Trading Update

As expected, the RBA reduced the cash rate last week by 0.25% to 3.85%. The market is now expecting at least two more rate reductions of 0.25% each prior to year end, which should see a cash rate of around 3.35%.

With inflation now within the RBA’s target the question remains as to how low the RBA is likely to reduce rates over the next 12 months.

While trade tariffs and their likely impact continue to dominate the US economy and equity markets, the risk is certainly to the downside, with a cash rate at or below 3% over the next 18 months more probable than not.

A lot will depend on how trade negotiations between China and the US play out and the likely impact this will have on our economy should Chinese growth stall or come in lower than expected.

This past weekend’s auction clearance rates received a boost from last weeks interest rate cut with an auction clearance rate of 71.3% across combined capital cities and with housing affordability improving as the RBA cuts we expect this will drive residential property prices higher.

We do however anticipate any increase from here to be constrained at around 3% – 5% growth for the remainder of 2025 due to the growth we have already seen since the market bottomed in early 2023.

ASCF Current Targeted Distribution Rates until 30th May 2025

ASCF High Yield Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.50% | 7.25% | 7.75% | 7.30% |

ASCF Select Income Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 6.25% | 6.75% | 7.25% | 6.75% |

ASCF Premium Capital Fund

| 6 Months | 12 Months | 18 Months | 24 Months |

|---|---|---|---|

| 6.10% | 6.25% | 6.75% | 6.30% |

ASCF Private Fund

| 3 Months | 6 Months | 12 Months | 24 Months |

|---|---|---|---|

| 8.19% | 8.39% | 8.59% | 8.49% |

Rate Changes Effective 1 June 2025

In line with market conditions and recent monetary policy shifts, ASCF will be adjusting our targeted distribution rates across selected investment terms, effective 1 June 2025.

The following changes will be made:

ASCF Premium Capital Fund

No changes.

3 Months: 6.10% → no change

6 Months: 6.25% → no change

12 Months: 6.75% → no change

24 Months: 6.30% → no change

ASCF Select Income Fund

3 Months: 6.25% → no change

6 Months: 6.75% → no change

12 Months: 7.25% → 7.00% (decrease of 0.25%)

24 Months: 6.75% → no change

ASCF High Yield Fund

3 Months: 6.50% → no change

6 Months: 7.25% → 7.00% (decrease of 0.25%)

12 Months: 7.75% → 7.50% (decrease of 0.25%)

24 Months: 7.30% → 7.10% (decrease of 0.20%)

You have until 4pm AEST, Friday 30 May 2025 to invest at the current targeted distribution rates, which will be honoured for the duration of your selected term. The updated target rates will apply to all new investments from 1 June. Existing investments will move to the new rates automatically when they roll over at maturity.

