Trading Update

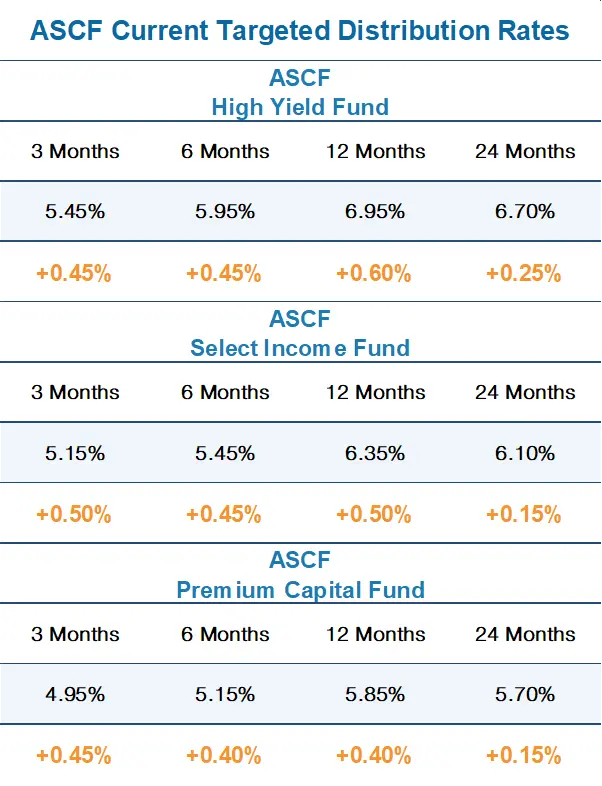

ASCF is pleased to advise that we have increased our investment rates across all our retail funds effective the 1st February 2023.

Our 12 month rate in our ASCF High Yield fund has now increased to 6.95% p.a paid monthly which we consider to be a very attractive rate and the highest of any fully licensed and fully audited retail pooled mortgage fund in the country with all fund assets held by an independent ASIC approved custodian. The new investment rates are as follows:

The new rates will apply to all new and additional investments and existing investors will receive the benefit of the new rates on the rollover of their accounts on the scheduled maturity date of their investment.

The inflation data released last week has probably cemented a further 0.25% rate hike in the RBA official cash rate at next week’s meeting of the board.

The increase of 7.8% was slightly above market consensus at 7.6% but below the RBA estimate of 8%.

We believe that inflation has now peaked and that the RBA is unlikely to increase rates further at their March meeting, as the risk of pushing the economy towards recession outweighs the benefit of a further clamping down on consumer and business spending to curtail inflation.

Whilst increasing mortgage rates has undoubtedly put home owners under some

pressure and reduced disposable income we do consider that most household and

company balance sheets remain strong and with continuing low unemployment and the ongoing wages growth we are seeing across the Australian economy, we believe the impact on property prices will wash out by mid year.

In fact we think the bottom in property prices is probably here and if the reserve bank does pause in March and stay on hold, we think prices will flatten with some level of confidence returning to the market over the coming months.

Interestingly, we have noticed more and more economic commentary and forecasts of the RBA reversing course and dropping rates by year end.

Whilst we consider this to be possible, in our view it is unlikely, particularly with unemployment remaining low and inflation remaining outside the RBA target rate. In other words official rates are likely to remain higher for longer.

Despite this, there is an argument that mortgage rates could still come down slightly once the RBA pauses bringing stability to wholesale money markets and creating a more certain environment for both bank and non bank lenders in terms of their funding costs.

This coupled with ongoing competition in the Australian mortgage market, should result in consumers being able to achieve more attractive mortgage rates moving forward with mortgage rates likely to peak during February.

Our loan books across all our funds continue to perform strongly and we are pleased to announce that we have now been appointed as a lender to the AFG residential broker network. AFG is one of Australia’s largest mortgage broking groups with over 3000 brokers Australia wide.

As a consequence we are continuing to originate significantly more loans than we can fund putting us in the envious position of being able to fund loans which best suit our lending policy.

