Trading Update

The RBA’s decision to leave rates on hold last week was very much as expected based on the October monthly inflation data which came in at 4.9% on an annual basis compared to September which was running at 5.6%.

The inflation data combined with the release of September’s GDP data at 0.2% which is well below forecasts of 0.4% clearly indicate that the impact of the RBA’s tightening policy it embarked on last year is working to take the heat out of the economy and bring inflation back within its 2-3% target.

Markets are now expecting the RBA to start cutting rates from mid to late next year and are fully pricing in a rate cut of 25 basis points and a 50% chance of rates dropping by 50 basis points by the end of 2024.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

With the next RBA meeting not scheduled until February next year it should provide mortgage holders some welcome relief however the December quarter inflation print released at the end of January will be paramount in the RBA’s decision.

Whilst we believe rates will come down next year and through 2025 the pace at which the RBA cuts rates will be measured and with current economic forecasts indicating rate reductions of anywhere between 0.75% and 1.5% by March 2026 we are clearly at the top of the cycle.

Residential property prices across the nation are now starting to flatline, and we expect limited gains moving forward although we believe they will continue to be supported by the structural undersupply of housing so we do not expect any significant declines.

In fact we believe that overall 2024 will be a positive year for residential property nationally particularly as the possibility of rate reductions become more evident to buyers from mid 2024.

As this is our final newsletter for 2023, we would like to wish you all a Merry Christmas and Happy New Year from all of us at ASCF.

Our next newsletter will be issued in February 2024.

