Trading Update

We are pleased to advise that we have increased our targeted distribution rates across all our funds.

The rates for the 3, 6 and 12 month investment terms have been increased by 0.25% per annum and the 24 month rates have increased by 0.1% per annum.

We are also pleased to advise that we have increased our targeted distribution rates in our ASCF Private Fund, this fund is open to wholesale and sophisticated investors.

The 6, 12 and 18 month term investments in this fund have increased by 0.30%.

The rate increases across all funds will apply to all new investments and existing investments will receive the benefit of the new rates as the investments roll over on their respective maturity dates.

ASCF Current Targeted Distribution Rates

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

The new RBA governor has certainly showed her hand in terms of how she intends to ensure inflation comes back within the RBA target band of 2% – 3% by 2025.

We still believe we are likely to hit the target by the end of 2024 with rate reductions still likely next year and whilst the September quarter inflation print was slightly above consensus we believe the downward trend remains intact and will become evident in the subsequent quarterly data releases.

The increased levels of overseas migration are obviously having a positive impact on the economy and helping to fill the post Covid job vacancies but they are also adding to inflation pressures in terms of housing and increased spending generally.

Money markets are currently indicating that the chances of a further rate rise are less than 50% but this will now obviously be data dependent and if one thing became evident from last week’s decision its that the RBA is more likely to move quickly should any subsequent quarterly inflation prints not be in line with their current estimates.

The rate increase did little to impact the auction clearance rates with the average across all capital cities holding up well at 68.6% and 63.1% respectively for the first two weekends post the RBA decision. Whilst unemployment remains low and governments struggle to implement policies that will help with the structural undersupply of housing across the country we do not believe the most recent interest rate rise will overly impact property prices however it may temper the month on month growth we have seen over the last several months.

