Trading Update

Australian Secure Capital Fund is pleased to provide this monthly update to our investors.

On Tuesday the Reserve Bank lifted rates by 0.25% bringing the cash rate to 2.85% and making it the seventh rate rise in a row.

Whilst we believed there were grounds for the RBA to take a breather the inflation data last week came in a little hotter than expected at 7.3% causing some economists to predict rates would be raised by 0.5% on Tuesday.

We do believe the Reserve Bank is still likely to pause so as to allow the impact of the previous rate rises to take effect.

There is always a lag factor between the raising of rates by central banks and their subsequent impact on economic activity and we do believe that the prior rate increases will now start impacting economic activity and consumer confidence.

Having said that consumer balance sheets do remain strong, unemployment at historically low levels and wage growth resilient due to the labor shortage across the country.

The recently elected Federal Government could certainly be doing more to assist with bringing down current inflation by opening up the country to skilled migration faster and also abolishing the list of eligible occupations so as to allow labour markets the ability to auto regulate the skills shortage.

The data they rely on to formulate the eligible occupations list for priority skilled visas would be unlikely to reflect what is actually happening in the labour market so why not let the market determine what it needs.

The recent removal of the Federal Government’s 50% reduction of the fuel excise levy will certainly do nothing to moderate inflation. With fuel prices impacting almost every aspect of the economy and only helping sustain elevated levels of inflation why not temporarily abolish the excise all together for a 2 year period and allow inflation to moderate.

The cost of doing so would certainly take some pressure off living costs and reduce input costs for businesses which would assist in moderating price increases on goods and services in particular transport costs.

Property price declines in Sydney and Melbourne have continued to moderate down 1.3% and 0.8% respectively for the month and we do expect them to level off over the next 2 -3 months particularly if the Reserve Bank takes a breather and inflation starts to moderate.

Over the last several months we have adopted a more cautious approach in our lending preferring lower LVR loans of shorter duration with clean exits and we are seeing the benefits of this in terms of our ability to fund new originations which remain strong.

Our loan book remains solid and we are expecting our loan growth to increase over the coming months as interest rates stabilise.

Following on from last months investor rates increase we are continuing to assess our investment rates on a monthly basis based on the movement of lending rates across the competitive landscape in which we operate.