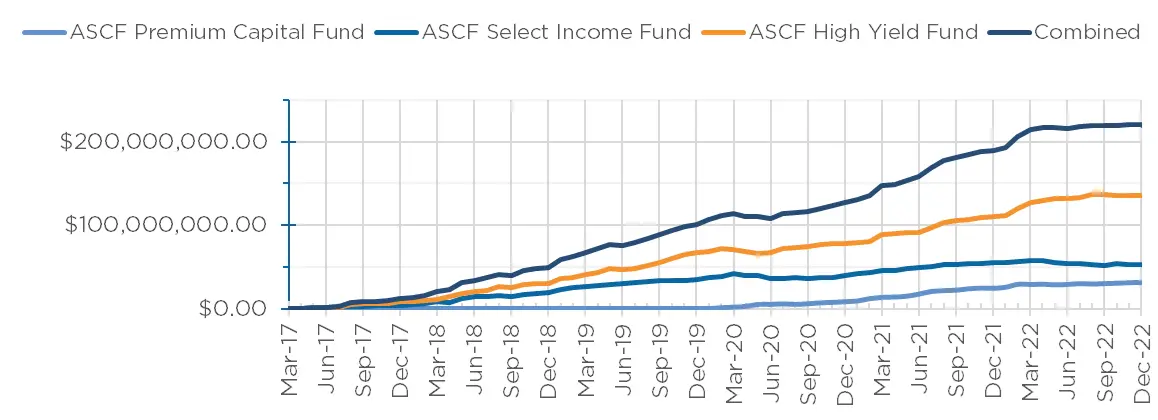

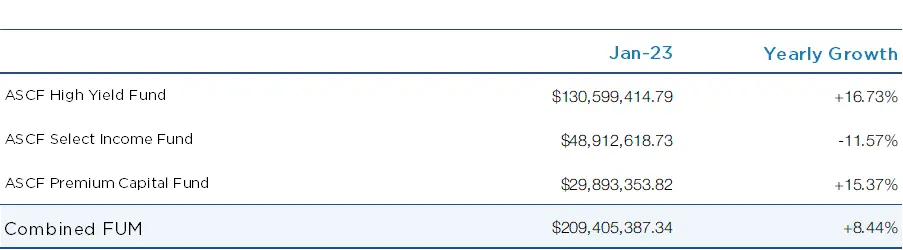

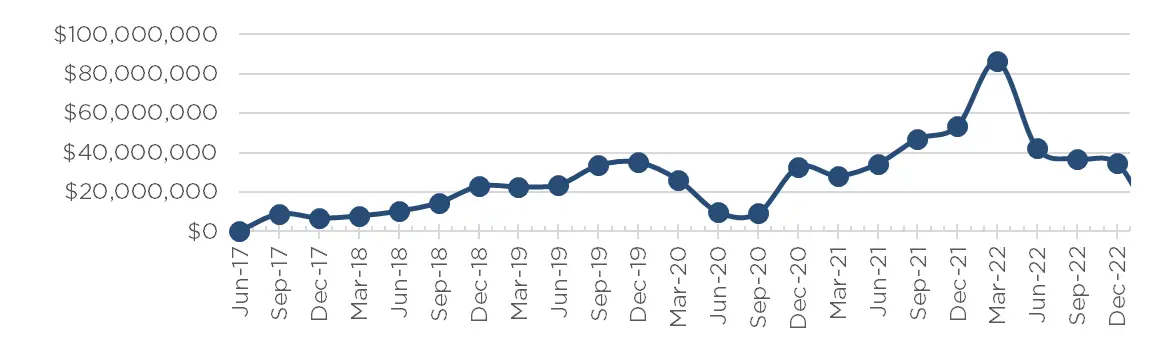

Monthly Funds Under Management

Funds Under Management

as at 31st of January 2023

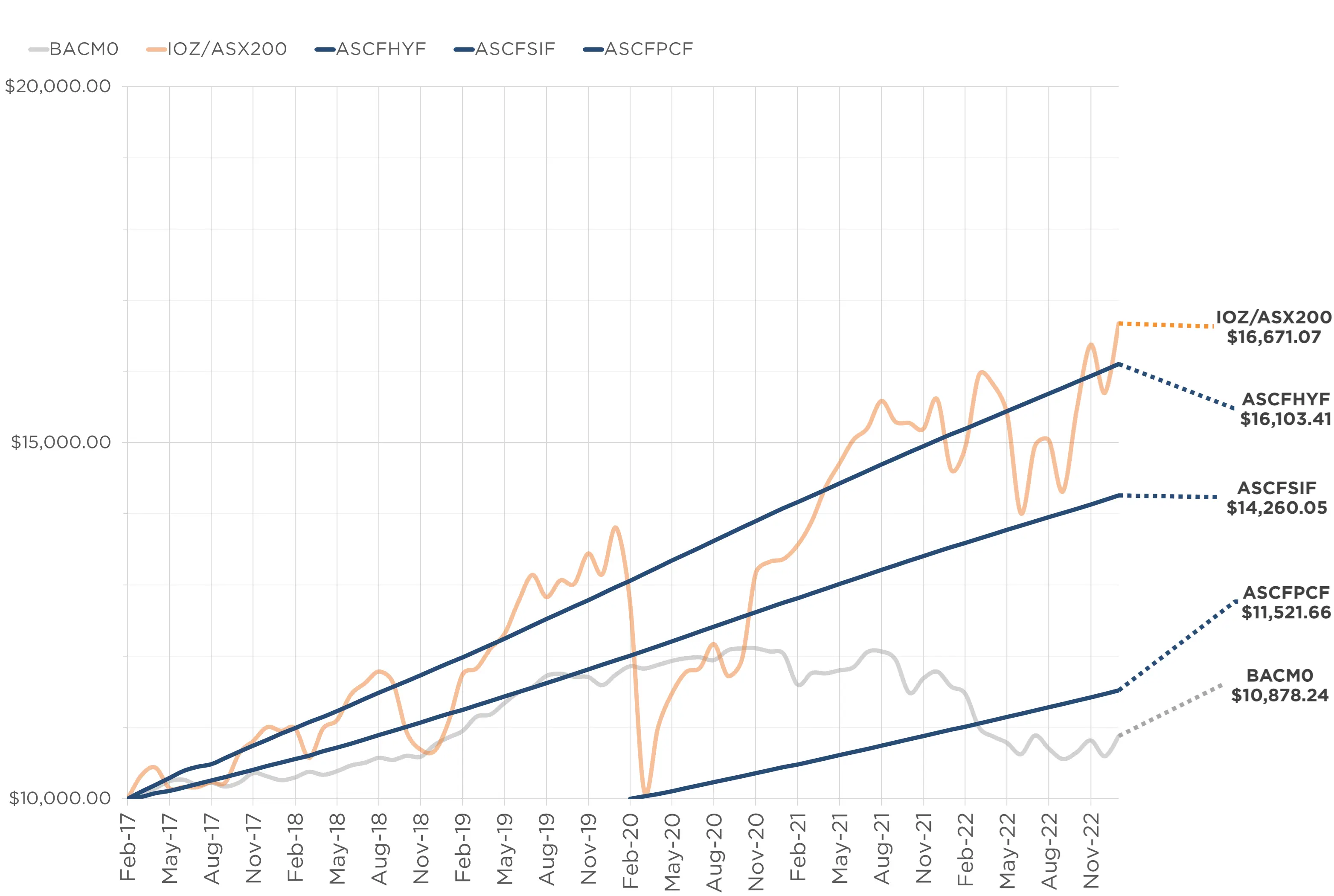

Monthly Fund Cumulative Growth & Performance

Note 2: Past performance is not indicative of future performance

Loan originations and inquiry levels in January remained solid with over $4,600,000 in new loan originations settled.

The unit price across all three of our retail funds remains stable at $1.00.

All monthly distributions have been paid in full for the month of January.