Managed Funds Under Management

as at 30th of April 2025

| April 2025 | |

|---|---|

| ASCF High Yield Fund | $167,836,904.93 |

| ASCF Select Income Fund | $51,316,036.22 |

| ASCF Premium Capital Fund | $27,663,390.82 |

| ASCF Private fund | $38,009,503.54 |

| Combined Funds under Management | $284,825,835.51 |

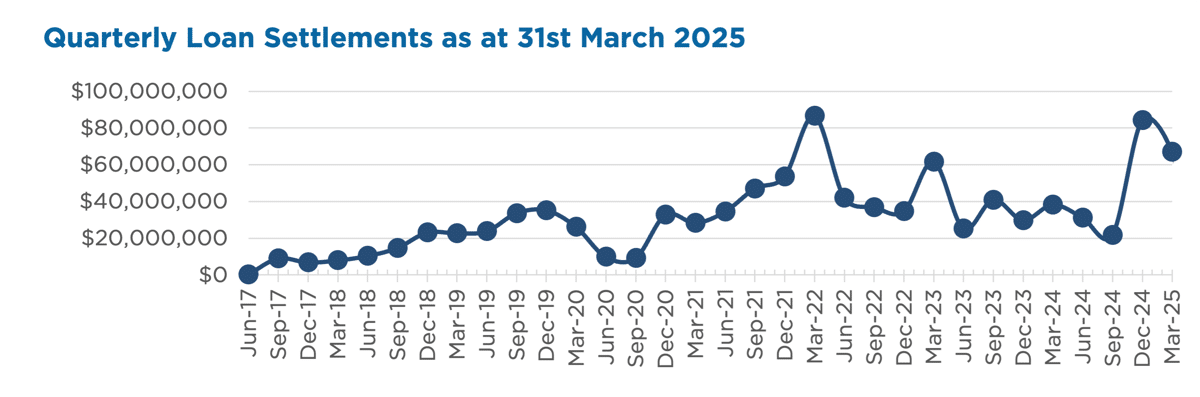

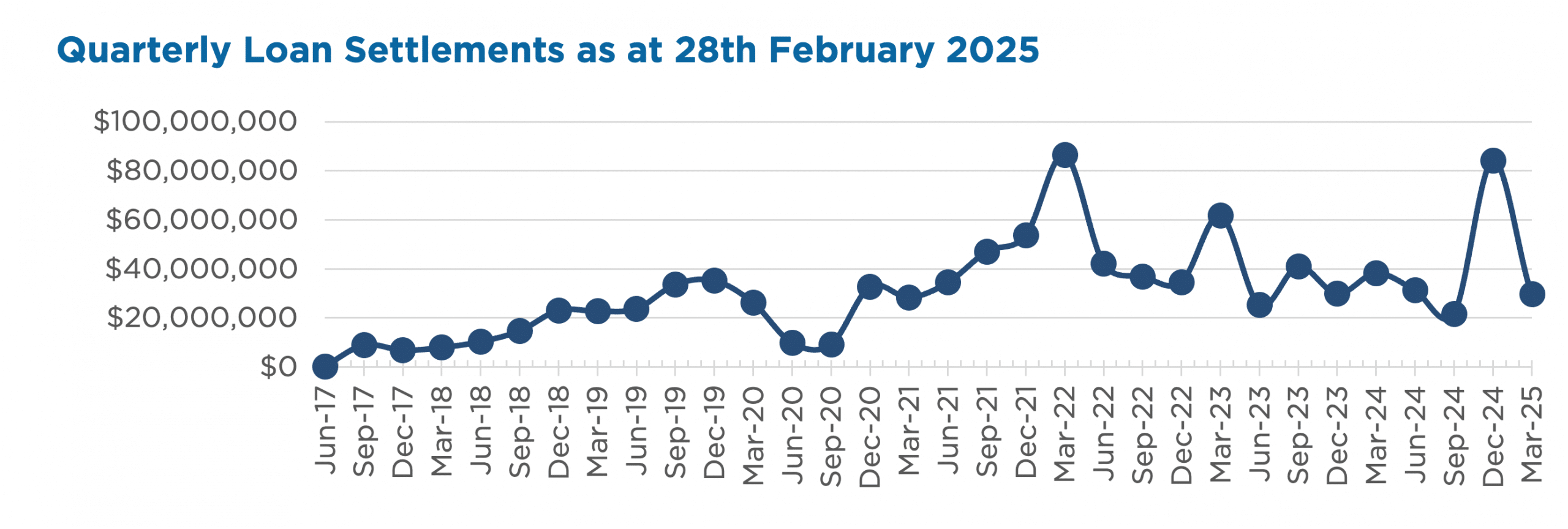

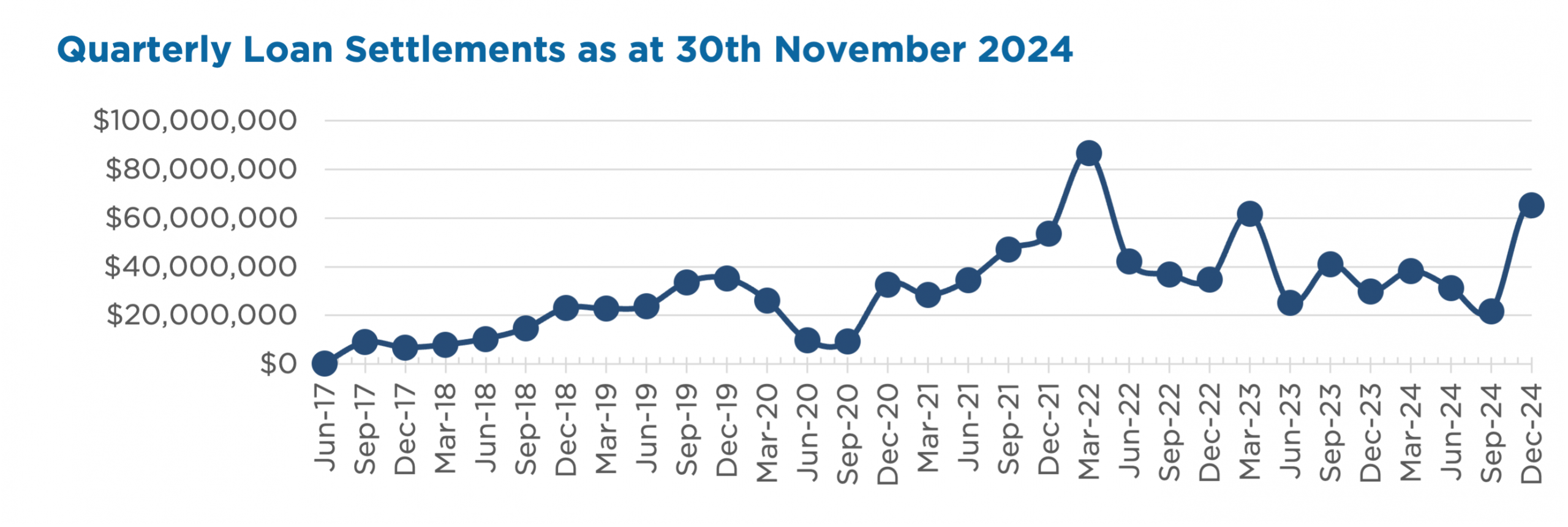

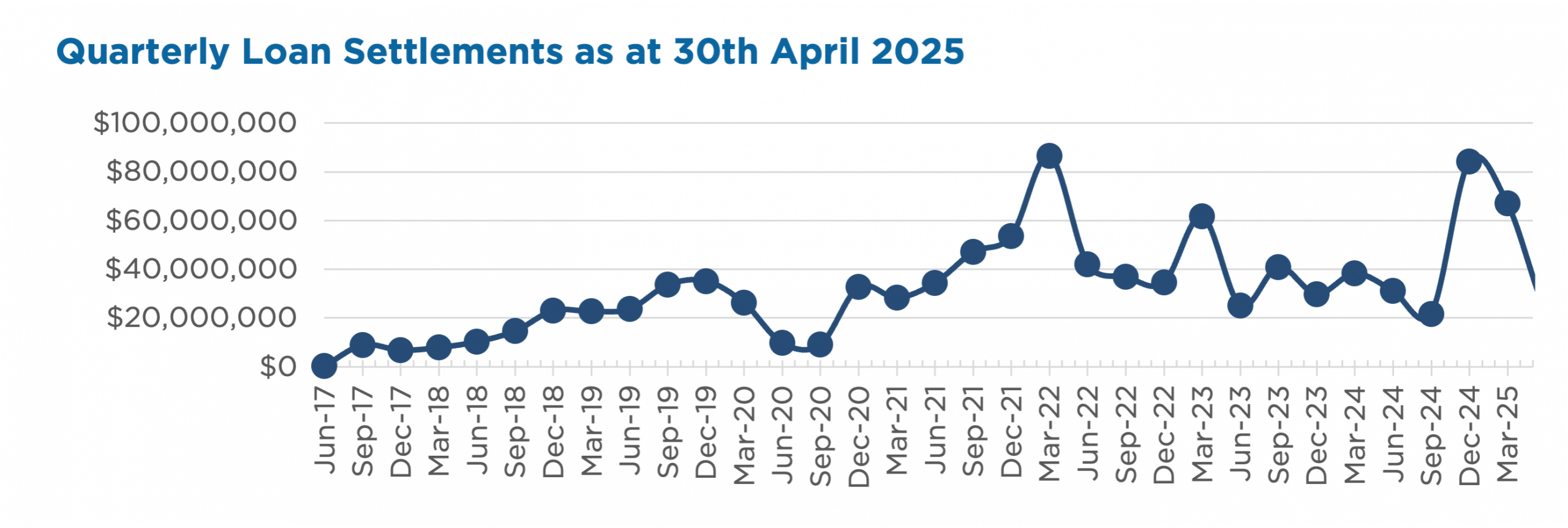

In April, loans and inquiry levels were steady, with $22,962,500.00 in new loans settled.

The unit price across all three of our retail funds remains stable at $1.00 per unit.

All monthly distributions have been paid in full for the month of April.

