Throughout September, Victoria continued with their stage four lockdown measures resulting in a significant decrease in new daily COVID-19 cases for the state, prompting the removal of curfew and the easing of some restrictions. Private real estate inspections are now once again possible, leading to an increase in inquiry providing promising signs for the months ahead.

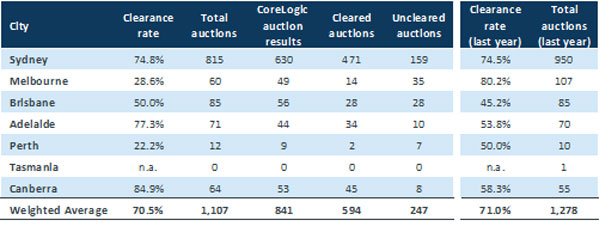

Auction clearance rates across the capital cities for the last weekend of September returned to levels similar to last year, despite the restrictions in Melbourne. As anticipated, Melbourne clearance rates were well below 2019 results with 28.6%, down from 80.2% last year. Brisbane, Adelaide and Canberra recorded significantly improved results on the same weekend last year, achieving clearance rates of 50%, 77.3% and 84.9% respectively, up from 45.2%, 53.8% and 58.3% last year. Sydney recorded their best clearance rate of the month with 74.8%, up from 74.5%.

The high clearance rates and an increase in properties going to auction, indicates the turning of the tide as investors and home-buyers alike continue to have faith in the property market.

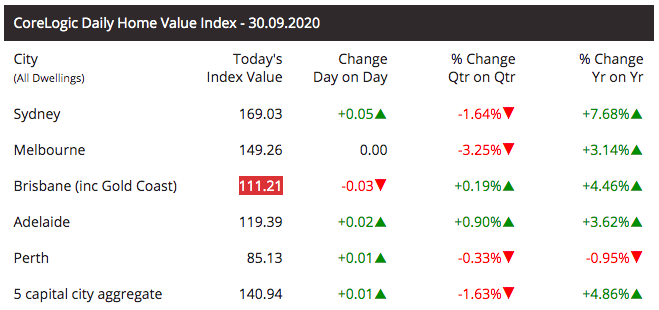

The year on year dwelling prices across the 5 major capital cities remains positive with the exception of Perth, despite the poor quarterly performance of Melbourne due to the Victorian Lockdown.

The total Funds Under Management (FUM) of our retail funds continues to grow, with over $116 million. We continue to maintain our strong cash position of over $19 million ready for the return of the Melbourne market in the coming weeks and continue to see strong loan enquiries both through our broker network and our recently launched online loan origination portal.

This article appeared in our September 2020 Investor Newsletter – download the full newsletter here.