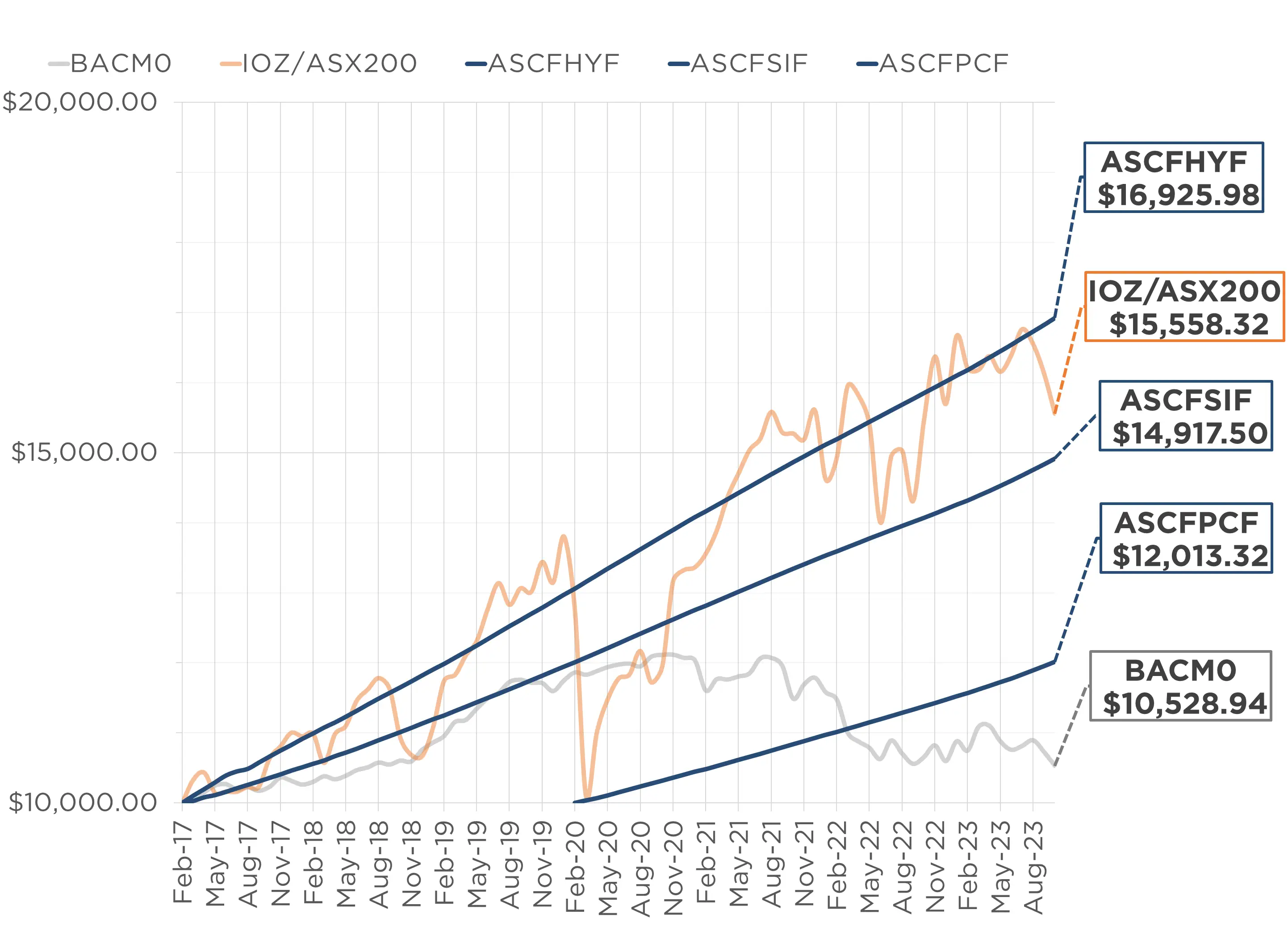

Monthly Managed Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

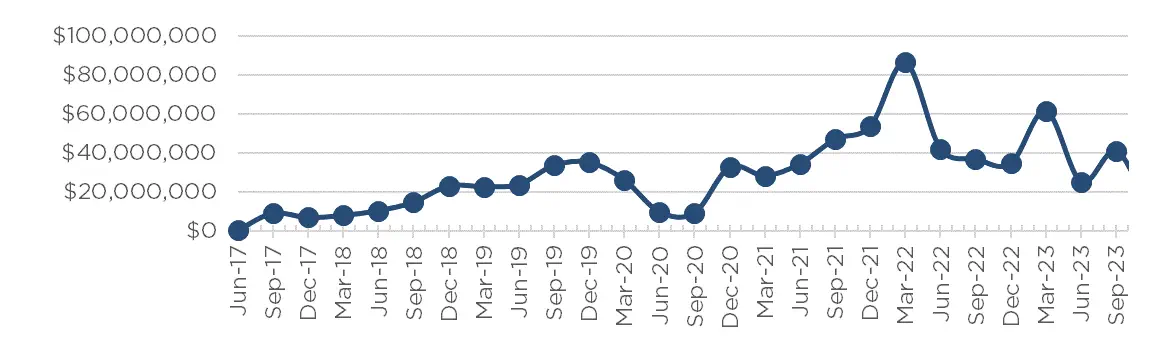

Managed Funds Under Management

as at 31st of October 2023

| September 2023 | |

|---|---|

| ASCF High Yield Fund | $130,469,121.97 |

| ASCF Select Income Fund | $44,129,618.73 |

| ASCF Premium Capital Fund | $26,461,353.82 |

| Combined Funds under Management | $201,060,094.52 |

In October, loan originations and inquiry levels remained solid, with $11,861,352.73 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of October.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of October 2023

Current Loans by Fund Source

as at 31st of October 2023

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 81.87% | 100% | 100% |

| 2nd Mortgage Loans | 14.76% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 3.37% | 0% | 0% |