Lending Activity Update

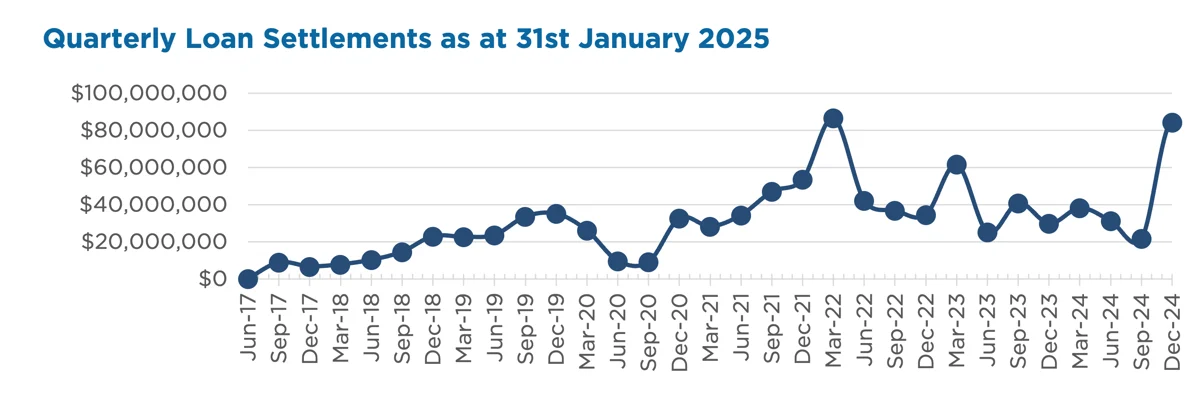

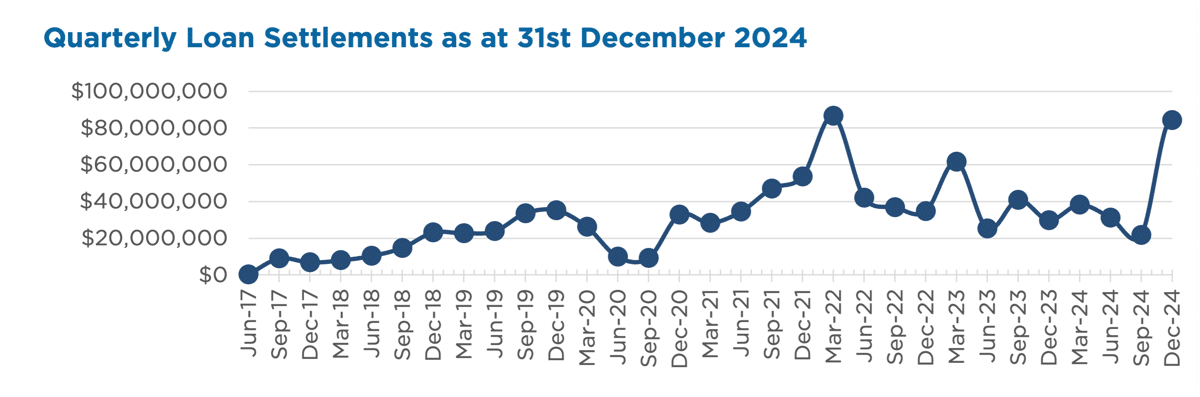

Quarterly Loan Settlements

as at 30th of April 2025

Current Loans by Fund Source

as at 30th of April 2025

| High Yield Fund | Select Income Fund | Premium Capital Fund | |

|---|---|---|---|

| 1st Mortgage Loans | 75.21% | 100% | 100% |

| 2nd Mortgage Loans | 17.30% | 0% | 0% |

| 1st & 2nd Mortgage Loans | 7.49% | 0% | 0% |

| Avg. Weighted LVR | 57.79% | 46.98% | 53.86% |

| Avg. Loan Size | $1,364,613.37 | $1,063,592.32 | $842,731.48 |

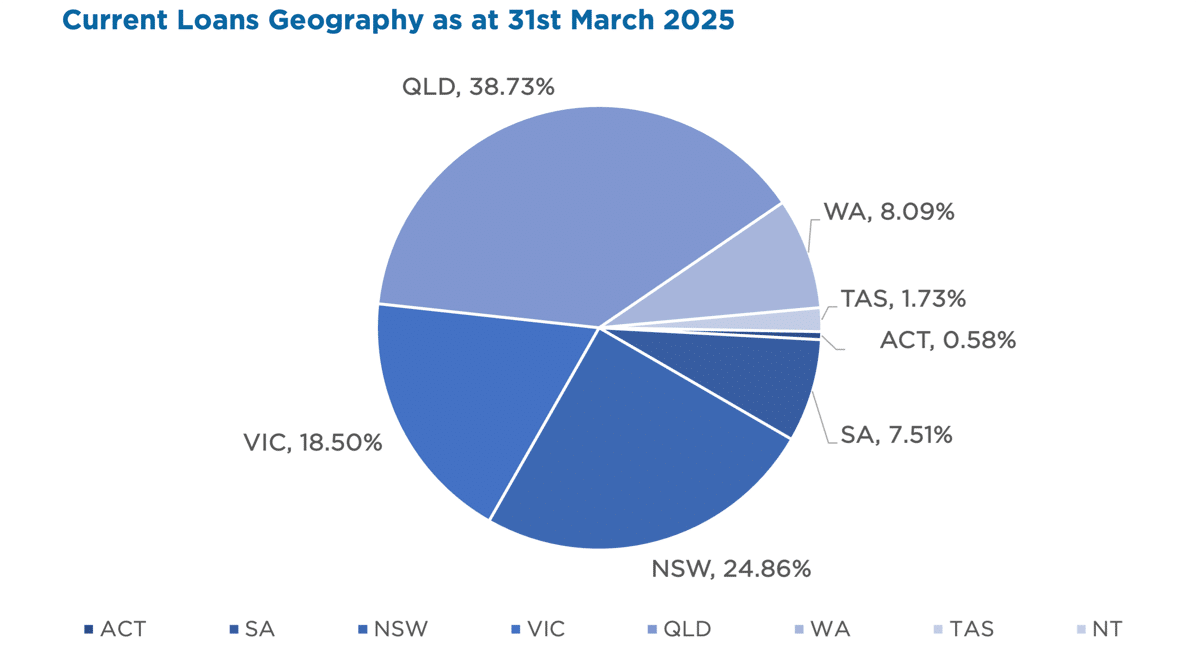

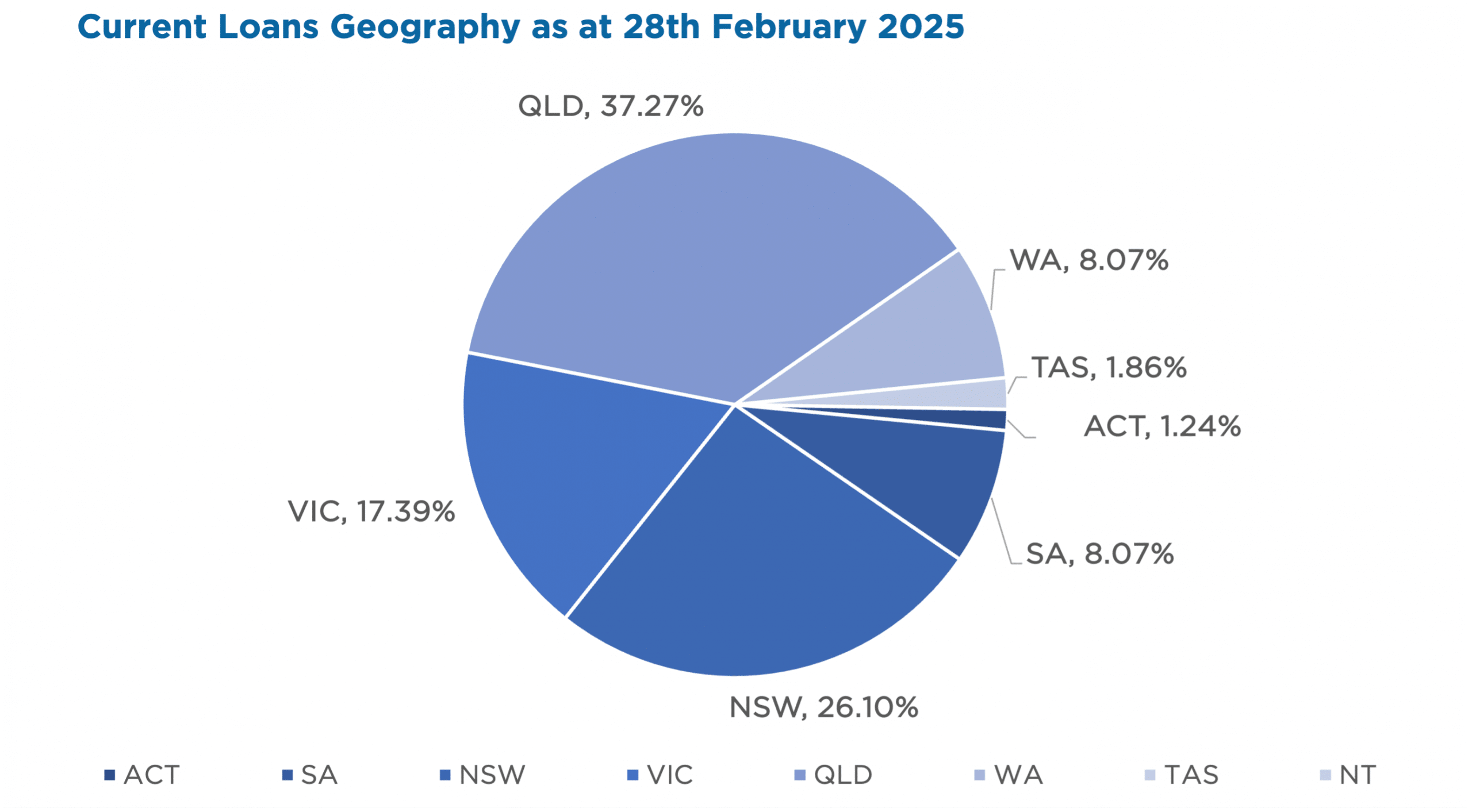

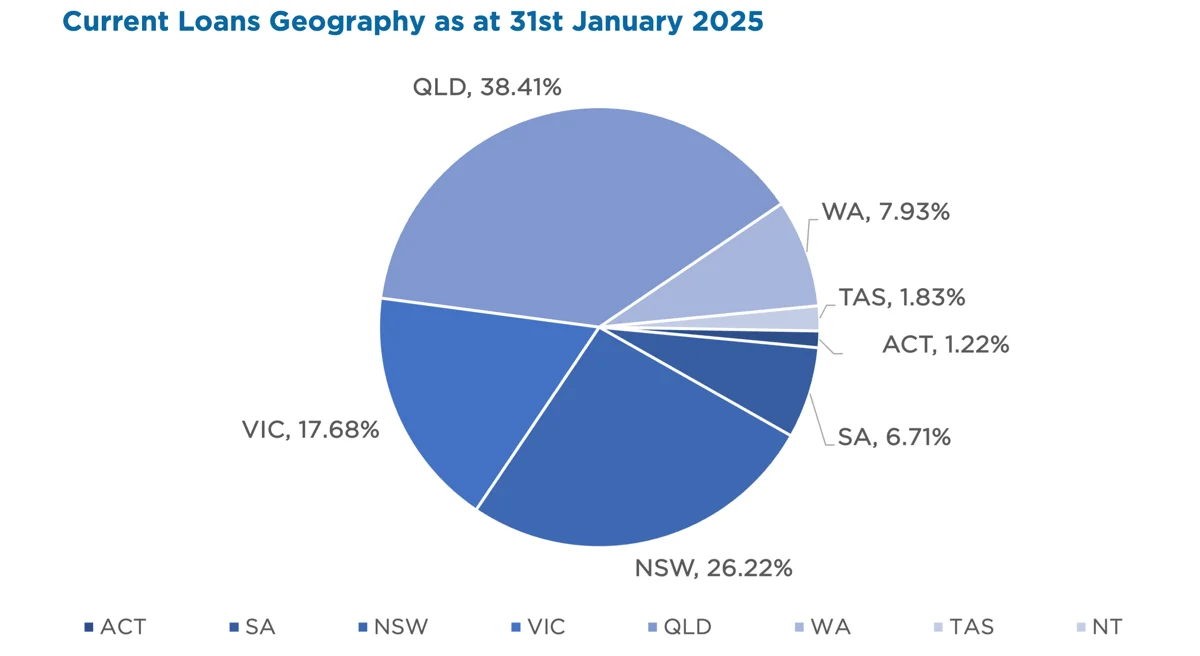

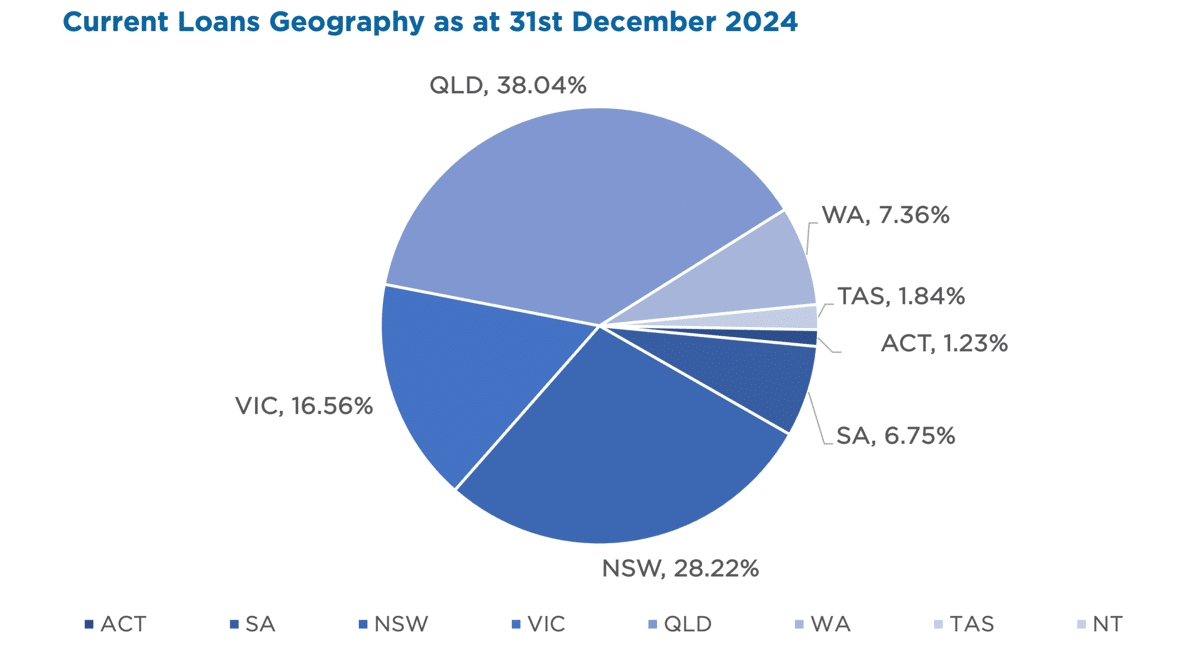

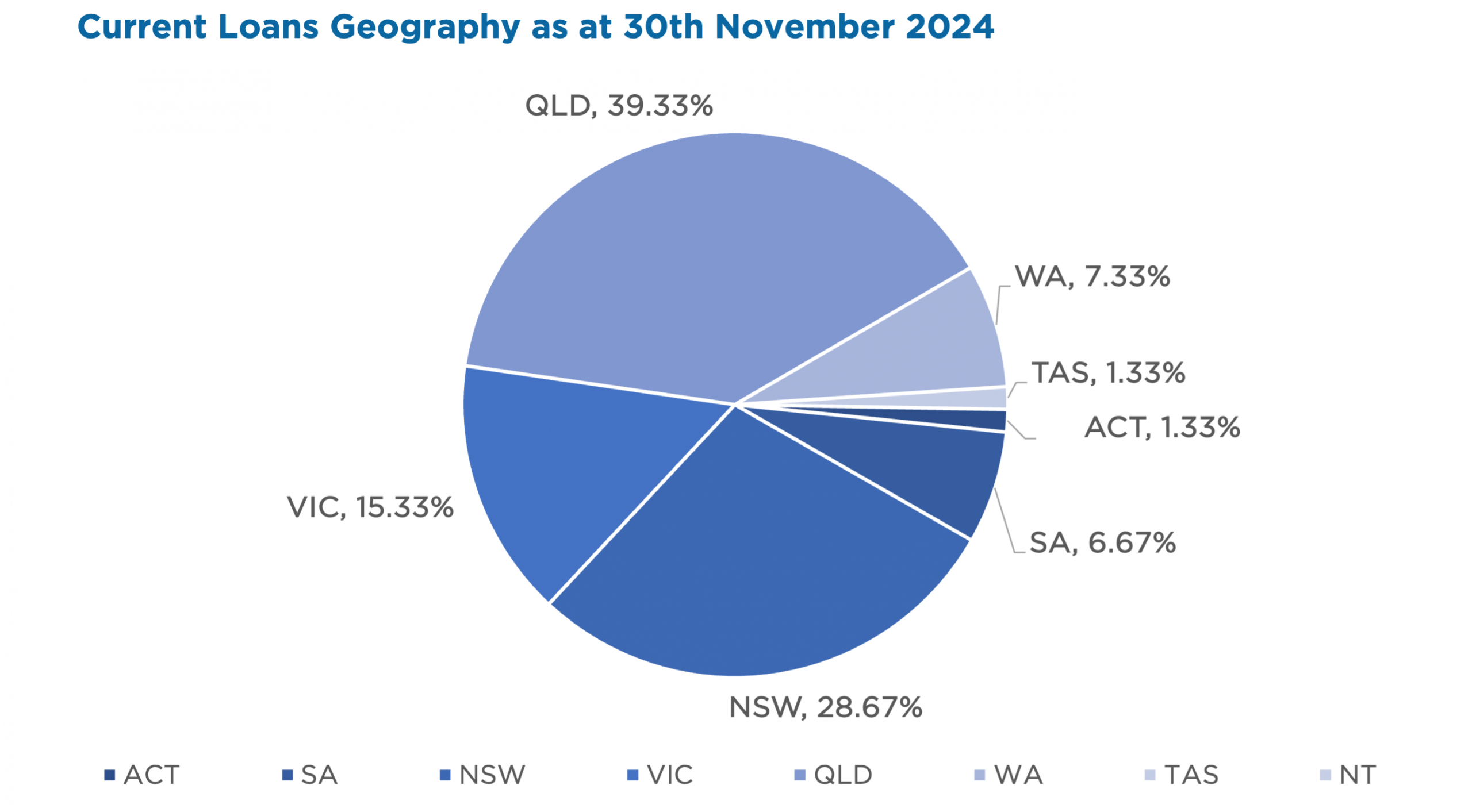

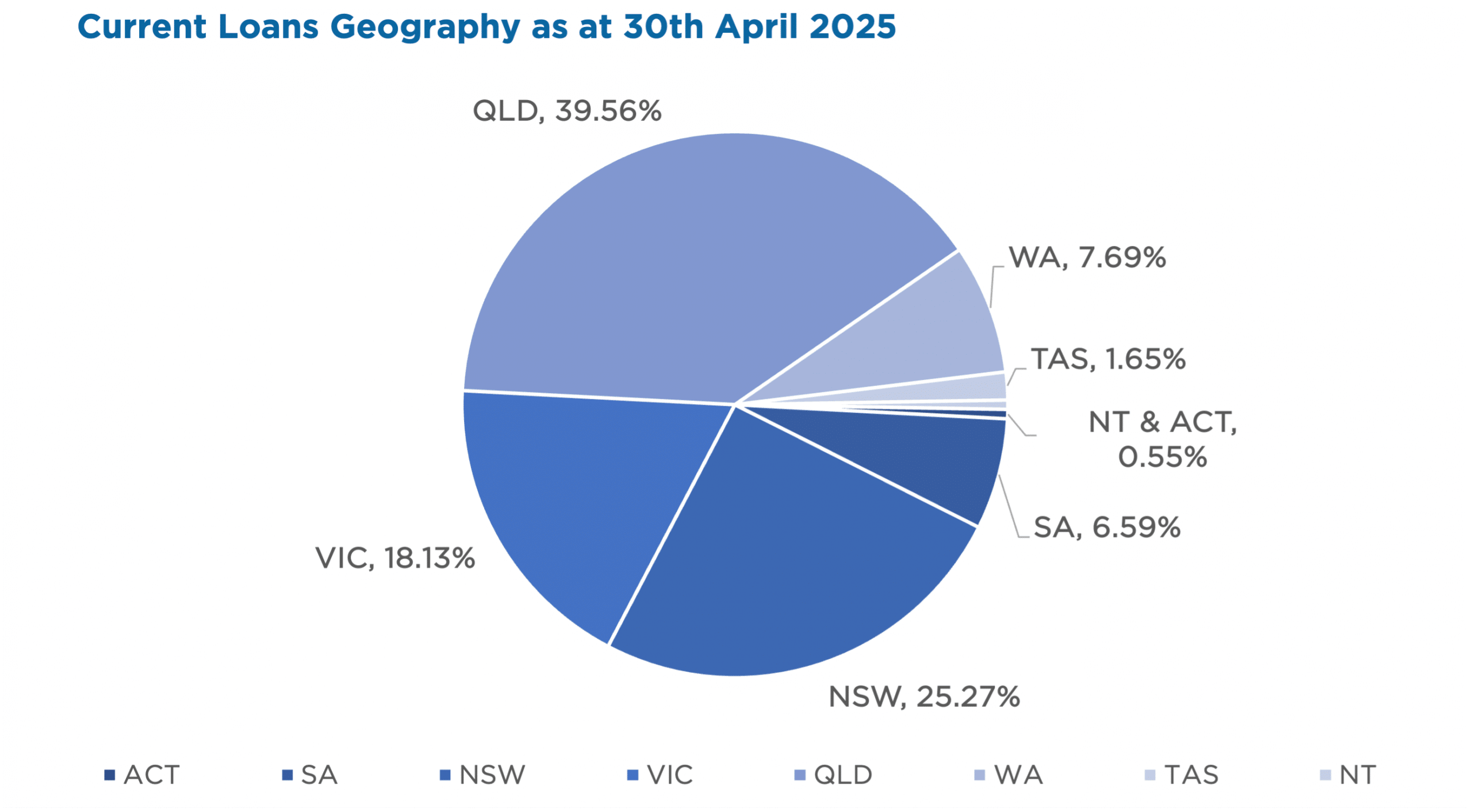

Current Loans Geography

as at 30th of April 2025

Why Invest with ASCF?

Performance Backed by Discipline and Fundamentals

At ASCF, we’re proud of the investment outcomes we’ve delivered across our mortgage funds over the past eight years. We believe that sustained performance starts with getting the fundamentals right.

As a specialist in short-term mortgage lending, our focus is on generating income from loans backed by Australian real estate. Every loan is supported by a registered mortgage over residential, commercial, or vacant land assets—we don’t lend on construction, development, high-rise apartments, or unsecured loans. That measured approach helps us manage risk effectively and structure our portfolio for ongoing income generation.