Lending Activity Update

Quarterly Loan Settlements

as at 31st of January 2023

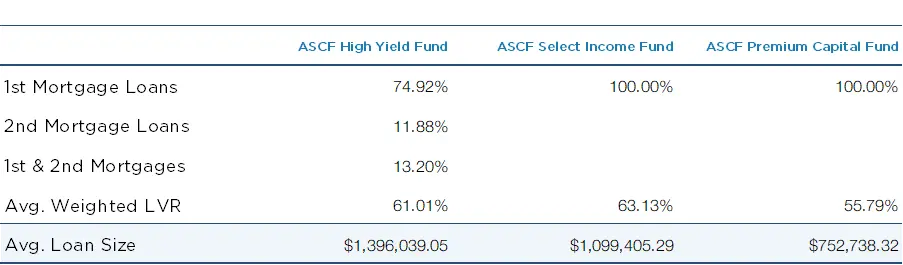

Current Loans by Fund Source

as at 31st of January 2023

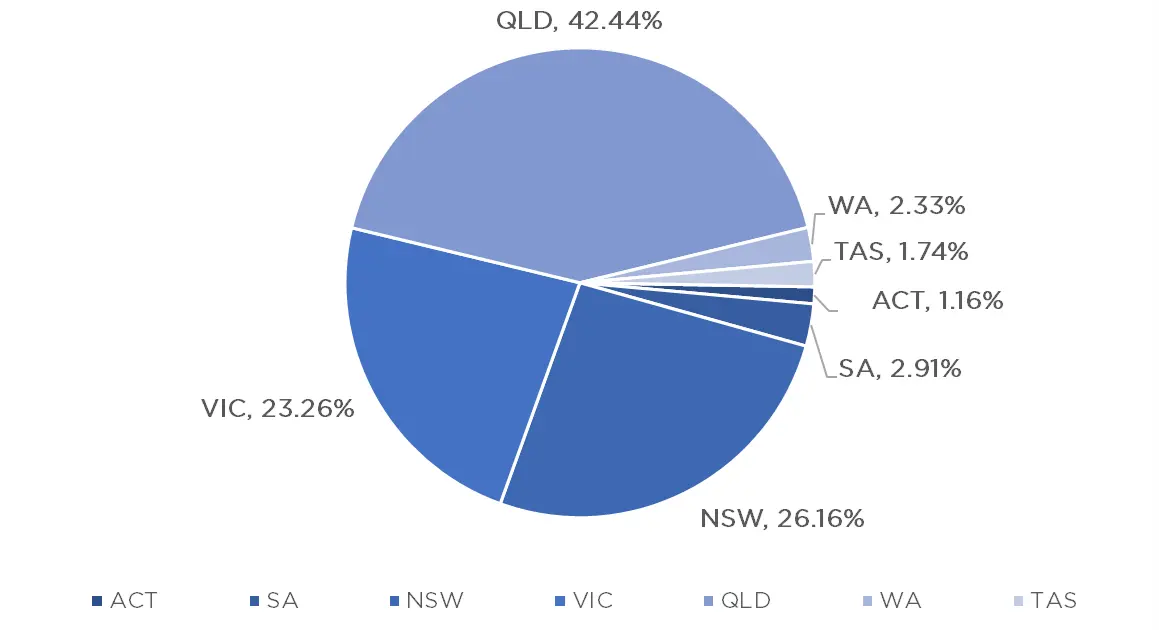

Current Loans Geography

as at 31st of January 2023

Why Invest with ASCF?

In our prior newsletter we discussed the key features of what makes ASCF different from traditional mortgage funds. We believe our unique business model is best in class by minimising risk whilst providing an attractive risk adjusted return for our investors.

In this month’s newsletter, we will delve into the basic principles of how we assess loans in terms of our lending policy and highlight the three key aspects of our assessment which can be summed up by the acronym PPE being Property, Purpose and Exit.

Property.

This is the first thing we consider. Where is the property offered as security located and what is the proposed LVR (loan-to-value ratio)? Our preference is always for residential property in metropolitan or larger regional cities as there is always demand for these types of properties in terms of refinance options for borrowers or the sale of the property should this be the proposed exit.