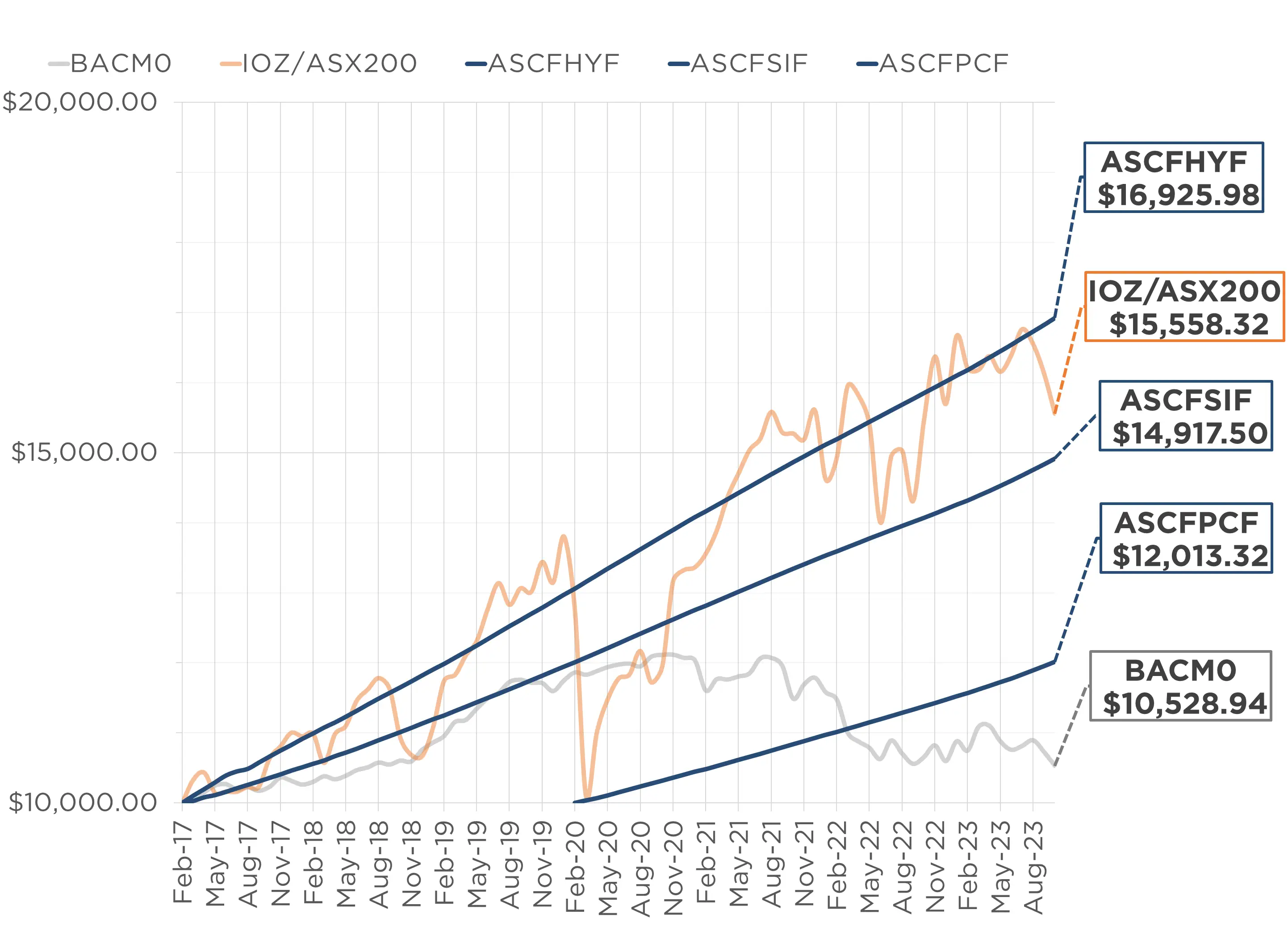

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Managed Funds Under Management

as at 30th of November 2023

| November 2023 | |

|---|---|

| ASCF High Yield Fund | $132,342,341.97 |

| ASCF Select Income Fund | $44,474,407.73 |

| ASCF Premium Capital Fund | $26,558,853.82 |

| Combined Funds under Management | $203,375,603.52 |

In November, loan originations and inquiry levels remained solid, with $8,973,468.50 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of November.

Lending Activity Update

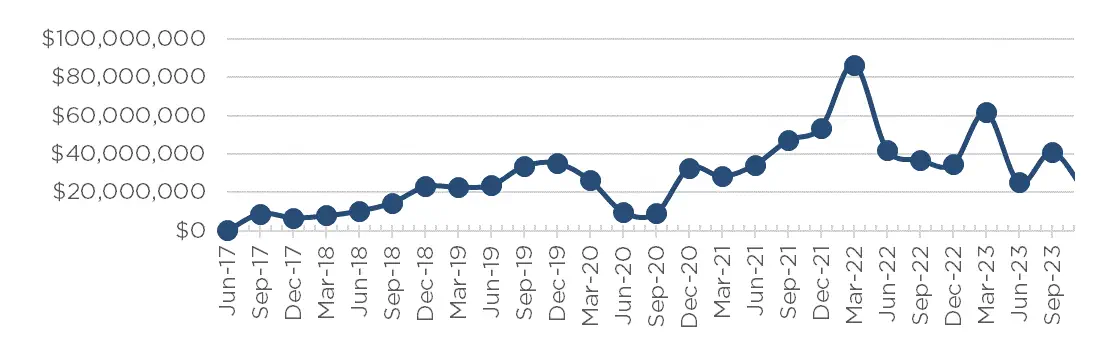

Quarterly Loan Settlements

as at 30th of November 2023

Current Loans by Fund Source

as at 30th of November 2023

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 80.53% | 100% | 100% |

| 2nd Mortgage Loans | 13.53% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 5.94% | 0% | 0% |