| Avg. Weighted LVR | 55.11% | 60.43% | 43.75% |

| Avg. Loan Size | $1,446,452.63 | $1,181,291.67 | $700,476.49 |

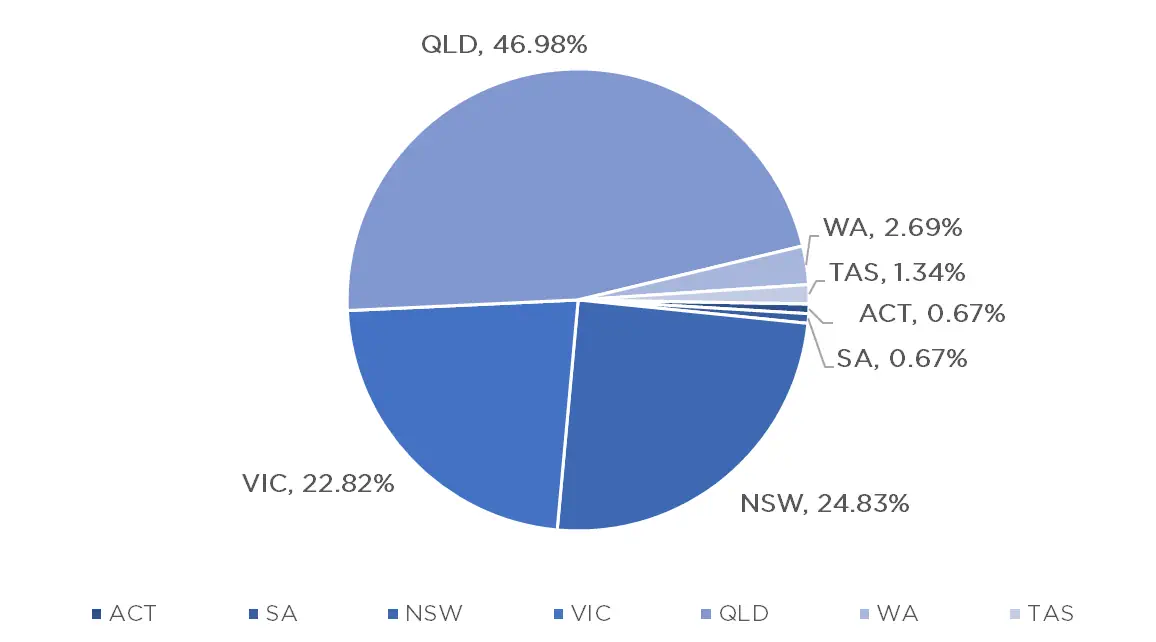

Current Loans Geography

as at 31st of October 2023

YEARLY AUDITED FINANCIALS ARE NOW ONLINE

We are pleased to advise that ASCF’s full year audited 2023 Financial Statements and Compliance Audit Reports for ASCF Premium Capital Fund, ASCF Select Income Fund and ASCF High Yield Fund are now available to download from our website.

You can view the financials by clicking here.

Should you have any questions in relation to the financials, please do not hesitate to contact our Investor Relations team on 1300 269 419.

2023 TAX CERTIFICATES NOW AVAILABLE

Tax Certificates for financial year ending 30th June 2023 are available to download via our online portal. If you are not registered for the portal, please contact us on 07 3506 3690 and our friendly team will assist you through the registration process.

Make sure you have the mobile phone associated with your account handy, as it will be needed during the registration process.

Need help?

Please contact us:

[email protected]

07 3506 3690

Monday – Friday 9am – 5pm AEST

Why Invest with ASCF?

ASCF is one of Australia’s leading short-term mortgage lenders, our objective is to provide consistent, high yielding investment returns that are secured by quality Australian real estate assets. All of our loans are by way of a registered mortgage over Australian residential, vacant land and/or commercial property, we do not do any construction loans, property development loans, high rise apartment loans, unsecured personal loans, car loans or equipment finance.

One of the ways ASCF continues to grow and thrive is because of how we effectively manage liquidity – at any one time we usually hold between 5% and 10% of the value of the Fund in liquid assets to cover withdrawals, monthly distributions and expenses.

Investing in a mortgage fund that effectively manages its liquidity can offer several advantages to investors. Liquidity management is crucial for such funds to ensure they can meet redemptions and seize investment opportunities while minimising risks. Here are five advantages for an investor in a mortgage fund that properly manages its liquidity:

Reduced Redemption Risk: When a mortgage fund manages its liquidity well, it is better prepared to meet redemption requests from investors without having to liquidate its loan book. This reduces the risk of forced liquidations, which could lead to losses for investors.

Stable Returns: Effective liquidity management can help the fund maintain a more stable portfolio, which, in turn, can lead to more predictable returns for investors. Avoiding sudden disruptions due to liquidity issues can contribute to a smoother investment experience. ASCF has a proud record of ensuring the value of investors’ initial investment has remained stable at $1.00 per unit since inception.

Capital Preservation: Proper liquidity management ensures that the fund retains enough cash or highly liquid assets to cover short-term obligations. This helps protect investors’ capital and ensures that they are less exposed to unexpected losses. None of our investors has ever lost any of their capital by investing in any of the three ASCF Mortgage Funds.

Enhanced Yield Opportunities: With adequate liquidity at its disposal, a mortgage fund can take advantage of attractive investment opportunities as they arise. This agility can lead to higher yields and potentially improved returns for investors.

Risk Mitigation: Liquidity management is a key aspect of risk management. A fund that handles liquidity effectively is better positioned to navigate market volatility, economic downturns, or unexpected events, reducing overall risk exposure for investors.

It’s important for investors to carefully assess a mortgage fund’s liquidity management strategy and policies before investing, as this can have a significant impact on the fund’s performance and their own investment outcomes.

An Interesting Transaction

Problem:

A valued broker introduced a consortium of professional individuals to ASCF seeking funding to refinance an existing loan secured by a development approved subdivision of land in Mount Cottrell, in Victoria.

Solution:

Our valuation confirmed an LVR of 65.22% against the property and we provided a 12 month facility for $3m with interest prepaid for the first 6 months at a rate of 11.95% pa. We were also able to take collateral mortgages over two residential properties to strengthen our security position.

