Since our last update, the easing of restrictions across most Australian states has continued as planned. As predicted, Victoria has experienced a setback resulting in further tightening of their restrictions toward the end of the month.

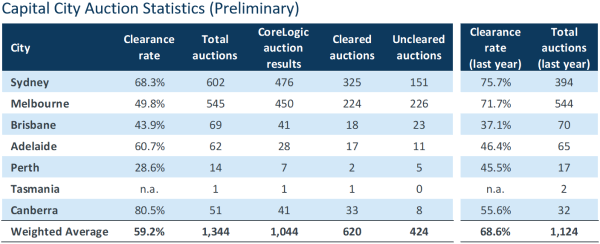

Whilst the Victorian “second wave” has delayed the reopening of some borders, recent auction clearance rates provided by CoreLogic have remained stable across most capital cities, with a preliminary weighted average of 59.2%.

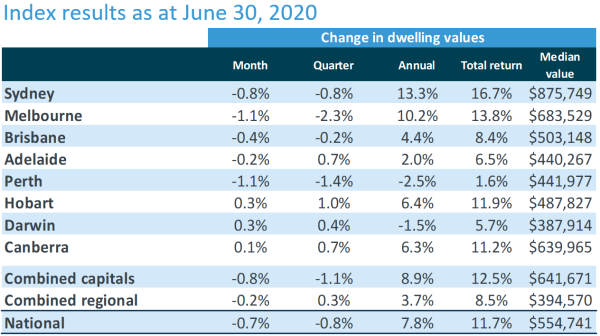

In regards to property prices across capital cities, prices are up an average of 7.8% for the year however the June quarter showed a reduction across most capital cities, with an average loss of 0.8%, achieving a better performance than many economists had previously forecast.

Research also suggests that the additional Government grants for first home buyers may actually lead to an increase in property values.

We are receiving a high level of inquiries from our recent appointment to the AFG broker panel. We believe this will continue to build over time as we increase our marketing to the broker networks within the group. However, we remain cautious while Victoria continues to announce record infection numbers.

Our Funds Under Management increased by over $5 million during the month of July, which is in line with pre-COVID levels of new investment.

The unit price across all of our funds remains stable at $1.00 per unit and the average weighted Loan to Valuation Ratio in each fund remains low (refer to the table below).Our Funds Under Management increased by over $5 million during the month of July, which is in line with pre-COVID levels of new investment.

This article appeared in our July 2020 Investor Newsletter – download the full newsletter here.