In recent weeks, Victoria has progressed to stage four lockdown restrictions leading to a decrease in loan inquiries from Victorian brokers. In all other Australian states, however, loan inquiry levels continue to increase since our appointment to the AFG Panel. We continue to enhance our brand awareness across their network, thereby increasing our exposure to the AFG lending market.

The recent decrease in confirmed COVID-19 cases across Victoria indicates the tightened restrictions are finally showing results. As we enter week four of the strict six-week lockdown, the lowest daily numbers since early July were recorded on 31st August with just 73 new cases.

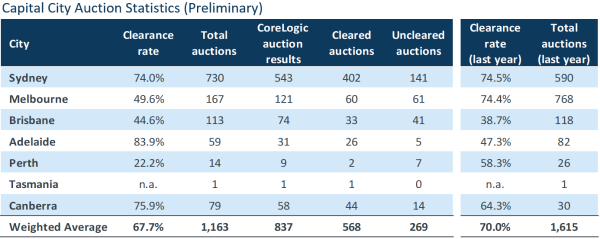

Recent data from CoreLogic for the last week of August show a rise in auction clearance rates to 67.7% across the capital cities, just 2.3% less than the same weekend last year. Whilst total auction numbers were down from 1,615 to 1,163, the total auctions in Sydney and Canberra were well above this time last year. The shortfall across total auctions and clearance rates is largely due to the current lockdown conditions within Victoria, with Melbourne reporting a clearance rate of 49.6% from 167 auctions, in comparison to 74.4% from 768 auctions last year.

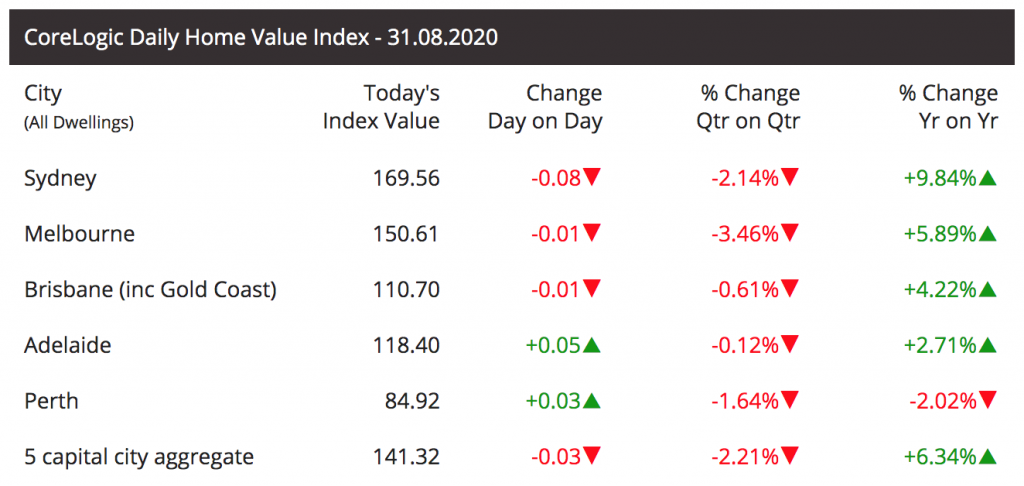

Furthermore, the CoreLogic Daily Home Value Index as at the 31st August 2020 indicates that the five capital city aggregate change year-on-year remains up by 6.34%, with all capital cities remaining positive with the exception of Perth.

Our retail Funds have continued to perform strongly during August, with Funds Under Management (FUM) returning to pre-COVID levels of $115 million including a strong cash balance of $13.8 million and over $5 million in cash reserves.

This article appeared in our August 2020 Investor Newsletter – download the full newsletter here.