Trading Update

Australian Secure Capital Fund is pleased to provide this monthly update to our investors.

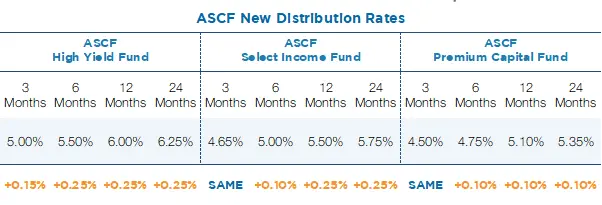

We are pleased to advise that we have now started seeing an increase in lending rates across the competitive lending landscape in which we operate.

This will enable us to increase our lending rates and maintain adequate interest margin protection across the loan portfolios in each of our retail funds.

As a consequence, we have increased our investment rates effective immediately.

The new rates are as follows:-

Yesterday’s interest rate rise by the Reserve Bank is also likely to filter through to lending rates.

We will continue to assess the impact of higher funding costs in the market with a view to increasing our rates further over the coming months as we start to see lending rates increase further.

Interestingly it appears the Reserve Bank has tempered its resolve and defied most economists’ expectations of a 0.5% increase at yesterday’s meeting by only increasing rates by 0.25%.

At this stage, our assessment is that the Reserve Bank is likely to pause at its next meeting with a view to assessing the economic impact of the prior rate increases before moving further.

The reduced rate increase is likely to mean the cash rate will peak early to mid-next year with our internal assessment forecasting a further combined increase of 0.5% between now and mid-next year thereby forecasting a peak cash rate of 3.1% by mid-2023.

Whilst property markets are still well up on the pre-COVID March 2022 values and the national September property price decline is less than August we do now expect some confidence to return to the market with the rate of declines in the market to soften further in the coming months and transaction volumes to increase.

YEARLY AUDITED FINANCIALS ARE NOW ONLINE

We are pleased to advise that ASCF’s full year audited 2022 Financial Statements and Compliance Audit Reports for ASCF Premium Capital Fund, ASCF Select Income Fund and ASCF High Yield Fund are now available to download from our website.

You can view the financials by clicking here.

Should you have any questions, please do not hesitate to contact our Investor Relations team on 1300 269 419.

PDS UPDATE

We have recently updated our Product Disclosure Disclosure Statement (PDS). The new PDS dated 30th September 2022 includes updated disclosures on our costs and fees in accordance with recently released ASIC guidelines, however there has been no change in the manner in which these are calculated. The updated PDS is available to download from our website or by clicking here. If you would like a copy mailed to you please do not hesitate to contact our Investor Relations Team.