The borrower will repay the loan from the sale of the site or via refinance through a construction facility.

What ASCF Does Differently:

Another example of how ASCF is able to assist its customers in executing on their wealth creation strategies.

Market Update

The November RBA meeting brought the 13th interest rate increase for the cycle, raising rates by 25 basis points, bringing the cash rate to 4.35%. This increase was anticipated following the uptick in inflation as reported in the last monthly newsletter.

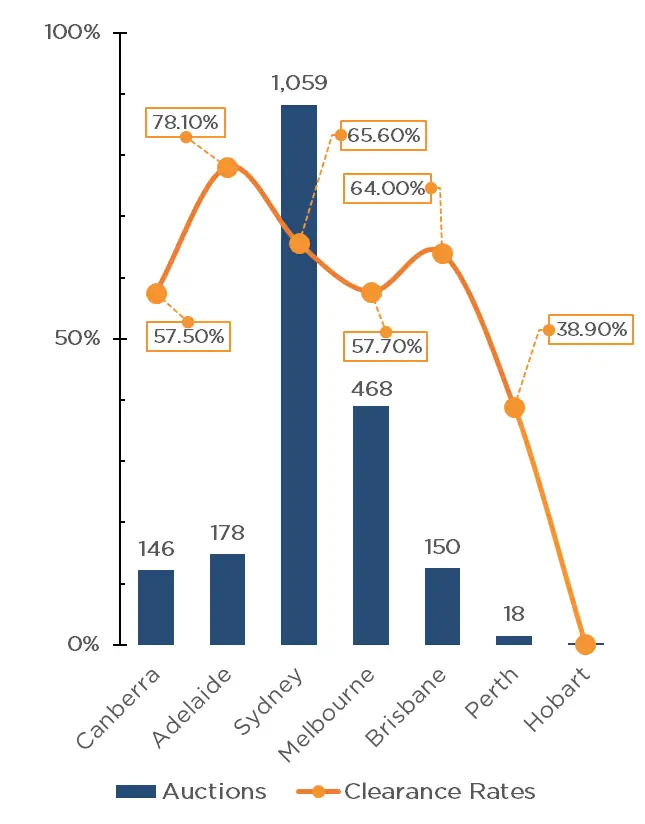

The first weekend of November saw a week-on-week reduction in auctions of 40% in the lead up to the Melbourne Cup with 2,015 auctions taking place. This was however somewhat expected following the “Super Saturday” auction in October, with 3,381 auctions being held over a single weekend.

Sydney held the most auctions by a considerable margin, with 1,065 well above that of Melbourne with 453. Adelaide, Brisbane and Canberra all recorded similar figures with 181, 150 and 144 respectively, whilst Perth recorded just 18 auctions for the weekend.

The uncertainty surrounding interest rates marginally impacted clearance rates, with the clearance rate falling to 68.6% for the weekend, despite the lower levels of stock. This was evident with just Adelaide and Sydney recording above a 70% clearance rate with 74.8% and 71.9% respectively. Brisbane was not far behind with 68.6%, so too with Canberra at 67.7%. Melbourne was well below however, with a clearance rate of just 60.8% for the weekend.