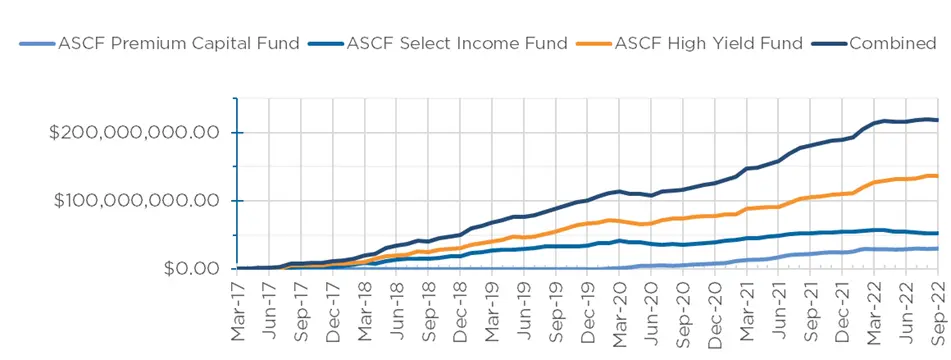

Monthly Funds Under Management

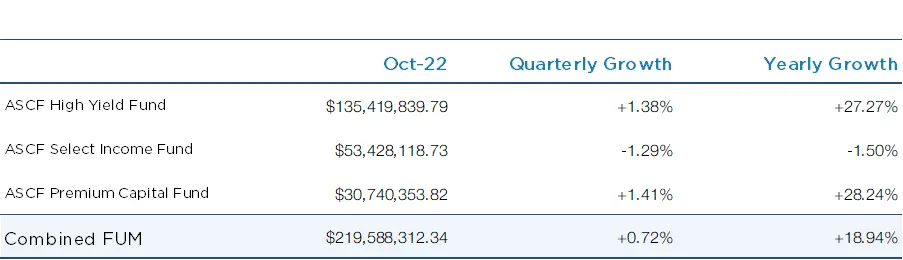

Funds Under Management

as at 31st of October 2022

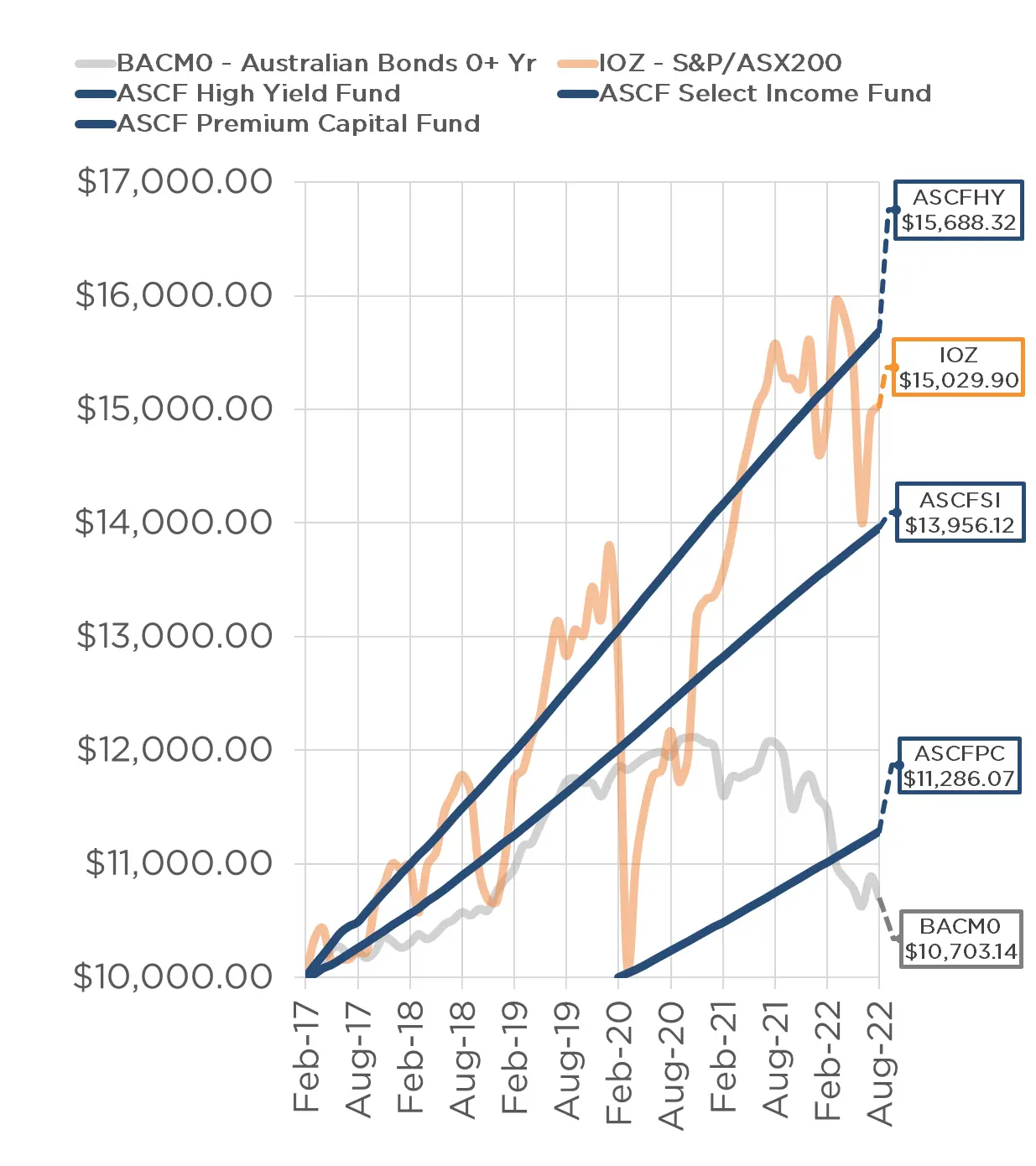

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

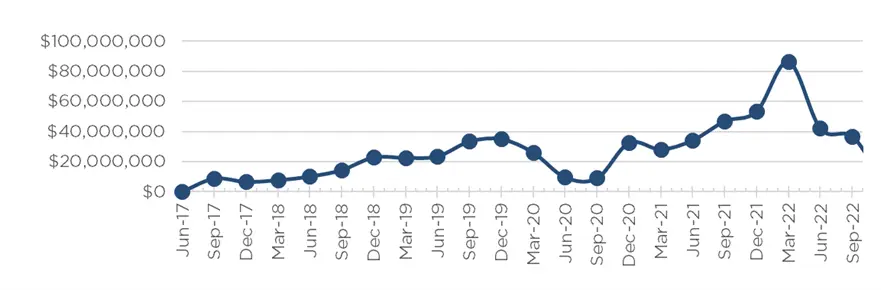

Loan originations and inquiry levels in October remained strong with over $8m in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of October.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of October 2022

