we have seen across most industries, particularly over the last 12 months.

Furthermore, the peak to trough declines in property prices this year have been significantly less than the price growth we experienced nationally in 2020 and 2021 resulting in many of these buyers seeing a significant increase in equity in the value of their property thereby providing additional comfort should the need to restructure their loan arise.

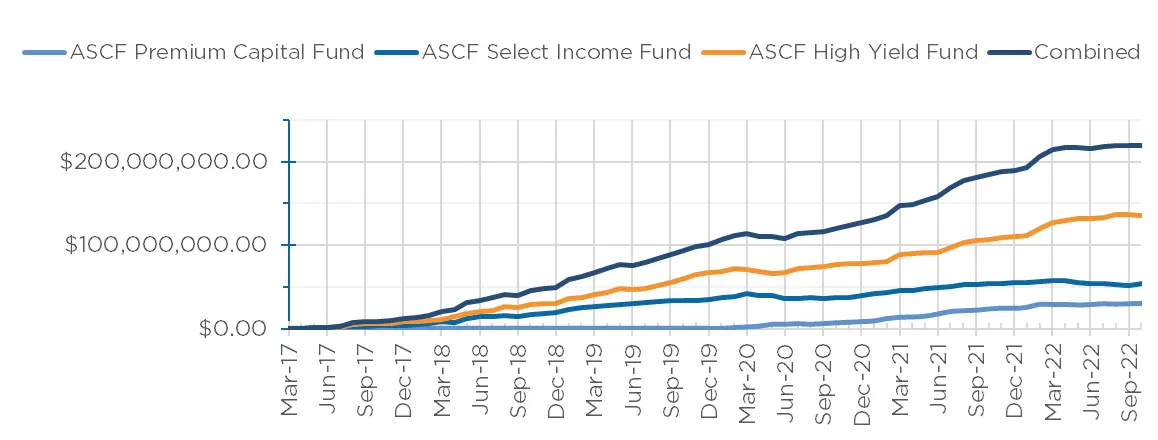

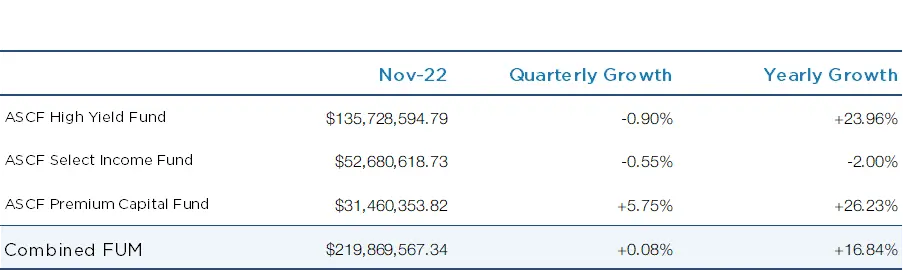

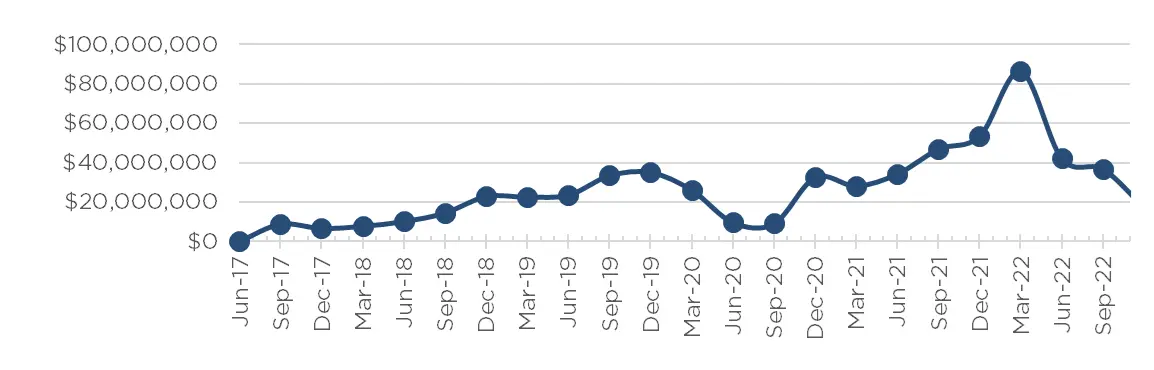

Monthly Funds Under Management

Funds Under Management

as at 30th of November 2022

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Loan originations and inquiry levels in November remained solid over $9m in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of November.