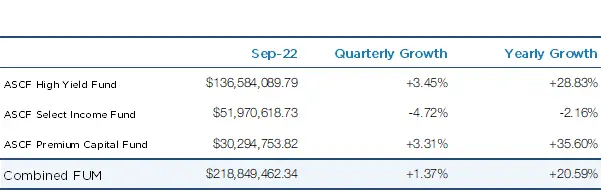

Funds Under Management

as at 4th of October 2022

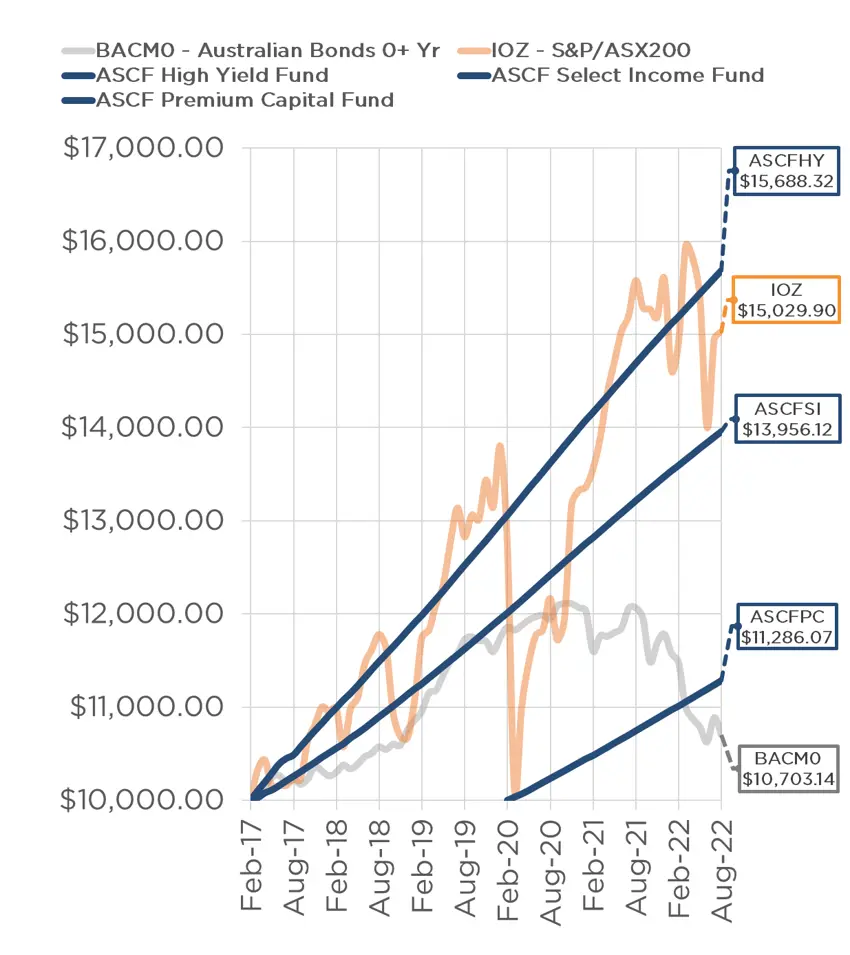

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Loan originations and inquiry levels in September remained strong with over $15m in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of September.