A key part of our fund management strategy is liquidity. At any given time, we aim to hold between 5% and 10% of the fund’s value in liquid assets. This allows us to meet withdrawal requests, pay monthly distributions, and cover operational costs—without needing to sell down core loan positions.

Some of the benefits of this approach include:

- Unit Price Consistency – Since inception, our unit price has remained at $1.00 per unit.*

- Capital Risk Management – To date, all investor capital has been repaid in full.*

- Responsive Lending – Having liquidity available enables us to act on timely lending opportunities.

- Mitigated Disruption – Our loan book is structured to help manage the impact of market fluctuations.

- Withdrawal Flexibility – Investors can request redemptions subject to the terms of the fund.

Our approach is grounded in transparency, discipline, and a clear investment philosophy.

Want to learn more? Contact us to explore your investment options.

Important information: At ASCF, we’re here to help you invest on your terms. Since inception, all investors have received their targeted distribution rate monthly and all redemption requests have been paid on time and in full, however past performance is not indicative of future performance. Distributions are not guaranteed nor a forecast. Lower than expected returns may be achieved. Investment in the Funds is not a bank deposit and investors risk losing some or all of their capital. Withdrawal rights are subject to liquidity and may be delayed or suspended. Read the PDS and TMD, available from our website.

An Interesting Transaction

Problem:

A valued ASCF introducer presented two borrowers who were nearing settlement on an off-the-plan unit purchase in Rouse Hill, originally contracted in June 2018. Their $67,100 deposit was at risk if they failed to settle, and they also stood to miss out on a significant uplift in the unit’s value since the original contract date.

Solution:

The customers sought 100% of the purchase price and therefore provided ASCF with 2nd mortgages over their principal place of residence and their investment property, as well as 1st mortgage over the property being purchased. Our valuations on all three properties resulted in a LVR of 55.43% after taking the existing 1st mortgages into account.

ASCF settled a loan amount of $675,000 for a 6 month term at a blended rate of 12.95%. The customers exit is to sell the purchased unit within our funding term.

What ASCF does differently

| ASCF continues to be go to lender for “off the plan purchases” where customers need to settle quickly to save their deposit and participate in value uplift in property that has been purchased off the plan. |