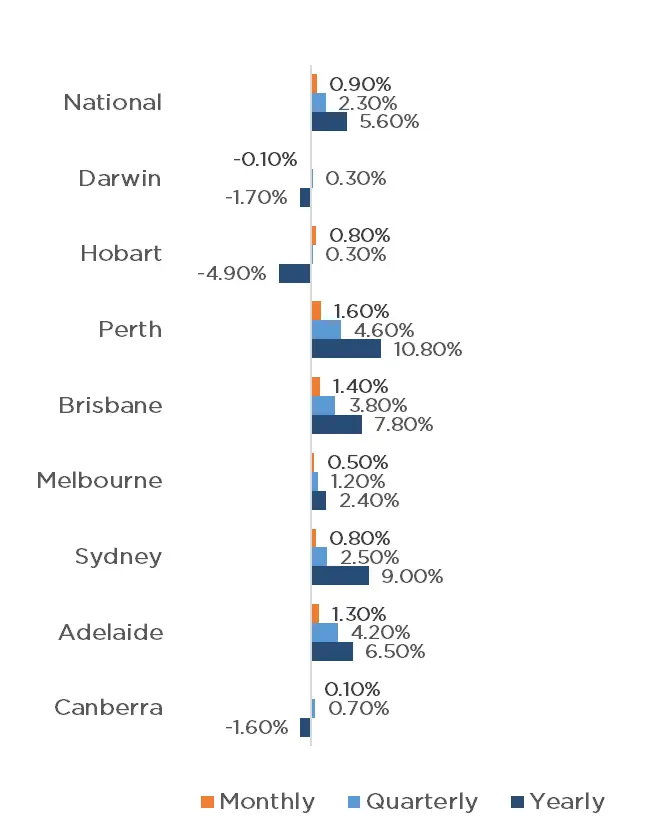

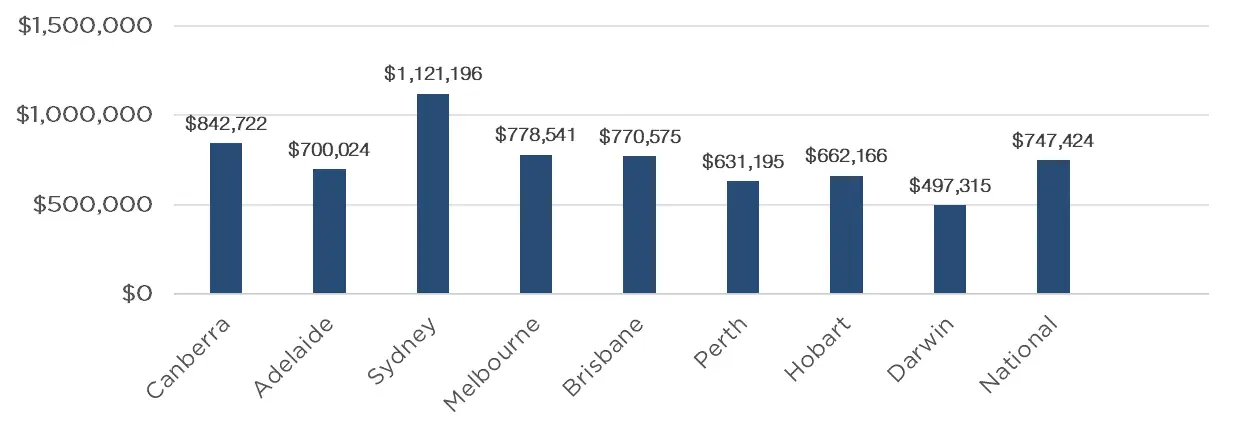

CoreLogic’s national Home Value Index rose a further 0.9% in October, which could see property prices reach a new record high before the end of year if the trend continues. This was driven by strong growth above 1% in 3 capital cities with Perth recording the largest monthly increase with 1.6%, followed by Brisbane and Adelaide with 1.4% and 1.3% respectively. Sydney (0.8%), Hobart (0.8%), Melbourne (0.5%) and Canberra (0.1%) all recorded growth, with just Darwin recording a loss (0.1%) for the month. With the continued strong growth of Brisbane, average dwelling prices are nearing that of Melbourne with less than $8,000 separating the two cities ($770,575 and $778,541 respectively).

Whilst most economists predicted the RBA to dampen Cup Day celebrations with a rate increase, there are mixed opinions on whether we have reached the peak. With rates already being well above economist predictions from earlier in the year, and mortgage holders feeling the pinch, a further rate rise may deter potential buyers and take the heat out of the property market, reducing the current growth rate.

Clearance Rates & Auctions

week of 12th of November 2023

Property Values

as at 1st of November 2023

Median Dwelling Values

as at 1st of November 2023

Quick Insights

Economists Stand Ground as Cash Rates Rise

Despite the rise in rates this month from the RBA economists remain resolute that any downturn is likely to be a short slowdown rather than a crash.

PEXA chief economist Julie Toth said, “We may see a welcome pause in price increases, but I doubt we’ll see another fall. On the flipside, we’ll probably see a burst of activity in refinancing.”

Source: Australian Financial Review

Growth, Growth, & More Growth

According to a survey of 10 economists and analysts conducted by The Australian Financial Review, many are expecting a 6.50% – 8.00% rise in property prices by 2024.

Jarden chief economist Carlos Cacho said, “The key drivers of this increase are expected to be continued limited listings, particularly of family homes, along with positive sentiment towards housing, given households’ expectations of RBA easing next year. That said, we don’t expect rate cuts until late 2024, at the earliest, which may challenge this positive sentiment.”

Source: Australian Financial Review

Lend Leasing in Australia

Land Lease arrrangements where a property owner owns the phyysical structure but rents the land it sits on are becomeing increasingly common in Australia with over 10,000 development under way and another 15,000 in the pipeline.

Residents say they are safer, more connected to community, and better off financially. They have become of particular interest to older Australians who need to downsize.

Source: Australian Financial Review