The 18th of April saw the return of international travel with Australia and New Zealand opening their borders for a Trans-Tasman travel bubble. The travel bubble allows for direct flights between Australia and New Zealand, without the requirement of the 14-day hotel quarantine; arriving just in time for the winter ski season.

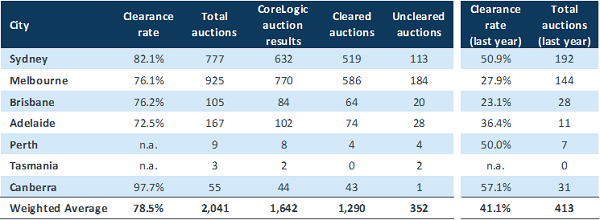

The opening of borders and the ongoing rollout of the COVID-19 vaccine continue to improve consumer confidence with auction clearance rates remaining high, and well above 2020 results. For the last weekend of April, Canberra and Sydney recorded strong clearance rates with 97.7% and 82.1% respectively, whilst Brisbane, Melbourne and Adelaide also recorded results of 76.2%, 76.1% and 72.5%, attributing to a weighted average of 78.5% for the weekend, across 2,041 auctions.

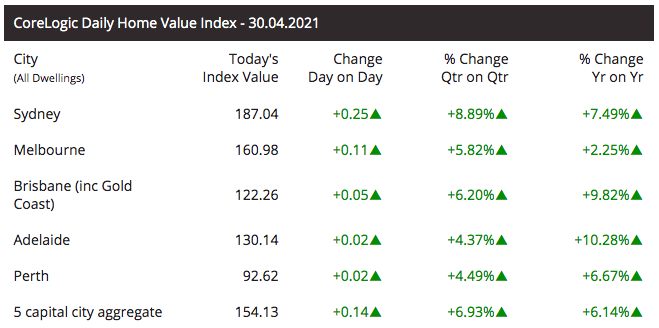

Property prices continue to rise with the CoreLogic Daily Home Value Index showing increases across the five major capital cities with all cities recording growth across day on day, quarter on quarter and year on year data. Sydney and Brisbane have seen the largest growth for the quarter with 8.89% and 6.20% respectively, with Adelaide and Brisbane achieving the highest growth for the year with 10.28% and 9.82% respectively. The five capital city aggregate also remains high with a 6.14% increase for the year on year.

On the 1st of April 2021, we launched the 24-month investment account for the ASCF Premium Capital Fund. This 24-month term offers investors a distribution rate of 5.55% pa.

Our loan origination enquiries remain strong and the unit price across all three retail funds remains stable at $1.00.

This article appeared in our April 2021 Investor Newsletter – download the full newsletter here.