The month of May saw the delivery of the 2021 federal budget and the unfortunate return of the Melbourne lockdown. The federal budget was delivered on the 11th of May with a continued focus on stimulating the economy. Tax offsets for low and middle-income earners will continue for another year and a significant increase in spending for aged care was announced on the back of improved aged care services and thousands of additional home care packages.

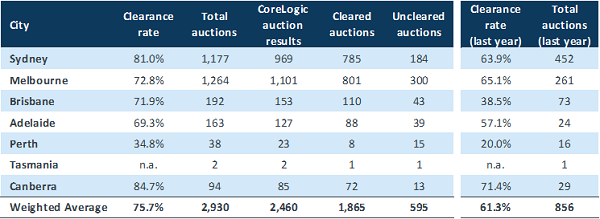

Despite the recent lockdown in Melbourne, preliminary auction clearance rates for the last weekend of May remain high with a weighted average clearance rate of 75.7%, well above the 61.3% of the corresponding weekend last year. Canberra led the way with a high 84.7% clearance rate, with Sydney recording 81% of auctions clearing, with Melbourne and Brisbane behind with 72.8% and 71.9% respectively. The total auctions for the weekend also saw an increase, with 2930 auctions taking place with Melbourne surprisingly topping the tally with 1264, ahead of Sydney with 1177.

On the back of Westpac’s property forecast, which predicts values rising by 20% over two years, property prices continue to climb across the 5-capital city aggregate, with Brisbane experiencing the largest growth year on year with 12.12%, followed closely by Adelaide at 11.84% and Sydney with 11.16%. The quarter-on-quarter change reflects similarly positive results with Sydney coming out on top with a change of 9.32%, followed by Brisbane and Melbourne with 6.57% and 5.51% respectively.

Performance across the retail investment funds remains positive, with a continued increase in demand via both our loan origination portal and broker inquiries.

The unit price across all three retail funds remains stable at $1.00.

This article appeared in our May 2021 Investor Newsletter – download the full newsletter here.