| Avg. Weighted LVR | 54.58% | 60.43% | 43.75% |

| Avg. Loan Size | $1,397,605.71 | $1,119,452.00 | $732,676.84 |

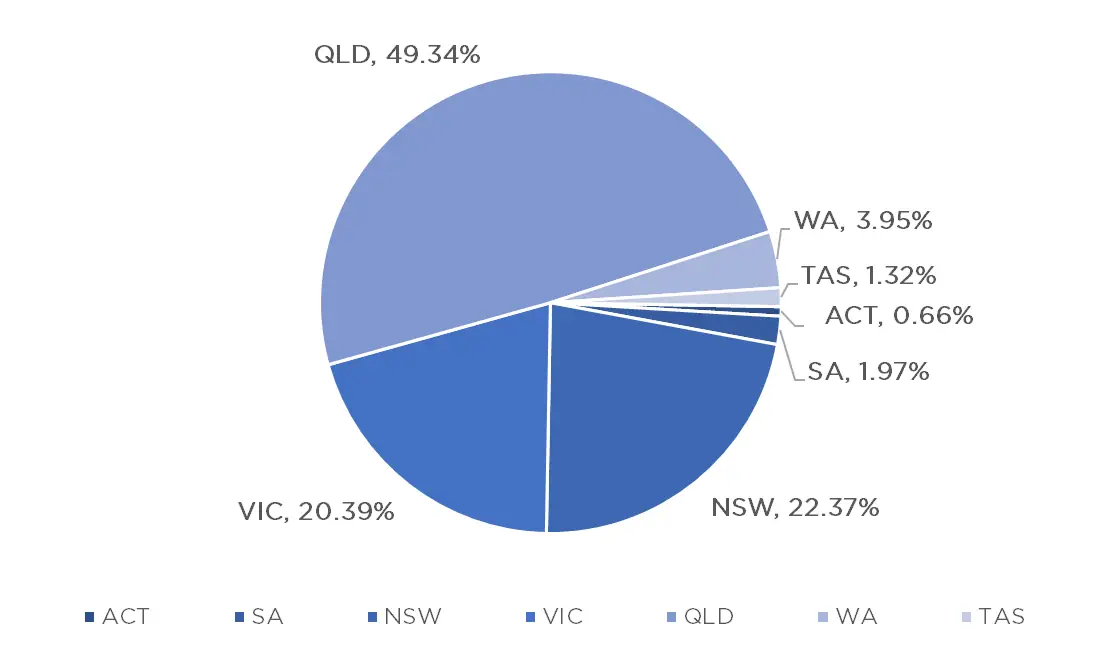

Current Loans Geography

as at 30th of November 2023

Why Invest with ASCF?

There’s a saying that inflation is a tax against your savings, and this is very true. When the value of currency goes down, the ‘buying power’ of the money you’ve saved also goes down. Thus, while you have the same amount of money, you are, in effect, worse off.

There is another popular saying that is “don’t save your money, invest it”. It’s pretty obvious that the investment needs to be returning a higher rate than the rate of inflation i.e. if the inflation rate is 5% you need your investments to be making more than 5%, otherwise you are just going backwards. To keep ahead of the curve, an investor must be able to grow their money faster than the effects of inflation.

So how can investors keep ahead of the curve to protect themselves from the effects of inflation and what should you do during inflationary periods?

Steer clear of having your funds invested in cash or in a savings account that is paying a rate of less than the rate of inflation. The reason for this is that inflation is linked to rising prices. If you have $100 in your wallet now, you can buy a certain amount of goods or services. If inflation pushes the price of those products up to $110 next year, you won’t be able to buy as much with your $100. If you hold this money in a bank account that pays no or little interest, the result is the same.

Another example is if your bank pays you 4% interest on your savings but inflation is 5%. So the real interest rate for your savings is -1%, which means your purchasing power will decrease by 1% per year and you are going backwards.

Look for investment options returning above inflation rates.

Whilst the returns are not guaranteed, there are options out there that will be offering above inflation returns.

However, not all investments are the same. Some require more attention than others, while some, by their nature, require huge capital upfront. Understanding your current situation and investor profile is crucial when selecting which investments match your financial goals. Otherwise, you could end up suffering big losses instead of gaining additional income.

Markets will always have highs and lows. What’s important is that the general trajectory is moving in your favour in the long term.

Research and ask as many questions until you are satisfied. Investing should protect you from inflation, not compound the problem because you entered into something you didn’t completely understand.

Our High Yield fund is now paying a targeted return of 7.75% p.a. for a 12 month investment or 7.30% p.a. for a 24 month investment with interest paid monthly and definitely worth considering if you are seeking a low volatility inflation responsive investment over the next 12 to 24 months.

Now is a great time to invest in one of our term investments knowing that the rate will be fixed for the duration of the investment term regardless of whether rates start to fall later next year.

An Interesting Transaction

Problem:

A

A broker was struggling to find a funder willing to assist with a client’s urgent off-the-plan purchase.

The client had signed contract in March 2021 to purchase a unit off the plan in Mermaid Beach, Gold Coast for $1.63m. Construction had been completed, titles issued and the developer then called for settlement within 14 days. The problem the client faced was that she had not yet sold her principal place of residence or her investment property to be able to purchase the unit. The broker tried to get urgent funding from a second-tier lender, but not only were they unable to settle in time, the client’s husband had recently passed away, so the second tier-lender was not able to lend against her existing properties or demonstrate servicing. Further, the value of the new unit had increased to $2.65m since the contract date so the client faced losing a $1m uplift if she failed to settle, along with losing her 10% deposit!

Solution:

A broker that regularly deals with ASCF suggested the broker contact their ASCF relationship manager. ASCF was able to provide a bridging facility of $1,730,000 to ensure the client had sufficient funds to complete the purchase before the contract was terminated by the developer. By taking advantage of the equity the client had in their existing properties, ASCF was able to provide the funds at an LVR of 40.71% at the rate of 11.95% p.a.

