The month of July brought the start to the new financial year and unfortunately, the return of lockdowns across some Australian States and cities. Whilst most states have now exited lockdown, NSW remains in lockdown for a further four weeks in a bid to reduce infection rates across the community. In positive news, the 2020 Tokyo Olympics have begun and it was announced that Australia will once again be hosting the Olympics, with Brisbane 2032 being confirmed. The excitement of the Olympics is sure to bring considerable infrastructure investment to the city over the next decade and boost Australian tourism.

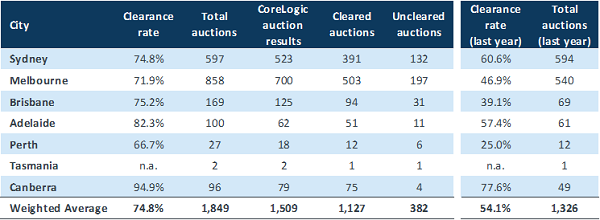

The total auctions for the weekend of July 24/25 were down compared to last month, with many cities being in lockdown. Melbourne came out on top with 858 auctions taking place for a clearance rate of 71.9% followed by Sydney with 597 auctions and a clearance rate of 74.8%. Brisbane, Adelaide and Canberra continued to show strong clearance rates with 75.2%, 82.3% and 94.9% respectively, although the number of auctions were down. Whilst total auctions of 1849 for the capital cities is down, the weighted average clearance rate of 74.8% demonstrates the strength of the current property market.

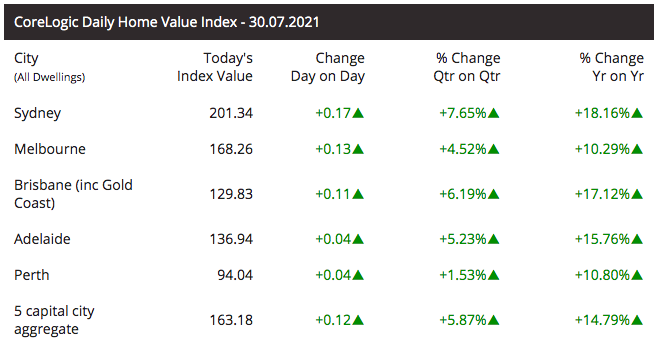

Despite the recent lockdowns, property prices continue to increase with the year on year change above 10% across all cities and an average of 14.79%, with Sydney, Brisbane and Adelaide leading the way with 18.16%, 17.12% and 15.76% respectively. The change quarter on quarter also remains positive with an average of 5.87%, again with Sydney, Brisbane and Adelaide in front with 7.65%, 6.19% and 5.23% growth.

The unit price across all three retail funds remains stable at $1.00 and our loan originations remain strong.

This article appeared in our July 2021 Investor Newsletter – download the full newsletter here.