Lending Activity Update

Quarterly Loan Settlements

as at 30th of November 2022

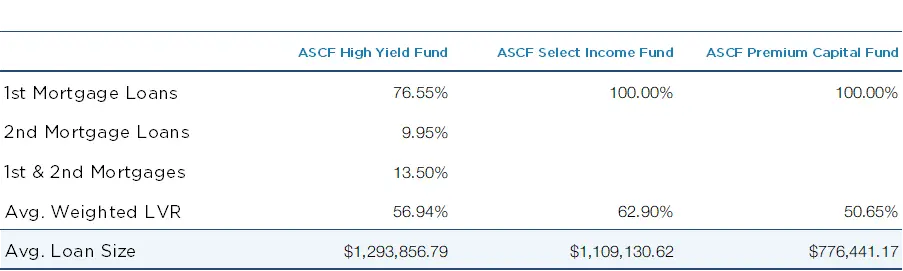

Current Loans by Fund Source

as at 30th of November 2022

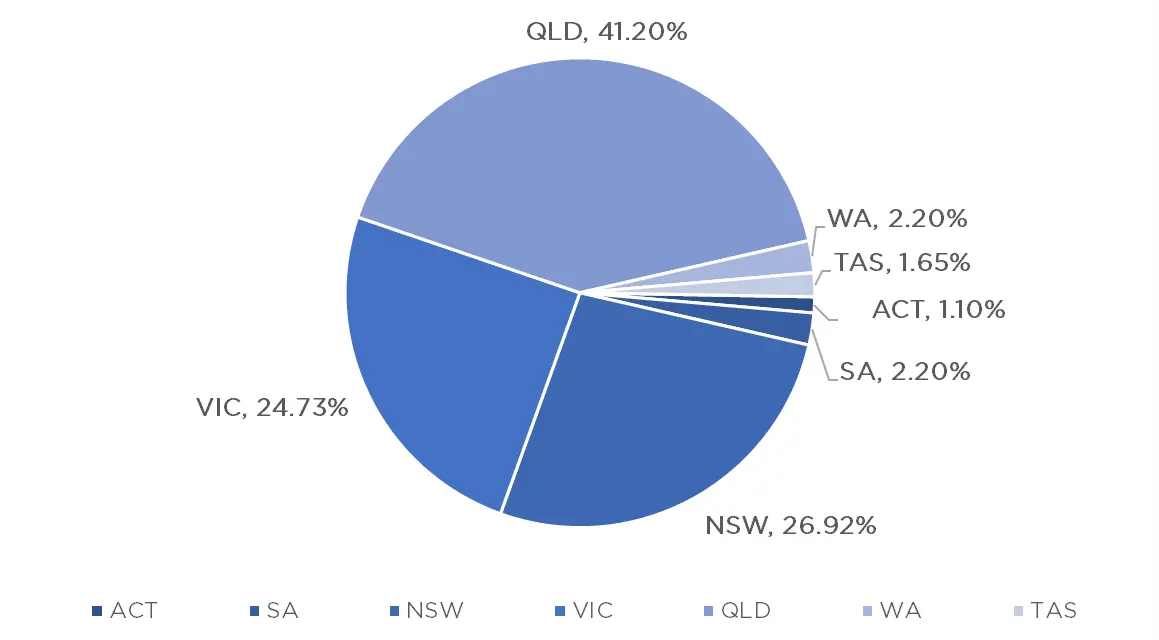

Current Loans Geography

as at 30th of November 2022

Why Invest with ASCF?

