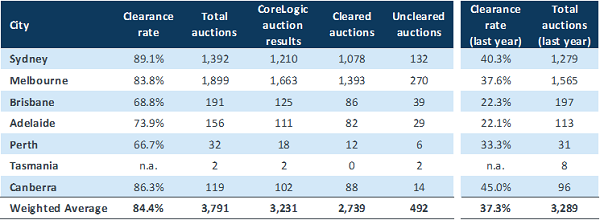

Whilst the recent three-day lockdown in Queensland has threatened to impact Easter travel plans, the auction volumes across the capital cities continue to flourish with 3,791 auctions taking place on the last weekend of March, the highest number since the week ending 25th March 2018.

Clearance rates also remain exceptionally high with Sydney, Canberra and Melbourne all achieving greater than 80% clearance rates with 89.1%, 86.3% and 83.8% respectively, contributing to a weighted average of 84.4% across the combined capitals. This is a marked improvement over the results last year, with just 37.3% of properties selling at auction.

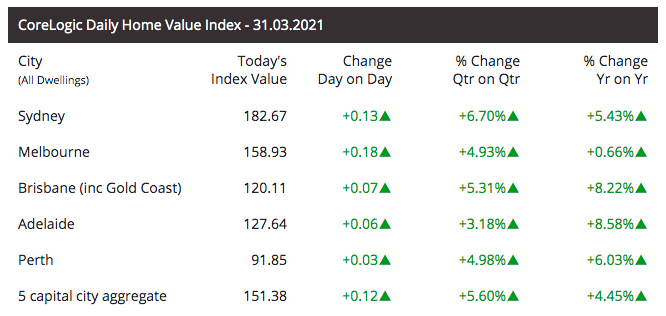

The CoreLogic Daily Home Value Index also indicates significant increases across the five major capital cities with all cities recording growth across day on day, quarter on quarter and year on year data. Sydney and Brisbane have seen the largest growth for the quarter with 6.70% and 5.31% respectively, with Brisbane and Adelaide achieving the highest growth for the year with 8.22% and 8.58% respectively. This correlates with the forecasts by the major banks that property prices would continue to rise throughout 2021.

The positive outlook on the Australian property market has contributed to significant growth for the ASCF retail investment funds with Funds Under Management (FUM), experiencing the largest monthly growth since inception with over $12 million of new investment, contributing to a total investment across our retail funds of over $147 million.

Loan originations for the month also reached record levels with over $19 million in loans being written during the month. This has been driven by borrowers seeking to capitalise on investment and growth opportunities that are presenting themselves in the current market.

The unit price across all three retail funds remains stable at $1.00.

This article appeared in our March 2021 Investor Newsletter – download the full newsletter here.