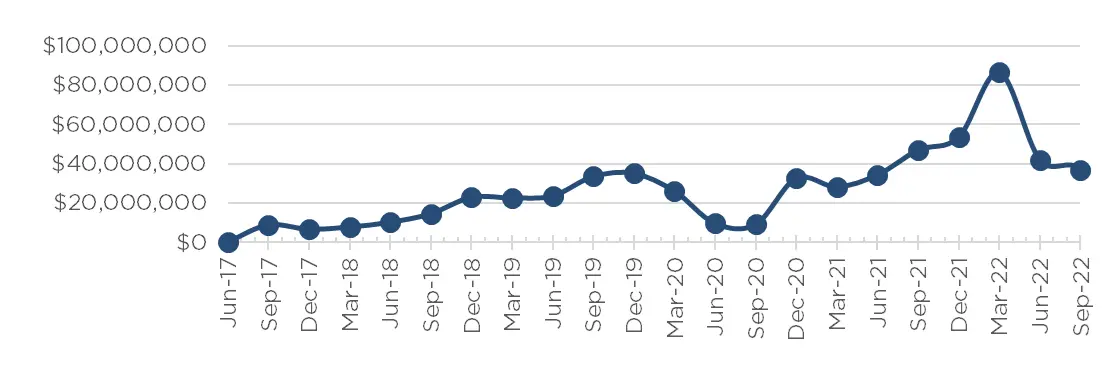

Lending Activity Update

Quarterly Loan Settlements

as at 4th of October 2022

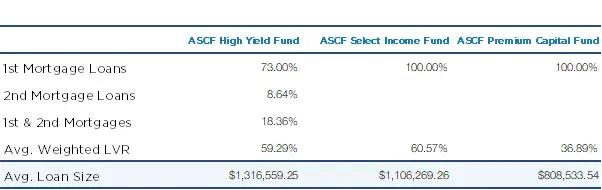

Current Loans by Fund Source

as at 4th of October 2022

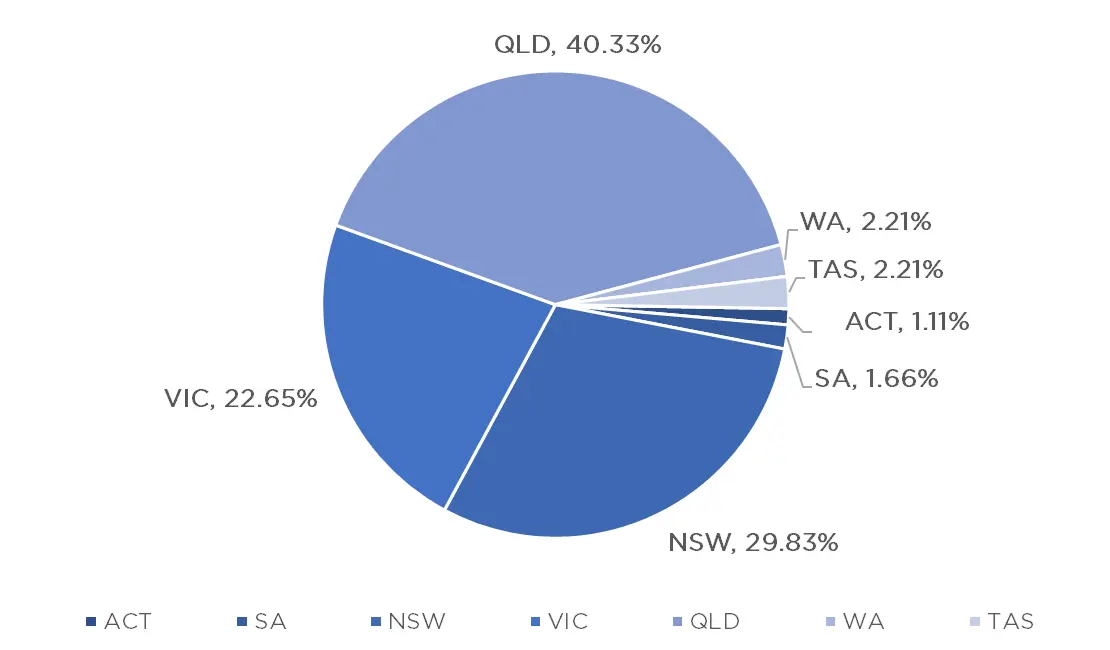

Current Loans Geography

as at 4th of October 2022

Why Invest with ASCF?

ASCF implements multiple risk mitigating strategies to ensure that investors’ funds are protected.

One of these strategies is the Investor Reserve Account which does not form part of the Fund’s assets and is in place for the sole benefit of investors across all three mortgage funds.

Contributions are made by ASCF Ltd to the account out of the management income it receives each month. These contributions are at the discretion of ASCF with a balance of 1% of funds under management per fund held in the reserve account.

Funds in the Investor Reserve account cannot be overdrawn and may be used to cover impairments and capital losses incurred on individual loans caused due to borrower defaults for either of the three ASCF pooled funds. Although this strategy is in place, to date, there has never been a need to use the funds from the Investor Reserve Account for any loan impairment or capital loss.

Furthermore, as all ASCF funds are pooled, your investment is spread across all our loans in each fund and not tied to a particular investment or security location. If a borrower on a particular loan fails to pay their interest on time you will still receive your distribution at the end of each month as your investment is spread across the entire loan book meaning there would need to be significant interest defaults across the entire loan book before our ability to pay our investors their monthly interest was impacted.

Since inception ASCF has paid all investors their full targeted rate of return on time and in full.

Just another reason to invest in an ASCF fund.

An Interesting Transaction

Problem:

ASCF was approached directly via our online origination portal by a retired town planner who required funds to purchase a retirement home in a land lease community on the Sunshine Coast, Queensland. The borrower lived on a property in Little Mountain, Queensland which had a development approval for a 7-lot subdivision over two stages.

Solution:

After obtaining a valuation on the Little Mountain property, ASCF was able to provide a 12-month loan facility of $1,035,500 at 11.25% pa secured by this property with an LVR of 52.41% which enabled him to purchase his new retirement home.