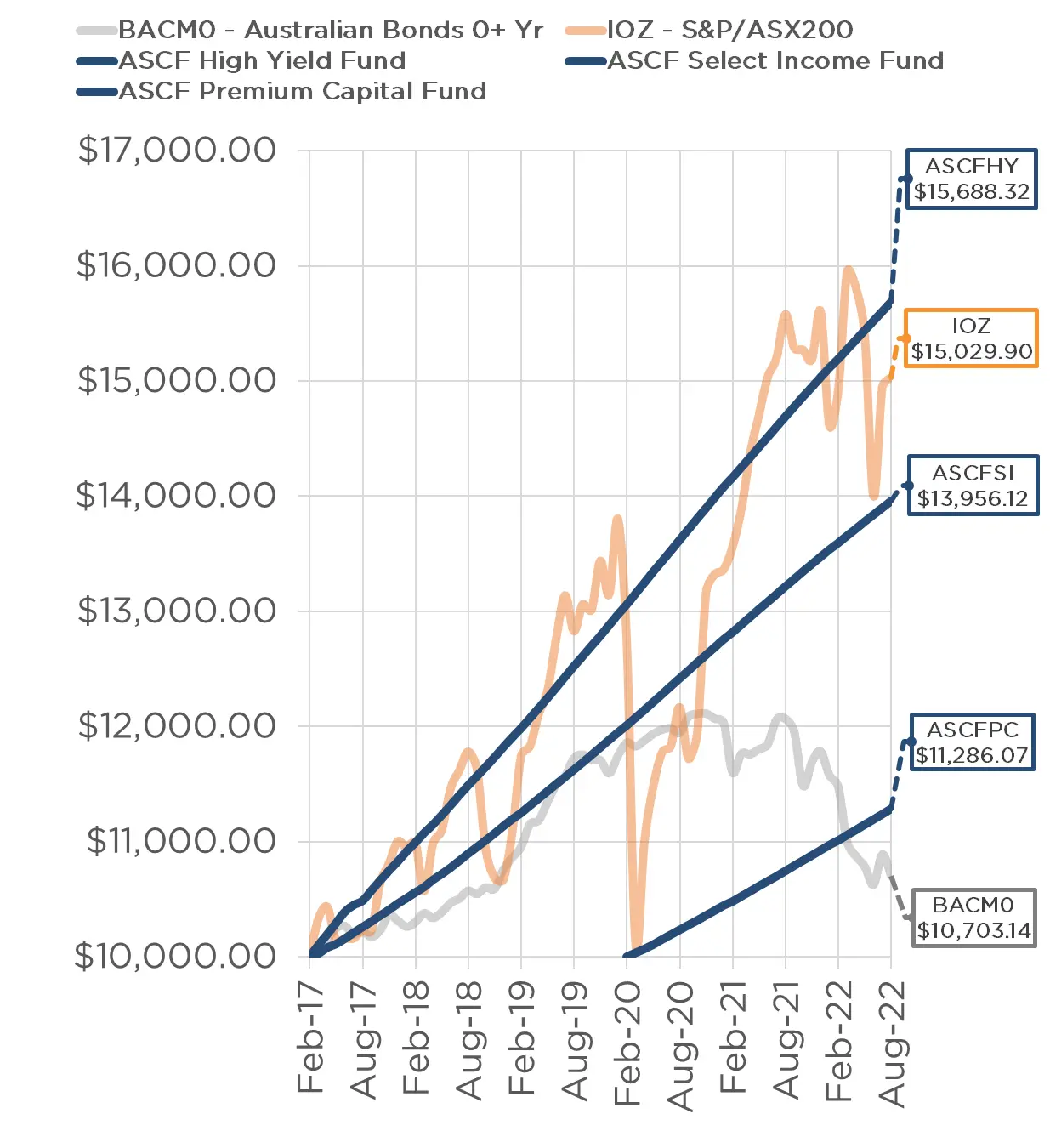

During the course of the year we have spoken about many of the reasons that make ASCF funds a compelling investment option in terms of providing a stable, inflation responsive income stream for investors which avoid many of the short term gyrations many equity and other funds have experienced over the last couple of years.

We thought we would close out the year by pointing out the main factors which distinguish ASCF mortgage funds from many other mortgage funds in todays market.

Our targeted investment rates do not fluctuate during the course of your investment term.

This is an important one and many of our investors benefited greatly from this as interest rates rapidly declined during Covid. ASCF offers 3,6,12 and 24 month investment terms across each of our funds with each term offering differing targeted investment rates.