The loan provided a six-month term which allowed more than sufficient time for the client to sell her existing properties and exit the ASCF loan.

What ASCF Does Differently:

An excellent example of how ASCF is able to provide a positive outcome for its borrowers by utilising a common-sense approach and overcoming obstacles banks often fail to see-through.

Market Update

Christmas came early for mortgage holders and new borrowers when the RBA left interest rates on hold at the December meeting. This hold, means the cash rate will remain at 4.35% until at least February, with no meeting taking place in January, providing reprieve for mortgage holders over the holiday period.

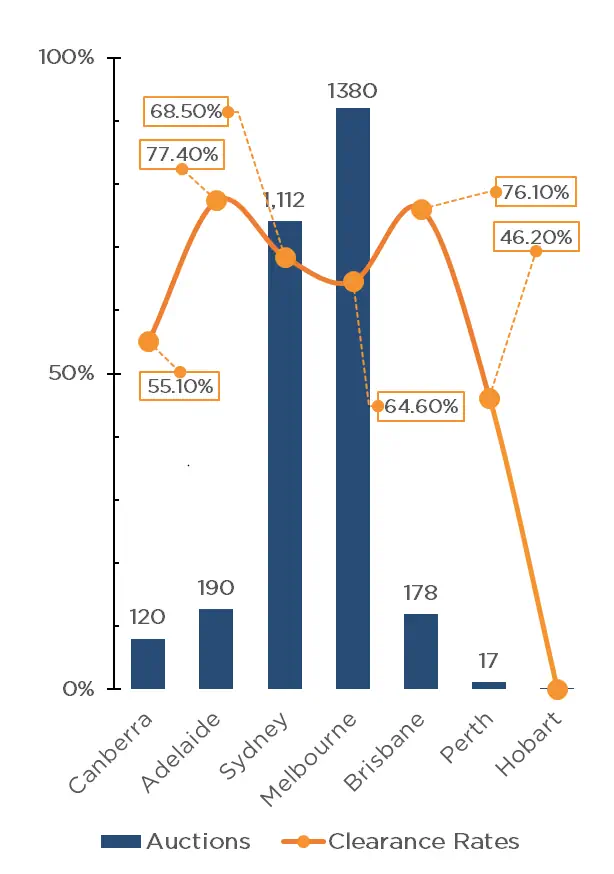

The first week of summer saw strong auction activity across the capitals with 2,999 auctions taking place, headlined by Melbourne and Sydney with 1,380 and 1,112 auctions respectively. Adelaide, Brisbane and Canberra all recorded triple digit auction figures with 190, 178 and 120 auctions respectively, whilst there were 17 in Perth and 2 in Tasmania.

Preliminary clearance rates are trending lower, with 67% of auctions being successful. Once again, Adelaide recorded the highest clearance rate with 77.4%, followed closely by Brisbane with 76.1%, with just the two capitals achieving a clearance rate of over 70%. Sydney and Melbourne both recorded clearance rates of above 60% with 68.5% and 64.6% respectively, whilst Canberra and Perth received a clearance rate of 55.1% and 46.2% respectively.

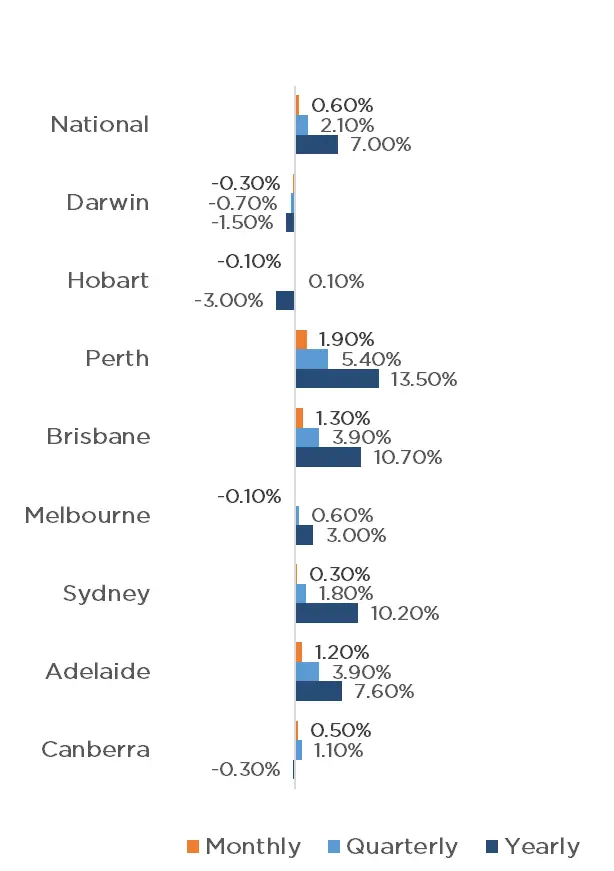

The rapid rise of the property market has shown signs of cooling, with CoreLogic’s National Home Value Index showing a smaller, 0.6% increase for the month, reaching a new record high.