The borrower will repay the loan via the sale of the subdivided lots in stage one of the subdivision.

What ASCF Does Differently:

Supporting a quick transition into a more perfect retirement is what distinguishes ASCF from traditional lenders.

Market Update

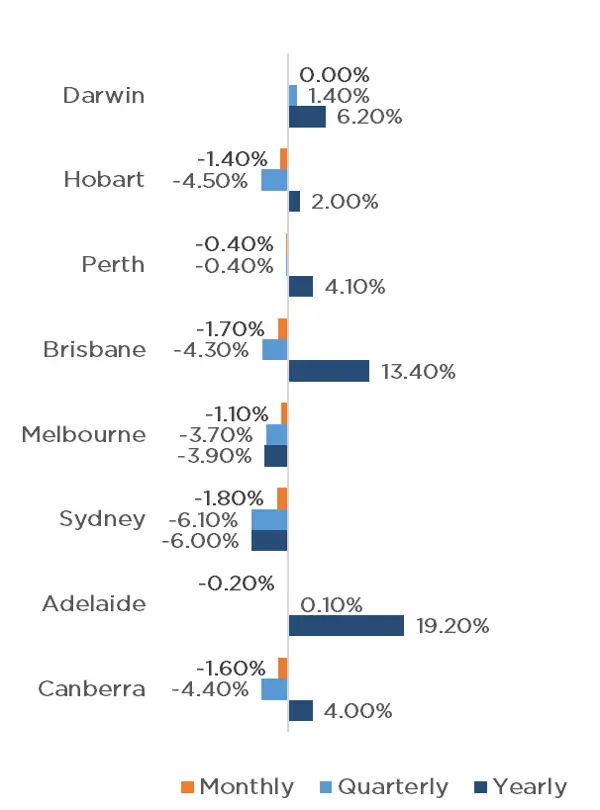

Property prices continued to decline slightly in September, with a combined average decline of 1.40% across capital cities. Interestingly Sydney and Melbourne are the only capital cities to have recorded negative growth on an annual basis, -3.90%, and -6.00% respectively, with average prices, still up nationally across both capital and regional areas by 1.70%. The monthly reduction in dwelling values was evident across all capital cities with Sydney, Brisbane and Hobart recording the largest declines with 1.80%, 1.70% and 1.40% respectively.

After a 25.50% increase in the most recent growth cycle, property prices across the combined capital cities have fallen -5.50% from this recent peak, with Sydney continuing to record the largest falls with housing values now -9.00% below the city’s January 2022 peak. Whilst the housing market has retreated in September, Adelaide and Brisbane are still up 19.20% and 13.40% respectively on an annual basis.

ASCF’s internal assessment is that property prices are likely to bottom by early next year before moving back into positive growth by mid-2023.

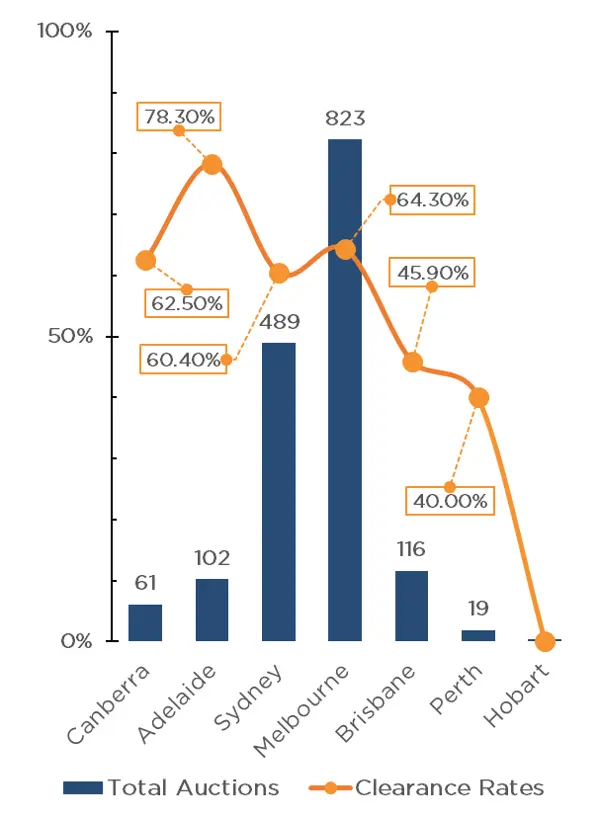

Auction activity has continued to pick up in the capitals week by week, with last week’s combined capital city’s clearance rate up 1.70% from the week prior.