Whilst similar investment terms are available from other mortgage funds they can and often do change their interest rates on a monthly basis meaning the rate you invested at can alter during the course of your investment.

With ASCF the rate you invest in at the time of investment is the same targeted rate of distribution during the course of your investment. Whilst past performance is not a guarantee of future performance we believe our track record in this regard speaks for itself with all investors having received their monthly distributions on time and in full since inception at the targeted distribution rate they invested at and all redemptions similarly paid on time and in full.

We do not provide traditional construction loans to developers.

This has become an increasing issue for mortgage funds that provide construction loans to developers, particularly as construction costs have escalated over the last 12 months and many builders have collapsed.

The cost to a funder in arranging for the borrower to secure an alternate builder in such circumstances or dealing with the escalation of construction costs that were not originally factored into the development creates in our opinion unacceptable risks for an investor, particularly in larger scale developments.

In addition to the construction risks, there is also the risk of market movement in the end value of the property during the course of the loan many of which are typically for 14 – 18 months or longer depending on the size of the development and construction timeline. This has particularly become apparent this year where many pre-sales achieved by developers were secured at higher prices which may not be reflected at the time of completion due to downward movement in prices over the last 9 months.

Our investment terms match our loan terms.

This is a really simple one but one which many mortgage funds have failed to adhere to. In simple terms, it means that if we are offering our investors 3, 6, 12 and 24 month terms then it is important that the loans we provide to borrowers are done so for similar durations.

When we established ASCF in 2016 we looked at some of the issues many mortgage funds had historically experienced particularly during the GFC and we found that many of them were offering investors investment terms of 12 months or less and then investing the money in loans of longer duration typically 18 – 36 months.

The obvious consequence is the potential for liquidity issues arising particularly if there are multiple investors seeking redemption of their funds at maturity. ASCF holds approximately 60% of funds invested in loans with terms of 6 months or less at origination and over 95% of all loans with terms of 12 months or less. This means we ensure that our loan terms match as closely as possible to the terms of our investments.

We do not offer peer to peer lending to our investors.

All ASCF funds are operated on a pooled mortgage basis. This means investor funds are spread proportionally across all loans within that fund and not lent specifically to a particular borrower on a specific property.

Whilst peer to peer loans can offer a higher return to investors the inherent risks associated with exposing 100% of your investment in a particular loan secured by one property in one location with one borrower is not in our option prudent due to the elevated risks involved.

We operate with a margin of safety across all our loans.

All our loans are originated with a buffer over and above the interest rate paid to investors. This ensures that should a percentage of loans fail to perform in the portfolio there is a sufficient buffer to ensure that investors are still able to be paid their monthly interest.

In addition, should there be a market downturn and a loss occur on one or more loans during the course of the year there is a sufficient return generated across the fund to ensure that there is no capital loss to investors. In fact, since inception, no investor has ever incurred a loss on any investment and our unit price has at all times remained stable at $1. Whilst past perforce is not indicative of future performance we do believe our track record speaks for itself.

We do not leverage against investor funds.

None of our retail funds have any borrowings nor are any of them leveraged in any way. This is important because many mortgage funds have historically leveraged retail investor funds with banks and other financial institutions.

Whilst this is something which some have managed to do successfully there are additional risks associated with such exposure and something investors should be aware of when investing.

Strong management.

Capital protection has and will always remain our highest priority however it is only with a strong management team that ASCF has been able to provide investors with the confidence and track record to establish the trust that has allowed us to pay out over $40m in interest to investors since inception and to currently service over 1000 active investment accounts.

Whilst our intention is always to remain a niche mortgage fund within the industry under the stewardship of our directors it is the team we have developed over the last 7 years and our hands on experience in the finance and property industry that distinguishes us.

Transparency.

We recently discussed this in a prior newsletter but you would be surprised how many mortgage funds offer limited visibility on where investor funds are actually deployed and what the loan book looks like at the time of investment; or cannot provide audited financials for their funds. ASCF has always provided investors with details of every loan we have ever invested in, the LVR, loan amount, interest rate, what’s current and what has been repaid.