The lower the LVR the better, but it is important the property be it residential or commercial is located in an area where there is sufficient liquidity via property sales to ensure our valuers can determine the property’s value via comparable sales.

The length of time it takes to sell a property in the market it is located is also a crucial factor in determining the liquidity aspect of the property, and whilst properties located in regional areas do tend to take longer this is often factored in when assessing a loan in terms of pricing and the suitability of the property based on our lending policy.

Purpose.

What is the purpose of the loan? Does it make sense, and will the borrower be better off with the loan than without it? If the answer is no, we will not approve the loan.

In most scenarios, we assist borrowers to achieve a specified purpose, whether it’s bridging finance which enables them to maximise the sale price of their existing property whilst acquiring another or helping them with a short-term financial solution in a more expedient manner than other lenders.

Typical examples include settlement of the purchase of a property in circumstances where their bank has been unable to finalise their finance approval, and the borrower now risks losing their deposit, or a small business operator seeking funding to take advantage of a business opportunity, but their bank is unable to provide the funding in the time frame required.

Our assessment also considers the cost to the borrower if they were unable to access the required funding versus the cost of the loan. It’s really an economic cost benefit analysis that we undertake and provided the benefit outweighs the cost of the loan we will assess the purpose favourably.

Exit.

What is the borrower’s exit strategy for the loan? This is the most important aspect of our loan process, particularly where the interest on the loan is capitalised.

Most of our loans, in fact over 95%, are for terms of 12 months or less, and almost 50% are for terms of 6 months or less. Hence, an adequate assessment of the borrower’s exit strategy is a key factor in determining whether to approve the loan to ensure the borrower can repay the loan on time.

If the proposed exit is the sale of the security property or other property, we will assess the likelihood of the property being sold within the term of the loan with the assessment considering the time it takes to sell a similar property in the market it is located.

The assessment includes macro considerations, i.e. properties are typically taking longer to sell today than they were 12 months ago, and micro factors such as the marketing budget the borrower has allowed for the sale of the property and the marketing strategy.

Should the proposed exit be refinance, we will assess the loan on the same basis as the proposed incoming lender would, be it a bank or other second-tier lender, to ensure the borrower can meet their requirements.

Buyers often present different exit strategies other than sale or refinance. Depending on what they are, we will ask for satisfactory evidence that the proposed exit can be achieved. In circumstances where the interest on the loan is not capitalised, we will also assess the borrower’s capacity to service the loan, and whilst this may not always include tax returns, we may request BAS returns or copies of bank statements to evidence satisfactory income as well as a declaration from their accountant that they can

service the monthly interest.

Whilst this is only a brief insight into our loan assessment criteria and does not include all the checks we undertake when approving a loan, we hope it provides insight into the main factors we consider when assessing and pricing a loan.

An Interesting Transaction

Problem:

ASCF was approached by a broker with a well-established property investor as a client who required urgent funds to settle the purchase of a large residential land site in Logan, Queensland. The borrower had been let down by another lender, and only had days to settle the property before the Christmas period.

Solution:

ASCF was able to instruct our local panel valuer in Queensland to provide an urgent valuation on the property, which was delivered within 72 hours. This allowed us to settle the loan on Friday 23rd December just before Christmas. A loan amount of $2,709,000 was provided at an LVR of 70% for a 9-month term at an interest rate of 12% p.a.

The customer’s proposed exit is via business proceeds from other property sales.

What ASCF Does Differently:

This is a prime example of how ASCF can deliver in even the most time-sensitive situations.