Perth recorded the largest monthly gain since March 2021, with 1.9%, followed by Brisbane and Adelaide with 1.3% and 1.2% respectively. Canberra and Sydney were the only other two capitals to achieve an increase, growing by 0.5% and 0.3% respectively, whilst Melbourne and Hobart both recorded a reduction of 0.1%, Darwin had a negative result with a 0.3% reduction.

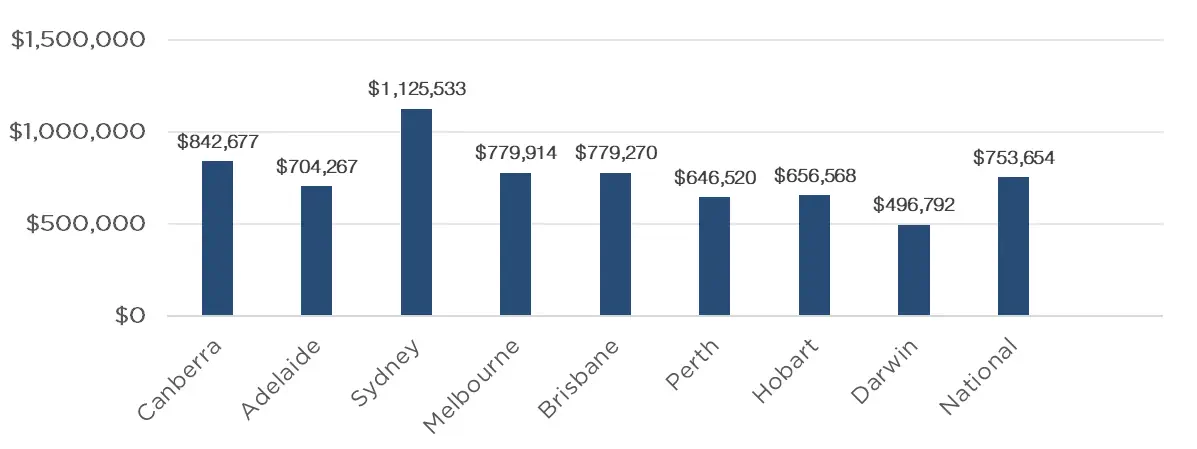

As the Brisbane property market continues to flourish, the average dwelling value in Melbourne is now less than $700 greater than that of Brisbane ($779,914 and $779,270 respectively) and may see Brisbane become the second most expensive capital city in a matter of weeks.

The pause in the cash rate has eased pressure leading into the holiday season. Inflation and employment data over the coming months will go a long way in determining the outcome of the February RBA meeting, however regardless of the result, the property market remains strong, continuing to be driven by a fundamental lack of supply, and an influx in migration to Australia.

Clearance Rates & Auctions

week of 4th of December 2023

Property Values

as at 1st of December 2023

Median Dwelling Values

as at 1st of December 2023

Quick Insights

House Price Soars Despite the Flights

A property in the Sydney suburb of Mascot has sold for over $1.65 million despite its close proximity to Sydney Airport.

After selling for $50,000 over reserve, the agent said, “The buyers just forgot about the aeroplanes. They bought it based on what they could buy for that price and live in Sydney. Despite the planes – you could touch their wheels – the buyers came back three, four, five times.“

Source: Australian Financial Review

Populism & Property Taxes

The Labor federal government has recently announced a plan to triple the foreign investment fee for purchases of established homes and to double the vacancy fee for homes owned by overseas investors.

While interest in buying Australian residential property by China-based buyers is increasing, Real Estate Institute of Australia president Leanne Pilkington said they would make little difference.

AMP chief economist Shane Oliver said: “It’s something that is populist policy, foreigners are not the cause of the problem. We went through the pandemic and there were no foreigners buying property and prices still took off.”

Source: Australian Financial Review