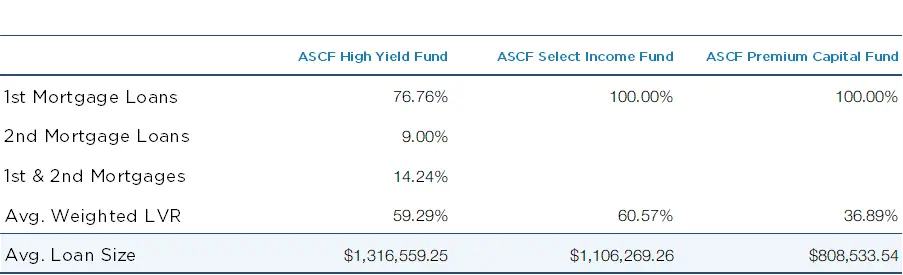

Current Loans by Fund Source

as at 31st of October 2022

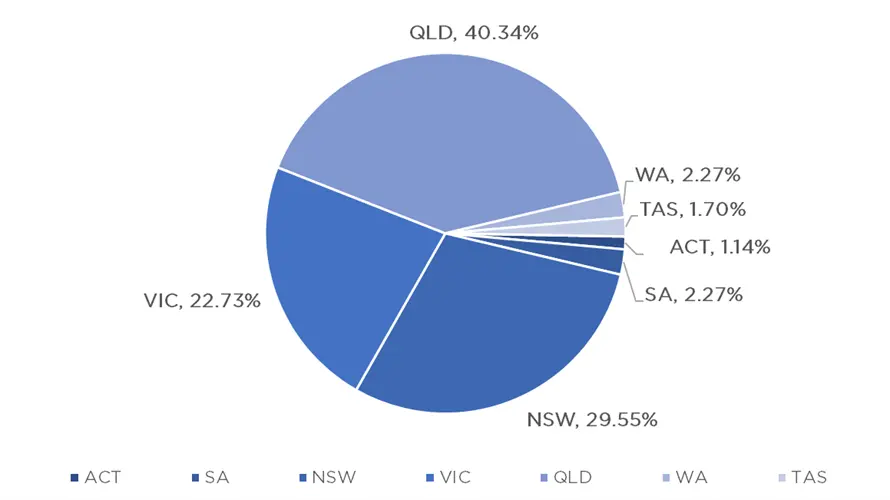

Current Loans Geography

as at 31st of October 2022

Why Invest with ASCF?

ASCF values transparency and is proud of its strong track record of success.

Detailed information relating to the financial performance and position of each Fund and our Compliance Audit Reports are available on our website, click here.

A summary of Loans held to date is also available on our website and is updated monthly, click here.

Investors can see exactly where their funds are invested by viewing the Summary of Loans which displays the Loan amount, Loan to Value Ratio, Existing Mortgage Considered, Settlement Date, Interest Rate Per Annum, Loan Term, Security Held, Security Type, Location within Australia, which ASCF Fund the Loan is in and the Loan Status.

What other mortgage fund has this type of disclosure available?

Additionally, active management of each of the Fund’s Loan Portfolios ensures that there is an appropriate level of diversification across Borrowers, Loan size, Geographic location and Loan sector (residential, commercial, retail and industrial), with an appropriate exposure and weighting having regard to the Objectives of the Funds and the Lending Guidelines found in the PDS.

To limit risk, the maximum loan amount we can lend to a borrower is 80% of their property value based on a current valuation of the security property for ASCF Select Income Fund and ASCF High Yield Fund (including second ranking mortgages) and 70% for ASCF Premium Capital Fund.

In essence, ASCF’s investment products are subject to a significant amount of operational oversight to ensure that investors are informed and protected.

Since inception ASCF has paid all investors their full targeted rate of return on time and in full.

Just another reason to invest in an ASCF fund.

An Interesting Transaction

Problem:

A high net worth borrower was introduced to ASCF by one of our premium brokers. The customer had settled on two commercial property purchases in Brisbane for cash, but required funding to settle a third commercial property purchase as his bank could not meet the settlement date.

Solution:

We confirmed the values on all three security properties via Contract of Sale and agents appraisals and lent $2,000,000 at an interest rate of 12% pa with an LVR of 34.75%.

The proposed exit was to be refinance, however the customer has since sold one of the properties for significantly more than his purchase price and will settle the sale prior to our 2 month term expiry and repay the loan.

What ASCF Does Differently:

When traditional lenders fail to understand your situation, its ASCF that bridges the funding divide.

Market Update

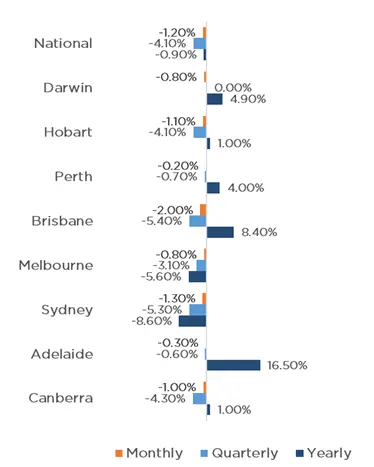

National property prices have fallen for the sixth consecutive month, with values declining a further 1.2% in October. Whilst the price correction continues, there is some signs of easing within the capital cities, with the rate of decline slowing following falls of 1.6% (August) and 1.4% (September), reducing to a 1.1% decline in October.