This is updated monthly in our loan summary which is on our website and issued monthly in our newsletter. In addition, each of our retail funds is audited annually and subject to a half year review by our Auditors Grant Thornton. Our audited financials for each of our retail funds since inception are on our website, and we would strongly recommend avoiding investment in any retail mortgage fund which does not provide access to its financials to its investors.

We trust this article has been of benefit to you if you are considering an investment with us and if you are an existing investor hopefully it reinforces why you chose ASCF over other mortgage fund investment options.

Should you have any questions about any of our funds please do not hesitate to reach out to any of our investment team who would be more than happy to assist.

An Interesting Transaction

Problem:

A broker approached ASCF after receiving a phone call from a new customer seeking urgent funding to settle a retail commercial property purchase in South Yarra. The customer was let down by her existing broker and only had one week to settle the transaction.

Solution:

ASCF immediately engaged our Panel Valuer in Melbourne to get a valuation within 48 hours and we managed to fund the purchase on the day of the rescission notice expiry. The loan amount of $1,200,000 was supported by a full valuation at 65% LVR with a 1 month term at 9.95% interest.

The customer’s proposed exit is to refinance.

What ASCF Does Differently:

Another example of how ASCF delivers for both brokers and customers.

Market Update

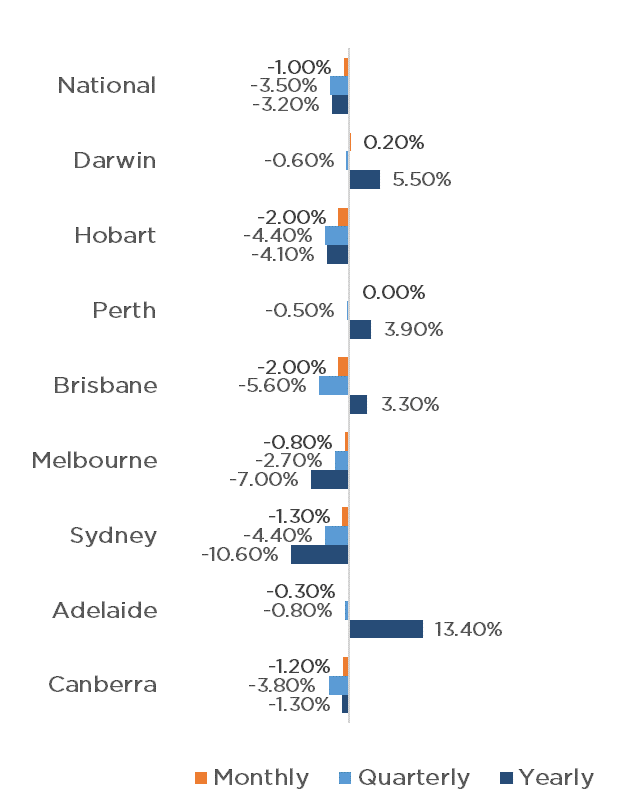

Property prices continued to fall across the nation with values declining a further 1.00% throughout November. This brings an approximate 7.00% (average of $53,400) decline since national property prices peaked in April of this year. Whilst this marks the seventh month of decline, the rate at which prices are declining is beginning to soften, with the 1.00% reduction being the smallest since the 1.60% monthly decline in August.

Queensland again recorded the most significant monthly reduction, along with Tasmania with a 2.00% reduction in the Home Value Index. New South Wales, Canberra, Victoria and South Australia also experienced a reduction in value with 1.30%, 1.20%, 0.80% and 0.30% respectively.

Western Australia remained stable, and the Northern Territory actually saw a small increase of 0.20% for the month.

Record low vacancy rates of 1.00% have allowed unit prices continue to remain somewhat resilient, recording a 0.60% reduction for the month, bringing 4.70% reduction since prices peaked.