The start of Spring historically begins the “selling season”, however, the flow of new listings in September was 12.00% lower than 2021, and 10.00% below the 5-year average. The reduced flow of new listings is likely preventing larger price falls, which is supported by the subtle reduction in dwelling values for September.

With supply easing, auction clearance rates have begun to bounce back, with Adelaide recording a clearance rate of 78.30% for the first weekend of October, followed by Melbourne, Canberra and Sydney with 64.30%, 62.50% and 60.40% respectively. Brisbane and Perth recorded the weakest clearance rates of 45.90% and 40.00% respectively.

As we have seen the Reserve Bank of Australia (RBA) decelerate on interest rate rises, bringing an increase of 0.25% on the 4th of October 2022 (following four consecutive months of 0.50% increases), it appears that the rapid rise of interest rates could be slowing as we move towards the end of the year.

Clearance Rates & Auctions

26th – 2nd of October 2022

Property Values

as at 30th of September 2022

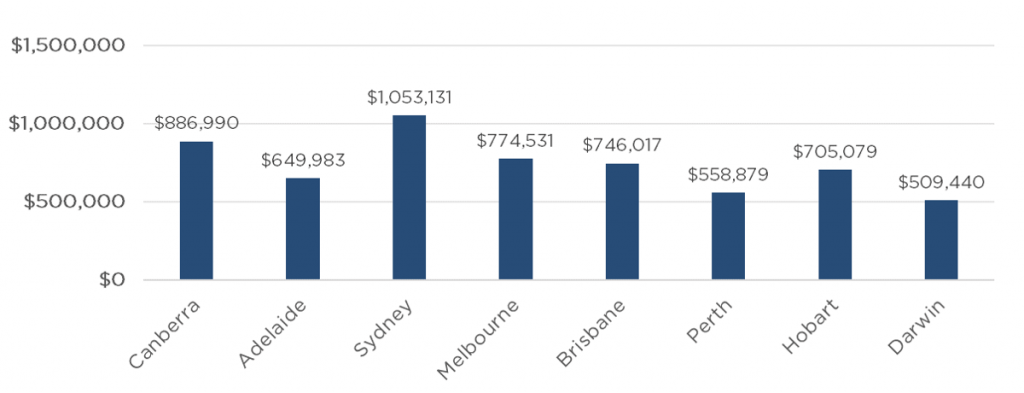

Median Dwelling Values

as at 30th of September 2022

Quick Insights

Art Deco Shift

An art deco home in Melbourne, Victoria has successfully sold for $200,000 more than its asking price last weekend, totalling $2.1 million dollars. As construction costs rise, it would seem investors are now favouring properties that require as little further investment as possible. Property agent Ms Bloom, from Morrell & Koren said, “Properties which you don’t have to spend money on will do best in this market…”

Source: Australian Financial Review

First Home Grants

The Productivity Commission has commented that stamp duty concessions and first home buyer grants, which totalled $2.7 billion dollars last year, can push up dwelling prices. The federal government which provides $1.6 billion dollars every year to states for housing have announced plans to tighten the targets each state is required to hit with their own housing grant initiatives prior to accessing federal funding.

Source: Australian Financial Review

Rentals Increase

Median rents have increased by over $100 per week in 35 house and 23 unit markets across the nation as the residential housing supply tightens. Nationally, unit rents surged by 11.30% over the past 12 months, one of the highest annual growth rates on record. Brisbane in particular had an incredible growth rate of 14.10%.

Source: Australian Financial Review