Queensland capital cities recorded the most significant monthly change with the Home Value Index recording a 2% reduction. New South Wales, Tasmania and Canberra experienced further declines of 1.3%, 1.1% and 1% respectively. Smaller falls of 0.8% for Victoria and the Northern Territory, with South Australia and Western Australia experiencing the smallest reductions of 0.3% and 0.2% respectively.

Despite the continued reduction in house prices, at the combined capital city level, housing values have fallen just 6.5% following a 25.5% increase through the upswing, with Sydney recording the largest falls of 10.2% since the January peak (after a 27.7% rise), and Melbourne down 6.4% since February (after a 17.3% rise). Interestingly, unit prices have held value better throughout the downturn (down 4.2%), likely driven by surges in rental returns, as well as experiencing smaller growth during the upswing.

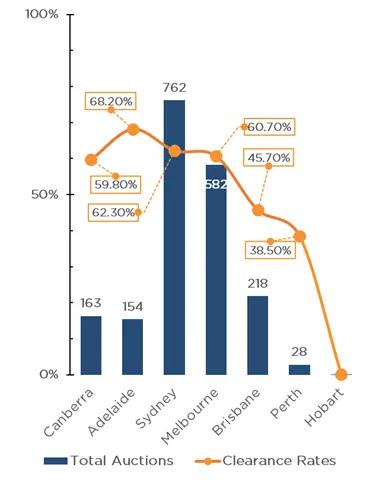

Supply remains lower than previous years, with the number of newly listed capital city dwellings in October down 25.2% from 2021, and almost 19% below that of the previous five-year average. This lack of supply is likely to contain the price falls to an extent, as there has not been any significant upswing in panicked selling or forced sales. The last weekend of October saw a total of 1,908 auctions take place across the capital cities, well below the 3,546 on the same weekend in 2021.

Clearance rates also remain lower than last year, with the weighted average clearance rate across the capital cities at 59.8% (down from 76.8% in 2021) in the last weekend of October. Similar to last month, clearance rates in Adelaide were the highest of the weekend, with a clearance rate of 68.2%, followed by Sydney (62.3%), Melbourne (60.7%), Canberra (59.8%), Brisbane (45.7%) and Perth (38.5%).

Whilst it is too early to determine if the worst of the decline phase is over, the RBA’s decision to raise the cash rate by a further 0.25% instead of 0.5% for the second straight month, despite the high inflation reading for the September quarter, indicates they do expect inflation to start moderating.

Clearance Rates & Auctions

24th – 30th of October 2022

Property Values

as at 31st of October 2022

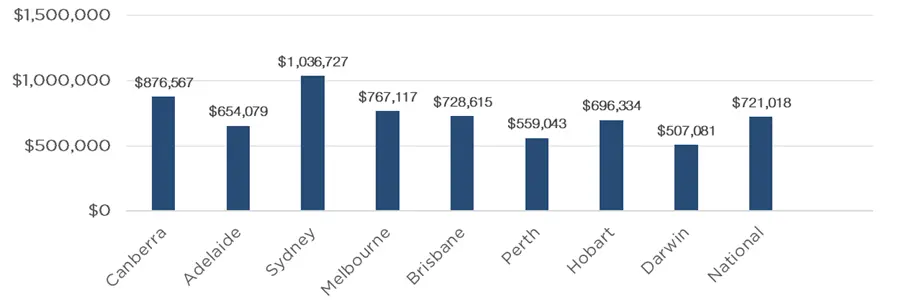

Median Dwelling Values

as at 31st of October 2022

Quick Insights

Housing Accords

The Federal Government’s new policy of targeting 1 million new homes over 5 years could be a difficult target to achieve based on current estimates however the policy has merit in attempting to deal with the ongoing structural under supply of housing across the country with significant economic benefits.

Source: Australian Financial Review

Low Vacancies

Co-living and build-to-rent operator UKO expects to more than double its portfolio to over 2500 rental units over the next two years after leasing up its newest building in inner Sydney in just four weeks. Near record low rental vacancy rates in Sydney has lifted occupancy across UKO’s portfolio of 18 buildings and more than 1000 apartments to 98 per cent and allowed it to bump up asking rents.

Source: Australian Financial Review

An Opportunity Presents

Some seasoned landlords are now taking advantage of the lull in the market to bulk up their portfolios. Domain calculated that a 4.34 per cent gross rental yields will cover the mortgage repayments on an average standard variable rate loan, taken on a 20 per cent deposit over 30 years. This means houses in 11 per cent of all suburbs in NSW are earning high enough rents to cover the mortgage repayments and even putting some extra cash into the landlords’ pockets.

Source: Australian Financial Review