Market Update

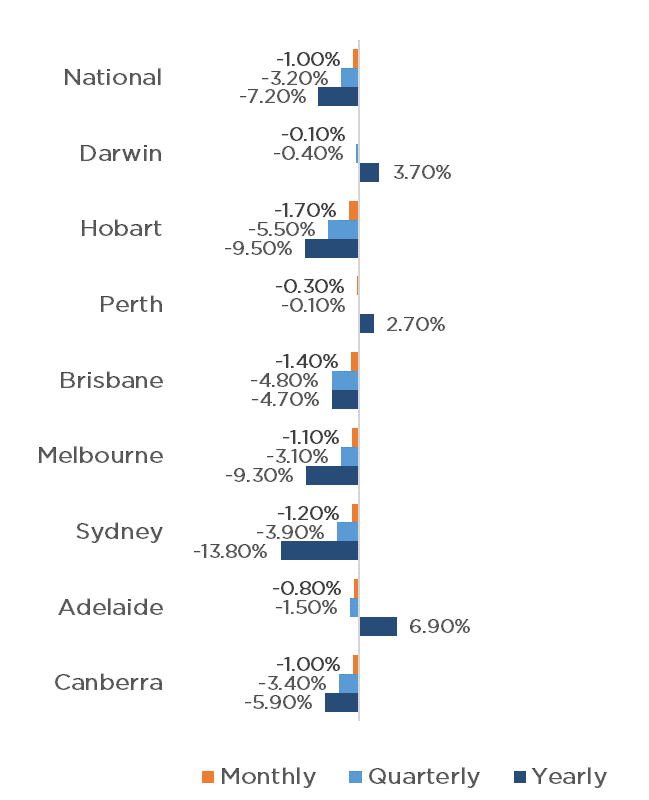

January saw property prices fall nationally by 1%, which was less than December and the smallest month to month decline since mid last year according to CoreLogic’s national Home Value Index.

Prices fell across all capitals by an average of 1.1%, however regional housing values continued to record a milder rate of decline at -0.8%. Hobart saw the largest reduction (-1.7%), followed by Brisbane (-1.4%), Sydney (-1.2%), Melbourne (-1.1%), Canberra (-1.0%), Adelaide (-0.8%) while the falls in Perth and Darwin were less significant at (-0.3%) and (-0.1%) respectively.

The quarterly trend however is pointing to a reduction of the in the pace of decline, and despite the falls every capital city and region is still recording home values above pre-pandemic levels. Contributing to the reduction of dwelling values, is the fall in demand. Capital city dwelling sales were down -29.4% on previous year figures, with listings -22.2% below the same time last year meaning that most home owners who are considering selling are sitting things out with no pressure to sell into this market.

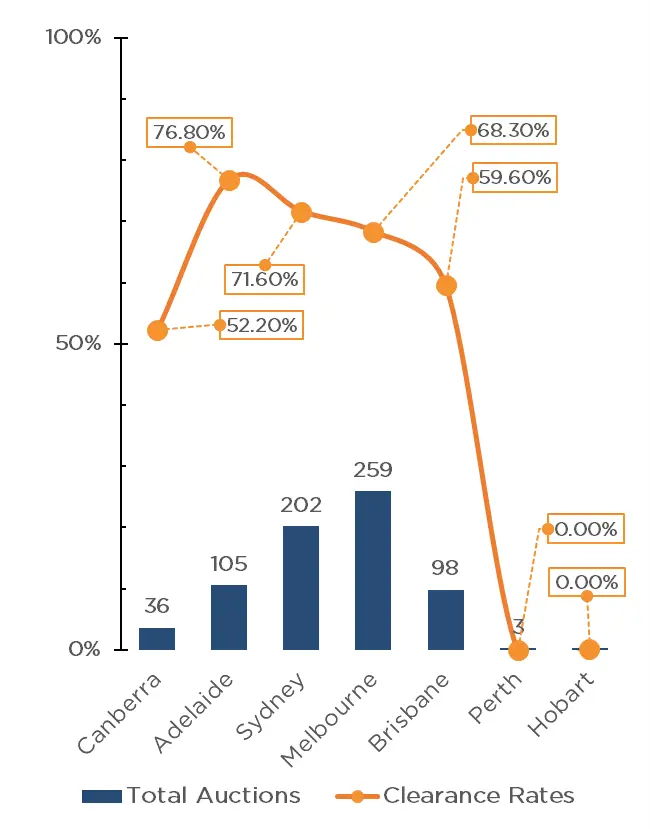

Weekly auction activity has begun to increase in 2023, with 706 auctions taking place across capital cities last weekend achieving a 67.9% clearance rate which we consider positive. Melbourne recorded the most auctions with 259 auctions taking place at a clearance rate of 68.3% (67.5% last year), followed by Sydney with 202 auctions and a strong clearance rate of 71.6% (66.3% last year). Adelaide achieved the best clearance rate for the weekend with 76.8% (81.8% last year) for their 105 auctions whilst Brisbane and Canberra were lower with clearance rates of 59.6% (80.1% last year) and 52.2% (85.5% last year) respectively.