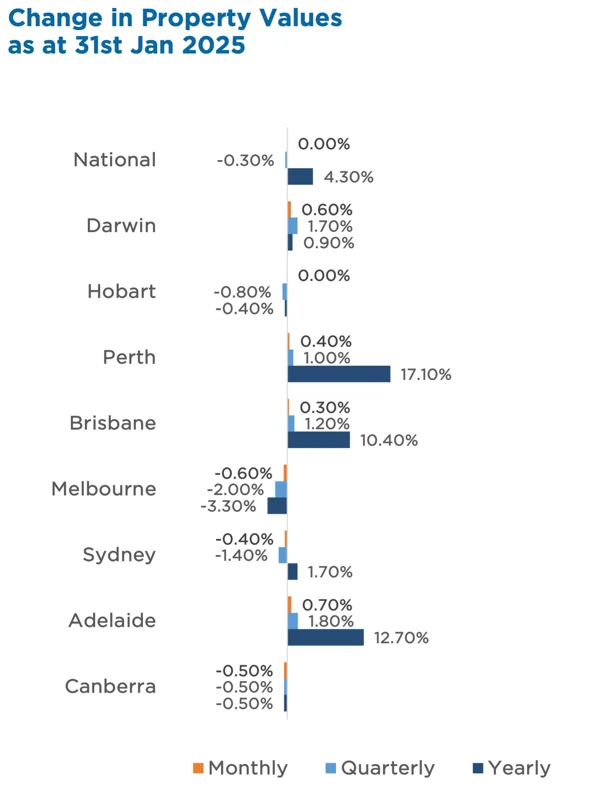

Market Update

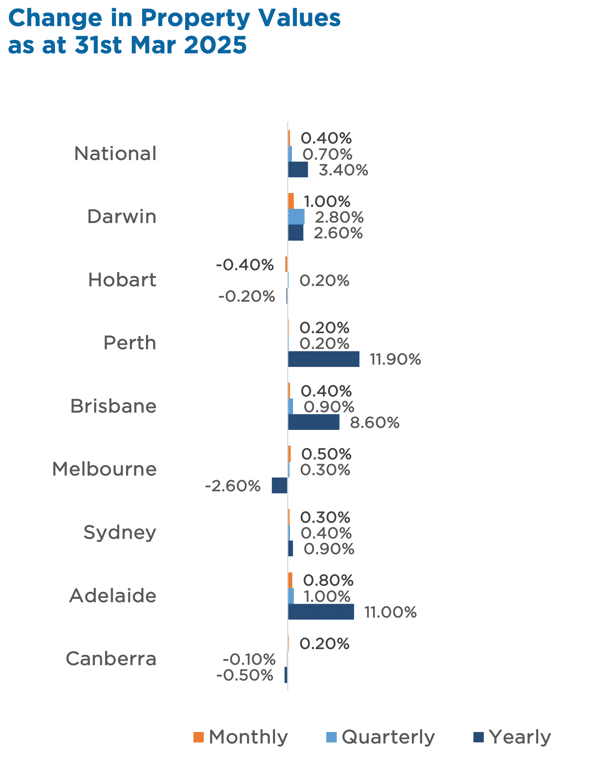

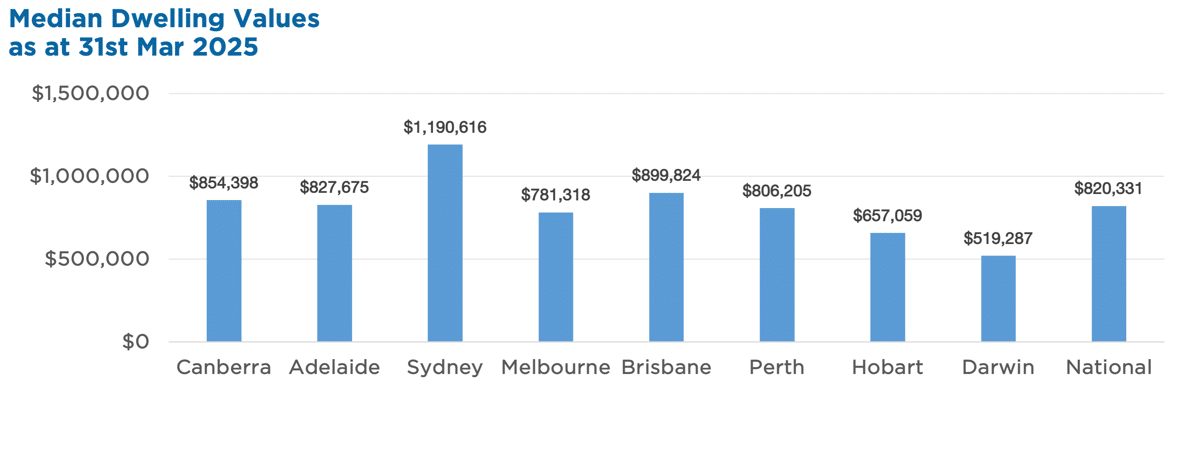

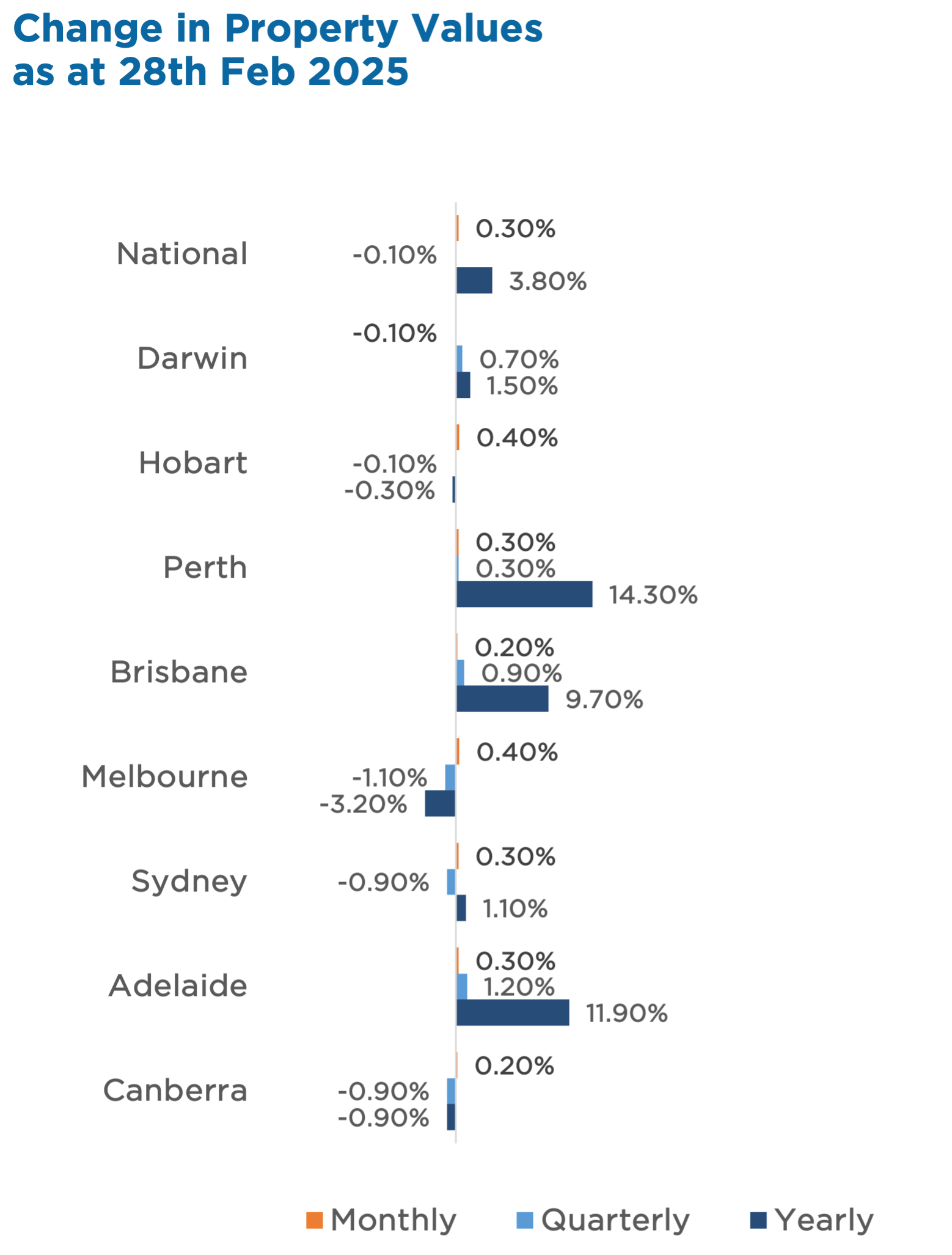

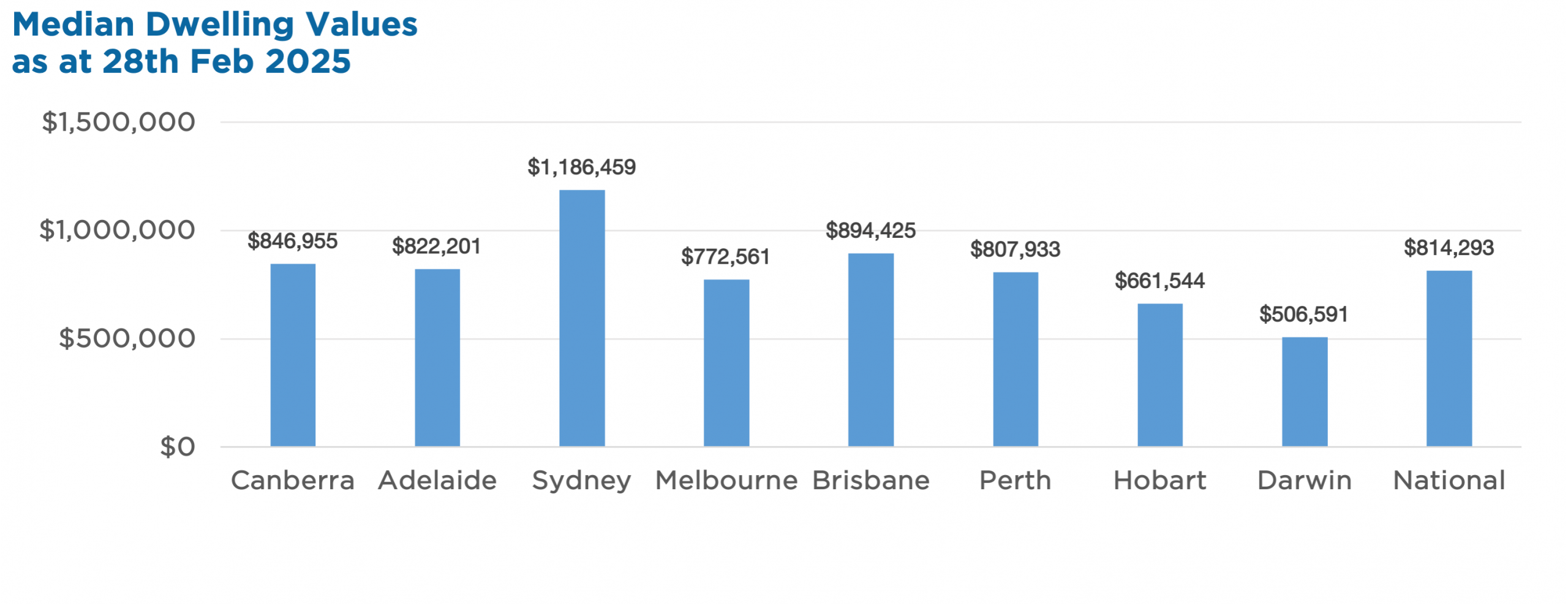

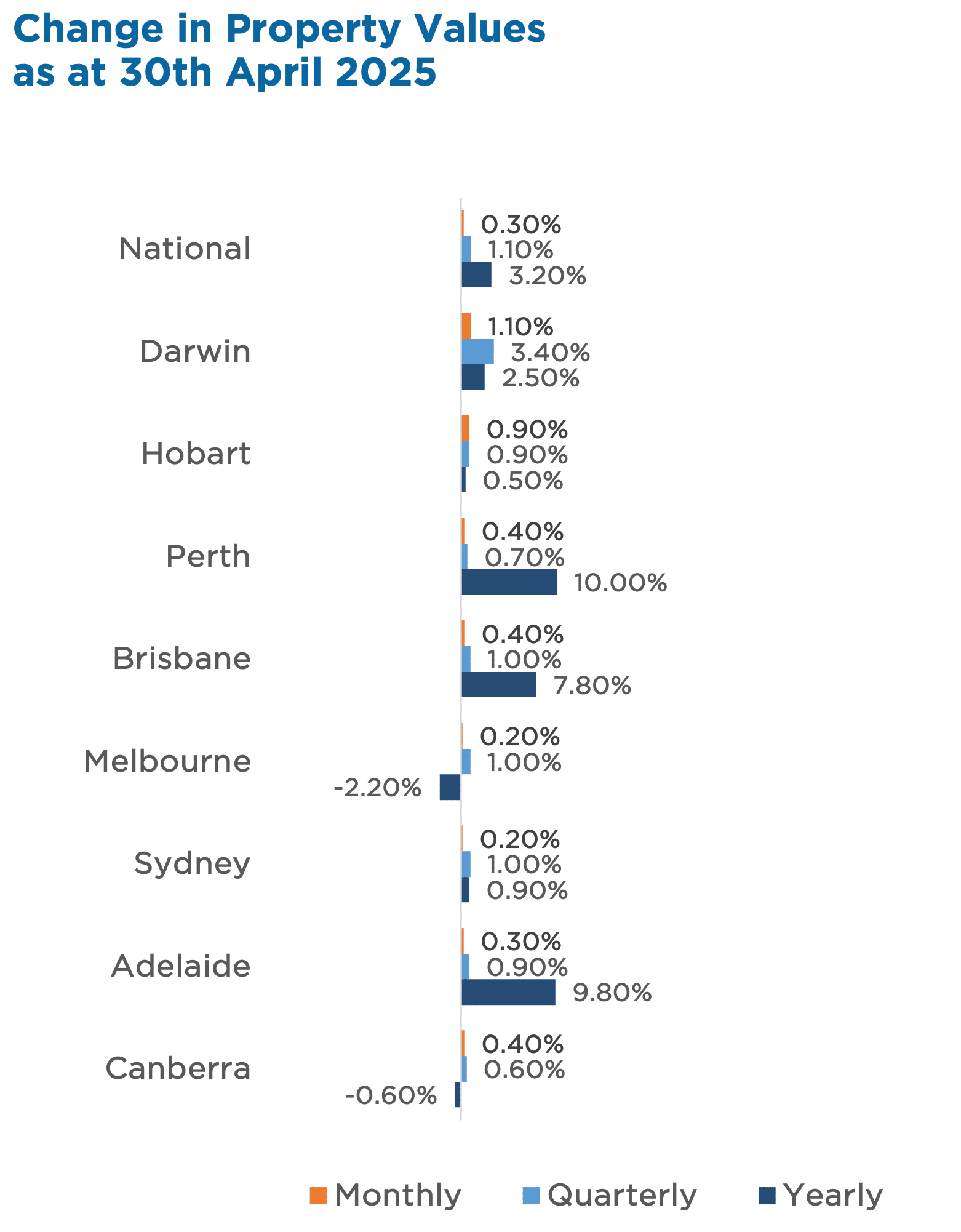

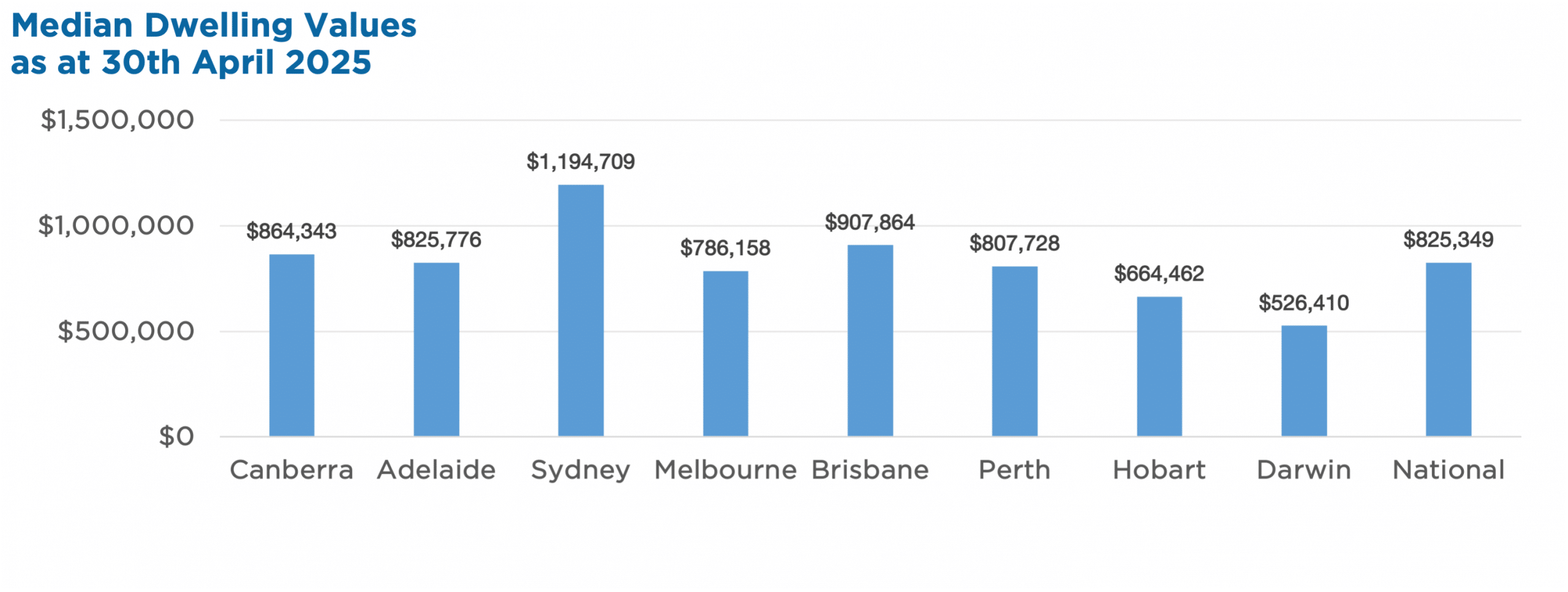

National home values rose for the third month in a row, with CoreLogic’s Home Value Index up 0.3% in April, adding roughly $2,720 to the median Australian dwelling. Growth was recorded across all capital cities, though the pace slowed slightly from March.

While mid-sized capitals and regional markets led the charge, Sydney and Melbourne remain below previous highs. Annual growth eased to 3.2%, reflecting last year’s broader slowdown despite a recent rebound since February’s rate cut.

Key Highlights:

- Market sentiment dipped in April amid global uncertainty and the federal election

- Every capital city posted gains, led by Darwin (+1.1%)

