The outlook for 2021 continues to remain positive as February brought the rollout of the first stage of vaccines to Australia. Phase 1a of the rollout plan has begun, with quarantine and border workers, frontline healthcare and the staff and residents at aged care centres around the country the first in line to receive the vaccine.

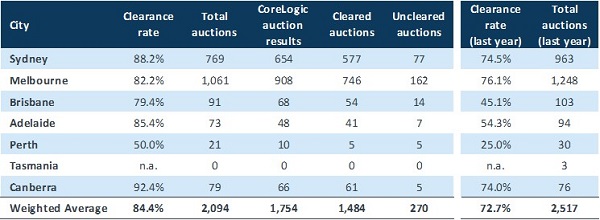

The news of the vaccine rollout appears to have prompted a positive response in the housing market with over 2000 properties heading to auction in the second last week of February. Auction clearance rates also continue to soar with an average weighted clearance rate of 84.4% across the seven capital cities, the highest level since May 2015.

This follows consumer sentiment of a “seller’s market” with clearance rates in Canberra reaching 92.4%, followed by 88.2% in Sydney, 85.4% in Adelaide, 82.2% in Melbourne and 79.4% in Brisbane, whilst Perth had just a 50% clearance rate and no auctions in Tasmania.

ASCF Funds Under Management (FUM) continue to increase, with close to $135m invested across our retail funds.

Our loan originations remain strong with record loan enquiries through both our broker networks and our online loan origination portal as borrowers seek to make the most of opportunities that are presenting themselves in the current market.

The unit price across all three retail funds remains stable at $1.00.

This article appeared in our February 2021 Investor Newsletter – download the full newsletter here.