Whilst property prices will undoubtedly be linked to the movement in interest rates we do believe we are nearing the end of the rate rise cycle, with some banks already beginning to reduce the fixed rates for 3 and 5 year terms.

The resurgence in overseas student migration will also see the rental market remain tight and help support yields across the residential property market. As a result we do believe housing values will stabilise over the coming months as some level of confidence returns to the market.

Clearance Rates & Auctions

23rd – 30th of January 2023

Property Values

as at 31st of January 2023

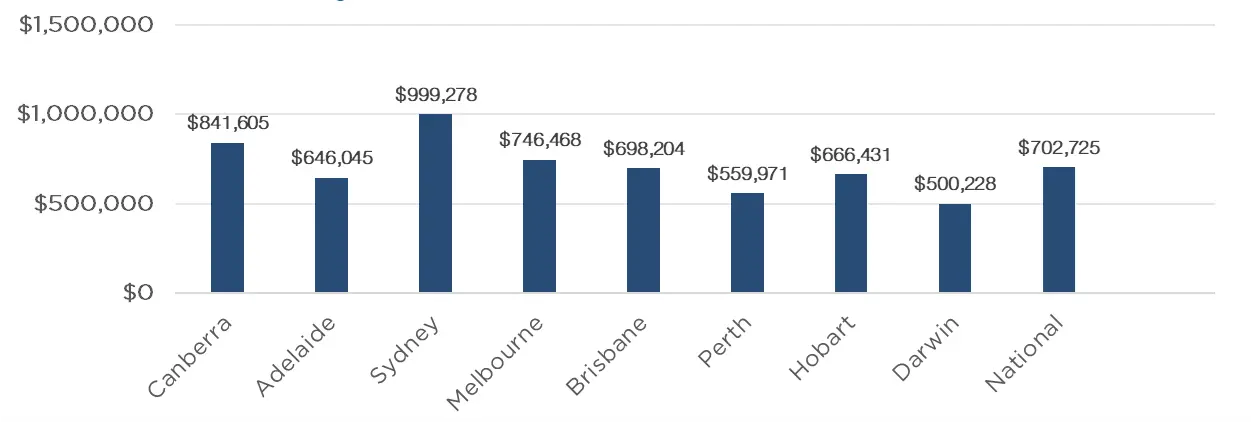

Median Dwelling Values

as at 31st of January 2023

Quick Insights

The Return of Students

Demand is set to strengthen in inner-city suburbs across Australia as the Chinese government directs its students to return to university campuses worldwide.

Almost 50,000 Chinese students are expected to flood back into Australian capitals looking for rental accommodation as they return to in-person study.

This injection of demand is likely to raise rental yields by at least 5%.

Source: Australian Financial Review

Extra Eastern Income

Demand for rentals in Sydney’s affluent eastern suburbs never waned throughout last year even as the supply of suitable housing dried up.

As a result, an additional $19,812 in rental income was delivered to some landlords throughout 2022. Across the country, houses and units across 195 suburbs made at least $5200 a year in extra rent during the same period.

Source: Australian Financial Review

Apartments Continue to Rise

In addition to the rental apartment frenzy in Melbourne and Sydney, property prices among apartments have also risen.

In particular, Adelaide, and Brisbane have seen unit values jump by significant amounts. 76 suburbs across Queensland and South Australia, broke record-high prices in December. Adelaide’s Mitchell Park alone rose by more than 30%.

Tim Lawless of CoreLogic has explained that, “…with borrowing capacity reducing as interest rates rise, it’s likely the lower price points of unit values have become more broadly appealing.”

Source: Australian Financial Review