- House values are outpacing units in most cities

- Regional markets rose faster than capitals, especially in SA and WA

- Auction activity and new listings hit their lowest April levels since 2019

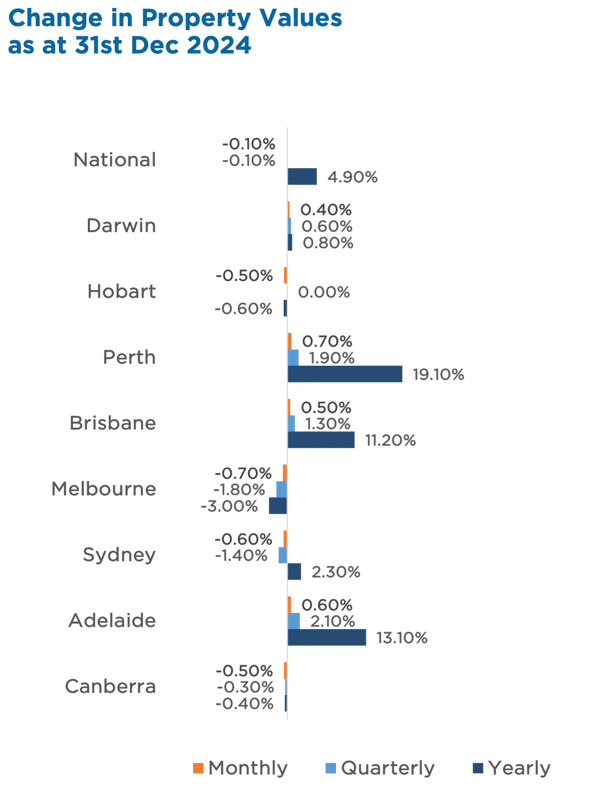

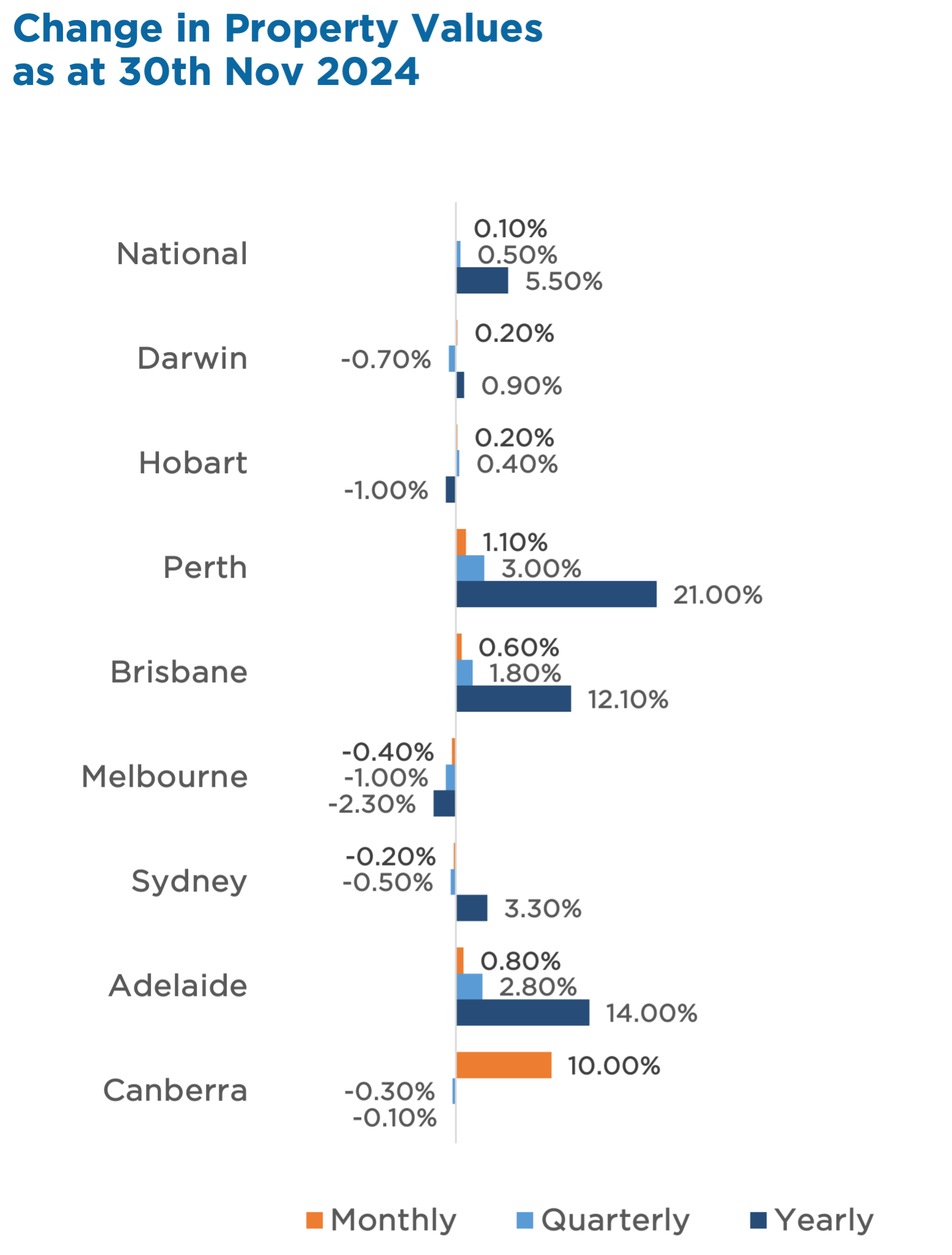

Property Values

as at 30th of April 2025

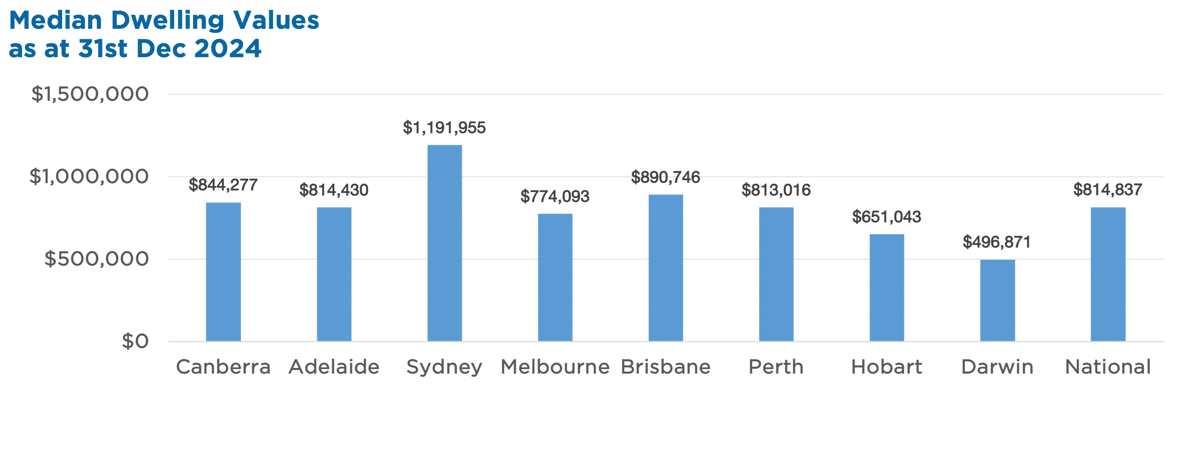

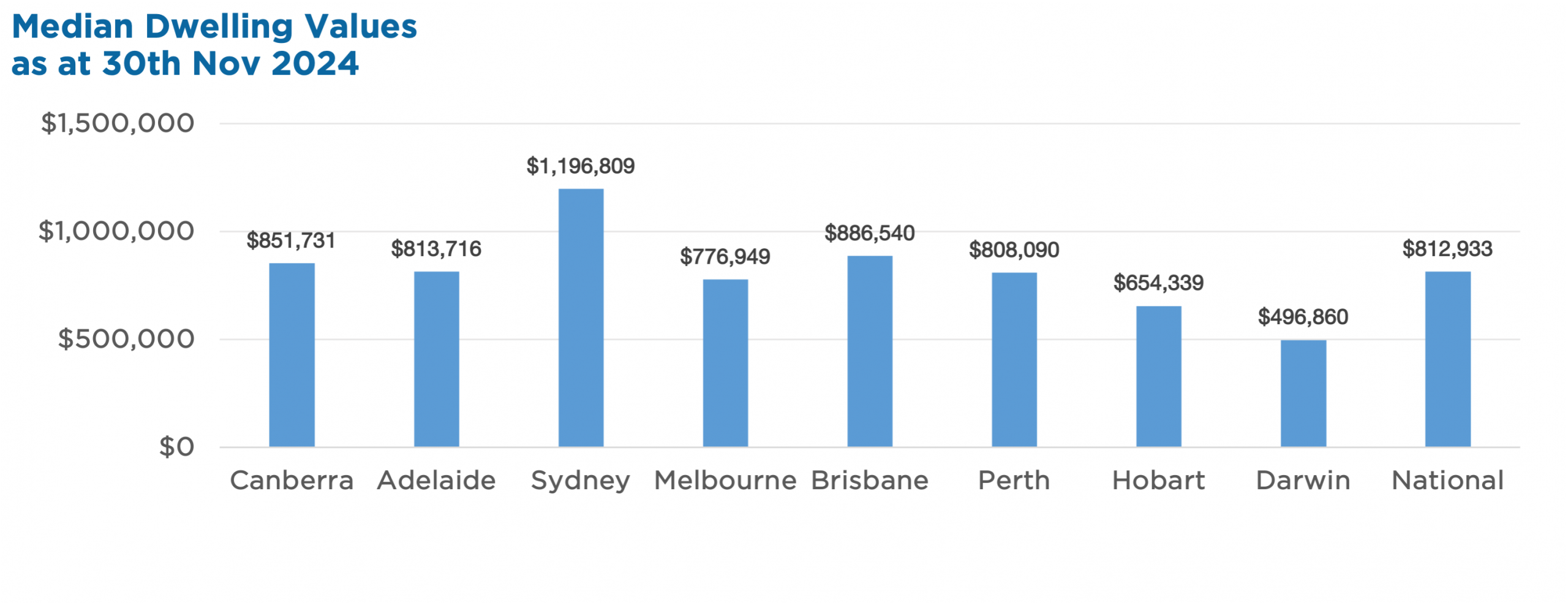

Median Dwelling Values

as at 30th of April 2025

Source: CoreLogic, Report, Article