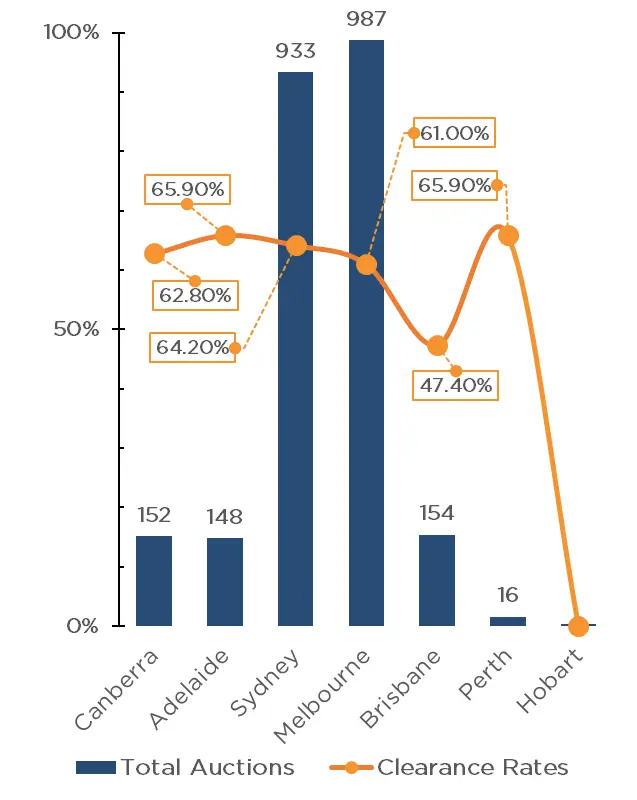

The number of auctions held in the last weekend of November remained considerably below that of last year, with 2,393 auctions taking place as opposed to 4,251 last year. Whilst well below that of last year, the number of auctions were up 4.10% on the previous weeks results and were in fact the highest since a weekend in mid-June recorded 2,528 auctions.

Clearance rates across the nation were also down on last year’s figures, with only 61.50% of auctions clearing (down from 68.50% last year) indicating that vendors may not yet have responded to market conditions. Adelaide again recorded the highest clearance rate for the weekend with 65.90%, followed by Sydney (64.20%), Canberra (62.80%), Melbourne (61.00%) and Brisbane (47.40%).

Clearance Rates & Auctions

21st – 28th of November 2022

Property Values

as at 1st of December 2022

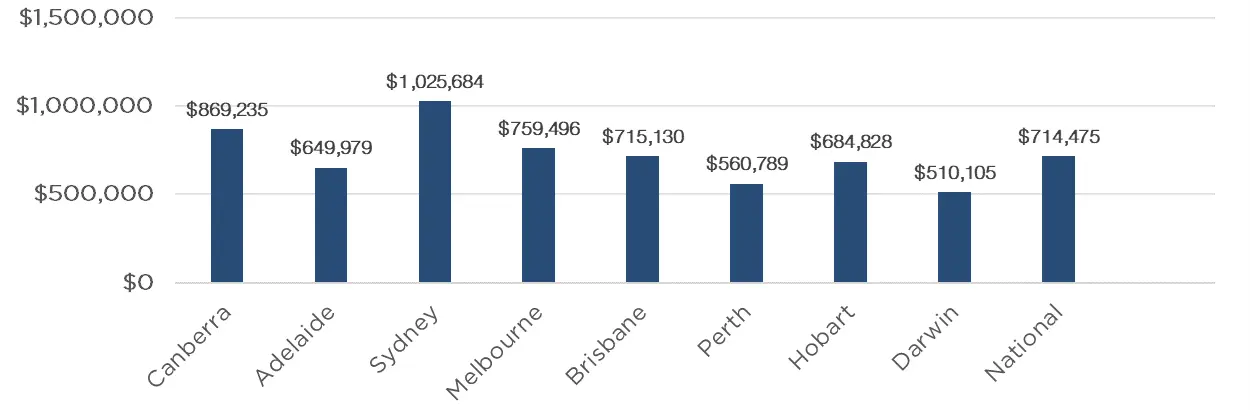

Median Dwelling Values

as at 1st of December 2022

Season’s Greetings & Holiday Trading Hours

As this will be our final newsletter for 2022 we would like to wish all our investors a Merry Christmas and all the best for the holiday season.

Our office will be closed from 5.00 pm Friday the 23rd December 2022 and will reopen at 9.00 am Tuesday on the 3rd January 2022.

For urgent investment enquiries during this closure period, please send an email to [email protected].

Wishing you a happy, safe and joyous holiday season from all the ASCF team and we look forward to working with you next year!